Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with a packet for account ! If it needs to be split into 2 parts ill split it, but plesse help ill tip

Need help with a packet for account ! If it needs to be split into 2 parts ill split it, but plesse help ill tip if i can !

just needs to be filled out please

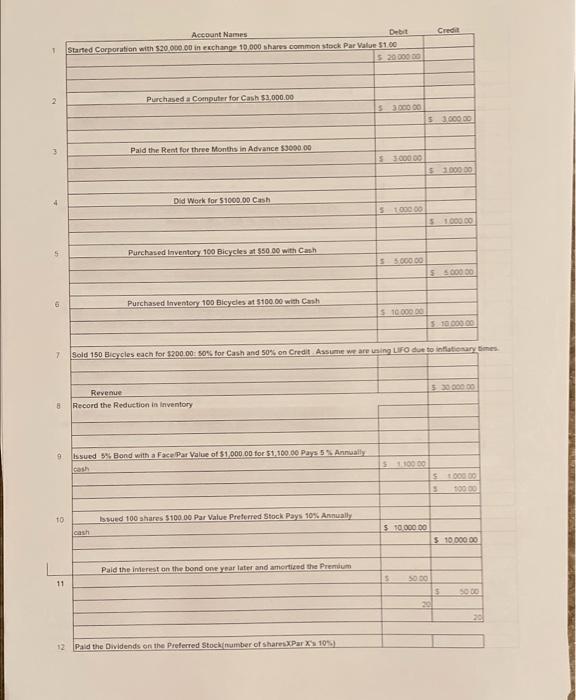

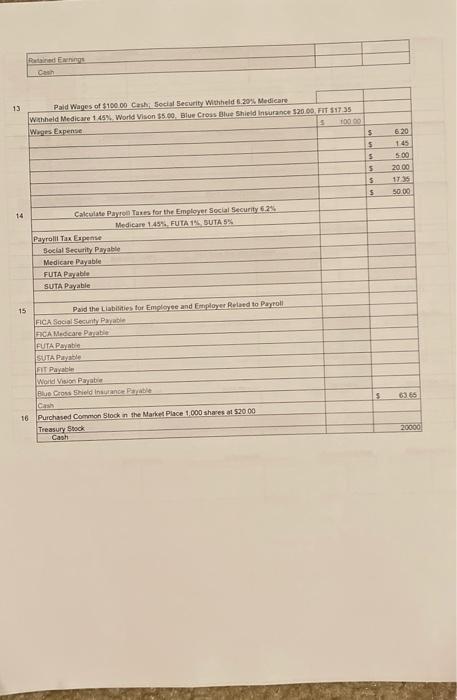

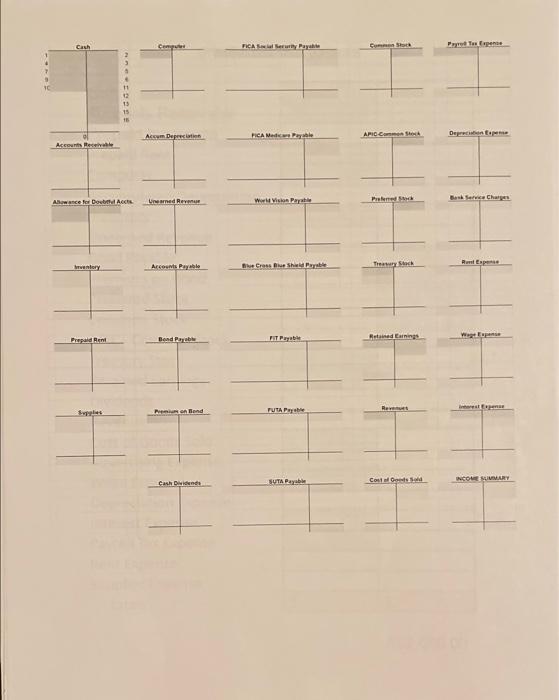

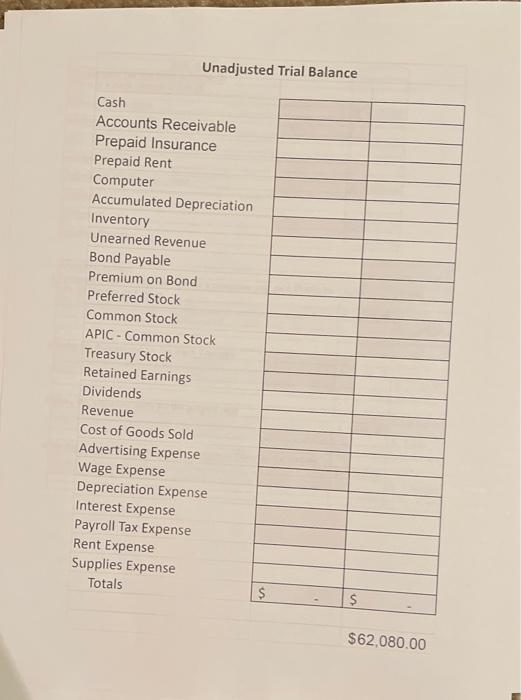

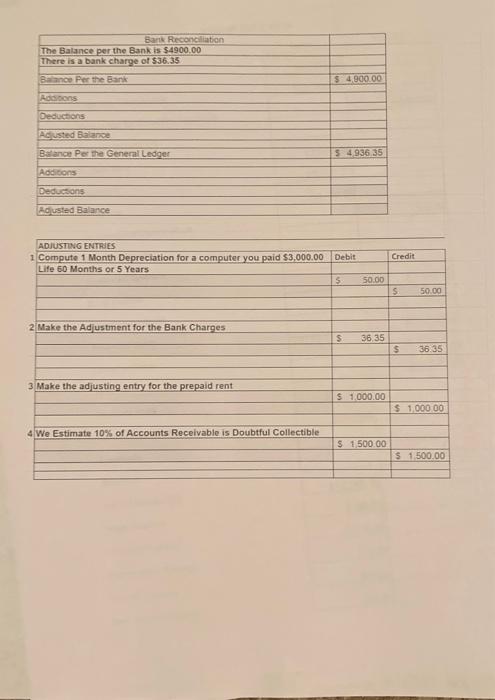

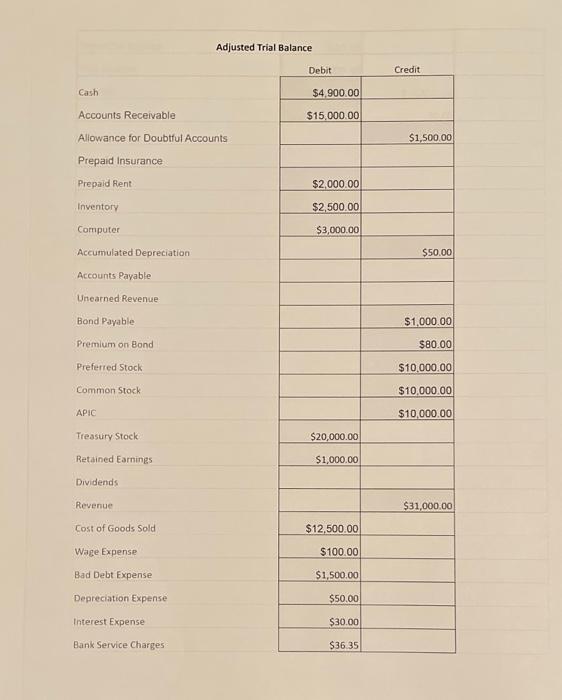

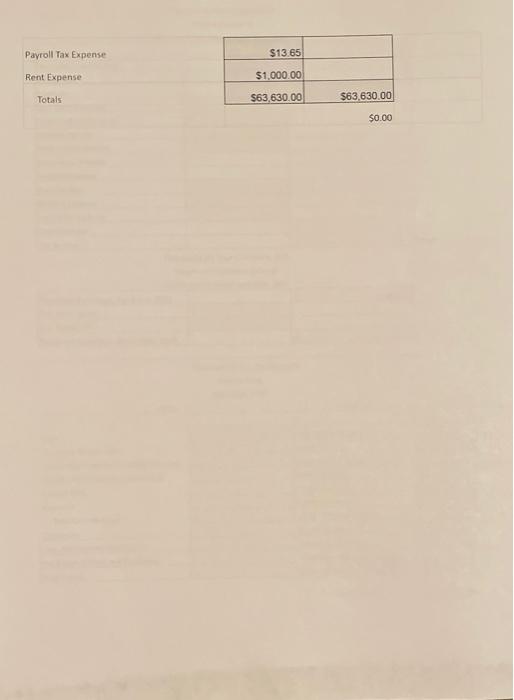

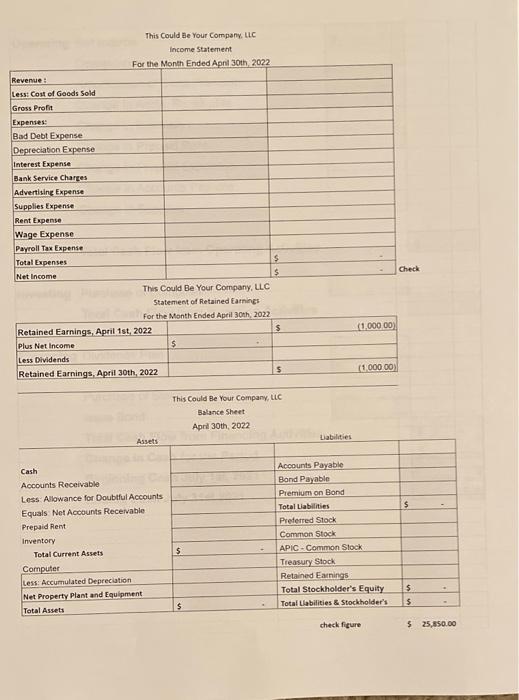

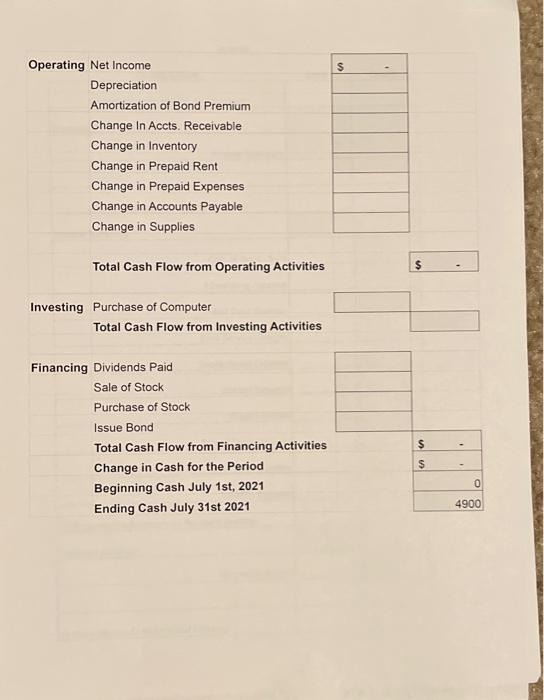

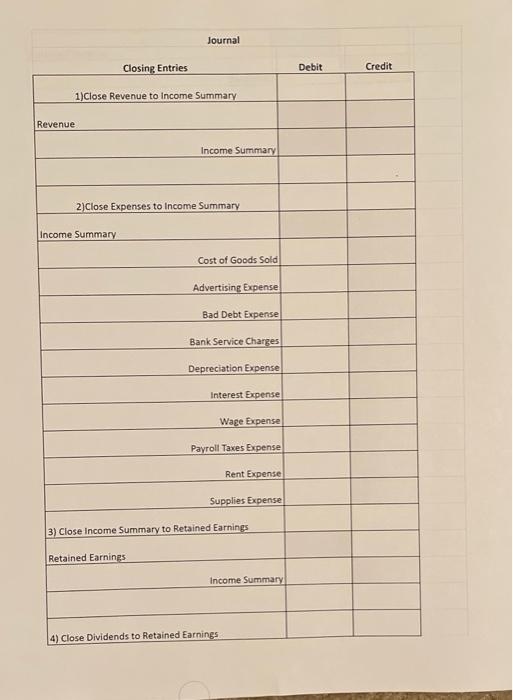

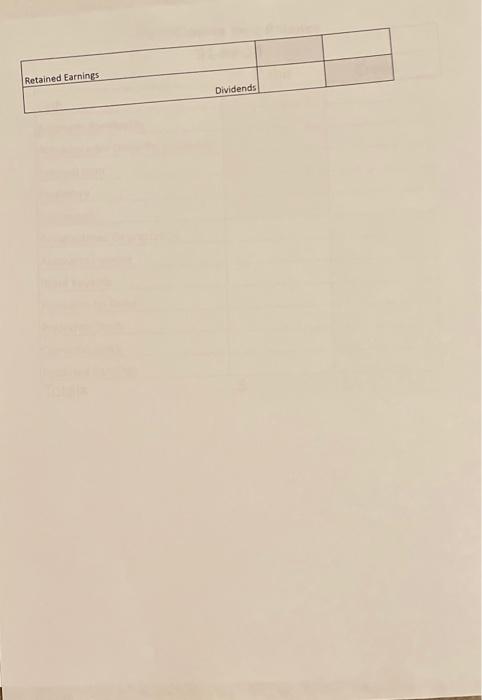

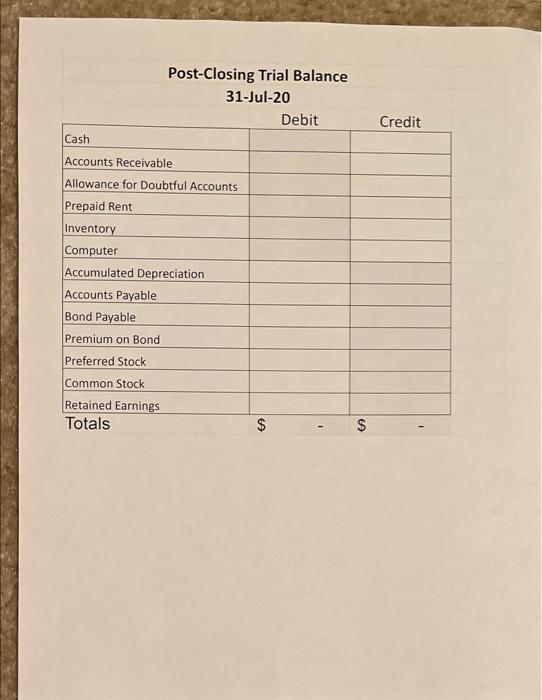

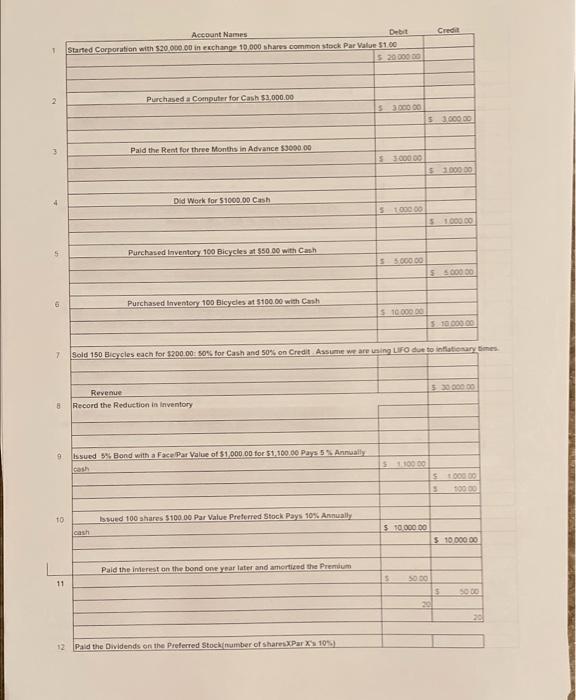

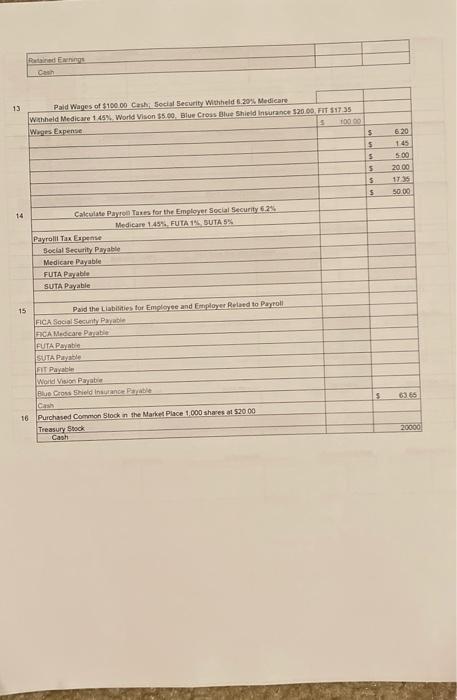

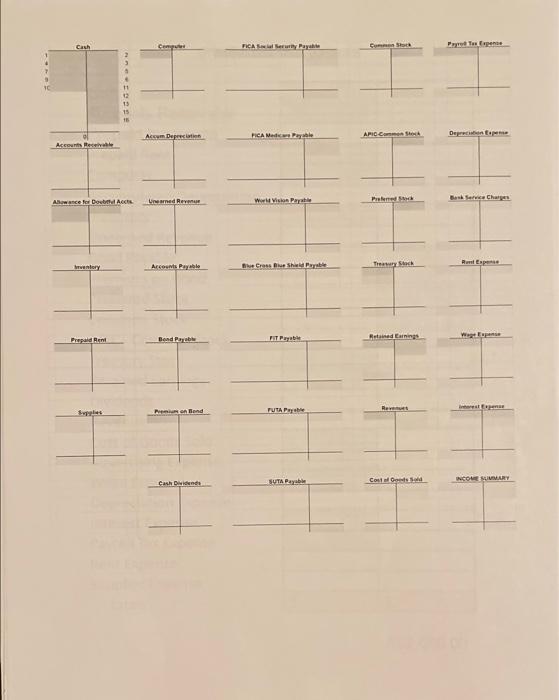

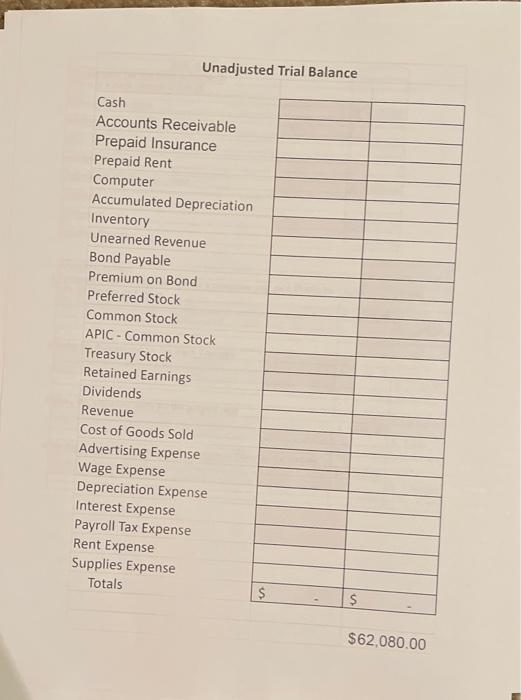

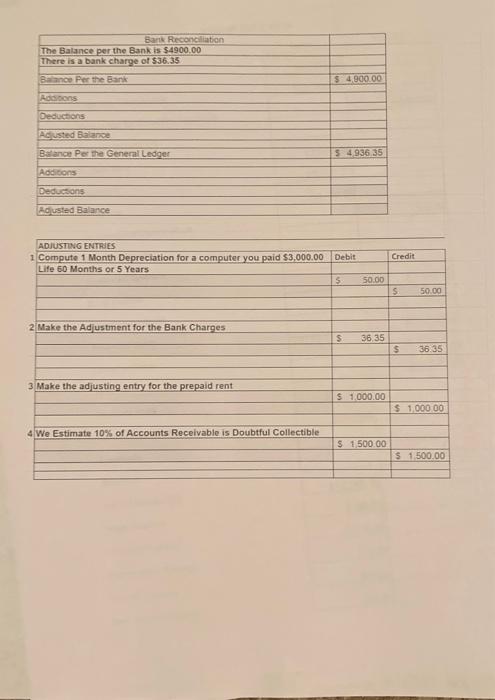

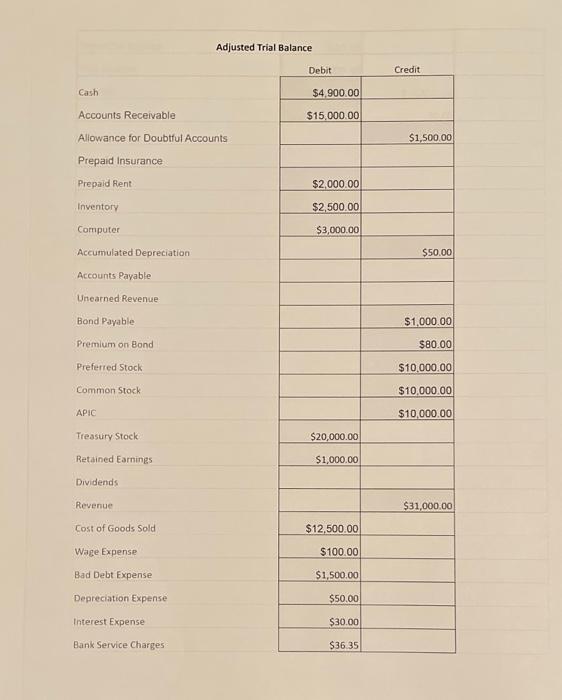

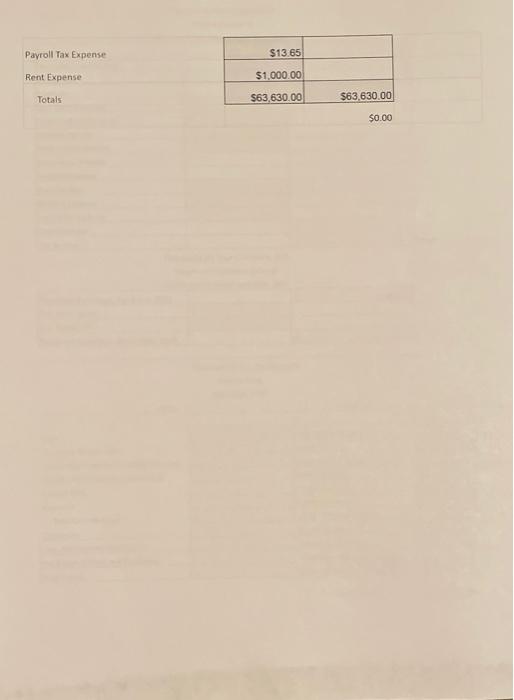

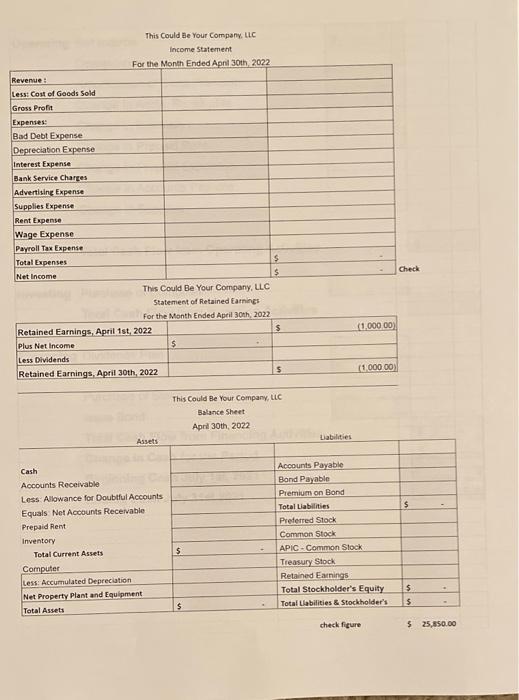

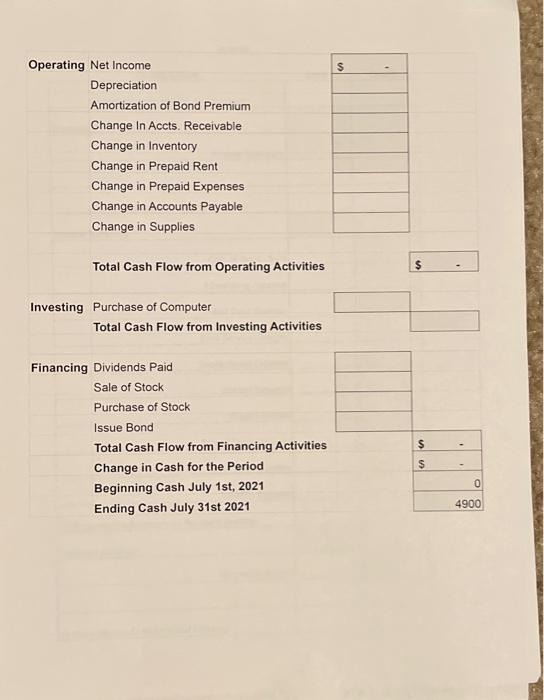

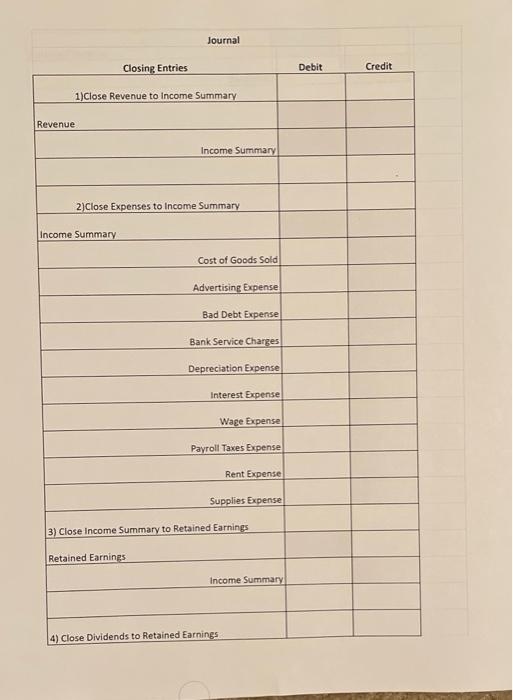

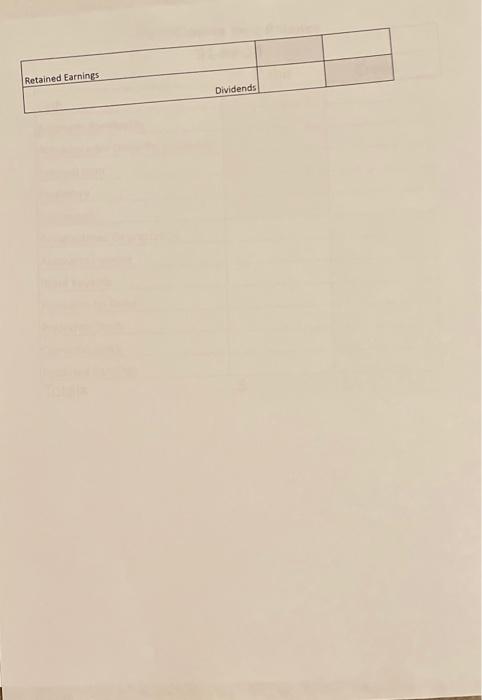

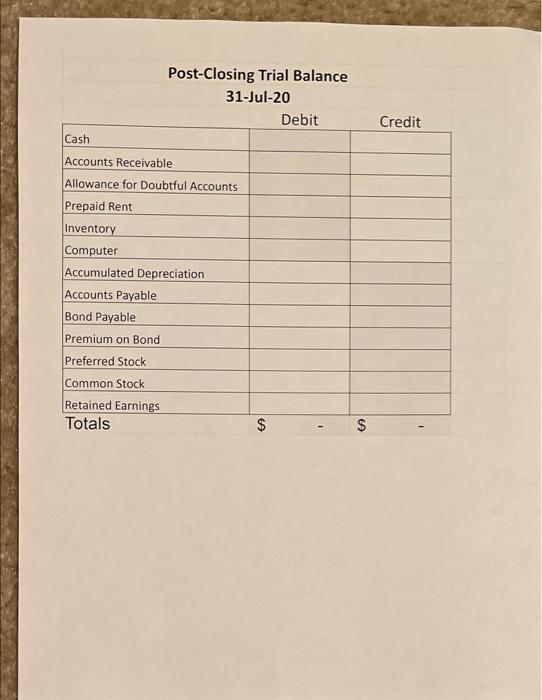

Credit 1 Account Names Det Started Corporation with 520 000.00 in rechange 10.000 shares common stock Par Value 5100 520 000 DO 2 Purchased Computer for Cash $2.000,00 SPOD DO 5000 80 3 Paid the Rent for three Months in Advance 5300000 53000.00 100000 4 Did Work for 51000.00 Cash 5 100.00 S 100000 Purchased Inventor 100 Bicycles at 55000 with