Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with all ASAP Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LOG-4, LO6-5, LOG-6] Due to erratic

need help with all ASAP

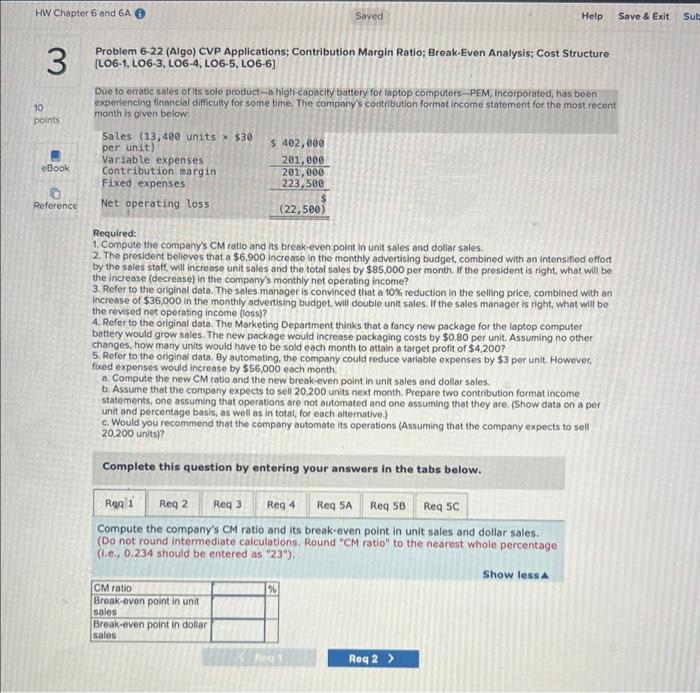

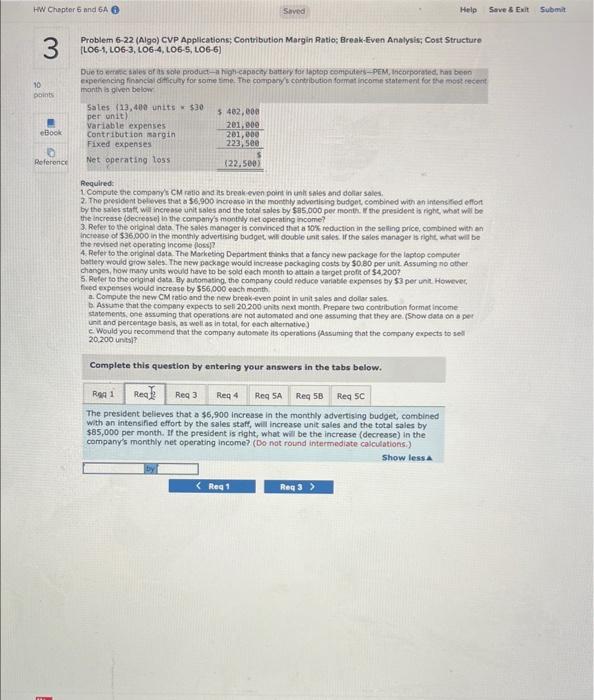

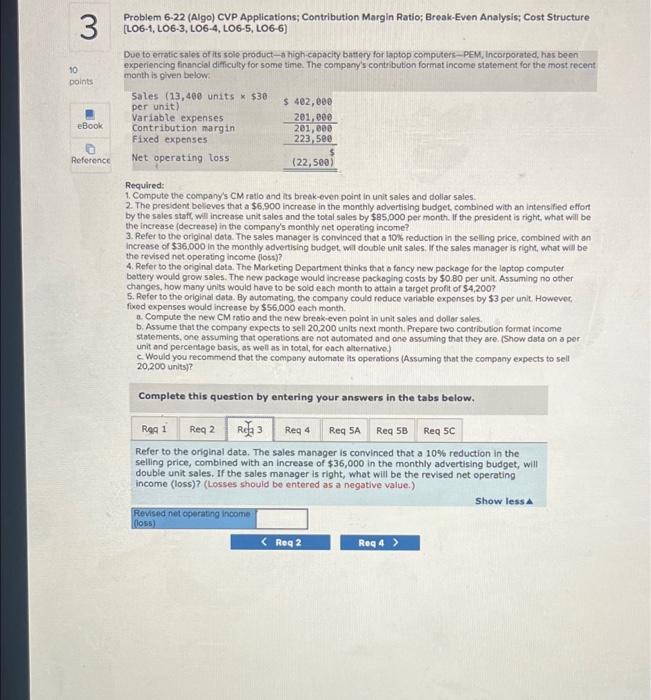

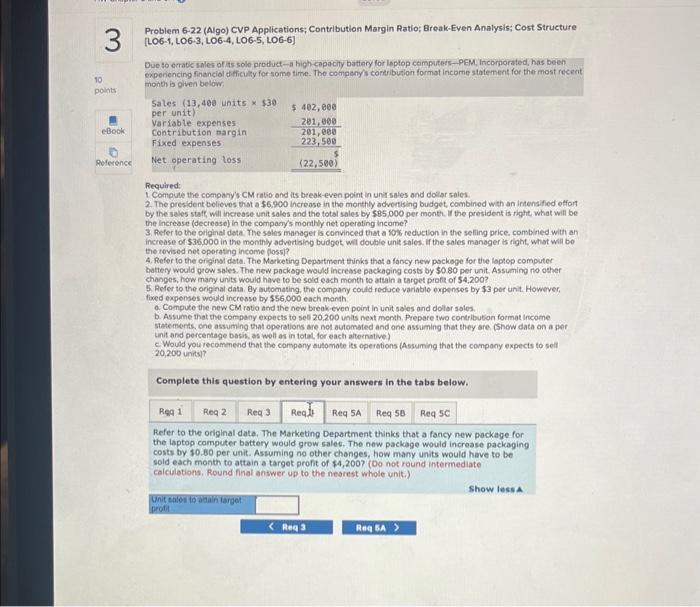

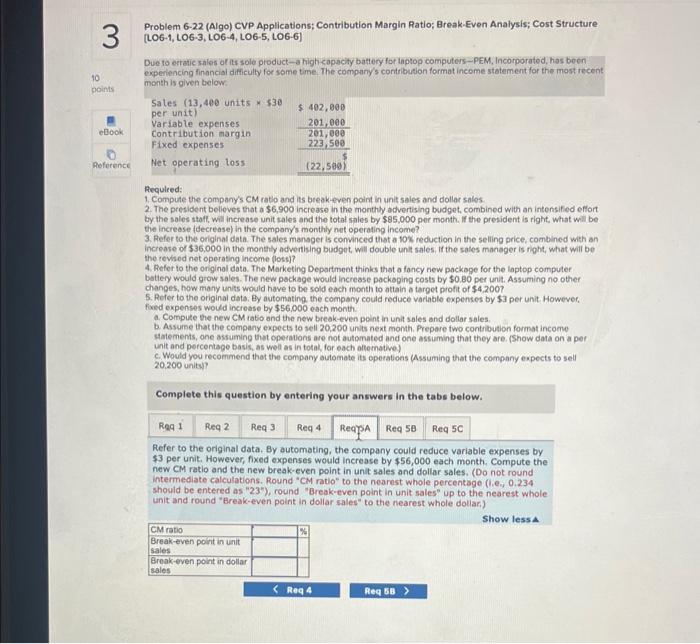

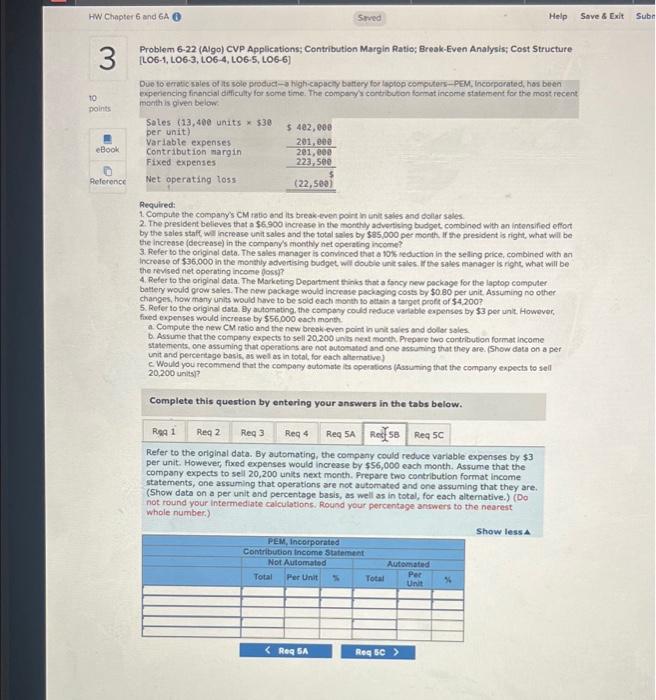

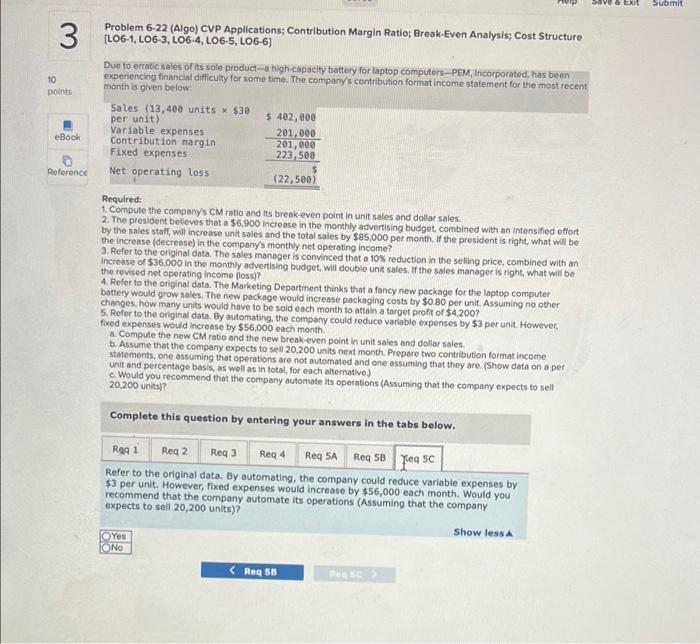

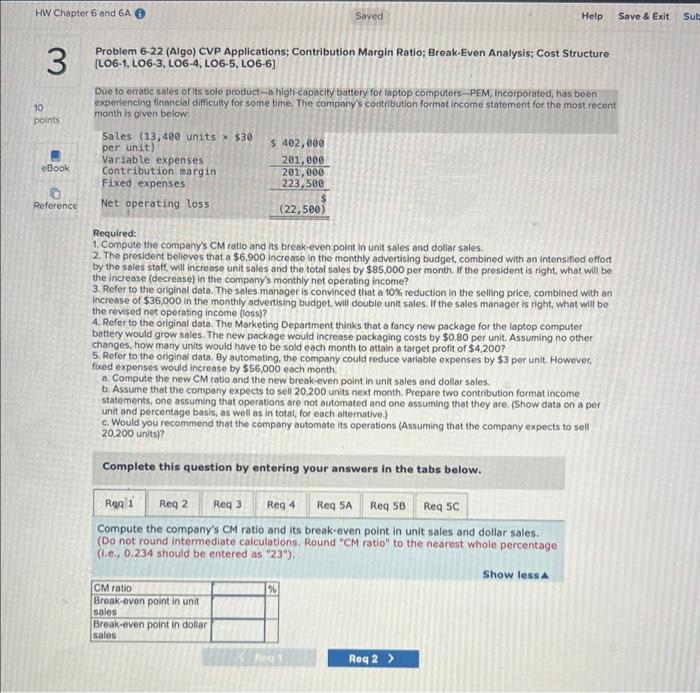

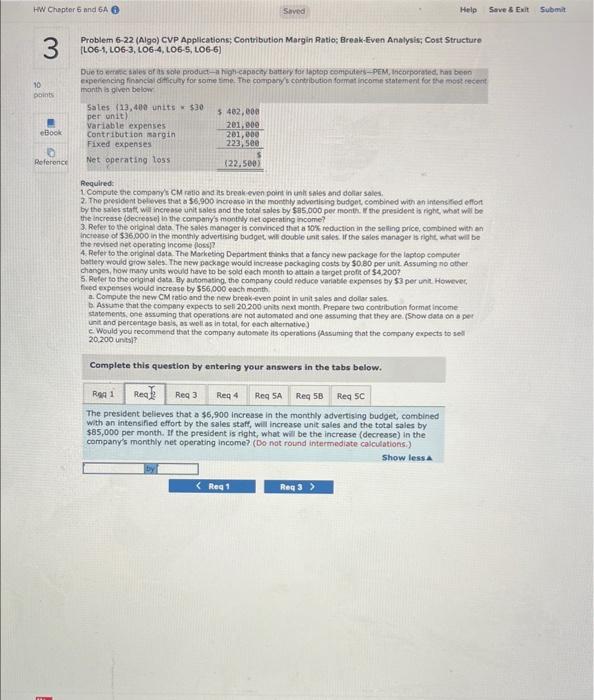

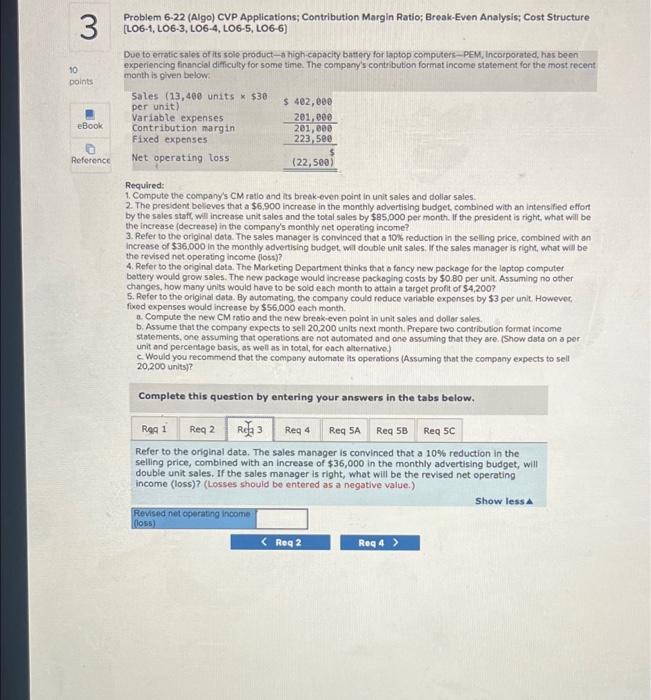

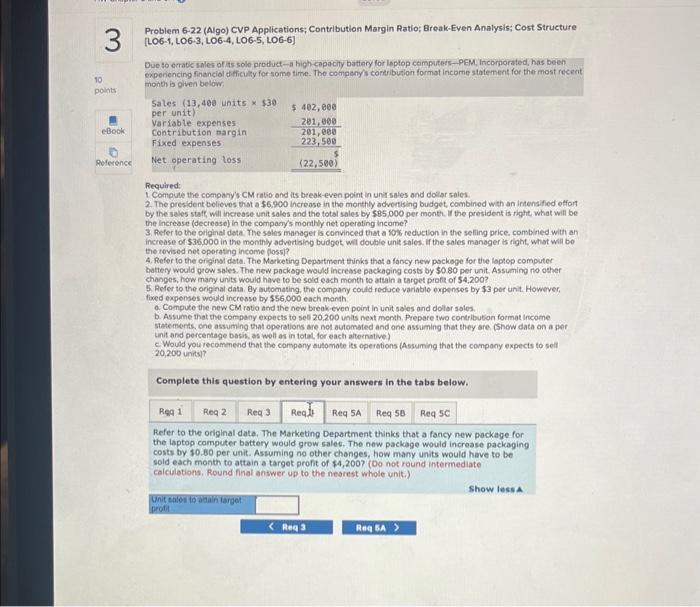

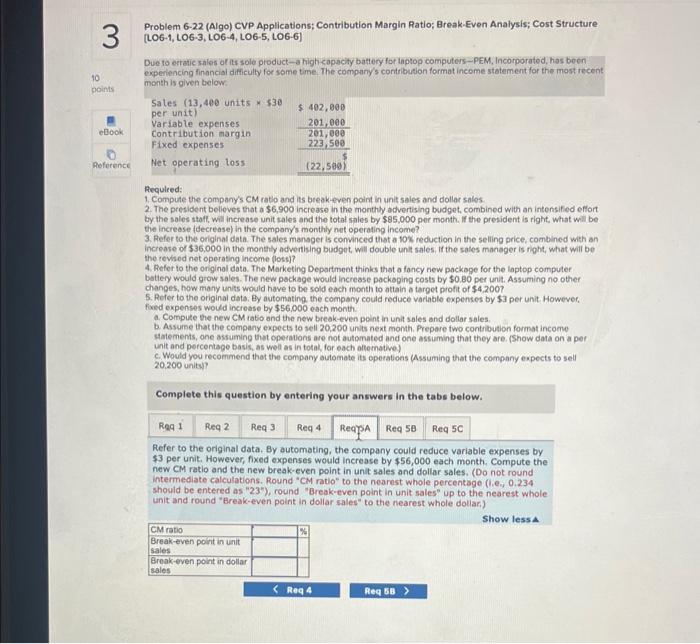

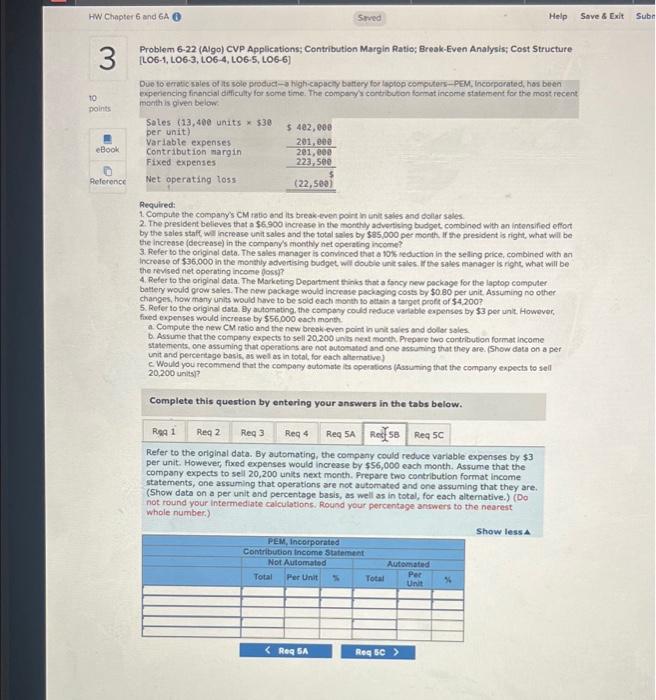

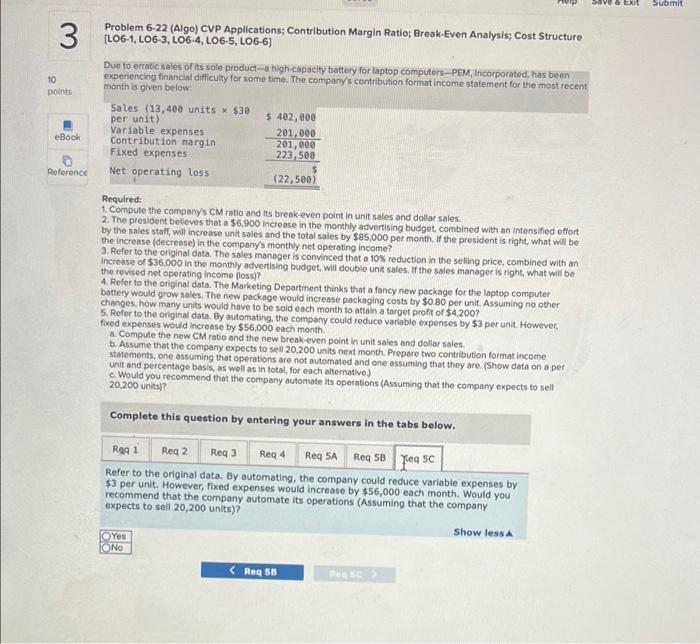

Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LOG-4, LO6-5, LOG-6] Due to erratic sales of its sole product-a high.capacity battery for laptop computors-PEM, Incorporated, has boen experiencing financial difficulty for some time. The company's contribution format income statement for the most recent