Need help with a finance homework please

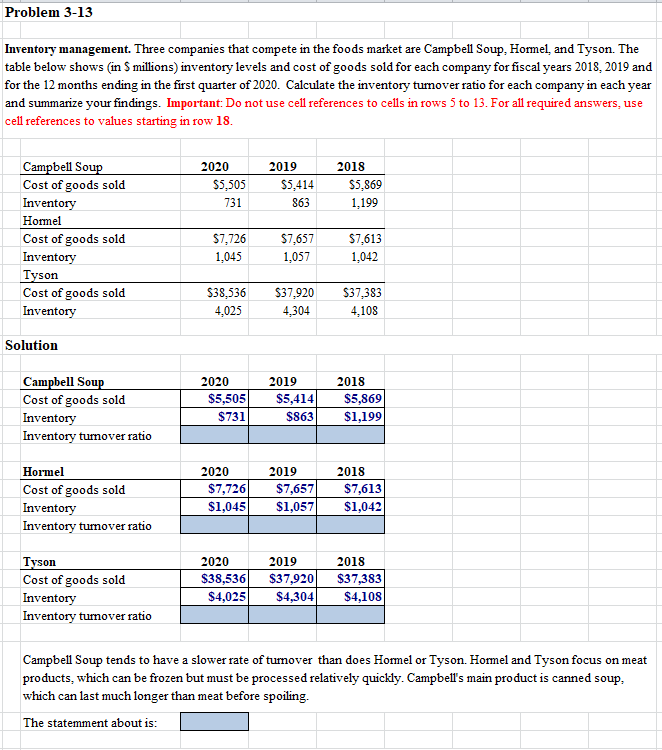

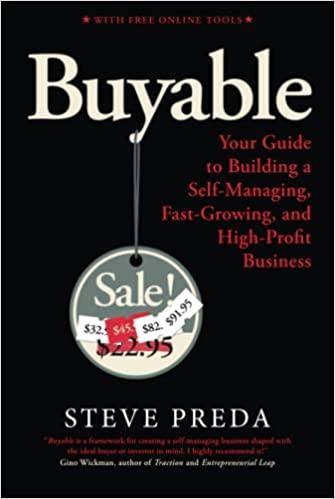

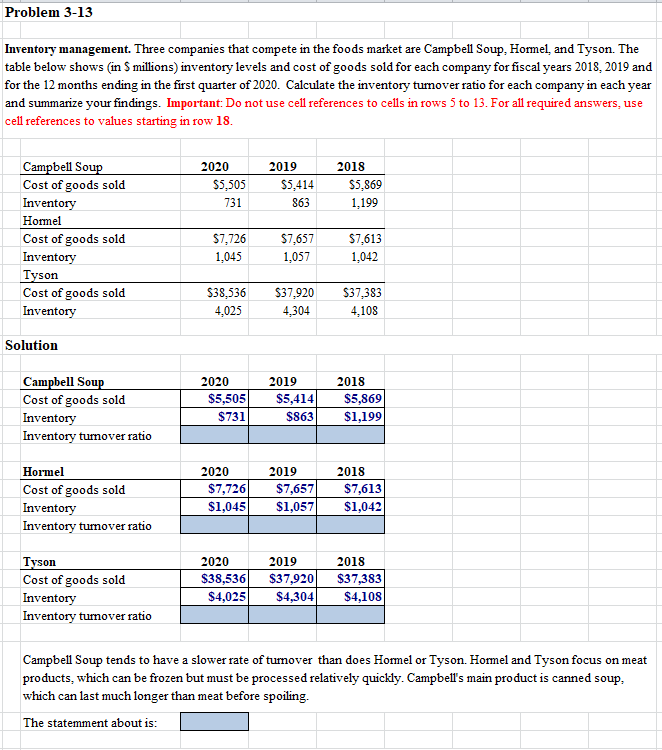

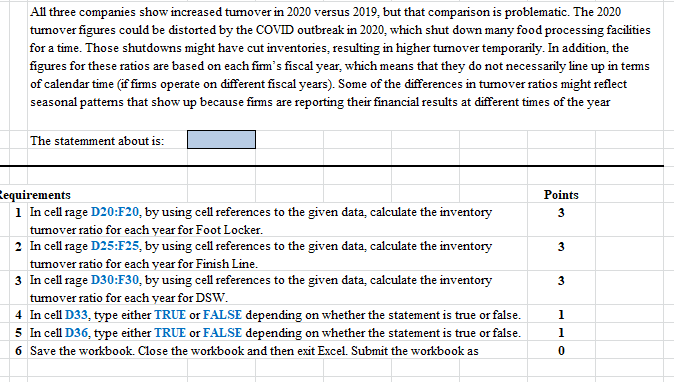

Problem 3-13 Inventory management. Three companies that compete in the foods market are Campbell Soup, Hormel, and Tyson. The table below shows (in 5 millions) inventory levels and cost of goods sold for each company for fiscal years 2018, 2019 and for the 12 months ending in the first quarter of 2020. Calculate the inventory tumover ratio for each company in each year and summarize your findings. Important: Do not use cell references to cells in rows 5 to 13. For all required answers, use cell references to values starting in row 18. Campbell Soup Cost of goods sold Inventory Hormel Cost of goods sold Inventory Tyson Cost of goods sold Inventory Solution Campbell Soup Cost of goods sold Inventory Inventory turnover ratio Hormel Cost of goods sold Inventory Inventory turnover ratio Tyson Cost of goods sold Inventory Inventory turnover ratio 2020 $5,505 731 $7,726 1,045 2020 $5,505 $731 $38,536 $37,920 4,025 4,304 2020 $7,726 $1,045 2019 2020 $38,536 $4,025 $5,414 863 $7,657 1,057 2019 $5,414 $863 2019 2018 2019 $37,920 $4,304 $5,869 1,199 $7,613 1,042 $37,383 4,108 2018 $5,869 $1,199 2018 $7,657 $7,613 $1,057 $1,042 2018 $37,383 $4,108 Campbell Soup tends to have a slower rate of turnover than does Hormel or Tyson. Hormel and Tyson focus on meat products, which can be frozen but must be processed relatively quickly. Campbell's main product is canned soup. which can last much longer than meat before spoiling. The statemment about is: All three companies show increased turnover in 2020 versus 2019, but that comparison is problematic. The 2020 turnover figures could be distorted by the COVID outbreak in 2020, which shut down many food processing facilities for a time. Those shutdowns might have cut inventories, resulting in higher turnover temporarily. In addition, the figures for these ratios are based on each firm's fiscal year, which means that they do not necessarily line up in terms of calendar time (if firms operate on different fiscal years). Some of the differences in turnover ratios might reflect seasonal patterns that show up because firms are reporting their financial results at different times of the year The statemment about is: Requirements 1 In cell rage D20:F20, by using cell references to the given data, calculate the inventory turnover ratio for each year for Foot Locker. 2 In cell rage D25:F25, by using cell references to the given data, calculate the inventory turnover ratio for each year for Finish Line. 3 In cell rage D30:F30, by using cell references to the given data, calculate the inventory tumover ratio for each year for DSW. 4 In cell D33, type either TRUE or FALSE depending on whether the statement is true or false. 5 In cell D36, type either TRUE or FALSE depending on whether the statement is true or false. 6 Save the workbook. Close the workbook and then exit Excel. Submit the workbook as Points 3 3 3 1 1 0