Cash 500000 G Purchased Inventory:100 Bicycles, at $100.00 with Cash S 10 000 20 7 Sold 150 Bisycles each for 1200,00: 50for Cash and 50% on Credit Asse we are using UFO due to itationary times Revenue Record the Reduction in Inventory 8 9 Issued Bond with a Face Par Value of $1000.00 for 51,100.00 Pays 5 Annual cash 1000 to Issued 100 shares $100 00 Par Value Preferred Stock Pays 10% Annually $ 10.000.00 cash $10 000.00 Paid the interest on the bond one year later and amortized the Premium 11 500 5 2 12 Pald the Dividends on the Preferred Stock number of shares.Par X 10% RedFwg Cash 13 Paid Wages of $100.00 Cash ecial Security Withheld 6.20%. Medicare withheld Medicare 145 World Vision 55.00 Blue Cross Blue Shield Insurance 52000 FIT 517 35 Weges Expense $ S 5 5 S $ 620 145 500 2000 1735 50 00 14 Calculate Payroll Taxes for the Employer Social Security 625 Medicare 1.45% FUTA 1 SUTA5% Payroll Tax Espere Social Security Payable Medicare Payable FUTA Payable SUTA Payable 15 Paid the Liabilities for Employee and Employer Reled to Payroll FICA Soal Security ACA Medicare Patie FUTA Payti SUTA Poble FIT Payable World Vision Pasti BU Shield Insurance $ 16 Purchased Common Stock in the Market Place 1000 shares a $2000 Treasury Stock Cash 20000 Cash Computer FICA Serway Payadite Partus pene GE 15 Accm Deprecat FICA Madeyle APIE Deprecate Accueil Preme Actor Dout Act WorVision Pape Bac Chat Led Revenue relery Arcos Poble Cross Blue Shala Parabe Trwach Repaiden Bendra Retained Earnings FIT Pry Pound PUTA P SUTA Payable Couto Cash Divine INCOME SUIVIMARY Unadjusted Trial Balance Cash Accounts Receivable Prepaid Insurance Prepaid Rent Computer Accumulated