Need help understanding. Please explain the answer, thank you.

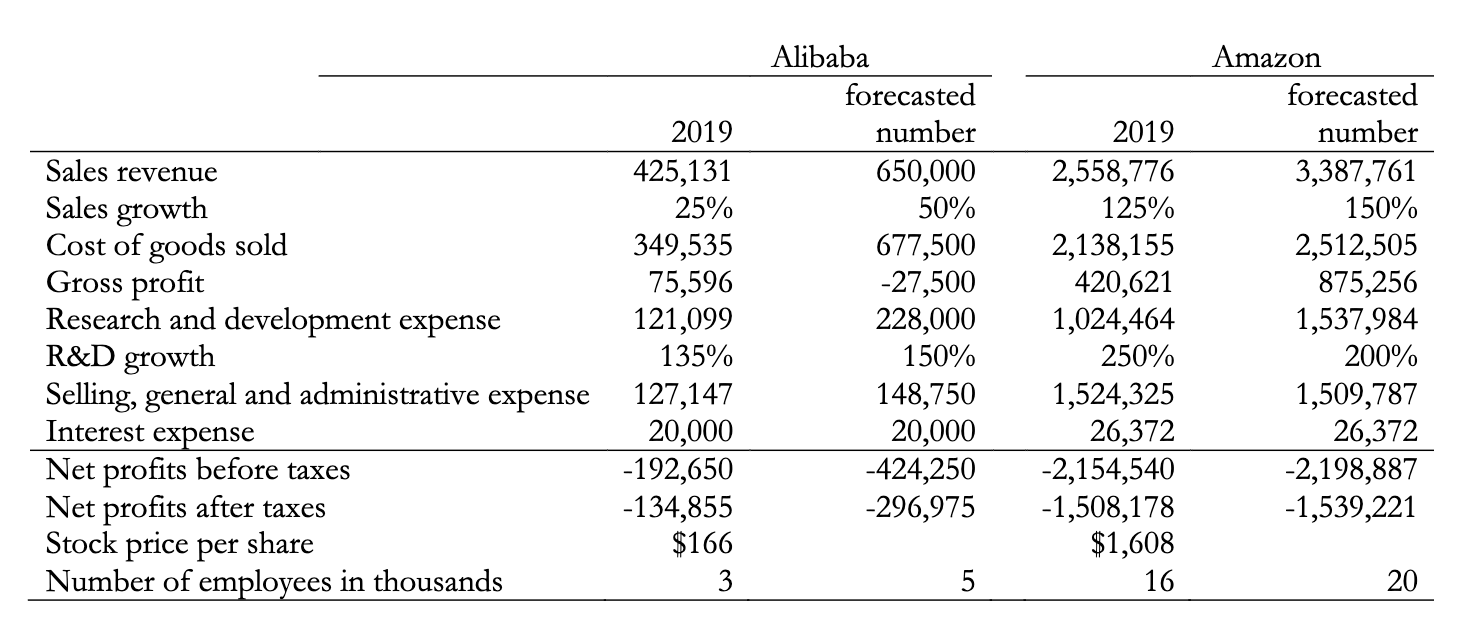

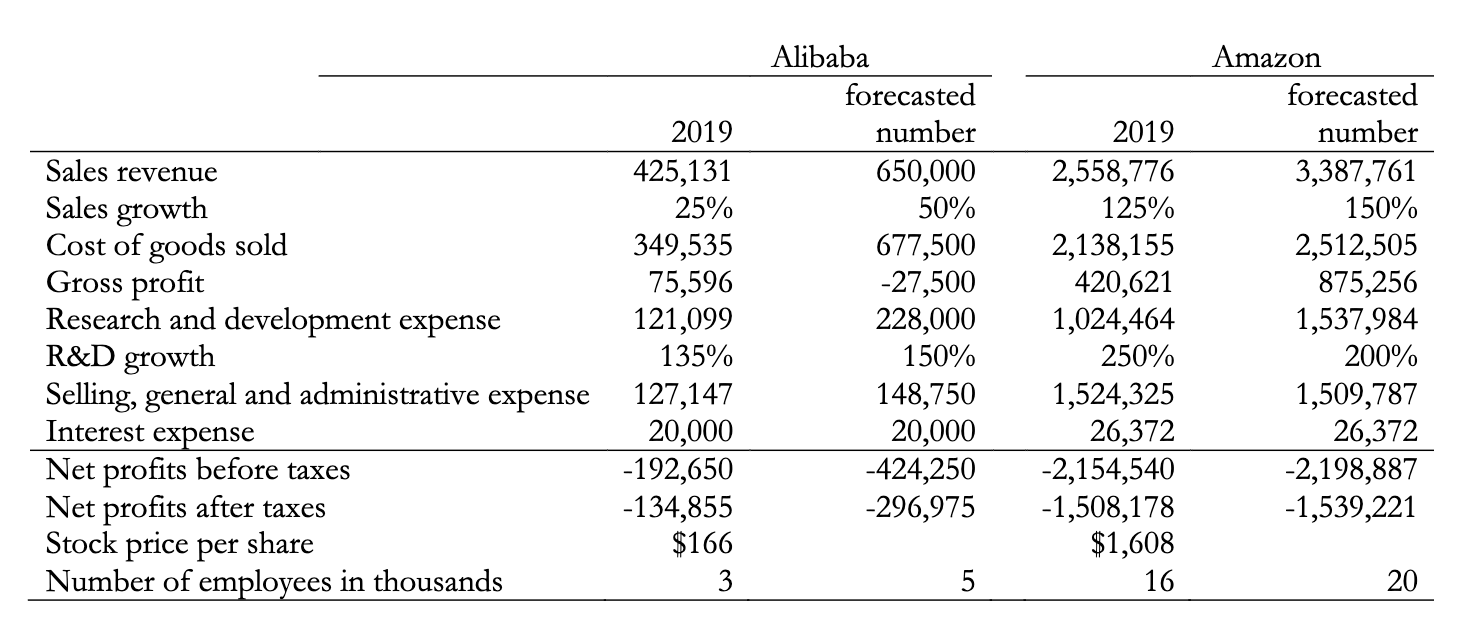

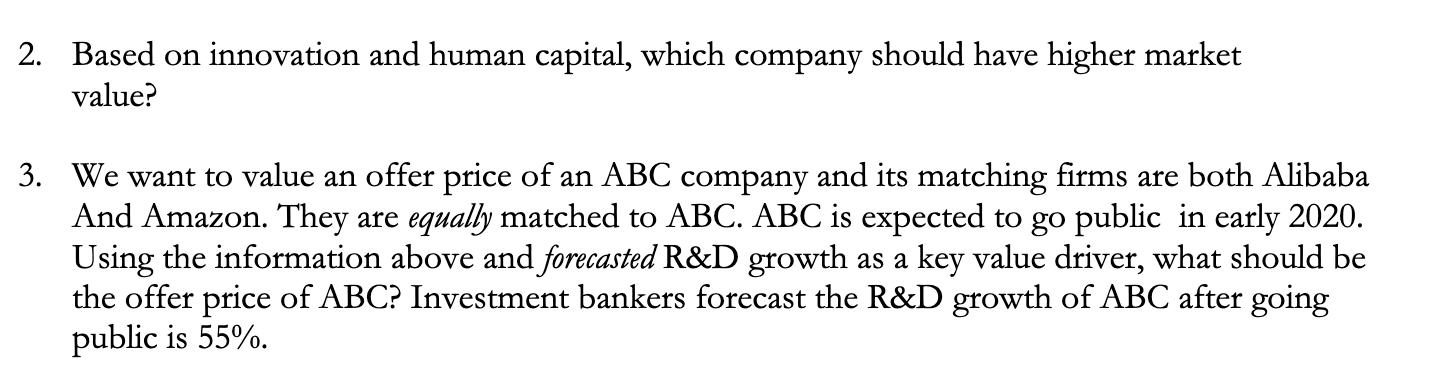

Use below information in thousands) to answer the questions. Forecasted numbers are the numbers that are based on analyst's forecasts. That is, Alibaba's forecasted revenue of $650,000 is the revenue analysts forecasted in 2019 Alibaba will have in 2020. Sales revenue Sales growth Cost of goods sold Gross profit Research and development expense R&D growth Selling, general and administrative expense Interest expense Net profits before taxes Net profits after taxes Stock price per share Number of employees in thousands 2019 425,131 25% 349,535 75,596 121,099 135% 127,147 20,000 -192,650 -134,855 $166 3 Alibaba forecasted number 650,000 50% 677,500 -27,500 228,000 150% 148,750 20,000 -424,250 -296,975 2019 2,558,776 125% 2,138,155 420,621 1,024,464 250% 1,524,325 26,372 -2,154,540 -1,508,178 $1,608 16 Amazon forecasted number 3,387,761 150% 2,512,505 875,256 1,537,984 200% 1,509,787 26,372 -2,198,887 -1,539,221 20 2. Based on innovation and human capital, which company should have higher market value? 3. We want to value an offer price of an ABC company and its matching firms are both Alibaba And Amazon. They are equally matched to ABC. ABC is expected to go public in early 2020. Using the information above and forecasted R&D growth as a key value driver, what should be the