Answered step by step

Verified Expert Solution

Question

1 Approved Answer

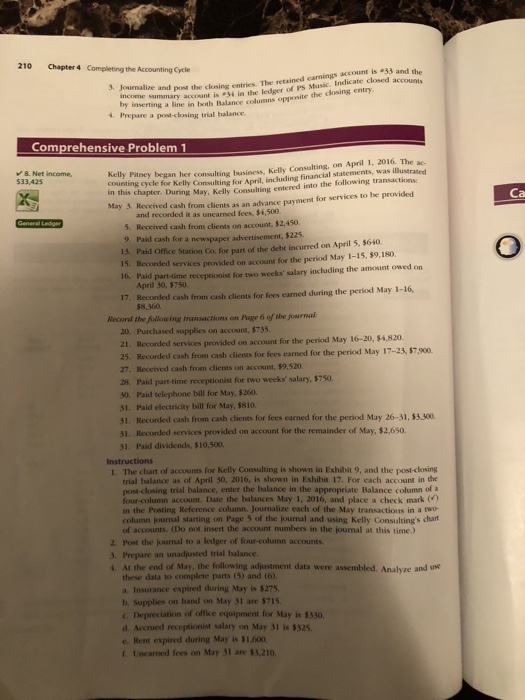

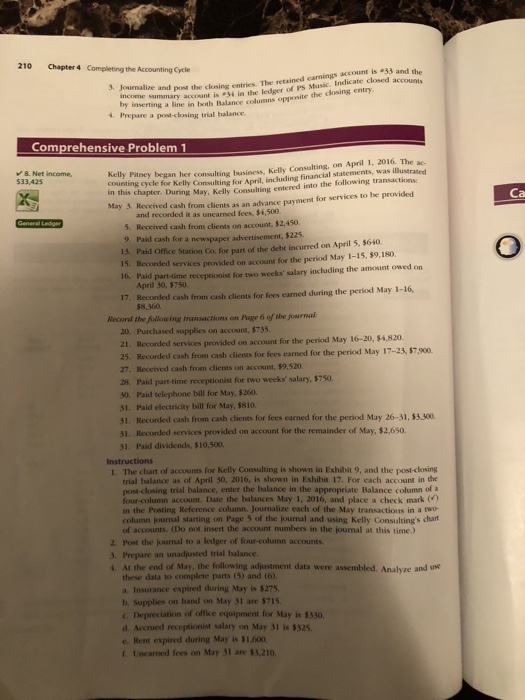

need help with 4 and 6. please. 210 Chapter 4 Completing the Accounting Cycle post the closing entries. The retained earnings account is 33 and

need help with 4 and 6. please.