Depreciation Inventory Unearned Revenue Bond Payable Premium on Bond Preferred Stock Common Stock APIC - Common Stock Treasury Stock Retained Earnings Dividends Revenue Cost of Goods Sold Advertising Expense Wage Expense Depreciation Expense Interest Expense Payroll Tax Expense Rent Expense Supplies Expense Totals $ $ $62,080.00 Bank Reconciliation The Balance per the Bank is $4900.00 There is a bank charge of $36.35 Balance Per the Bank $ 4.900.00 Adsons Deductions Agusted Balance Balance Per the General Ledger Additions 5 4 936 35 Deducsons Adusted Balance ADJUSTING ENTRIES 1 Compute 1 Month Depreciation for a computer you paid $3,000.00 Life 60 Months or 5 Years Debit Credit $ 50.00 $ 50.00 2 Make the Adjustment for the Bank Charges $ 36.35 $ 36.35 3 Make the adjusting entry for the prepaid rent $ 1.000.00 $ 1.000.00 4 We Estimate 10% of Accounts Receivable is Doubtful Collectible $ 150000 $ 1.500.00 Adjusted Trial Balance Debit Credit Cash $4,900.00 $15,000.00 Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance $1,500.00 Prepaid Rent $2,000.00 Inventory $2,500.00 Computer $3,000.00 Accumulated Depreciation $50.00 Accounts Payable Unearned Revenue Bond Payable Premium on Bond Preferred Stock $1,000.00 $80.00 $10.000.00 $10,000.00 $10,000.00 Common Stock APIC Treasury Stock $20,000.00 Retained Earnings $1,000.00 Dividends Revenue $31,000.00 $12,500.00 Cost of Goods Sold Wage Expense $100.00 Bad Debt Expense $1,500.00 Depreciation Expense $50.00 Interest Expense $30.00 Bank Service Charges $36.35 Payroll Tax Expense $13.65 Rent Expense $1.000 00 Totals $63,630.00 $63,630.00 $0.00 This Could Be Your Company, LLC Income Statement For the Month