Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP TO COMPLETE A 2021 FORM 1040, SCH. A, SCH.1, AND FORM 8283 PLEASE!!! Assume the taxpayer does NOT wish to contrlbute to the

NEED HELP TO COMPLETE A 2021 FORM 1040, SCH. A, SCH.1, AND FORM 8283 PLEASE!!!

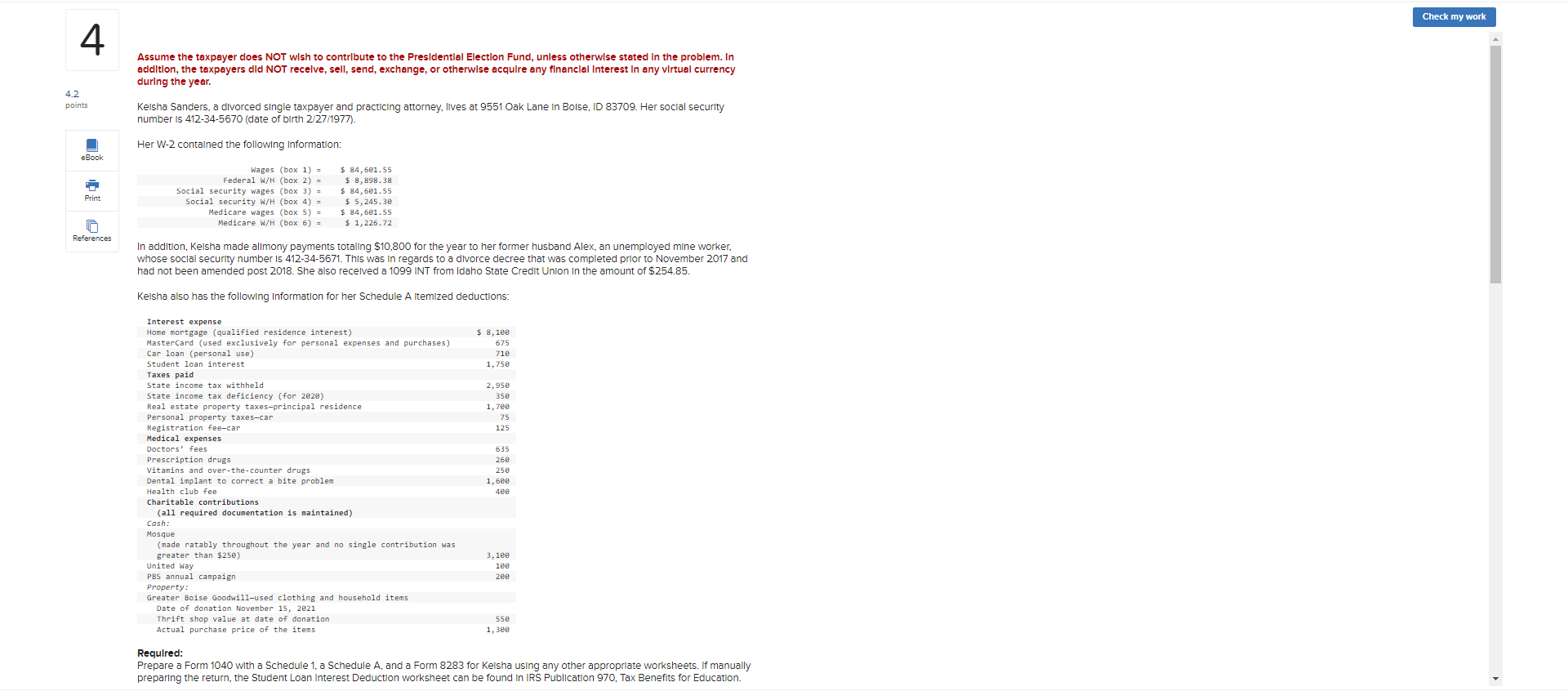

Assume the taxpayer does NOT wish to contrlbute to the Presidentlal Election Fund, unless otherwlse stated In the problem. In addltion, the taxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any flnanclal Interest In any virtual currency during the year. Kelsha Sanders, a divorced sIngle taxpayer and practicing attorney, IIves at 9551 Oak Lane In Bolse, ID 83709 . Her social security number is 412-34-5670 (date of birth 2/27/1977 ). Her W-2 contained the following Information: In addition, Kelsha made almony payments totaling $10,800 for the year to her former husband Alex, an unemployed mine worker, whose soclal security number is 412-34-5671. This was in regards to a divorce decree that was completed prior to November 2017 and had not been amended post 2018. She also recelved a 1099 INT from Idaho State Credit Union In the amount of $254.85. Kelsha also has the following Information for her Schedule A Itemized deductions: Required: Prepare a Form 1040 with a Schedule 1, a Schedule A, and a Form 8283 for Kelsha using any other approprlate worksheets. If manually preparIng the return, the Student Loan Interest Deduction worksheet can be found In IRS Publication 970 , Tax Benefits for Education

Assume the taxpayer does NOT wish to contrlbute to the Presidentlal Election Fund, unless otherwlse stated In the problem. In addltion, the taxpayers did NOT recelve, sell, send, exchange, or otherwise acquire any flnanclal Interest In any virtual currency during the year. Kelsha Sanders, a divorced sIngle taxpayer and practicing attorney, IIves at 9551 Oak Lane In Bolse, ID 83709 . Her social security number is 412-34-5670 (date of birth 2/27/1977 ). Her W-2 contained the following Information: In addition, Kelsha made almony payments totaling $10,800 for the year to her former husband Alex, an unemployed mine worker, whose soclal security number is 412-34-5671. This was in regards to a divorce decree that was completed prior to November 2017 and had not been amended post 2018. She also recelved a 1099 INT from Idaho State Credit Union In the amount of $254.85. Kelsha also has the following Information for her Schedule A Itemized deductions: Required: Prepare a Form 1040 with a Schedule 1, a Schedule A, and a Form 8283 for Kelsha using any other approprlate worksheets. If manually preparIng the return, the Student Loan Interest Deduction worksheet can be found In IRS Publication 970 , Tax Benefits for Education Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started