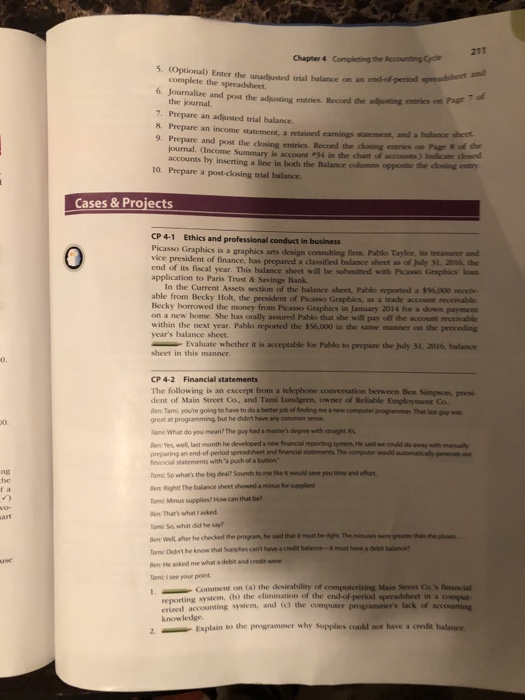

210 Chapter 4 Completing the Accounting Cycle post the closing entries. The retained earnings account is "33 and the ount is 34 in the ledger of PS Music. Indicate closed a line in both Balance columns opposite the cdosing entry 4. Prepare a post-closing trial halance Comprehensive Problem 1 counting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May Kelly Pitney began her consltng siness, Kelly Consulting, on April 1, 2016. The ac. $33,425 May, Kelly Consulting entered into the following transactions clients as an advance payment for services to be provided Ca May 3. Received cash from and recorded it as unearned fees, $,500. 5. Received cash from clients on account, $2,450 9. Paid cash for a newspaper advertisement, $22 13. Paid Office Station Co. foe part of the debt incurred on April 5, 5640. 15. Recorded services provided on account for the period May 1-15, $9,180. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750 17. Recorded cash from cash clients for fees earned during the period May 1-16, $8,360. Record tbhe fullowing fransactions on Page 6 of the journal 20. Purchased supplies on account, $735 21. Recorded services provided on account for the period May 16-20, $4,820 25. Recorded cash from cash cients for fees earned for the period May 17-23, $7,900. 27. Received cash from clients on account, $9.520 28. Paid pan-time receptionist for two weeks' salary, $750. 30. Paid telephone bill for May, $260. 31. Paid electricity bill for May, $810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 53,300 31. Recorded services provided on account for the remainder of May, $2,650. 31. Paid dividends, $10,500. Instructions I. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 50, 2016, is shown in Exhibis 17. For each accout in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark ) in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts 3. Prepare an unadjusted trial balance 4. Ar the end of May, the following adjustment data were assembled. Analvze and use these data to complete parts (5) and (6). a. Insurance expired during May is $275. b. Supplies on hand on May 31 are $715 c. Depreciation of office equipment for May is $330 d. Accrued receptionist salary on May 31 is $325 e. Rent expired during May is $1,600 f. Uncaned fees on May 31 are $3,210 211 Chapter 4 Completing the Accounting Cycle 5. (Optional) Enter the unadjusted trial halance on and complete the spreadsheet 6. Journalize and the journal. entries on Page 7 of 7. Prepare an adjusted trial balance. 8. Prepare an income 9. Prepare and post the closing entries. Record the closing entries an statement, a retained earnings statement, and a halance sheet journal. (Income Summary is account 34 in the chart of accounts) Indicatne accounts by inserting a line in both the Balance columns opposite the dkaing catry Page S of the closed 10. Prepare a post-closing trial balance. Cases & Projects CP 4-1 Ethics and professional conduct in business Picasso Graphics is a graphics arts design consulting firm. Pablo Taylor, its treasurer and vice president of finance, has prepared a classified balance sheet as of July 51 2016, the end of its fiscal year. This balance sheet will be submited with Picasso Graphics loan application to Paris Trust & Savings Bank In the Current Assets section of the balance sheet, Pablo reported a $$6,000 recei able from Becky Holt, the president of Picasso Graphics, as a trade account receivable Becky borrowed the money from Picasso Graphics in January 2014 for a down payment on a new home. She has orally assured Pablo that she will pay off the account receivable within the next year. Pablo reported the $56,000 in the same manner on the preceding year's balance sheet. Evaluate whether it is acceptable for Pablo to prepare the July 31, 2016, balance sheet in this manner. o, CP 4-2 Financial statements The following is an e, from a telephone coerversakn between Ben dent of Main Street Co, and Tami Landgren, owner of Reliable Employment Co Ben: Tami, youre going to have to do a better job of finding me a new computer programmes That last guy wa great at programming, but he ddit have any common sense. Simpson, presi 0. Tame What do you mean? The guy had a master's degree with straight A Ben Yes, well, last month he developed a new fnancial reporting sytem He said we coud do away with manualy an end-of period spreadsheet and fnancial statements The computer would automaticaly generateur financial stabements with 'a push of a button' Tami: So what's the big deal? Sounds to me ike t would save you time and effort he Sen Right The balance sheet showed a minus for supples fami: Minus supplies? How can that be Ben That's what l asked sa what did he say? Be Well, aher he checked the program he sald that it must be right. The minuses wer art gres than the Tame Didn ten He asked me what a debit and credit were Tamc I see your point t he know that Supplies cant have a credit balance-t must have a debit balnce? Comment on (a) the desirability of e g Main Street Co's financial ecsorting system, 0h) the elimination of the end-of period spreadshect in a comput crized accounting system, and () the computer programmer's lack of accounting know ledge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started