Ended April 30th 2022 Revenue : Less: Cost of Goods Sold Gross Profit Expenses: Bad Debt Expense Depreciation Expense Interest Expense Bank Service Charges Advertising Expense Supplies Expense Rent Expense Wage Expense Payroll Tax Expense Total Expenses $ Net Income $ This Could Be Your Company, LLC Statement of Retained Earnings For the Month Ended April 30th2022 Retained Earnings, April 1st, 2022 $ Plus Net Income 5 Less Dividends Retained Earnings, April 30th, 2022 $ Check (1 000 00) (1 000 00) This Could Be Your Company, LLC Balance Sheet April 30th, 2022 Liabilities Assets $ Cash Accounts Receivable Less Allowance for Doubtful Accounts Equals Net Accounts Receivable Prepaid Rent Inventory Total Current Assets Computer Less: Accumulated Depreciation Net Property Plant and Equipment Total Assets Accounts Payable Bond Payable Premium on Bond Total Liabilities Preferred Stock Common Stock APIC - Common Stock Treasury Stock Retained Earnings Total Stockholder's Equity Total Liabilities & Stockholder's S 5 $ $ check figure $ 25,850.00 $ Operating Net Income Depreciation Amortization of Bond Premium Change In Accts. Receivable Change in Inventory Change in Prepaid Rent Change in Prepaid Expenses Change in Accounts Payable Change in Supplies Total Cash Flow from Operating Activities $ Investing Purchase of Computer Total Cash Flow from Investing Activities Financing Dividends Paid Sale of Stock Purchase of Stock Issue Bond Total Cash Flow from Financing Activities Change in Cash for the Period Beginning Cash July 1st, 2021 Ending Cash July 31st 2021 $ $ o 4900 Journal Closing Entries Debit Credit 1)Close Revenue to Income Summary Revenue Income