Answered step by step

Verified Expert Solution

Question

1 Approved Answer

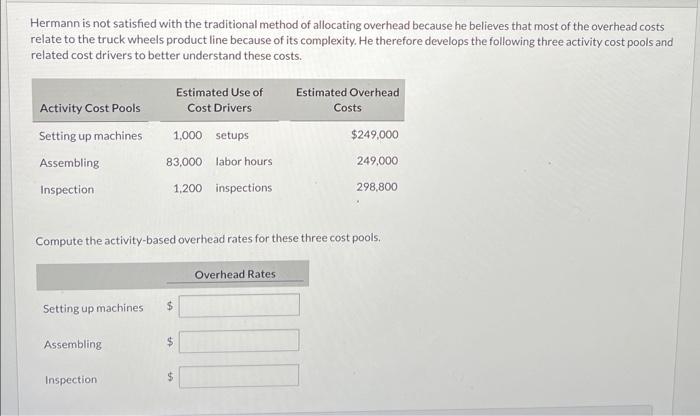

need help with 3rd pic only thanks ex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign

need help with 3rd pic only thanks

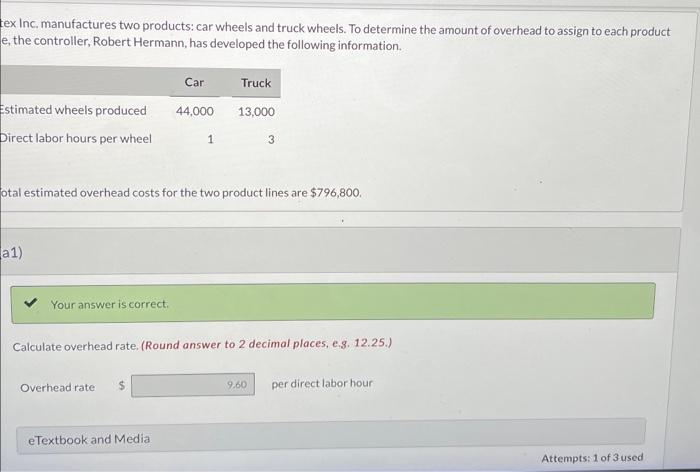

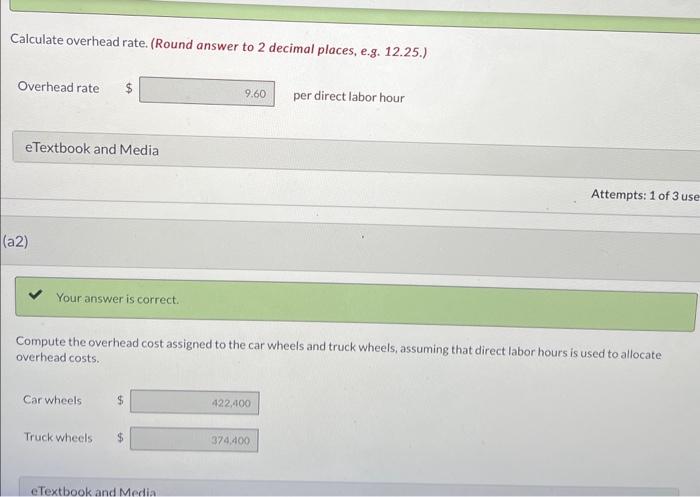

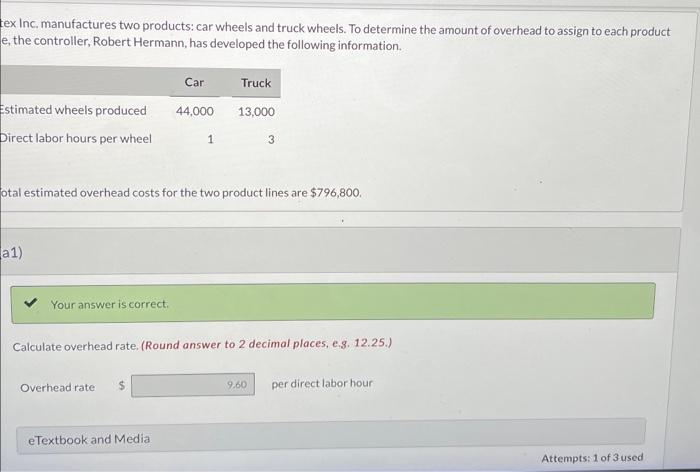

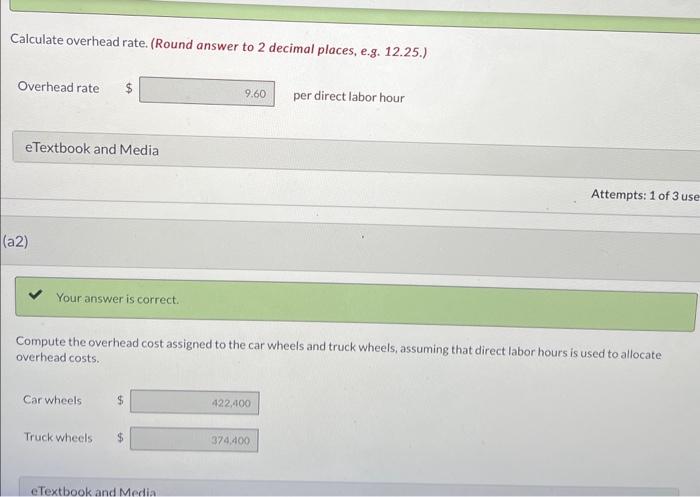

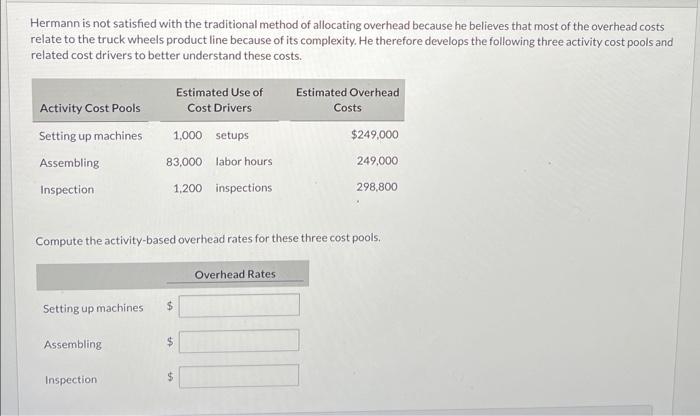

ex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product e, the controller, Robert Hermann, has developed the following information. otal estimated overhead costs for the two product lines are $796,800. a1) Your answer is correct. Calculate overhead rate. (Round answer to 2 decimal places, e.s. 12.25.) Overhead rate per direct labor hour Calculate overhead rate. (Round answer to 2 decimal places, e.g. 12.25.) Overhead rate $ per direct labor hour eTextbook and Media Attempts: 1 of 3 a2) Your answer is correct. Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs. Car wheels Truck wheels \$ Hermann is not satisfied with the traditional method of allocating overhead because he believes that most of the overhead costs relate to the truck wheels product line because of its complexity. He therefore develops the following three activity cost pools and related cost drivers to better understand these costs. Compute the activity-based overhead rates for these three cost pools

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started