Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with #5 a.b.c. and d. the numbers and info to solve will be below. please show work on solving this is for solving

need help with #5 a.b.c. and d. the numbers and info to solve will be below. please show work on solving

this is for solving b)

this is for solving a)

percentages :

direct labor percentages:

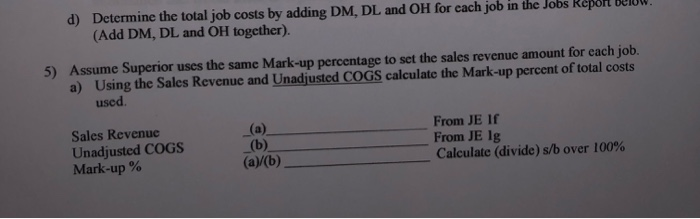

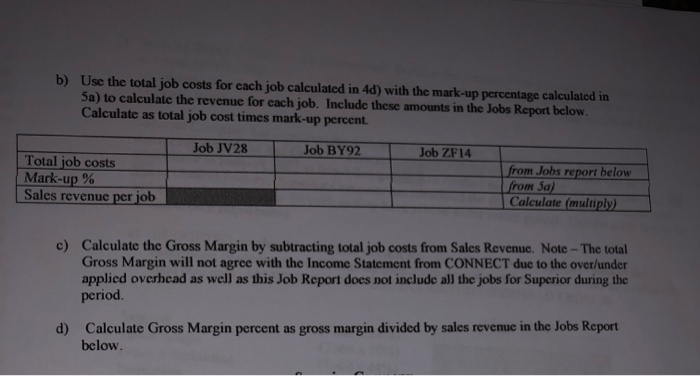

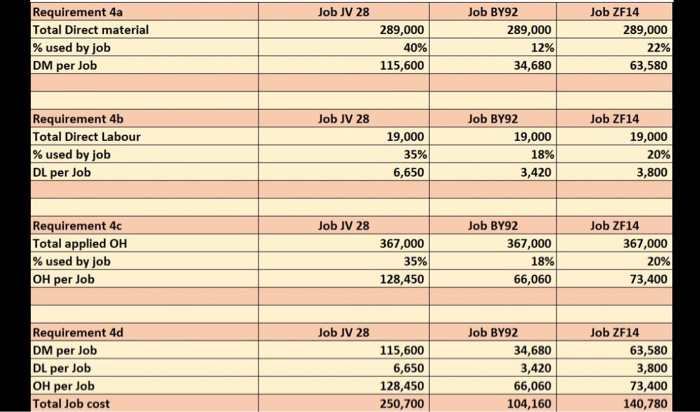

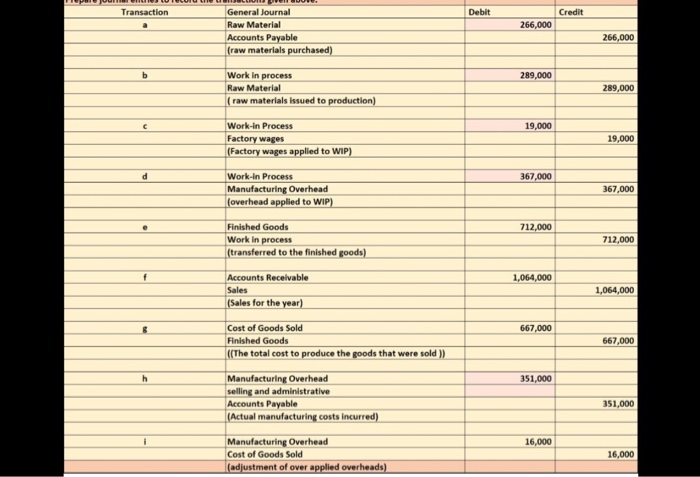

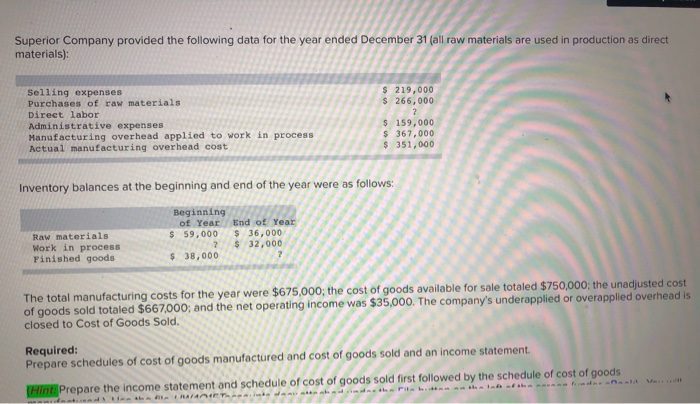

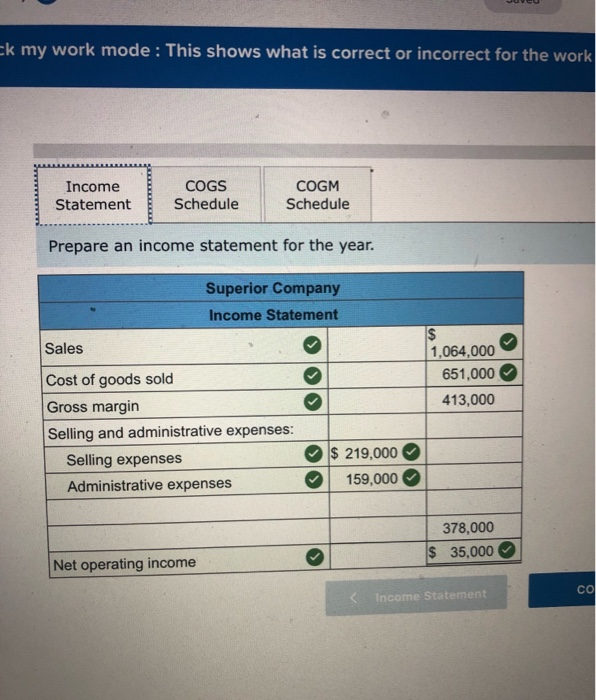

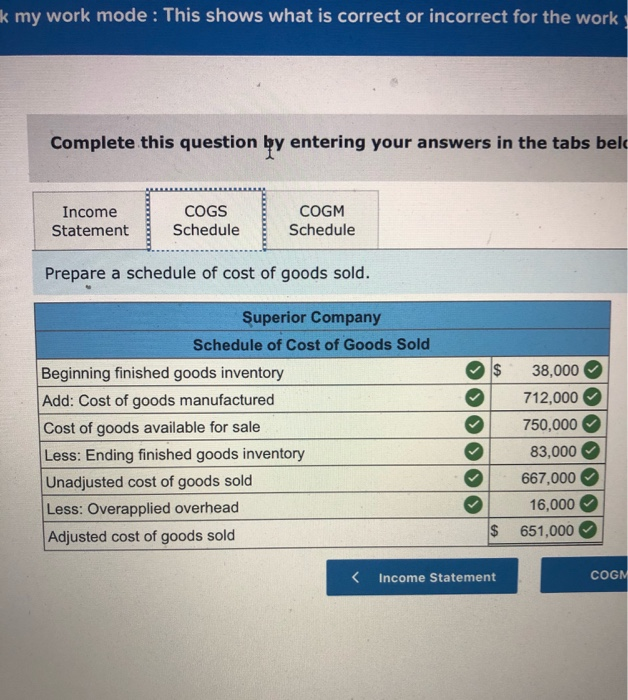

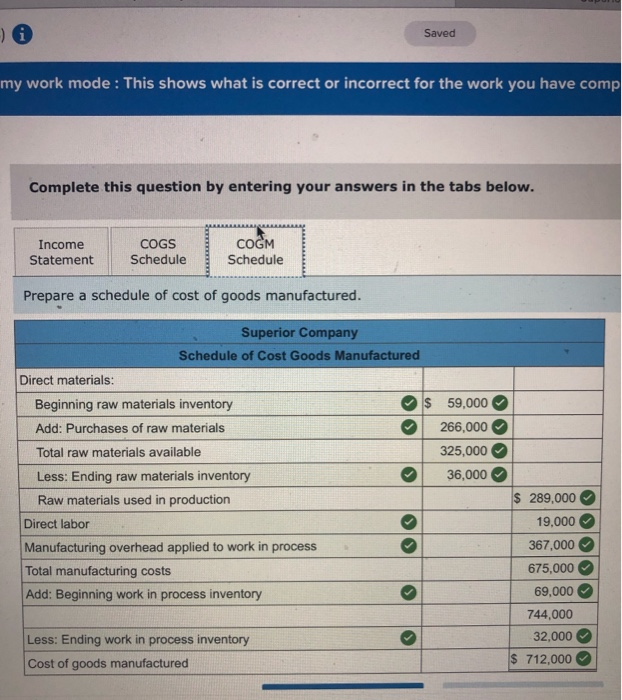

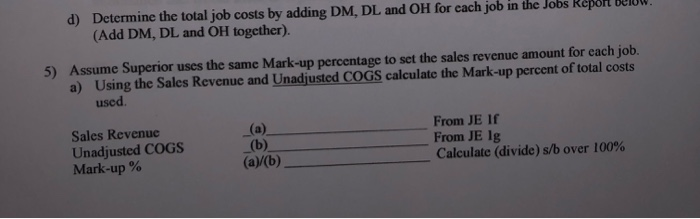

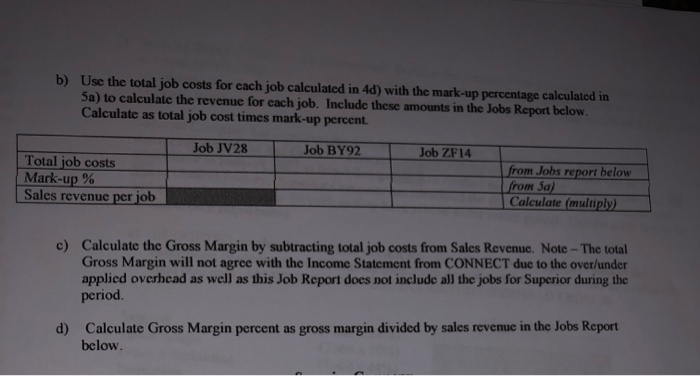

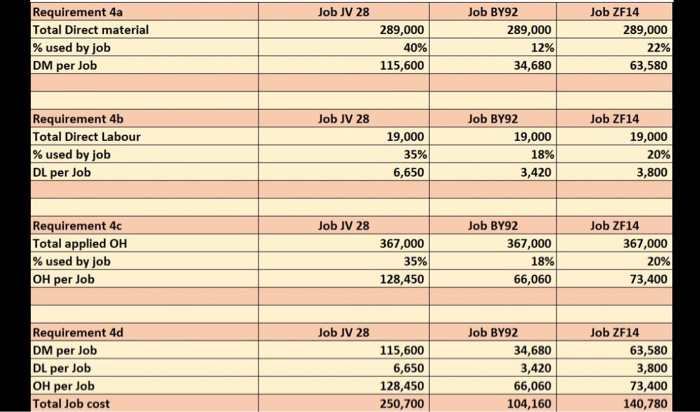

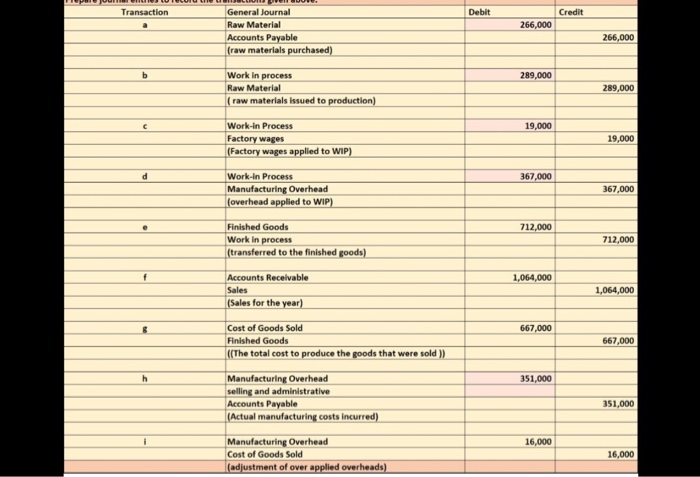

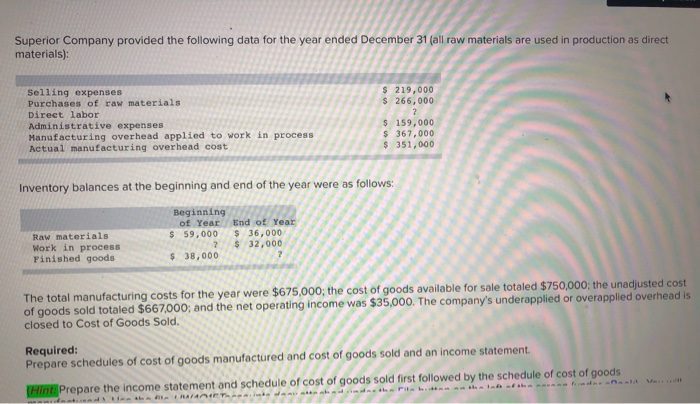

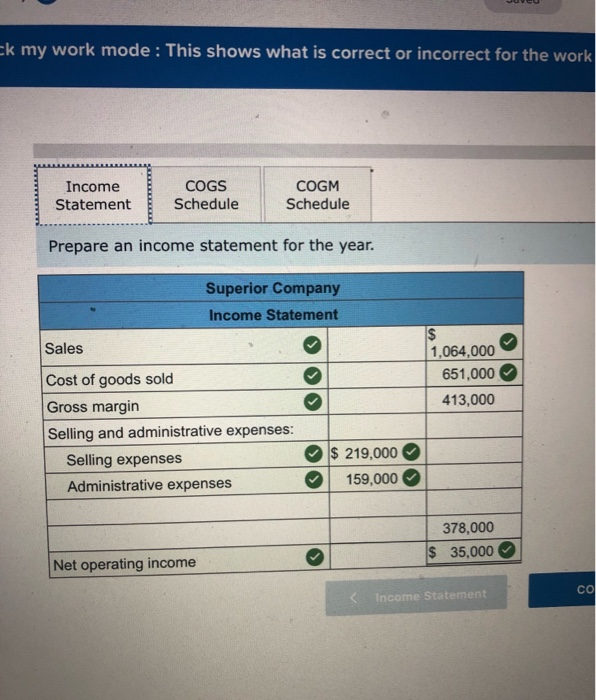

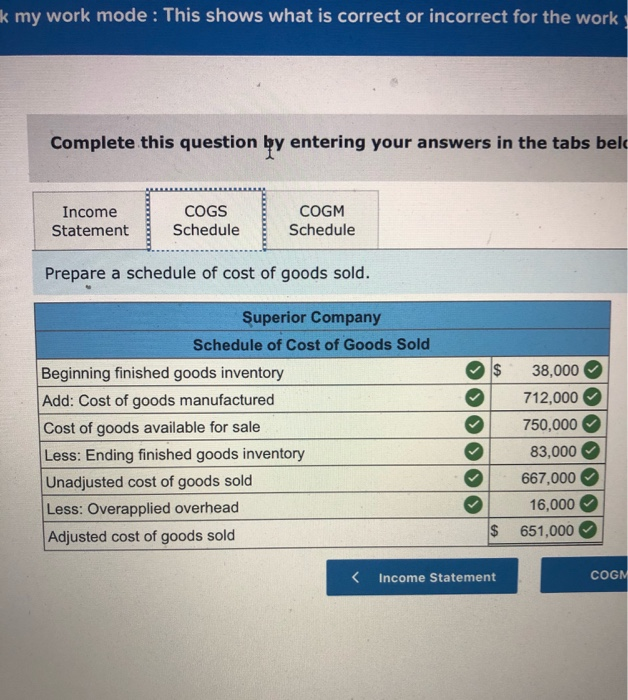

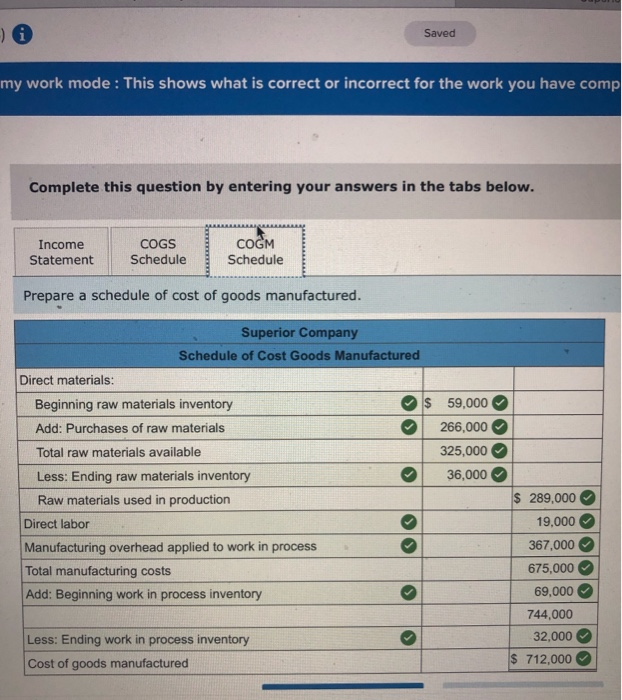

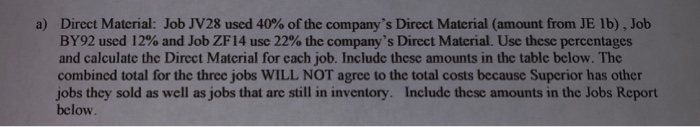

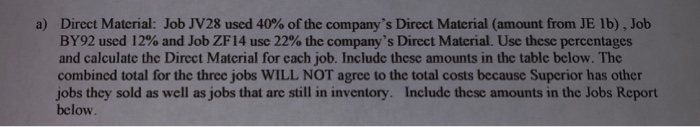

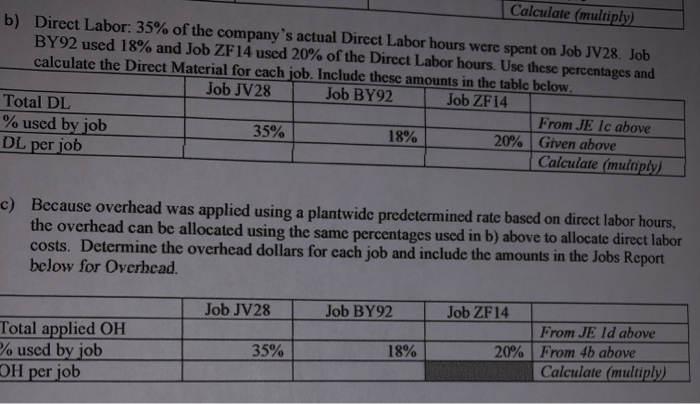

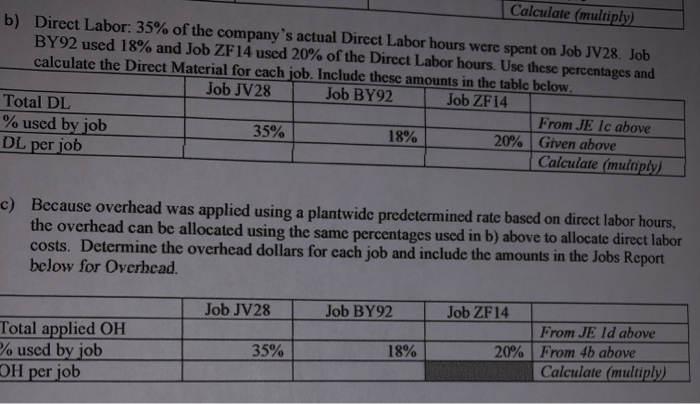

