Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with (a). Problem 12-32 (LO. 3, 7) In 2020, Geoff incurred $900,000 of mine and exploration expenditures. He elects to deduct the expenditures

Need help with (a).

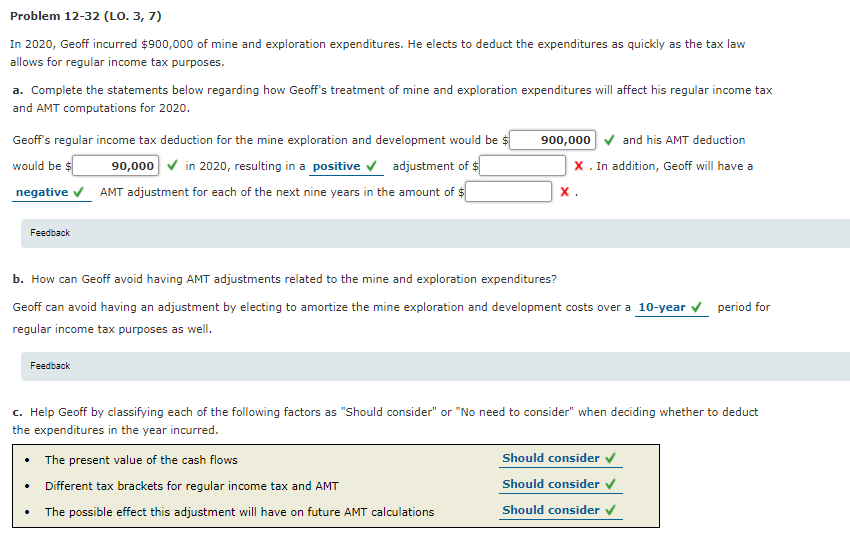

Problem 12-32 (LO. 3, 7) In 2020, Geoff incurred $900,000 of mine and exploration expenditures. He elects to deduct the expenditures as quickly as the tax law allows for regular income tax purposes. a. Complete the statements below regarding how Geoff's treatment of mine and exploration expenditures will affect his regular income tax and AMT computations for 2020. Geoff's regular income tax deduction for the mine exploration and development would be $ 900,000 and his AMT deduction would be $ 90,000 in 2020, resulting in a positive adjustment of $ X. In addition, Geoff will have a negative AMT adjustment for each of the next nine years in the amount of $ X. Feedback b. How can Geoff avoid having AMT adjustments related to the mine and exploration expenditures? Geoff can avoid having an adjustment by electing to amortize the mine exploration and development costs over a 10-year period for regular income tax purposes as well. Feedback C. Help Geoff by classifying each of the following factors as "Should consider" or "No need to consider" when deciding whether to deduct the expenditures in the year incurred. The present value of the cash flows Should consider Different tax brackets for regular income tax and AMT Should consider The possible effect this adjustment will have on future AMT calculations Should considerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started