Summary 2)Close Expenses to Income Summary Income Summary Cost of Goods Sold Advertising Expense Bad Debt Expense Bank Service Charges Depreciation Expense Interest Expense Wage Expense Payroll Taxes Expense Rent Expense Supplies Expense 3) Close Income Summary to Retained Earnings Retained Earnings Income Summary 4) Close Dividends to Retained Earnings Retained Earnings Dividends Post-Closing Trial Balance 31-Jul-20 Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Rent Inventory Computer Accumulated Depreciation Accounts Payable Bond Payable Premium on Bond Preferred Stock Common Stock Retained Earnings Totals $ $ Credit 1 Account Names Det Started Corporation with 520 000.00 in rechange 10.000 shares common stock Par Value 5100 520 000 DO 2 Purchased Computer for Cash $2.000,00 SPOD DO 5000 80 3 Paid the Rent for three Months in Advance 5300000 53000.00 100000 4 Did Work for 51000.00 Cash 5 100.00 S 100000 Purchased Inventor 100 Bicycles at 55000 with Cash 500000 G Purchased Inventory:100 Bicycles, at $100.00 with Cash S 10 000 20 7 Sold 150 Bisycles each for 1200,00: 50for Cash and 50% on Credit Asse we are using UFO due to itationary times Revenue Record the Reduction in Inventory 8 9 Issued Bond with a Face Par Value of $1000.00 for 51,100.00 Pays 5 Annual cash 1000 to Issued 100 shares $100 00 Par Value Preferred Stock Pays 10% Annually $ 10.000.00 cash $10 000.00 Paid the interest on the bond one year later and amortized the Premium 11 500 5 2 12 Pald the Dividends on the Preferred Stock number of shares.Par X 10% RedFwg Cash 13 Paid Wages of $100.00 Cash ecial Security Withheld 6.20%. Medicare withheld Medicare 145 World Vision 55.00 