d) Determine the total job costs by adding DM, DL and OH for cach job in the Jobs Report (Add DM, DL and OH together). 5) Assume Superior uses the same Mark-up percentage to set the sales revenue amount for each job. a) Using the Sales Revenue and Unadjusted COGS calculate the Mark-up percent of total costs used Sales Revenue Unadjusted COGS Mark-up % From JE If From JE lg Calculate (divide) s/b over 100% (b) (a) (b) b) Use the total job costs for each job calculated in 4d) with the mark-up percentage calculated in Sa) to calculate the revenue for each job. Include these amounts in the Jobs Report below. Calculate as total job cost times mark-up percent. Job JV28 Job BY92 Job ZF14 Total job costs Mark-up % Sales revenue per job from Jobs report below from 5a) Calculate (multiply) c) Calculate the Gross Margin by subtracting total job costs from Sales Revenue. Note - The total Gross Margin will not agree with the Income Statement from CONNECT due to the over/under applied overhead as well as this Job Report does not include all the jobs for Superior during the period d) Calculate Gross Margin percent as gross margin divided by sales revenue in the Jobs Report below. Job JV 28 Requirement 4a Total Direct material % used by job DM per Job 289,000 40% 115,600 Job BY92 289,000 12% 34,680 Job ZF14 289,000 