offer price of ABC? Investment bankers forecast the R&D growth of ABC after going public is 55%. Use below information in thousands) to answer the questions. Forecasted numbers are the numbers that are based on analyst's forecasts. That is, Alibaba's forecasted revenue of $650,000 is the revenue analysts forecasted in 2019 Alibaba will have in 2020. Sales revenue Sales growth Cost of goods sold Gross profit Research and development expense R&D growth Selling, general and administrative expense Interest expense Net profits before taxes Net profits after taxes Stock price per share Number of employees in thousands 2019 425,131 25% 349,535 75,596 121,099 135% 127,147 20,000 -192,650 -134,855 $166 3 Alibaba forecasted number 650,000 50% 677,500 -27,500 228,000 150% 148,750 20,000 -424,250 -296,975 2019 2,558,776 125% 2,138,155 420,621 1,024,464 250% 1,524,325 26,372 -2,154,540 -1,508,178 $1,608 16 Amazon forecasted number 3,387,761 150% 2,512,505 875,256 1,537,984 200% 1,509,787 26,372 -2,198,887 -1,539,221 20 2. Based on innovation and human capital, which company should have higher market value? 3. We want to value an offer price of an ABC company and its matching firms are both Alibaba And Amazon. They are equally matched to ABC. ABC is expected to go public in early 2020. Using the information above and forecasted R&D growth as a key value driver, what should be the offer price of ABC? Investment bankers forecast the R&D growth of ABC after going public is 55%