month is given below: Required: 1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales. 2. The president believes that a $6,900 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $85,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of $36,000 in the monthly advertising budget, will double unit sales. If the sales manager is fight, what will be the revised not operating income (loss)? 4. Refer to the original data. The Marketing Department thinks that a fancy new packoge for the laptop computer bottery would grow sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how many units would have to be sold each month to attain a target profit of $4,200 ? 5. Refer to the originat data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $56,000 eoch month. a. Compute the new CM ratio and the new break-even point in unit sales and dollor sales. b. Assume that the company expects to sell 20,200 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as well as in total, for each alternative.) c. Would you recommend that the company automate its operations (Assuming that the company expects to sell 20,200 units)? Complete this question by entering your answers in the tabs below. Compute the company's CM ratio and its break-even point in unit sales and dollar sales. (Do not round intermediate calculations. Round "CM ratio" to the nearest whole percentage (i.e., 0.234 should be entered as "23"), Problem 622 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Sitructure [LO6-1, L06-3, L06-4, LO6-5, LO6-6] Due to ectiese sales of as sale product-ithigh-capocty battery for taptop computes - PeM, thebrpotated, has beno emperencing finshcisi difficuty for some time. The corripary's contribution foeman income statement for the most tecent manth is given below- Required: 1 Compute the componyts CM ratio and its break-even point in umit sales and doliar soles. 2. The president belives that a $6,900 increase in the mocthly advertising budget combined witn an inteas fived effort by the sales stats, will inerease unit sales ond the total soles by 585.000 per month. II the president is right, whst wal bet the increase (decreasef in the company's monthy net operating income? 