22% 63,580 Job JV 28 Requirement 4b Total Direct Labour % used by job DL per Job 19,000 35% 6,650 Job BY92 19,000 18% 3,420 Job ZF14 19,000 20% 3,800 Job JV 28 Requirement 4c Total applied OH % used by job OH per Job 367,000 35% 128,450 Job BY92 367,000 18% 66,060 Job ZF14 367,000 20% 73,400 Job JV 28 Requirement 4d DM per Job DL per Job OH per Job Total Job cost 115,600 6,650 128,450 250,700 Job BY92 34,680 3,420 66,060 104,160 Job ZF14 63,580 3,800 73,400 140,780 Transaction Debit Credit 266,000 General Journal Raw Material Accounts Payable (raw materials purchased) 266,000 b 289,000 Work in process Raw Material ( raw materials issued to production) 289,000 c 19,000 Work in Process Factory wages (Factory wages applied to WIP) 19,000 d 367,000 Work In Process Manufacturing Overhead (overhead applied to WIP) 367,000 712,000 Finished Goods Work in process (transferred to the finished goods) 712,000 1,064,000 Accounts Receivable Sales (Sales for the year) 1,064,000 667,000 667,000 h Cost of Goods Sold Finished Goods ((The total cost to produce the goods that were sold )) Manufacturing Overhead selling and administrative Accounts Payable (Actual manufacturing costs incurred) 351,000 351,000 16,000 Manufacturing Overhead Cost of Goods Sold (adjustment