Need help sorting this information into T accounts. Thank you!

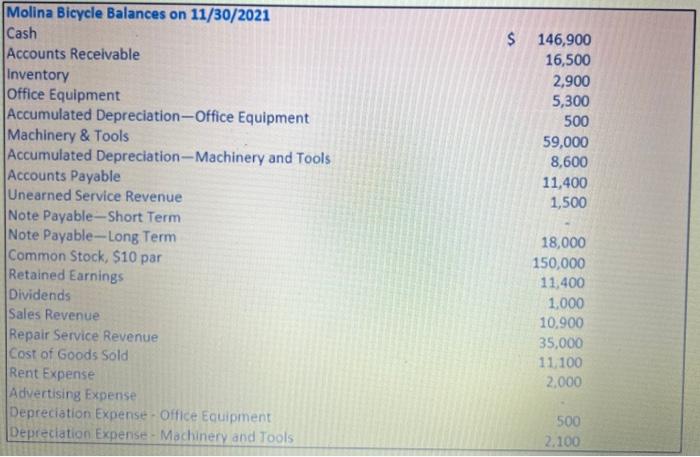

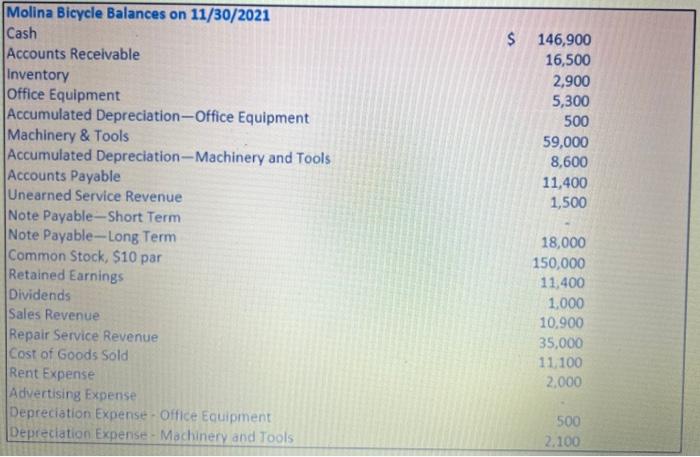

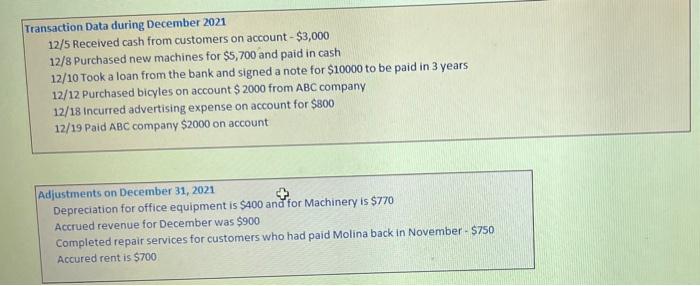

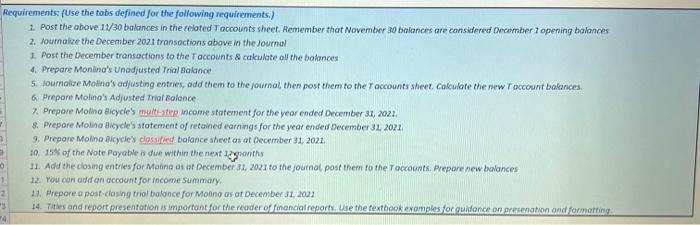

Molina Bicycle Balances on 11/30/2021 Cash Accounts Receivable inventory Office Equipment Accumulated Depreciation-Office Equipment Machinery \& Tools Accumulated Depreciation-Machinery and Tools Accounts Payable Unearned Service Revenue Note Payable-Short Term Note Payable-Long Term Common Stock, $10 par Retained Earnings Dividends Sales Revenue Repair Service Revenue Cost of Goods sold Rent Expense Advertising Expense Depreciation Expense - Office Equipment Depreciation Expense-Machinery and Tools $146,90016,5002,9005,30050059,0008,60011,4001,50018,000150,00011,4001,00010,90035,00011,1002,000 Transaction Data during December 2021 12/5 Received cash from customers on account $3,000 12/8 Purchased new machines for $5,700 and paid in cash 12/10 Took a loan from the bank and signed a note for $10000 to be paid in 3 years 12/12 Purchased bicyles on account $2000 from ABC company 12/18 incurred advertising expense on account for $800 12/19 Paid ABC company $2000 on account Adjustments on December 31,2021 Depreciation for office equipment is $400 and for Machinery is $770 Accrued revenue for December was $900 Completed repair services for customers who had paid Molina back in November - $750 Accured rent is $700 Requirements: (Use the tobs defined for the following requirements.) 1. Post the above 12/30 balances in the related Joccounts sheet. Aemember that November 30 balances are considered Decamber 1 opening balances 2. Journaize the December 2021 transoctions above in the Journol 1. Post the December transactions to the I accounts 8 cakulate all the balances 4. Prepare Monling's Unadjusted Trial Ealance 5. loamaise Molina's adjusting entries, add them to the joumal, then post thern to the T accounts sheet. Cakulate the new T account balances. 6. Prepore Molino's Adjusted Triaf Ealence 7. Prepare Molno dicycie's muiti-atep income stotement for the year ended December 31, 2022. 8. Prepore Molina Aisycle's statement of retained earnings for the year ended December 32,2021. 9. Prepare Molina nicycies ciassificd balance sheet as at December 312021. iQ. 15% of the Note Poyable is due within the next 1 gyganths 11. Add the ciosing eatries for Maa at at December 31, 2021 to the journal post them fo the T accounts. Prepare new banances 12. You can add an account for income suminiary. 13. Prepare a post-clasing triol balonce for Moang os at December 11,2021 14. fities and report presentation is important for the reader of financialrepartr. Wise the fextbook exompies for qualance on peruenation and formatfing