Answered step by step

Verified Expert Solution

Question

1 Approved Answer

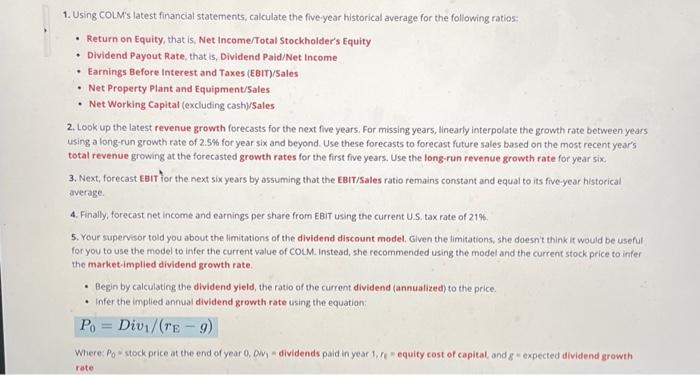

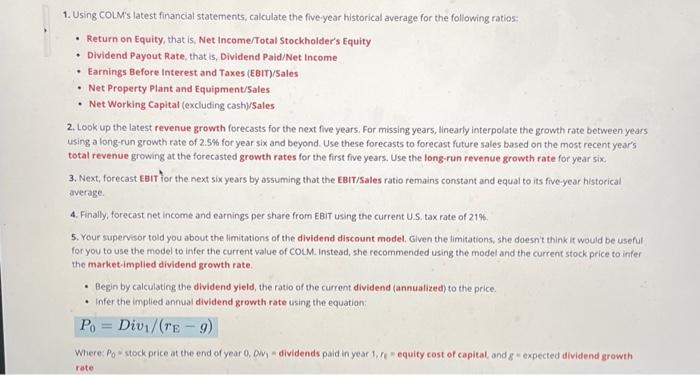

need help specifically with #5 1. Using COLM's latest financial statements, calculate the five-year historical average for the following ratios: - Return on Equity, that

need help specifically with #5

1. Using COLM's latest financial statements, calculate the five-year historical average for the following ratios: - Return on Equity, that is, Net Income/Total Stockholder's Equity - Dividend Payout Rate, that is, Dividend Paid/Net Income - Earnings Before Interest and Taxes (EBm)/Sales - Net Property Plant and Equipment/5ales - Net Working Capital (excluding cashysales 2. Look up the latest revenue growth forecasts for the next five years, For missing years, linearly interpolate the growth rate between years using a long-run growth rate of 2.5% for year six and beyond. Use these forecasts to forecast future sales based on the most recent year's total revenue growing at the forecasted growth rates for the first five years. Use the long-run revenue growth rate for year six. 3. Next, forecast EBIT ior the next six years by assuming that the EBIT/Sales ratio remains constant and equal to its frve-year historical average. 4. Finally, forecast net income and earnings per share from EBiT using the current U.S, tax rate of 21%. 5. Your supervisor told you about the limitations of the dividend discount model. Glven the limitations, she doesn't think it would be useful for you to use the model to infer the current value of couM. Instead, she recommended using the model and the current stock price to infer the market-implied dividend growth rate. - Begin by calculating the dividend yletd, the ratio of the current dividend (annualized) to the price. - Infer the implied annual dividend growth rate using the equation: P0=Div1/(rEg) Where: P0 * stock price at the end of year 0,OV1 = dividends paid in year 1,r1 * equity cost of capital, and g * expected dividend growth rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started