Answered step by step

Verified Expert Solution

Question

1 Approved Answer

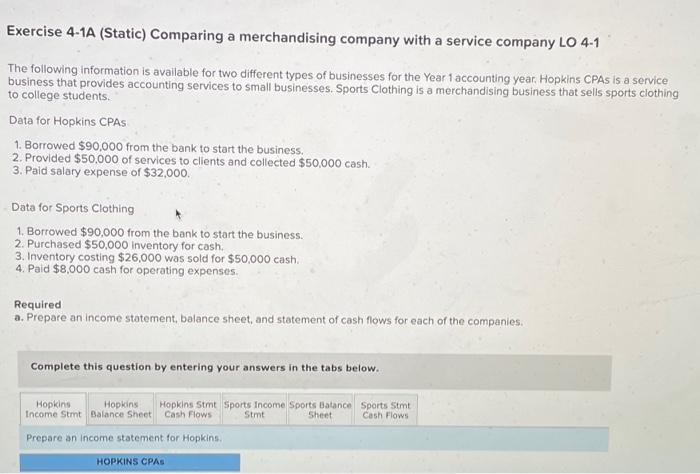

need help! stuck on this Exercise 4-1A (Static) Comparing a merchandising company with a service company LO 4-1 The following information is available for two

need help! stuck on this

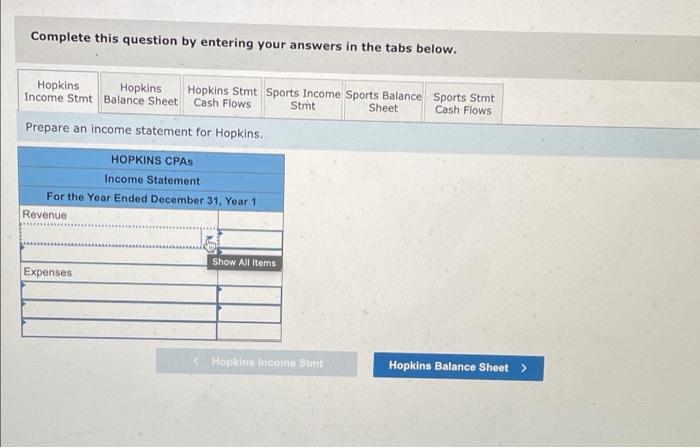

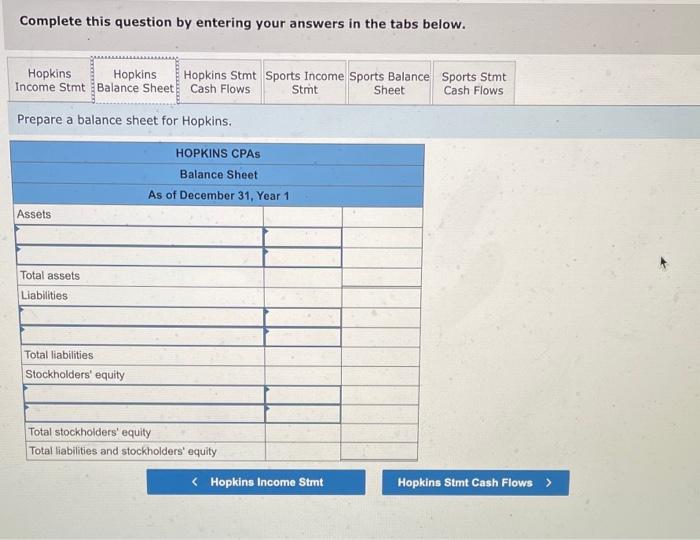

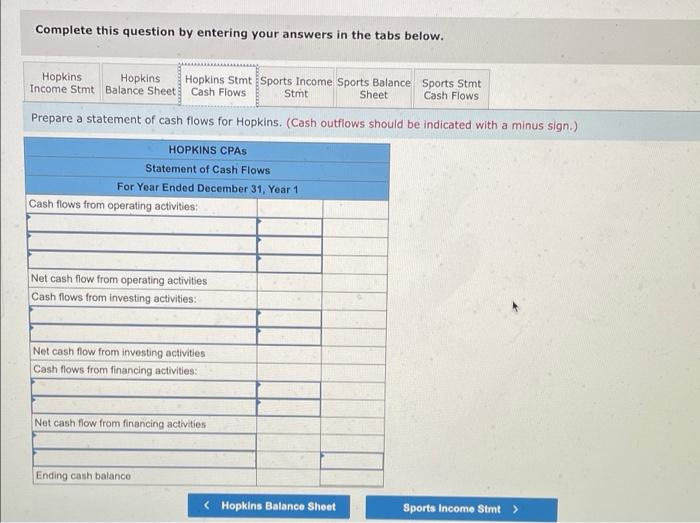

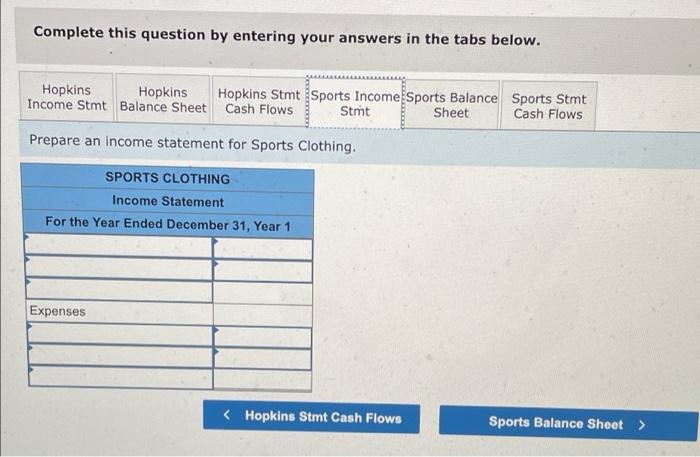

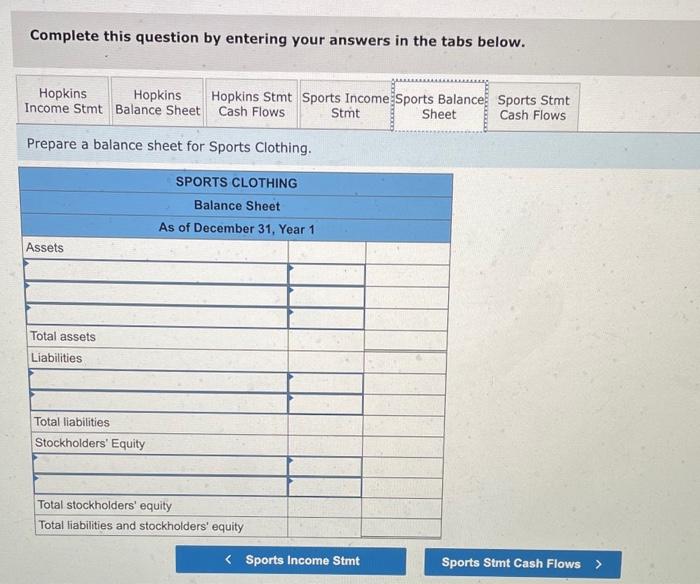

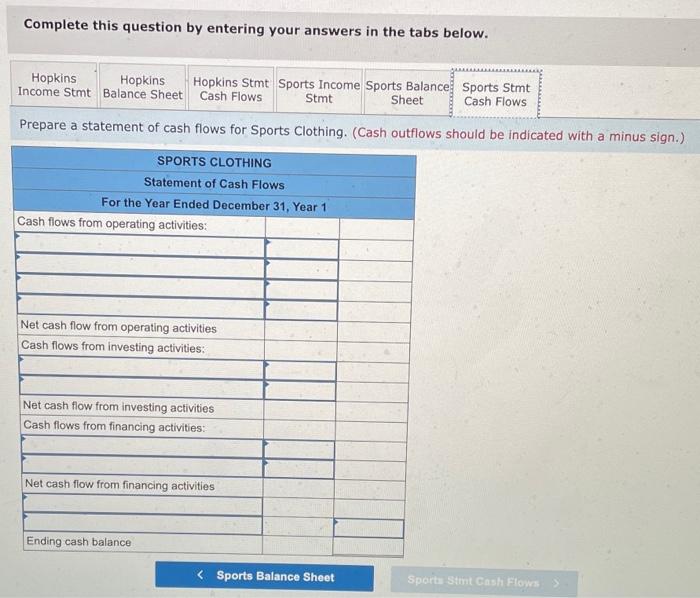

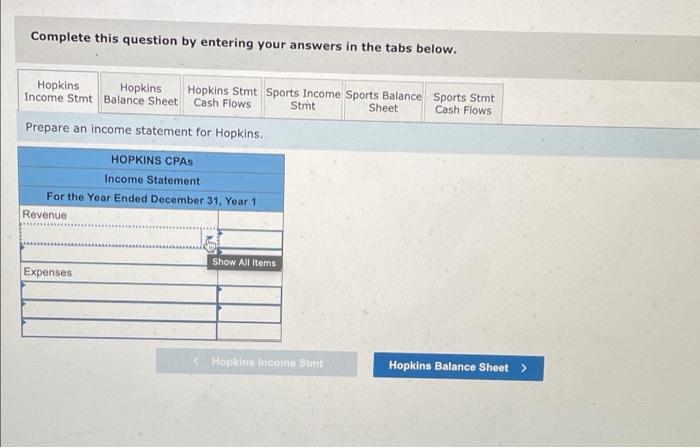

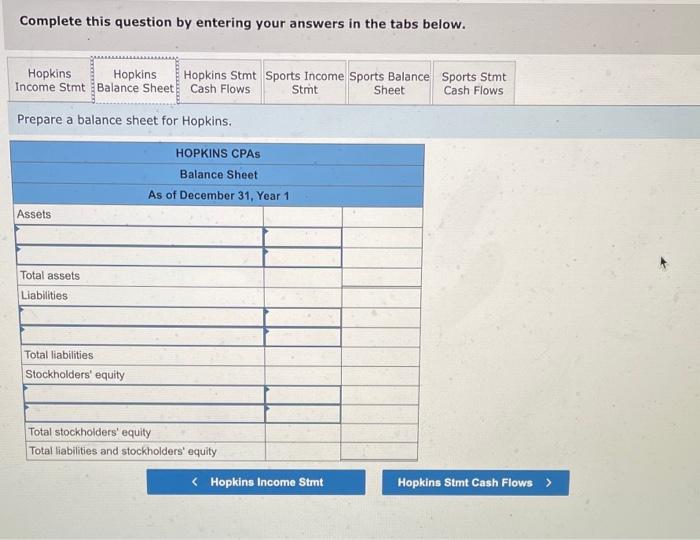

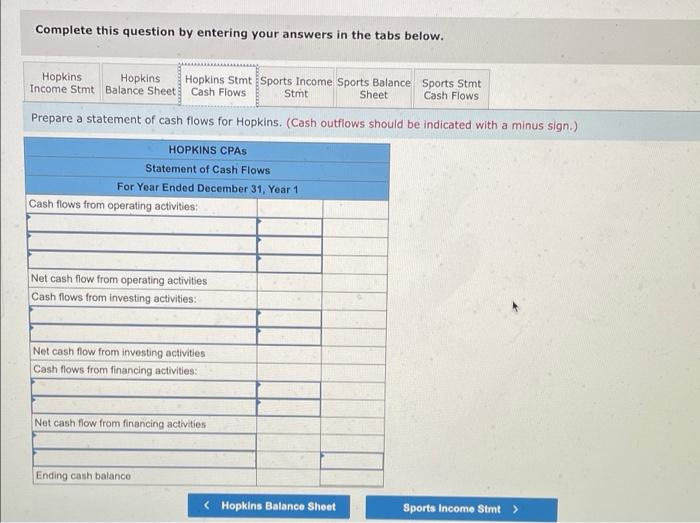

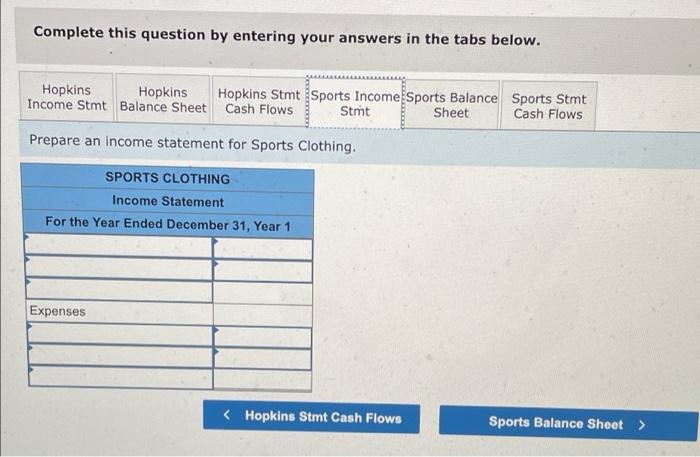

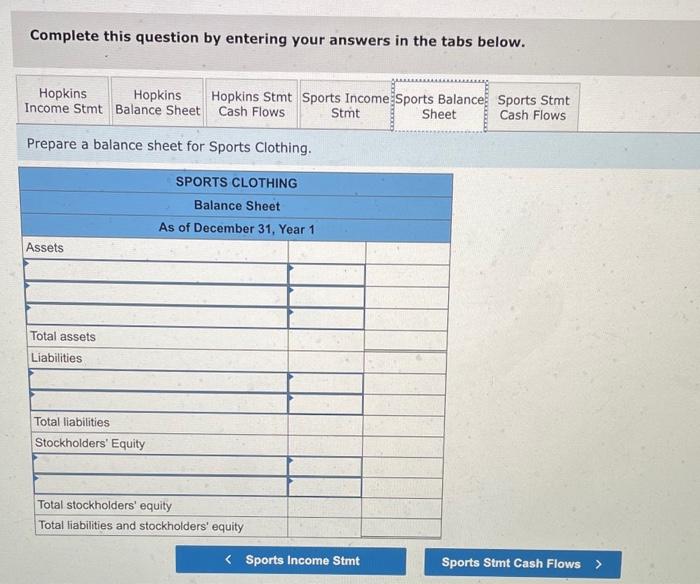

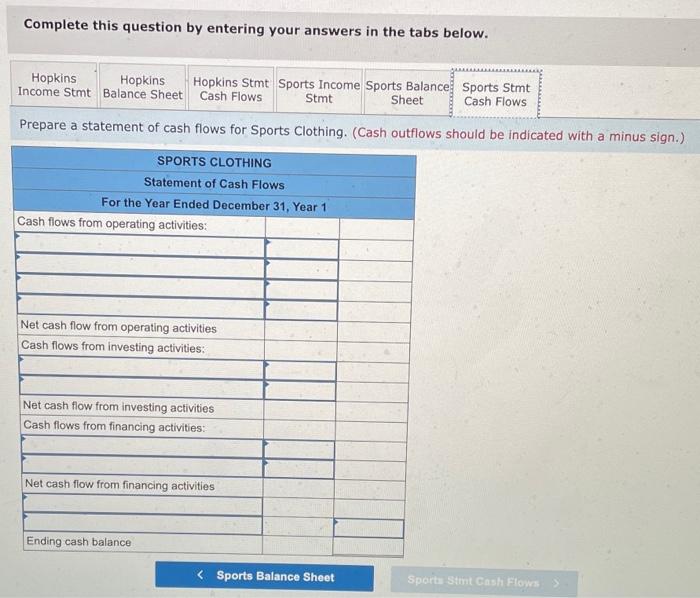

