Answered step by step

Verified Expert Solution

Question

1 Approved Answer

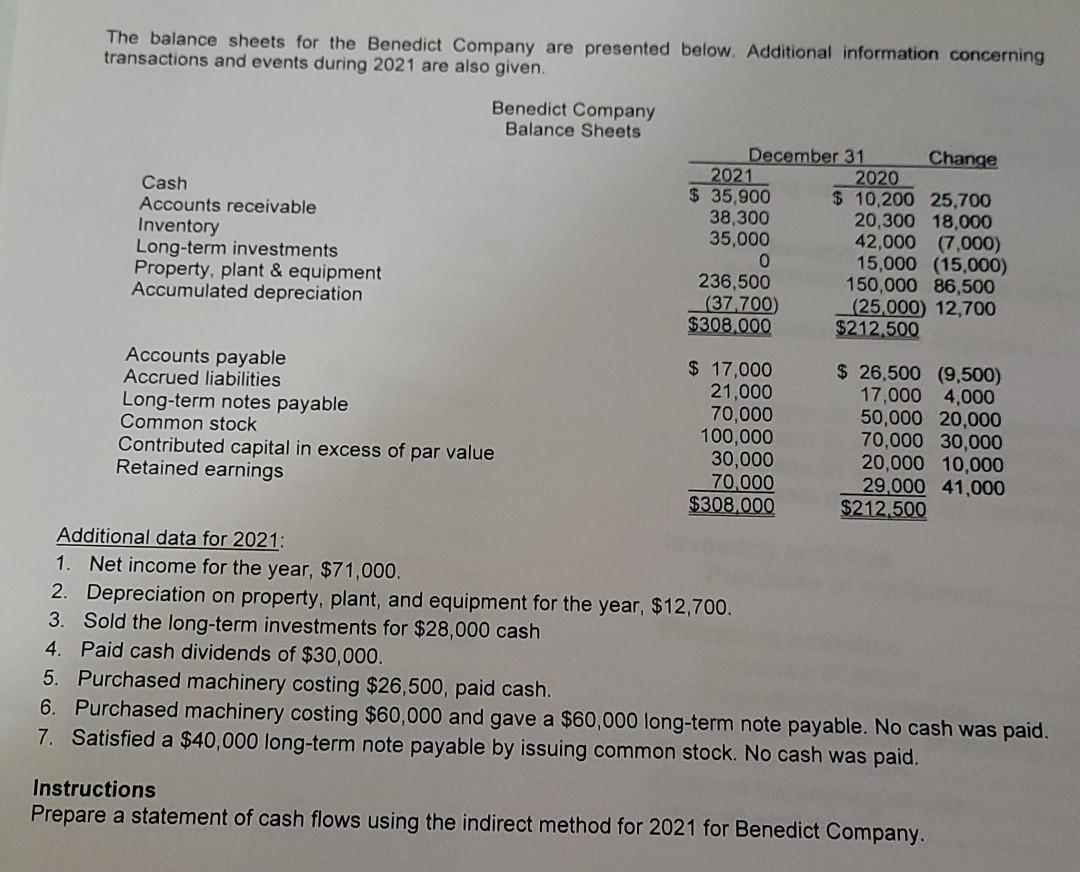

need help with additional data The balance sheets for the Benedict Company are presented below. Additional information concerning transactions and events during 2021 are also

need help with additional data

The balance sheets for the Benedict Company are presented below. Additional information concerning transactions and events during 2021 are also given. Benedict Company Balance Sheets Cash Accounts receivable Inventory Long-term investments Property, plant & equipment Accumulated depreciation December 31 Change 2021 2020 $ 35,900 $ 10,200 25,700 38,300 20,300 18.000 35,000 42,000 (7,000) 0 15,000 (15,000) 236,500 150,000 86,500 (37.700) (25,000) 12,700 $308.000 $212.500 Accounts payable Accrued liabilities Long-term notes payable Common stock Contributed capital in excess of par value Retained earnings $ 17,000 21,000 70,000 100,000 30,000 70,000 $308,000 $ 26,500 (9,500) 17,000 4,000 50,000 20,000 70,000 30,000 20,000 10,000 29,000 41,000 $212,500 Additional data for 2021: 1. Net income for the year, $71,000. 2. Depreciation on property, plant, and equipment for the year, $12,700. 3. Sold the long-term investments for $28,000 cash 4. Paid cash dividends of $30,000. 5. Purchased machinery costing $26,500, paid cash. 6. Purchased machinery costing $60,000 and gave a $60,000 long-term note payable. No cash was paid. 7. Satisfied a $40,000 long-term note payable by issuing common stock. No cash was paid. Instructions Prepare a statement of cash flows using the indirect method for 2021 for Benedict CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started