Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help with 9 ASAP QUESTIONS You plan to purchase a $100.000 house using a 15-year mortgage obtained from your local bank. The mortgage rate

Need Help with 9 ASAP

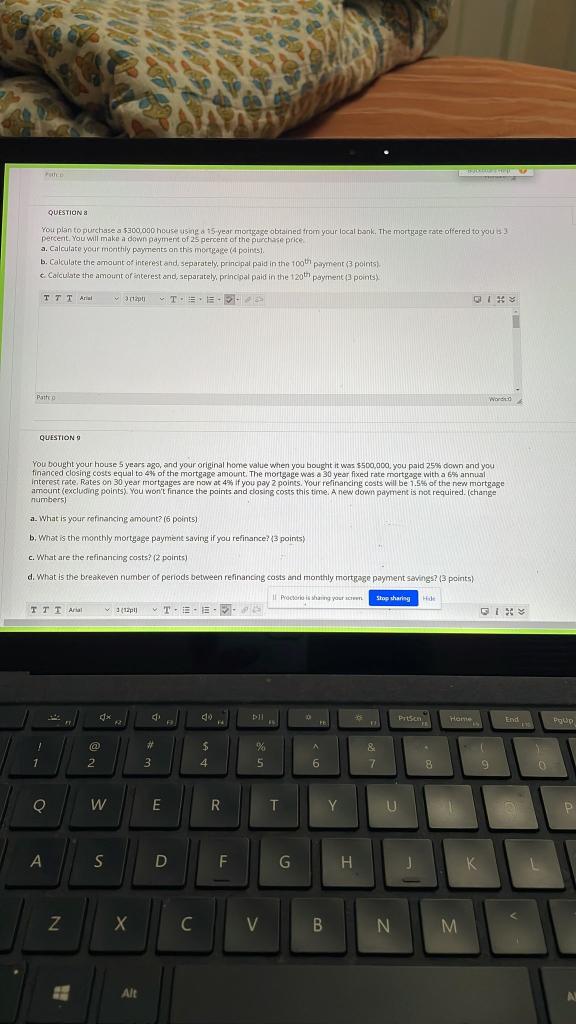

QUESTIONS You plan to purchase a $100.000 house using a 15-year mortgage obtained from your local bank. The mortgage rate offered to you - percent. You will make a down payment of 25 percent of the purchase price a. Calculate your monthly payments on this mortgage (4 points b. Calculate the amount of interest and separately, principal paid in the 10th payment (3 points) e Calculate the amount of interest and separately princoat paid in the 120th payment 3 points) Arial 10 THESE Q1 Date Wordt QUESTION You bought your house 5 years ago, and your original home value when you bought it was $500,000, you paid 25% down and you financed closing costs equal to 4% of the mortgage amount. The mortgage was a 30 year fixed rate mortgage with a 6% annual Interest rate Rates on 30 year mortgages are now at 4% if you pay 2 points. Your refinancing costs will be 1.5% of the new mortgage amount (excluding points. You won't finance the paints and closing costs this time. A new down payment is not required. (change numbers) a. What is your refinancing amount? (5 points) b. What is the monthly mortgage payment saving if you refinance? (3 points) c. What are the refinancing costs? (2 points) d. What is the breakeven number of periods between refinancing costs and monthly mortgage payment Savings? (3 points) Il Pohang your Stop sharing HJE 3 (121 T T-EES BI . DIL 00 Priser A Home End _ E # @ 2 $ 4 % % 5 & 7 7 1 3 6 8 9 0 Q W E R T Y U P . S D F G J K Z N C V B N M AltStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started