Exercise 4-1A (Static) Comparing a merchandising company with a service company LO 4-1 The following information is available for two different types of businesses for the Year 1 accounting year Hopkins CPAs is a service business that provides accounting services to small businesses. Sports Clothing is a merchandising business that sells sports clothing to college students Data for Hopkins CPAS 1. Borrowed $90,000 from the bank to start the business. 2. Provided $50,000 of services to clients and collected $50,000 cash. 3. Pald salary expense of $32,000. Data for Sports Clothing 1. Borrowed $90,000 from the bank to start the business. 2. Purchased $50,000 inventory for cash. 3. Inventory costing $26,000 was sold for $50,000 cash 4. Pald $8,000 cash for operating expenses Required a. Prepare an income statement, balance sheet, and statement of cash flows for each of the companies. Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare an income statement for Hopkins HOPKINS CPAS Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare an income statement for Hopkins. HOPKINS CPAS Income Statement For the Year Ended December 31, Year 1 Revenue Show All Items Expenses Hopkins Income Stmt Hopkins Balance Sheet > Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare a balance sheet for Hopkins. HOPKINS CPAS Balance Sheet As of December 31, Year 1 Assets Total assets Liabilities Total liabilities Stockholders' equity Total stockholders' equity Total liabilities and stockholders' equity Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare a statement of cash flows for Hopkins. (Cash outflows should be indicated with a minus sign.) HOPKINS CPAS Statement of Cash Flows For Year Ended December 31, Year 1 Cash flows from operating activities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow from investing activities Cash flows from financing activities: Net cash flow from financing activities Ending cash balanco Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare an income statement for Sports Clothing. SPORTS CLOTHING Income Statement For the Year Ended December 31, Year 1 Expenses Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare a balance sheet for Sports Clothing. SPORTS CLOTHING Balance Sheet As of December 31, Year 1 Assets Total assets Liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Complete this question by entering your answers in the tabs below. Hopkins Hopkins Hopkins Stmt Sports Income Sports Balance Sports Stmt Income Stmt Balance Sheet Cash Flows Stmt Sheet Cash Flows Prepare a statement of cash flows for Sports Clothing. (Cash outflows should be indicated with a minus sign.) SPORTS CLOTHING Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities: Net cash flow from operating activities Cash flows from investing activities: Net cash flow from investing activities Cash flows from financing activities: Net cash flow from financing activities Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started