Need help, very appreciated!!

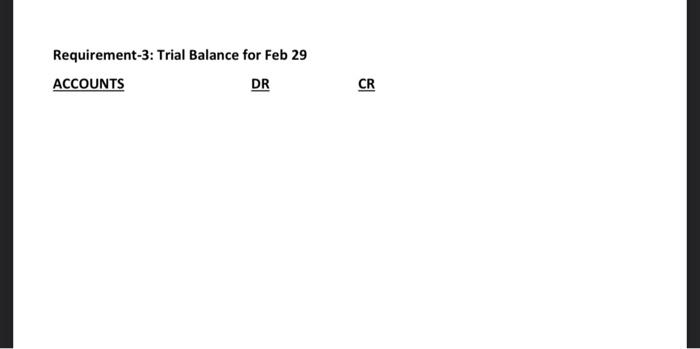

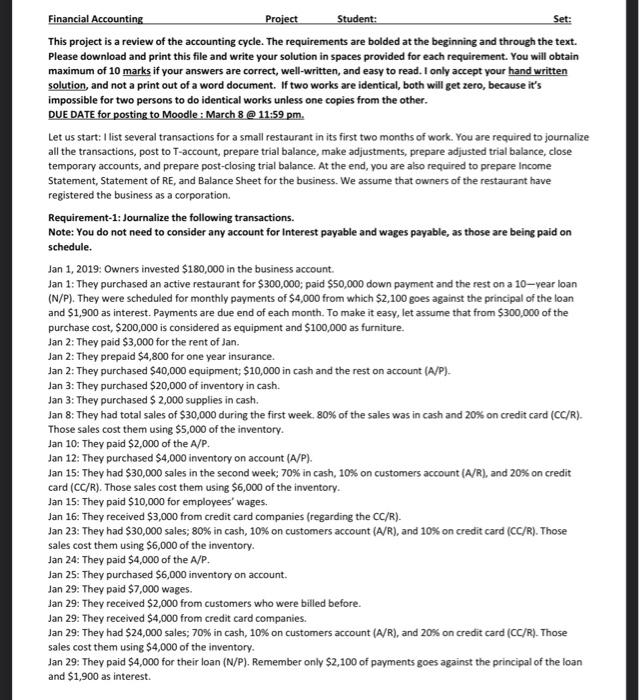

Set: Financial Accounting Project Student: This project is a review of the accounting cycle. The requirements are bolded at the beginning and through the text. Please download and print this file and write your solution in spaces provided for each requirement. You will obtain maximum of 10 marks if your answers are correct, well-written, and easy to read. I only accept your hand written solution, and not a print out of a word document. If two works are identical, both will get zero, because it's impossible for two persons to do identical works unless one copies from the other. DUE DATE for posting to Moodle : March 8 @ 11:59 pm Let us start: I list several transactions for a small restaurant in its first two months of work. You are required to journalize all the transactions, post to T-account, prepare trial balance, make adjustments, prepare adjusted trial balance, close temporary accounts, and prepare post-closing trial balance. At the end, you are also required to prepare Income Statement, Statement of RE, and Balance Sheet for the business. We assume that owners of the restaurant have registered the business as a corporation. Requirement-1: Journalize the following transactions. Note: You do not need to consider any account for interest payable and wages payable, as those are being paid on schedule. Jan 1, 2019: Owners invested $180,000 in the business account. Jan 1: They purchased an active restaurant for $300,000; paid $50,000 down payment and the rest on a 10-vear loan (N/P). They were scheduled for monthly payments of $4,000 from which $2,100 goes against the principal of the loan and $1,900 as interest. Payments are due end of each month. To make it easy, let assume that from $300,000 of the purchase cost, $200,000 is considered as equipment and $100,000 as furniture. Jan 2: They paid $3,000 for the rent of Jan. Jan 2: They prepaid $4,800 for one year insurance. Jan 2: They purchased $40,000 equipment; $10,000 in cash and the rest on account (A/P). Jan 3: They purchased $20,000 of inventory in cash. Jan 3: They purchased $ 2,000 supplies in cash. Jan 8: They had total sales of $30,000 during the first week. 80% of the sales was in cash and 20% on credit card (CC/R). Those sales cost them using $5,000 of the inventory. Jan 10: They paid $2,000 of the A/P. Jan 12: They purchased $4,000 inventory on account (A/P). Jan 15: They had $30,000 sales in the second week: 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 15: They paid $10,000 for employees' wages. Jan 16: They received $3,000 from credit card companies (regarding the CC/R). Jan 23: They had $30,000 sales: 80% in cash, 10% on customers account (A/R), and 10% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 24: They paid $4,000 of the A/P. Jan 25: They purchased $6,000 inventory on account. Jan 29: They paid $7,000 wages. Jan 29: They received $2,000 from customers who were billed before. Jan 29: They received $4,000 from credit card companies. Jan 29: They had $24,000 sales: 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $4,000 of the inventory. Jan 29: They paid $4,000 for their loan (N/P). Remember only $2,100 of payments goes against the principal of the loan and $1,900 as interest. Requirement-3: Trial Balance for Feb 29 ACCOUNTS DR CR Requirement-4: Adjustments ACCOUNTS DR CR NO a. b. c. Requirement-5: Update the adjusted accounts on your T-Accounts and find the new balance for those accounts which you adjusted. You may add new accounts too. Requirement-6: Adjusted Trial Balance, Feb 29 ACCOUNTS DR CR Requirement-7: Financial Statements a. Income Statement b. Retained Earnings Statement Note: RE at the beginning is zero. c. Balance Sheet Requirement-8: Closing Temporary Accounts a. Journal entries b. Updating RE account c. Post-Closing Trial