Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help using Excel please! Thank you and will upvote! Saving for College Congratulations! Your first child has just been born and there are a

Need help using Excel please! Thank you and will upvote!

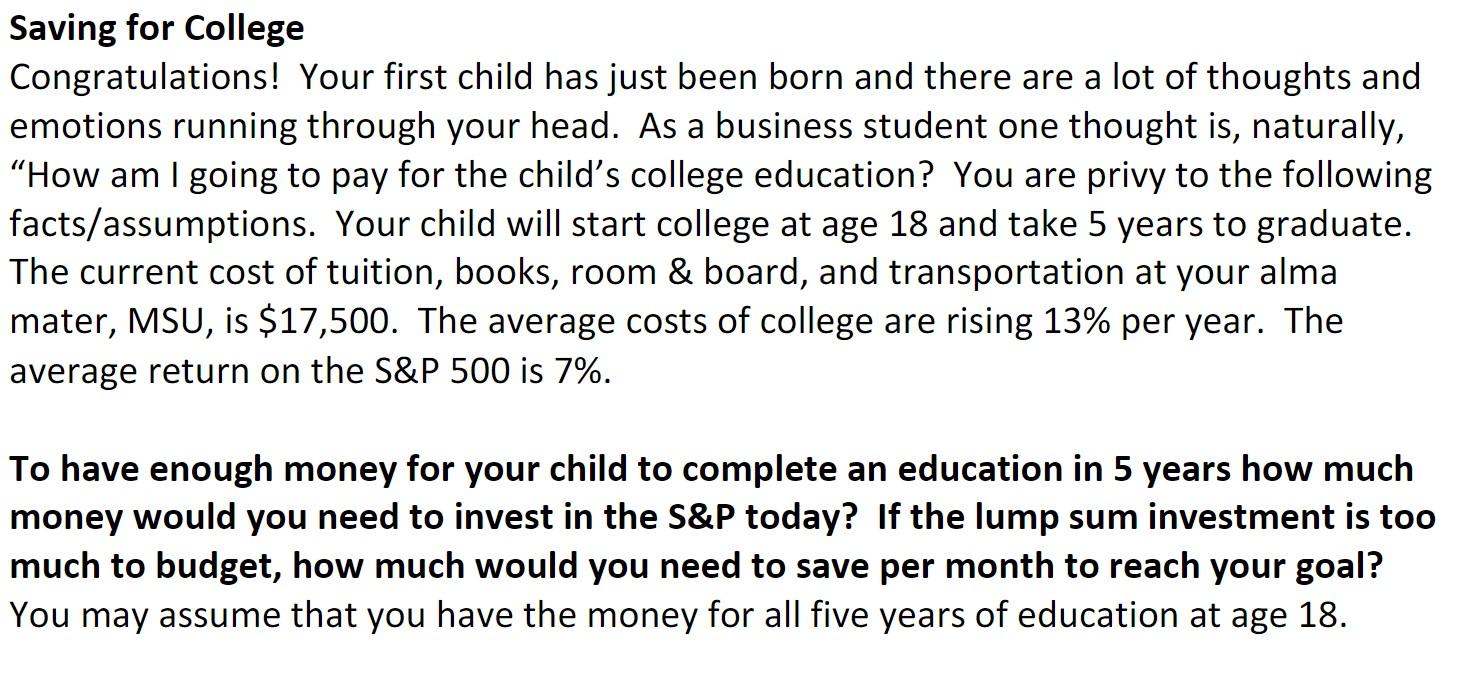

Saving for College Congratulations! Your first child has just been born and there are a lot of thoughts and emotions running through your head. As a business student one thought is, naturally, "How am I going to pay for the child's college education? You are privy to the following facts/assumptions. Your child will start college at age 18 and take 5 years to graduate. The current cost of tuition, books, room & board, and transportation at your alma mater, MSU, is $17,500. The average costs of college are rising 13% per year. The average return on the S&P 500 is 7%. To have enough money for your child to complete an education in 5 years how much money would you need to invest in the S&P today? If the lump sum investment is too much to budget, how much would you need to save per month to reach your goal? You may assume that you have the money for all five years of education at age 18. Saving for College Congratulations! Your first child has just been born and there are a lot of thoughts and emotions running through your head. As a business student one thought is, naturally, "How am I going to pay for the child's college education? You are privy to the following facts/assumptions. Your child will start college at age 18 and take 5 years to graduate. The current cost of tuition, books, room & board, and transportation at your alma mater, MSU, is $17,500. The average costs of college are rising 13% per year. The average return on the S&P 500 is 7%. To have enough money for your child to complete an education in 5 years how much money would you need to invest in the S&P today? If the lump sum investment is too much to budget, how much would you need to save per month to reach your goal? You may assume that you have the money for all five years of education at age 18Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started