Answered step by step

Verified Expert Solution

Question

1 Approved Answer

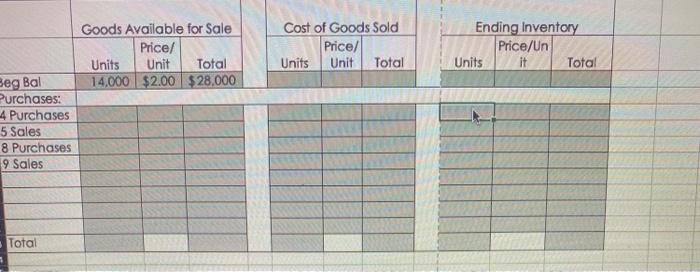

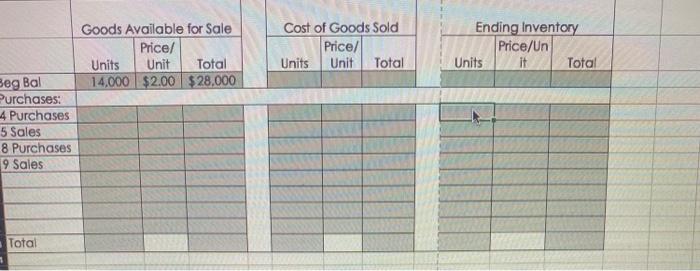

Need help using FIFO method to complete inventory table Goods Available for Sale Price/ Units Unit Total 14.000 $2.00 $28,000 Cost of Goods Sold Price/

Need help using FIFO method to complete inventory table

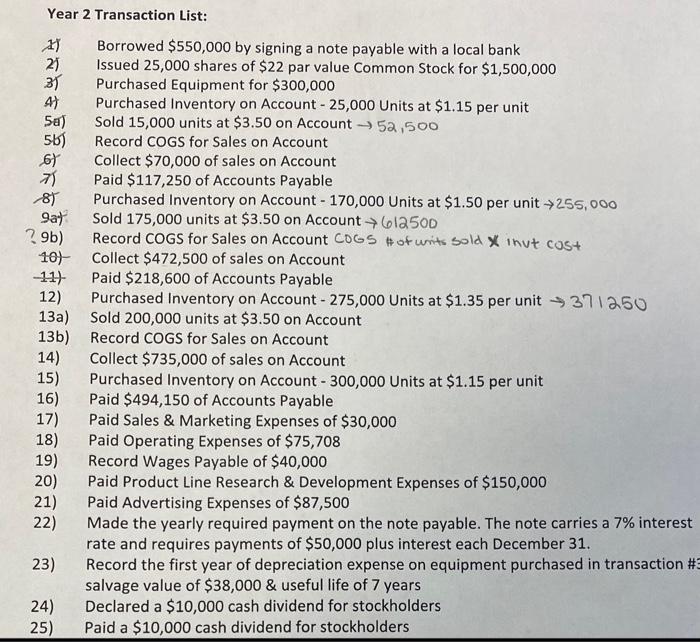

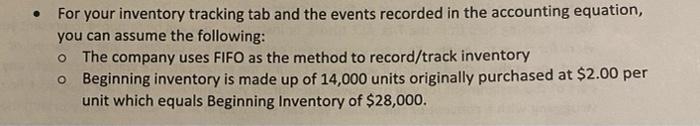

Goods Available for Sale Price/ Units Unit Total 14.000 $2.00 $28,000 Cost of Goods Sold Price/ Units Unit Total Ending Inventory Price/Un Units it Total Beg Bal Purchases: 4 Purchases 5 Sales 8 Purchases 9 Sales Total Year 2 Transaction List: 29b) 11 Borrowed $550,000 by signing a note payable with a local bank 21 Issued 25,000 shares of $22 par value Common Stock for $1,500,000 31 Purchased Equipment for $300,000 41 Purchased Inventory on Account - 25,000 Units at $1.15 per unit 5a) Sold 15,000 units at $3.50 on Account - 53,500 56) Record COGS for Sales on Account 6) Collect $70,000 of sales on Account 7 Paid $117,250 of Accounts Payable 81 Purchased Inventory on Account - 170,000 Units at $1.50 per unit +255,000 9a) Sold 175,000 units at $3.50 on Account 612500 Record COGS for Sales on Account COGS # of units sold Xinut cost 10) Collect $472,500 of sales on Account 117 Paid $218,600 of Accounts Payable 12) Purchased Inventory on Account - 275,000 Units at $1.35 per unit 371250 13a) Sold 200,000 units at $3.50 on Account 13b) Record COGS for Sales on Account 14) Collect $735,000 of sales on Account Purchased Inventory on Account - 300,000 Units at $1.15 per unit 16) Paid $494,150 of Accounts Payable 17) Paid Sales & Marketing Expenses of $30,000 18) Paid Operating Expenses of $75,708 19) Record Wages Payable of $40,000 20) Paid Product Line Research & Development Expenses of $150,000 21) Paid Advertising Expenses of $87,500 22) Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. 23) Record the first year of depreciation expense on equipment purchased in transaction # salvage value of $38,000 & useful life of 7 years 24) Declared a $10,000 cash dividend for stockholders 25) Paid a $10,000 cash dividend for stockholders 15) Goods Available for Sale Price/ Units Unit Total 14.000 $2.00 $28,000 Cost of Goods Sold Price/ Units Unit Total Ending Inventory Price/Un Units it Total Beg Bal Purchases: 4 Purchases 5 Sales 8 Purchases 19 Sales Total For your inventory tracking tab and the events recorded in the accounting equation, you can assume the following: o The company uses FIFO as the method to record/track inventory o Beginning inventory is made up of 14,000 units originally purchased at $2.00 per unit which equals Beginning Inventory of $28,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started