need help soon!! thanks!!

please help ASAP!!

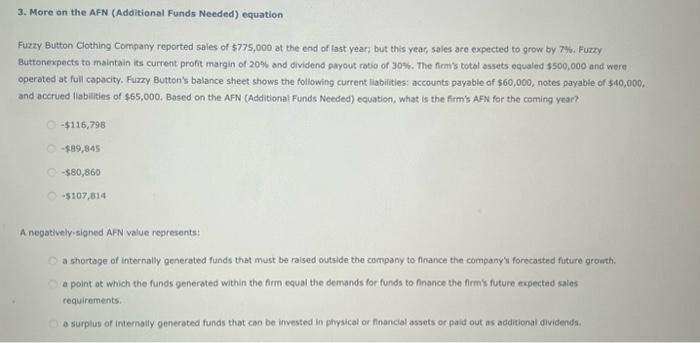

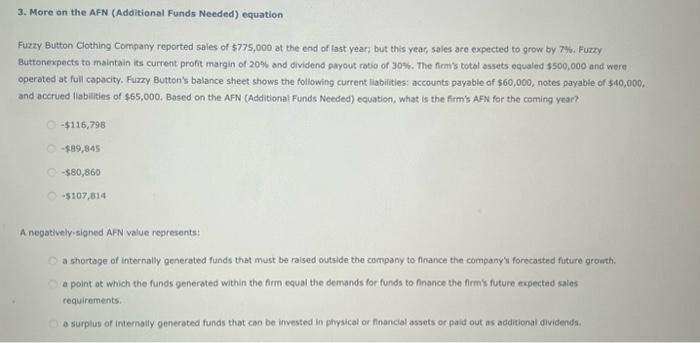

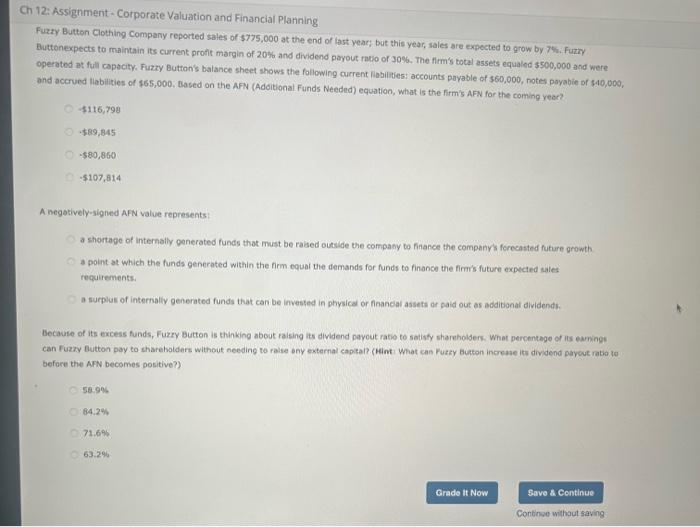

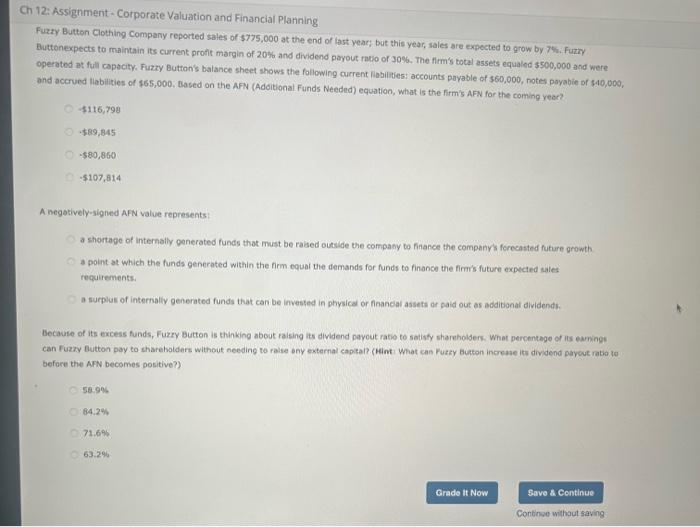

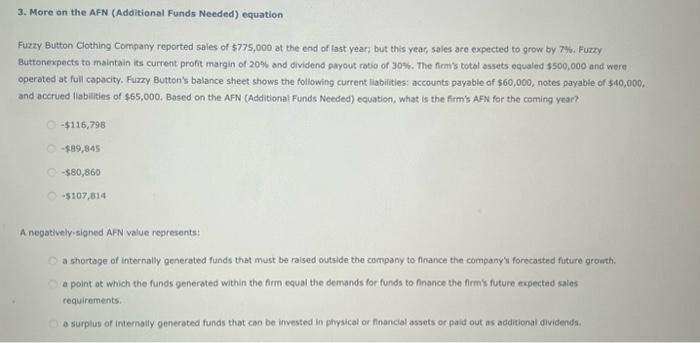

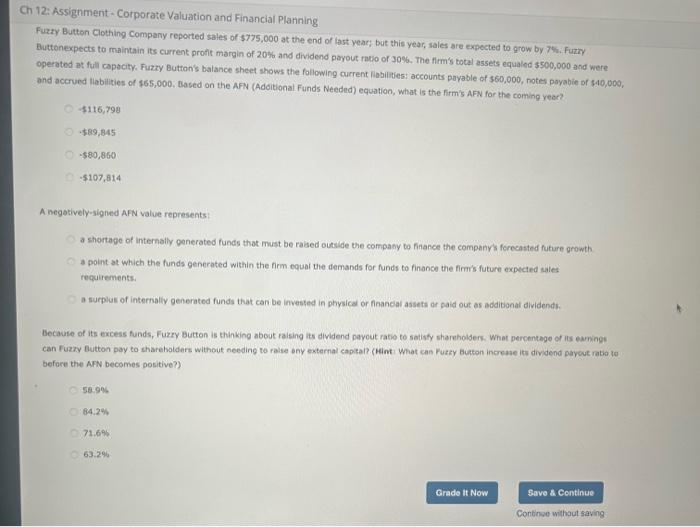

Fuzzy Button Clothing Company reported sales of $775,000 at the end of last yeary but this year, sales are expected to grow by 7\%. Fuzxy Buttonexpects to malntain its current profit margin of 20% and dividend payout rotio of 30%. The firm's total assets equaled $500,000 and were operated at full capacity. Fuzzy Button's balance sheet shows the following current liabilities: accounts payable of $60,000, notes payabie of $40,000, and acerued fisbilities of 465,000 , Based on the AFN (Additional Funds Needed) equation, what is the firm's AFN for the coming year? $116,798$899,845$80,860$107,814 A negatively-signed AFN value represents: a shortage of internally generated funds that must be raised outside the company to finance the company's forecasted future growth. a point ot which the funds generated within the firm equal the demands for funds to finance the firm's future expected sales requirements. as surplus of intemally generated funds that can be imvested in physical or financial assets or paid out as additional dividends. Fuzzy Button Glothing Company reported sales of 3775,000 at the end of last yeac; but this year, sales are expected to grow by 7 . Fuztry Buttonexpects to maintain its current profit margin of 20% and dividend payout ratio of 30%. The fitm's total assets equaled 3500,000 and were operated at full capacity. Fuzzy Button's balance sheet shows the following current liabilitiest accounts payable of 360,000 , notes poyabie of s40,000, and accrucd llabilities of $65,000, Babed on the AFN (Adoitional Funds Needed) equation, what is the firm's AFN for the coming vear? $116,798$89,845$80,860$107,814 A negotively-signed AFN value represents: a shortage of intemally generated funds thot must be raised outside the company to finance the company forecasted future growth 3 point at which the funds generated within the firm equal the demands for funds to finance the firmis future expected sales requitementsi a surplas of internaliy generated funds that can be invested in physical or financial assets or paid out as additionat dividends. Because of its excess funds, Fuzry button is thinking about raising its dividend paycut ratio to satisfy shareholder. What percentege of its eamingt can Fuzzy futton pay to thareholders without needing to raise eny external capital? (Mint What can Fuzey button incresse ite divdend payout ratio to before the AFN becomes positive?) 58.906 64.241 71,695 63.2%