Blue Cross Blue Shield Insurance 52000 FIT 517 35 Weges Expense $ S 5 5 S $ 620 145 500 2000 1735 50 00 14 Calculate Payroll Taxes for the Employer Social Security 625 Medicare 1.45% FUTA 1 SUTA5% Payroll Tax Espere Social Security Payable Medicare Payable FUTA Payable SUTA Payable 15 Paid the Liabilities for Employee and Employer Reled to Payroll FICA Soal Security ACA Medicare Patie FUTA Payti SUTA Poble FIT Payable World Vision Pasti BU Shield Insurance $ 16 Purchased Common Stock in the Market Place 1000 shares a $2000 Treasury Stock Cash 20000 Cash Computer FICA Serway Payadite Partus pene GE 15 Accm Deprecat FICA Madeyle APIE Deprecate Accueil Preme Actor Dout Act WorVision Pape Bac Chat Led Revenue relery Arcos Poble Cross Blue Shala Parabe Trwach Repaiden Bendra Retained Earnings FIT Pry Pound PUTA P SUTA Payable Couto Cash Divine INCOME SUIVIMARY Unadjusted Trial Balance Cash Accounts Receivable Prepaid Insurance Prepaid Rent Computer Accumulated Depreciation Inventory Unearned Revenue Bond Payable Premium on Bond Preferred Stock Common Stock APIC - Common Stock Treasury Stock Retained Earnings Dividends Revenue Cost of Goods Sold Advertising Expense Wage Expense Depreciation Expense Interest Expense Payroll Tax Expense Rent Expense Supplies Expense Totals $ $ $62,080.00 Bank Reconciliation The Balance per the Bank is $4900.00 There is a bank charge of $36.35 Balance Per the Bank $ 4.900.00 Adsons Deductions Agusted Balance Balance Per the General Ledger Additions 5 4 936 35 Deducsons Adusted Balance ADJUSTING ENTRIES 1 Compute 1 Month Depreciation for a computer you paid $3,000.00 Life 60 Months or 5 Years Debit Credit $ 50.00 $ 50.00 