Answered step by step

Verified Expert Solution

Question

1 Approved Answer

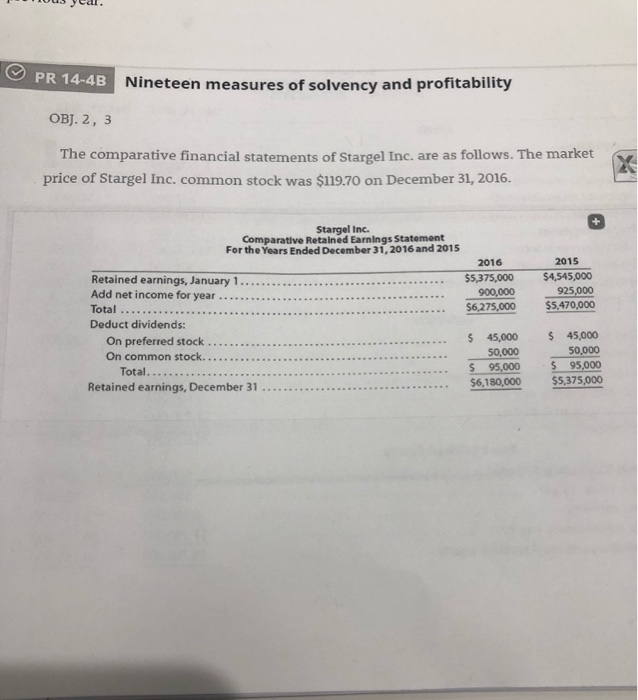

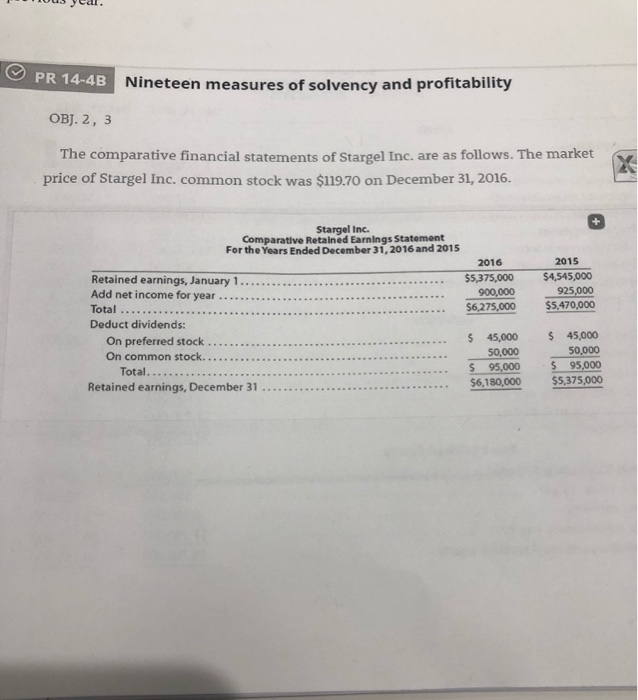

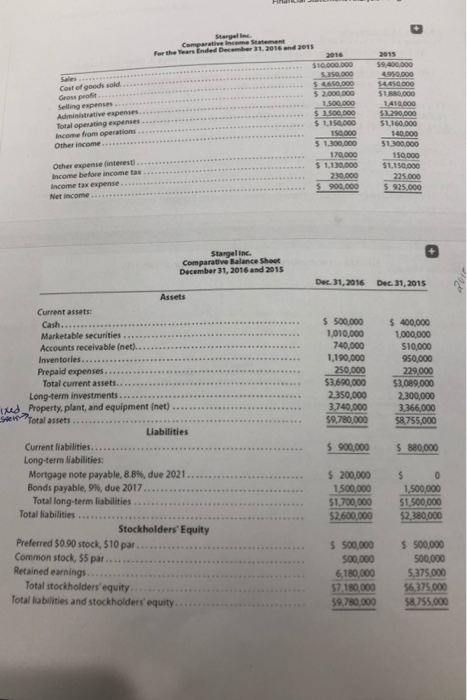

Need help with 16, 17, 18 PR 14-4B Nineteen measures of solvency and profitability OBJ. 2, 3 The comparative financial statements of Stargel Inc. are

Need help with 16, 17, 18

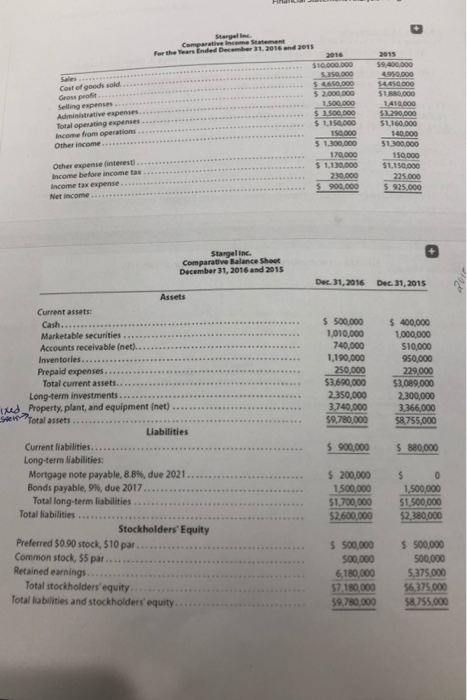

PR 14-4B Nineteen measures of solvency and profitability OBJ. 2, 3 The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel Inc. common stock was $119.70 on December 31, 2016. Stargel Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2016 and 2015 2015 2016 $5,375,000$4,545,000 925 900,000 275,000 Add net income for year .. Total Deduct dividends: .. .. .. . . $5,470,000 45,000 50,000 45,000 50,000 . 95,000 95,000 $5,375,00o Total. Retained earnings, December 31 . .. . Stargel ine December 31, 2016and 2015 Fer the $10.000,00 9400000 51.880000 $3290.000 Income from operations$1,19000 Other income....ce $1,160,000 $1,300,000 1,130,000 $1,150,000 900.000 5 925.000 5 1.300,000 170,000 .$ Income before income tax -u Income tax expense Net income Stargel inc Comparative Balance Shoot December 31, 2016 and 2015 Dec. 31, 2016 Dec 31,2015 Assets Current assets: Cash.500,000 $ 400000 1,010,000 740,000 1,190,000 510,000 250,000 229000 2,350,000 2,300,000 3,740,000 3366000 9,780,000 $8,755,000 Long-term investments... XudProperty, plant, and equipment (net) is Total assets Liabilities 900,000 880,000 Long-term liabilities Mortgage note payable, 88%, due 2021 Bonds payable, 9%, due 2017 Total long-term liabilities 200,000 1,500,000 1,700,000 $1,500,000 $2600,000 2.380,000 Stockholders' Equity 500,000 $ 500,000 Preferred $0.90 stock, $10 par.. 6180,000 5,375,000 s7180000 s6375000 $9,780,000 58755,000 Retained earnings Total stockholders' equity Total liabilities and stockholders equity. 15. Rate earned on common stockholders' equity 16. Earnings per share on common stock 17. Price-earnings ratio 18. Dividends per share of common stock 19. Dividend yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started