Need help solving these.

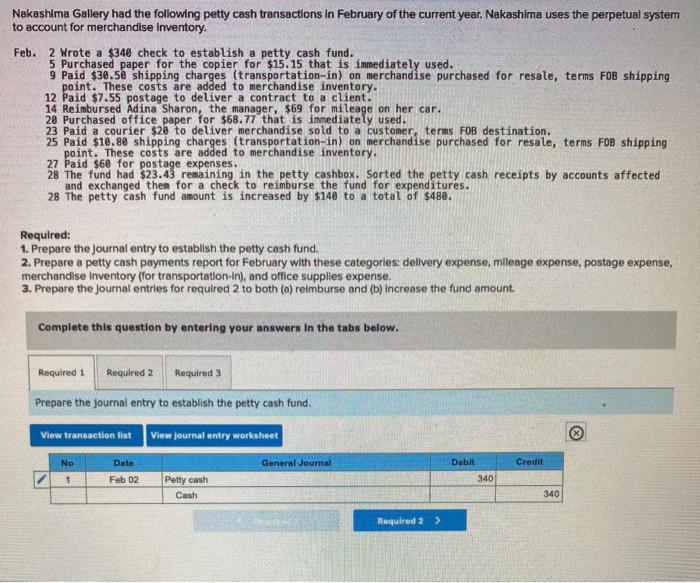

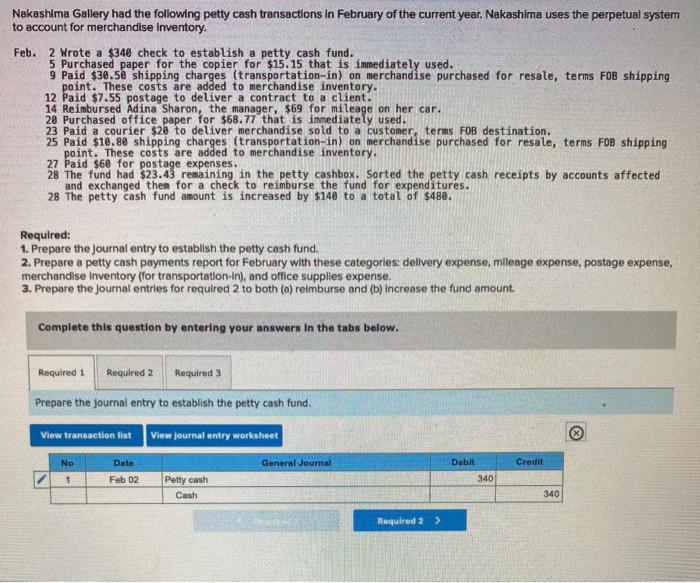

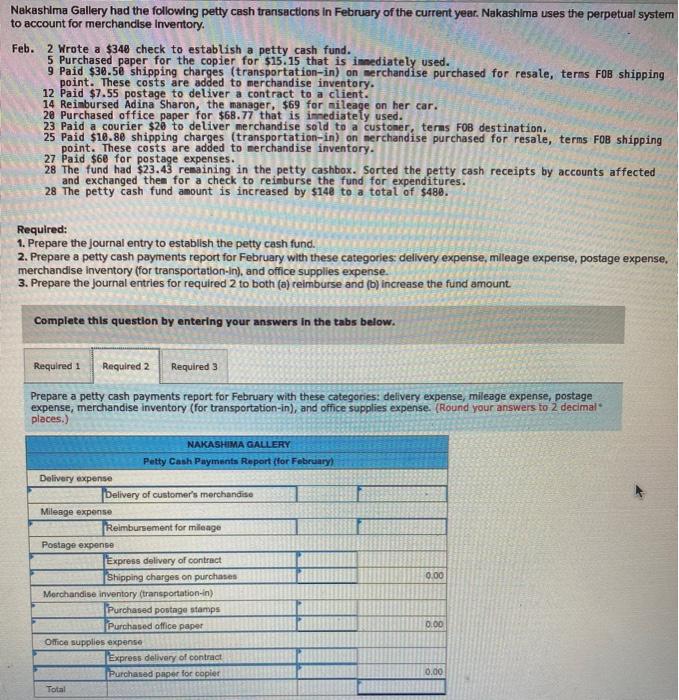

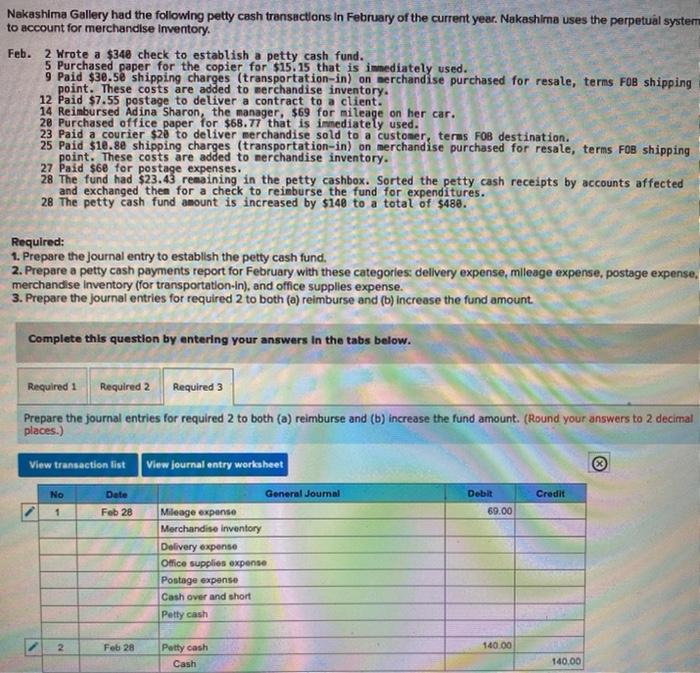

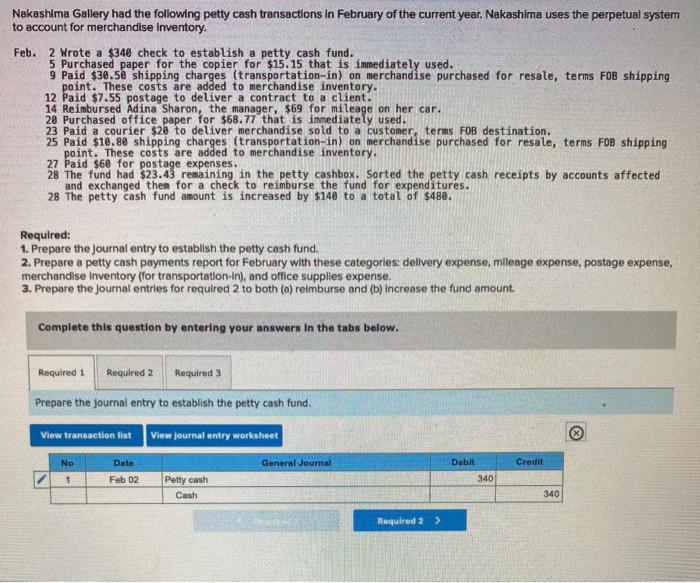

Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise Inventory. Feb. 2 Wrote a $348 check to establish a petty cash fund. 5 Purchased paper for the copier for $15.15 that is immediately used. 9 Paid $39.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 12 Paid $7.55 postage to deliver a contract to a client. 14 Reimbursed Adina Sharon, the manager, $69 for mileage on her car. 20 Purchased office paper for $68.77 that is immediately used. 23 Paid a courier $20 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $18.80 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 27 Paid $60 for postage expenses. 28 The fund had $23.43 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged them for a check to reimburse the fund for expenditures. 28 The petty cash fund amount is increased by $140 to a total of $480. Required: 1. Prepare the journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise Inventory (for transportation-in), and office supplies expense. 3. Prepare the Journal entries for required 2 to both (a) reimburse and (b) Increase the fund amount Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entry to establish the petty cash fund. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Feb 02 Petty cash 340 Cash 340 Required 2 Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise Inventory. Feb. 2 Wrote a $348 check to establish a petty cash fund. 5 Purchased paper for the copier for $15:15 that is immediately used. 9 Paid $38.58 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 12 Paid $7.55 postage to deliver a contract to a client. 14 Reimbursed Adina Sharon, the manager, $69 for mileage on her car. 20 Purchased office paper for $68.77 that is imediately used. 23 Paid a courier $28 to deliver merchandise sold to a customer, terns FOB destination. 25 Paid $10.80 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 27 Paid $60 for postage expenses. 28 The fund had $23.43 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged them for a check to reimburse the fund for expenditures. 