2 Make the Adjustment for the Bank Charges $ 36.35 $ 36.35 3 Make the adjusting entry for the prepaid rent $ 1.000.00 $ 1.000.00 4 We Estimate 10% of Accounts Receivable is Doubtful Collectible $ 150000 $ 1.500.00 Adjusted Trial Balance Debit Credit Cash $4,900.00 $15,000.00 Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance $1,500.00 Prepaid Rent $2,000.00 Inventory $2,500.00 Computer $3,000.00 Accumulated Depreciation $50.00 Accounts Payable Unearned Revenue Bond Payable Premium on Bond Preferred Stock $1,000.00 $80.00 $10.000.00 $10,000.00 $10,000.00 Common Stock APIC Treasury Stock $20,000.00 Retained Earnings $1,000.00 Dividends Revenue $31,000.00 $12,500.00 Cost of Goods Sold Wage Expense $100.00 Bad Debt Expense $1,500.00 Depreciation Expense $50.00 Interest Expense $30.00 Bank Service Charges $36.35 Payroll Tax Expense $13.65 Rent Expense $1.000 00 Totals $63,630.00 $63,630.00 $0.00 This Could Be Your Company, LLC Income Statement For the Month Ended April 30th 2022 Revenue : Less: Cost of Goods Sold Gross Profit Expenses: Bad Debt Expense Depreciation Expense Interest Expense Bank Service Charges Advertising Expense Supplies Expense Rent Expense Wage Expense Payroll Tax Expense Total Expenses $ Net Income $ This Could Be Your Company, LLC Statement of Retained Earnings For the Month Ended April 30th2022 Retained Earnings, April 1st, 2022 $ Plus Net Income 5 Less Dividends Retained Earnings, April 30th, 2022 $ Check (1 000 00) (1 000 00) This Could Be Your Company, LLC Balance Sheet April 30th, 2022 Liabilities Assets $ Cash Accounts Receivable Less Allowance for Doubtful Accounts Equals Net Accounts Receivable Prepaid Rent