Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with 9.09, 9.13, 9.14 Please show steps. All the above numbers are correct. Division N has decided to develop its budget based upon

Need help with 9.09, 9.13, 9.14

Please show steps. All the above numbers are correct.

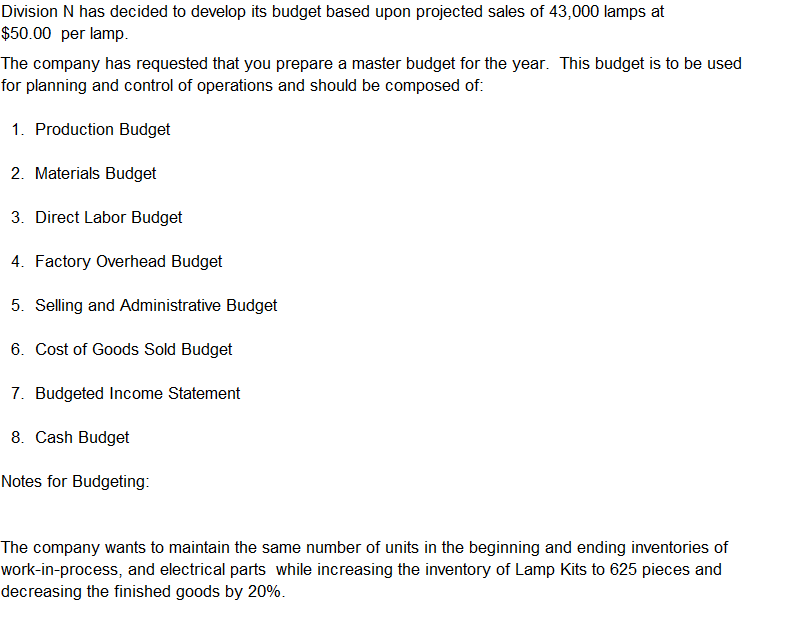

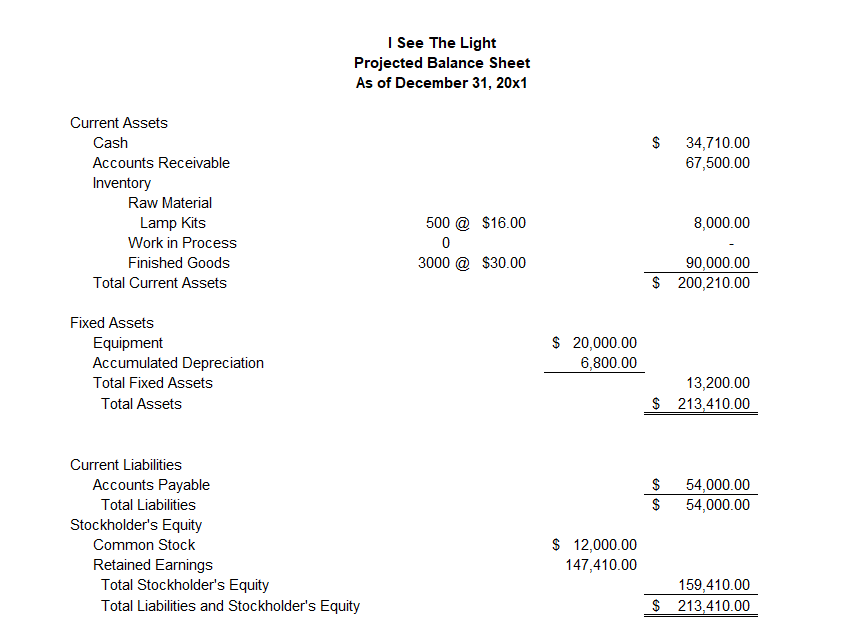

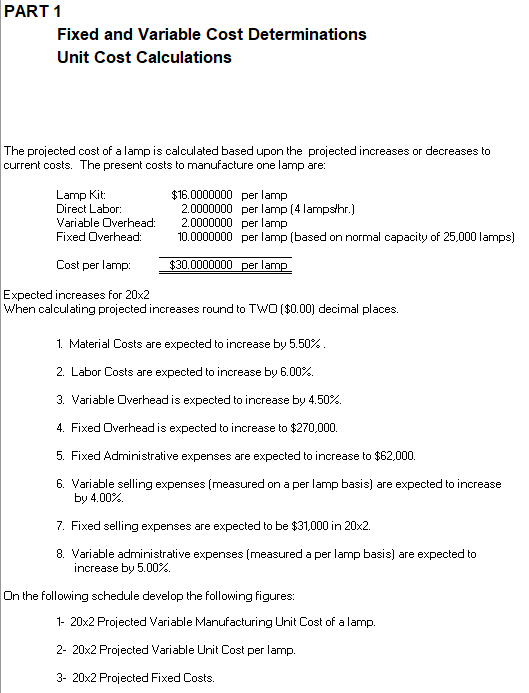

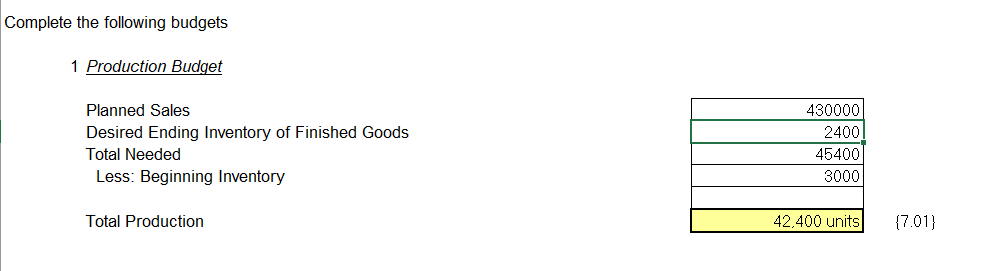

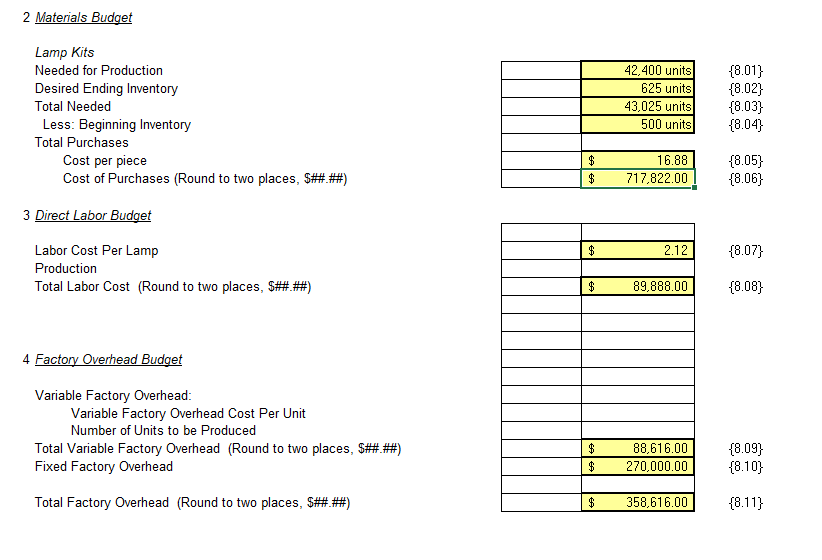

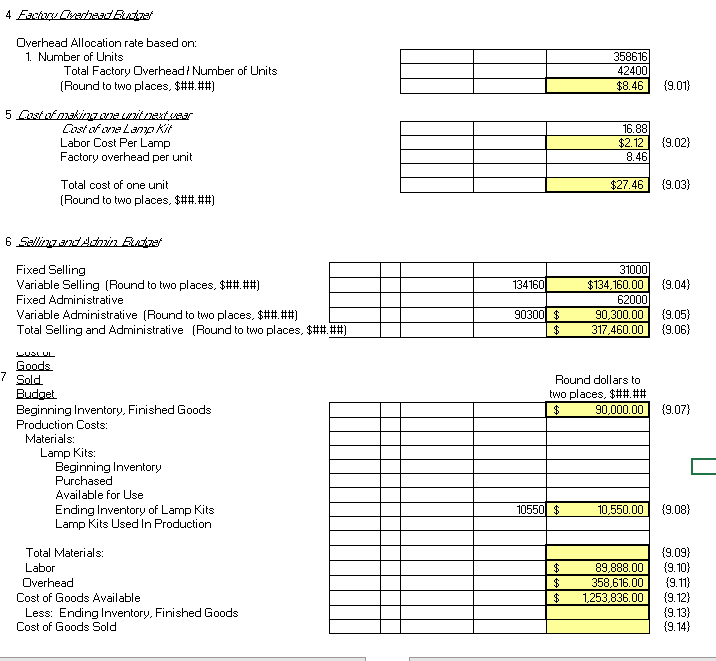

Division N has decided to develop its budget based upon projected sales of 43,000 lamps at $50.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 625 pieces and decreasing the finished goods by 20%. I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 @ $30.00 90,000.00 $ 200,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13,200.00 $ 213,410.00 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147,410.00 159,410.00 $ 213,410.00 PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Lamp Kit: $16.0000000 per lamp Direct Labor: 2.0000000 per lamp (4 lamps/hr.) Variable Overhead 2.0000000 per lamp Fixed Overhead: 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp $30.0000000 per lamp Expected increases for 20x2 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 5.50%. 2. Labor Costs are expected to increase by 6.00%. 3. Variable Overhead is expected to increase by 4.50%. 4. Fixed Overhead is expected to increase to $270,000. 5. Fixed Administrative expenses are expected to increase to $62,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 4.00% 7. Fixed selling expenses are expected to be $31,000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 5.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory 430000 2400) 45400 3000 Total Production 42,400 units {7.01} 4 Ezhudby Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead/ Number of Units (Round to two places, $##.##) 358616 42400 $8.46 {9.01) 5 O xX/X WA 225/723/770 Kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit (Round to two places, $##.##) 16.88 $2.12 8.46 {9.02) $27.46 (9.03) 6 Sallizzani Buz' Fixed Selling Variable Selling (Round to two places, $##.##) Fixed Administrative Variable Administrative (Round to two places, $##.##) Total Selling and Administrative (Round to two places, $##.##] 134160 {9.04) 31000) $134,160.00 62000 90,300.00 317,460.00 90300 $ $ {9.05) {9.06) 7 Round dollars to two places, $##.## $ 90,000.00 {9.07) LUSUL Goods Sold Budget Beginning Inventory, Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold 10550 $ 10,550.00 {9.08) $ 89,888.00 358,616.00 1,253,836.00 (9.09) {9.10) {9.11} (9.12) {9.13) (9.14)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started