of over applied overheads) 16,000 Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials) Selling expenses Purchases of raw materials Direct labor Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead cost $ 219,000 $ 266,000 ? $ 159,000 $367,000 $ 351,000 Inventory balances at the beginning and end of the year were as follows: Raw materials Work in process Finished goods Beginning of Year End of Year $ 59,000 $ 36,000 $ 32,000 $ 38,000 The total manufacturing costs for the year were $675,000; the cost of goods available for sale totaled $750,000; the unadjusted cost of goods sold totaled $667.000; and the net operating income was $35,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods Ek my work mode : This shows what is correct or incorrect for the work Income Statement COGS Schedule COGM Schedule Prepare an income statement for the year. Superior Company Income Statement Sales $ 1,064,000 651,000 413,000 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses $ 219,000 159,000 378,000 $ 35,000 Net operating income CO Income Statement k my work mode : This shows what is correct or incorrect for the work Complete this question by entering your answers in the tabs bel Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods sold. $ Superior Company Schedule of Cost of Goods Sold Beginning finished goods inventory Add: Cost of goods manufactured Cost of goods available for sale Less: Ending finished goods inventory Unadjusted cost of goods sold Less: Overapplied overhead Adjusted cost of goods sold 38,000 712,000 750,000 83,000 667,000 16,000 651,000 $ Income Statement COGM Saved my work mode : This shows what is correct or incorrect for the work you have comp Complete this question by entering your answers in the tabs below. Income Statement COGS Schedule COGM Schedule Prepare a schedule of cost of goods manufactured. Superior Company Schedule of Cost Goods Manufactured Direct materials: Beginning raw materials inventory $ 59,000 Add: Purchases of raw materials 266,000 Total raw materials available 325,000 Less: Ending raw materials inventory 36,000 Raw materials used in production Direct labor Manufacturing overhead applied to work in process Total manufacturing costs Add: Beginning work in process inventory $ 289,000 19,000 367,000 675,000 69,000 744,000 32,000 Less: Ending work in process inventory Cost of goods manufactured $ 712,000 a) Direct Material: Job JV28 used 40% of the company's Direct Material (amount from JE 1b), Job BY92 used 12% and Job ZF 14 use 22% the company's Direct Material. Use these percentages and calculate the Direct Material for each job. Include these amounts in the table below. The combined total for the three jobs WILL NOT agree to the total costs because Superior has other jobs they sold as well as jobs that are still in inventory. Include these amounts in the Jobs Report below. Calculate (multiply) b) Direct Labor: 35% of the company's actual Direct Labor hours were spent on Job JV28. Job BY92 used 18% and Job ZF 14 used 20% of the Direct Labor hours. Use these percentages and calculate the Direct Material for each job. Include these amounts in the table below. Job JV28 Job BY92 Job ZF14 Total DL From JE Ic above % used by job 35% 18% 20% Given above DL per job Calculate (multiply) c) Because overhead was applied using a plantwide predetermined rate based on direct labor hours, the overhead can be allocated using the same percentages used in b) above to allocate direct labor costs. Determine the overhead dollars for each job and include the amounts in the Jobs Report below for Overhead. Job JV28 Job BY92 Total applied OH % used by job OH per job 35% Job ZF14 From JE Id above 20% From 4b above Calculate (multiply 18%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started