Inventory Total Current Assets Computer Less: Accumulated Depreciation Net Property Plant and Equipment Total Assets Accounts Payable Bond Payable Premium on Bond Total Liabilities Preferred Stock Common Stock APIC - Common Stock Treasury Stock Retained Earnings Total Stockholder's Equity Total Liabilities & Stockholder's S 5 $ $ check figure $ 25,850.00 $ Operating Net Income Depreciation Amortization of Bond Premium Change In Accts. Receivable Change in Inventory Change in Prepaid Rent Change in Prepaid Expenses Change in Accounts Payable Change in Supplies Total Cash Flow from Operating Activities $ Investing Purchase of Computer Total Cash Flow from Investing Activities Financing Dividends Paid Sale of Stock Purchase of Stock Issue Bond Total Cash Flow from Financing Activities Change in Cash for the Period Beginning Cash July 1st, 2021 Ending Cash July 31st 2021 $ $ o 4900 Journal Closing Entries Debit Credit 1)Close Revenue to Income Summary Revenue Income Summary 2)Close Expenses to Income Summary Income Summary Cost of Goods Sold Advertising Expense Bad Debt Expense Bank Service Charges Depreciation Expense Interest Expense Wage Expense Payroll Taxes Expense Rent Expense Supplies Expense 3) Close Income Summary to Retained Earnings Retained Earnings Income Summary 4) Close Dividends to Retained Earnings Retained Earnings Dividends Post-Closing Trial Balance 31-Jul-20 Debit Credit Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Rent Inventory Computer Accumulated Depreciation Accounts Payable Bond Payable Premium on Bond Preferred Stock Common Stock Retained Earnings Totals $ $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started