Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help, thanks! A Number Styles fa b) Monroe Products plans to purchase $100,000 of fixed assets in 2020, but will not dispose of any

need help, thanks!

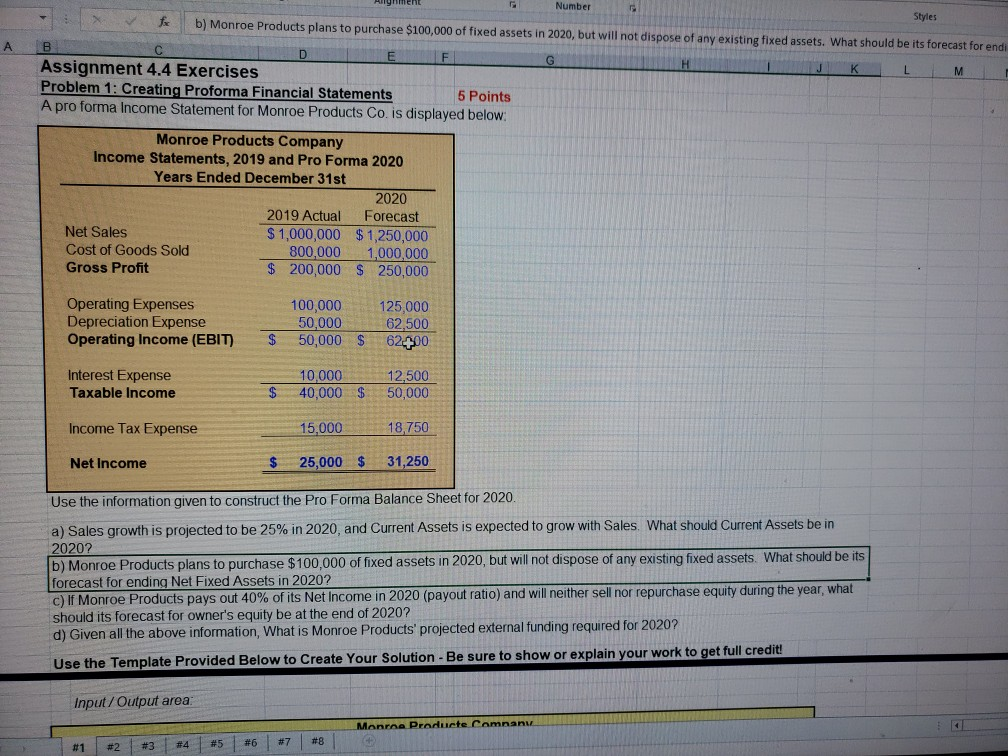

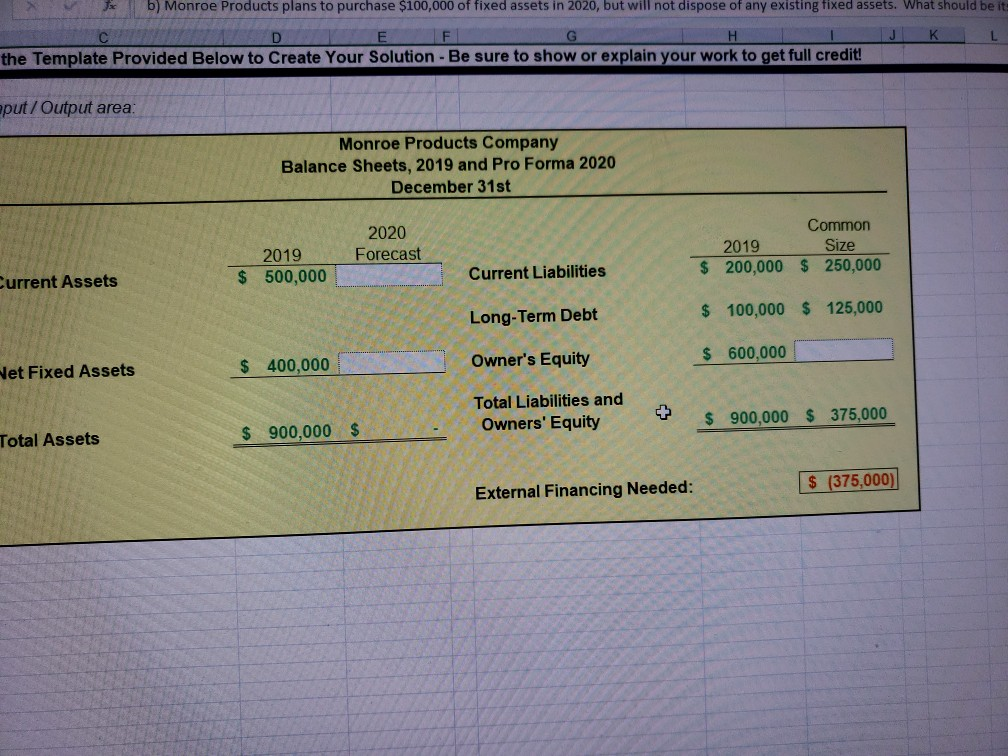

A Number Styles fa b) Monroe Products plans to purchase $100,000 of fixed assets in 2020, but will not dispose of any existing fixed assets. What should be its forecast for endi B D F G L M Assignment 4.4 Exercises Problem 1: Creating Proforma Financial Statements 5 Points A pro forma Income Statement for Monroe Products Co. is displayed below: Monroe Products Company Income Statements, 2019 and Pro Forma 2020 Years Ended December 31st 2020 2019 Actual Forecast Net Sales $1,000,000 $1,250,000 Cost of Goods Sold 800,000 1,000,000 Gross Profit $ 200,000 $ 250,000 Operating Expenses Depreciation Expense Operating Income (EBIT) 100,000 50,000 50,000 $ 125,000 62,500 62400 $ Interest Expense Taxable income $ 10,000 40,000 $ 12,500 50,000 Income Tax Expense 15,000 18,750 Net Income $ 25,000 $ 31,250 Use the information given to construct the Pro Forma Balance Sheet for 2020. a) Sales growth is projected to be 25% in 2020, and Current Assets is expected to grow with Sales. What should Current Assets be in 2020? b) Monroe Products plans to purchase $100,000 of fixed assets in 2020, but will not dispose of any existing fixed assets. What should be its forecast for ending Net Fixed Assets in 2020? c) If Monroe Products pays out 40% of its Net Income in 2020 (payout ratio) and will neither sell nor repurchase equity during the year, what should its forecast for owner's equity be at the end of 2020? d) Given all the above information, What is Monroe Products' projected external funding required for 2020? Use the Template Provided Below to Create Your Solution - Be sure to show or explain your work to get full credit! Input/Output area Monroe Producte Camnanu #3 #1 #4 #6 #2 #5 #7 #8 b) Monroe Products plans to purchase $100,000 of fixed assets in 2020, but will not dispose of any existing fixed assets. What should be it J K L D FI H the Template Provided Below to Create Your Solution - Be sure to show or explain your work to get full credit! put/Output area: Monroe Products Company Balance Sheets, 2019 and Pro Forma 2020 December 31st 2020 Forecast 2019 $ 500,000 Common 2019 Size $ 200,000 $ 250,000 Current Liabilities Current Assets Long-Term Debt $ 100,000 $ 125,000 Owner's Equity $ 600,000 Net Fixed Assets $ 400,000 Total Liabilities and Owners' Equity $ 900,000 $ 375,000 Total Assets $ 900,000 $ $ (375,000) External Financing NeededStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started