Answered step by step

Verified Expert Solution

Question

1 Approved Answer

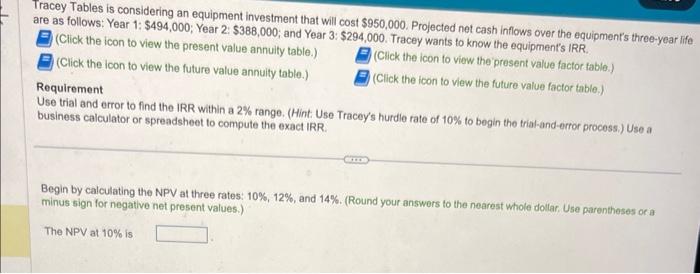

need help Tracey Tables is considering an equipment investment that will cost $950,000. Projected net cash inflows over the equipment's three-year iff are as follows:

need help

Tracey Tables is considering an equipment investment that will cost $950,000. Projected net cash inflows over the equipment's three-year iff are as follows: Year 1: $494,000; Year 2: $388,000; and Year 3: $294,000. Tracey wants to know the equipment's IRR. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) (Click the icon to view the present value factor fable.). Requirement (Click the icon to view the future value factor table.) Use trial and error to find the IRR within a 2% range. (Hint: Use Tracey's hurdle rate of 10% to begin the tria-and-error process.) Use a business calculator or spreadsheet to compute the exact IRR. Begin by calculating the NPV at three rates: 10%,12%, and 14%. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV at 10% is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started