28 The petty cash fund amount is increased by $14e to a total of $488. Required: 1. Prepare the journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categories delivery expense, mileage expense, postage expense, merchandise Inventory (for transportation-in), and office supplies expense. 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense. (Round your answers to 2 decimal places.) NAKASHIMA GALLERY Petty Cash Payment Report {for February Delivery expense Delivery of customer's merchandise Mileage expense Reimbursement for mileage Postage expense Express delivery of contract Shipping charges on purchases Merchandise inventory (transportation-in) Purchased postage stamps Purchased office paper Office supplies expense Express delivery of contract Purchased paper for copier Total 0.00 0.00 0.00 Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise Inventory. Feb. 2 Wrote a $348 check to establish a petty cash fund. 5 Purchased paper for the copier for $15.15 that is immediately used. 9 Paid $30.se shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 12 Paid $7.55 postage to deliver a contract to a client 14 Reimbursed Adina Sharon, the manager, $69 for mileage on her car. 28 Purchased office paper for $68.77 that is immediately used. 23 Paid a courier $28 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $10.8e shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 27 Paid $6e for postage expenses. 28 The tund had $23.43 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged then for a check to reimburse the fund for expenditures. 28 The petty cash fund amount is increased by $148 to a total of $488. Required: 1. Prepare the Journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categories: dellvery expense, mileage expense, postage expense, merchandise Inventory (for transportation-in), and office supplies expense. 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries for required 2 to both () reimburse and (b) increase the fund amount. (Round your answers to 2 decimal places.) View transaction list View journal entry worksheet No Date General Journal Credit Debit 69.00 1 Feb 28 Mileage expense Merchandise inventory Delivery expense Office supplies expense Postage expense Cash over and short Petty cash 2 Feb 28 140.00 Petty cash Cash 140.00