Balance ACCOUNTS DR CR Set: Financial Accounting Project Student: This project is a review of the accounting cycle. The requirements are bolded at the beginning and through the text. Please download and print this file and write your solution in spaces provided for each requirement. You will obtain maximum of 10 marks if your answers are correct, well-written, and easy to read. I only accept your hand written solution, and not a print out of a word document. If two works are identical, both will get zero, because it's impossible for two persons to do identical works unless one copies from the other. DUE DATE for posting to Moodle : March 8 @ 11:59 pm Let us start: I list several transactions for a small restaurant in its first two months of work. You are required to journalize all the transactions, post to T-account, prepare trial balance, make adjustments, prepare adjusted trial balance, close temporary accounts, and prepare post-closing trial balance. At the end, you are also required to prepare Income Statement, Statement of RE, and Balance Sheet for the business. We assume that owners of the restaurant have registered the business as a corporation. Requirement-1: Journalize the following transactions. Note: You do not need to consider any account for interest payable and wages payable, as those are being paid on schedule. Jan 1, 2019: Owners invested $180,000 in the business account. Jan 1: They purchased an active restaurant for $300,000; paid $50,000 down payment and the rest on a 10-vear loan (N/P). They were scheduled for monthly payments of $4,000 from which $2,100 goes against the principal of the loan and $1,900 as interest. Payments are due end of each month. To make it easy, let assume that from $300,000 of the purchase cost, $200,000 is considered as equipment and $100,000 as furniture. Jan 2: They paid $3,000 for the rent of Jan. Jan 2: They prepaid $4,800 for one year insurance. Jan 2: They purchased $40,000 equipment; $10,000 in cash and the rest on account (A/P). Jan 3: They purchased $20,000 of inventory in cash. Jan 3: They purchased $ 2,000 supplies in cash. Jan 8: They had total sales of $30,000 during the first week. 80% of the sales was in cash and 20% on credit card (CC/R). Those sales cost them using $5,000 of the inventory. Jan 10: They paid $2,000 of the A/P. Jan 12: They purchased $4,000 inventory on account (A/P). Jan 15: They had $30,000 sales in the second week: 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 15: They paid $10,000 for employees' wages. Jan 16: They received $3,000 from credit card companies (regarding the CC/R). Jan 23: They had $30,000 sales: 80% in cash, 10% on customers account (A/R), and 10% on credit card (CC/R). Those sales cost them using $6,000 of the inventory. Jan 24: They paid $4,000 of the A/P. Jan 25: They purchased $6,000 inventory on account. Jan 29: They paid $7,000 wages. Jan 29: They received $2,000 from customers who were billed before. Jan 29: They received $4,000 from credit card companies. Jan 29: They had $24,000 sales: 70% in cash, 10% on customers account (A/R), and 20% on credit card (CC/R). Those sales cost them using $4,000 of the inventory. Jan 29: They paid $4,000 for their loan (N/P). Remember only $2,100 of payments goes against the principal of the loan and $1,900 as interest. Requirement-3: Trial Balance for Feb 29 ACCOUNTS DR CR Requirement-4: Adjustments ACCOUNTS DR CR NO a. b. c. Requirement-5: Update the adjusted accounts on your T-Accounts and find the new balance for those accounts which you adjusted. You may add new accounts too. Requirement-6: Adjusted Trial Balance, Feb 29 ACCOUNTS DR CR Requirement-7: Financial Statements a. Income Statement b. Retained Earnings Statement Note: RE at the beginning is zero. c. Balance Sheet Requirement-8: Closing Temporary Accounts a. Journal entries b. Updating RE account c. Post-Closing Trial Balance ACCOUNTS DR CR