3. Refer to the origins) data. The sales manecer is cominced that a 50% redaction in the selling price, combinod with an inciease of $36.000 in the montrly advertising budget will double une sales. If the sales manager is right, what wit be the revised net operating income (loss)? 4. Reler to the original dsta. The Marketing Department thinks that a fancy new package for the laptop compuser bytlety would giow sales. The new package would increase pockaging costs by 50.80 per unct. Assuming no other changes, haw many units would have to be sold esch month to attain a terpet proft of 34,200 ? 5. Reter to the original data. By aufomating. the company could reduce variable experises by $3 per unit however, fived expenses would increase by 556,000 each month a. Compute the new CM ratio and the new breakeven point in unit sales and dolly sales b. Assume that the company expects to sell 20200 units next month. Prepore twa contribution format income: tatemens, one assuming that operations are not automated and one assuming that they are. (5how data on a pet unit and percentage basis, as well as in tetat, for each altemative) e. Would you recommend that the company sutomete its eperasions (Assuming that the corripany expects to sedl 20,200 units)? Complete this question by entering your answers in the tabs below. The president believes that a $6,900 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $85,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? (Do not rothd intermediate calculations.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6] Due to erratic stiles of its sole product-t high-capacity buttery for laptop computers- PEM, Incorporated, has been experiencing financial difficulty for some time. The company's contribution format income statement for the most recent month is given below. Required: 1. Compute the company's CM ratio and ats break-even point in unit sales and dollar 5a les. 2. The president bolicves that a $5,900 increase in the menthly advertising budget. combined with an intensified effort by the sales staff, will inerease unit sales and the total sales by $85,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original data. The sales manager is cominced that a 10% reduction in the selling price, combined with an increase of $36,000 in the monthly advertising budget wil double unit sales, if the sales manager is right, what will be the revised net operating income (loss)? 4. Refer to the ociginal data. The Marketing Department thinks that a fancy new pockage for the loptop computer bottery would grow sales. The new pockage would increase packoging costs by $0.80 per unit. Assuming no other changes, how many units would have to be soid each month to attain a target profit of $4,200 ? 5. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $56,000 each month. a. Compute the new CM ratio and the new break-even point in unit soles and dollar sales. b. Assume that the company expects to sell 20,200 units next month. Prepare two contribution format income statements, one assuming that ogerations are not automated and one assuming that they bre. (Show data on a per unit and percentage basis, as well as in total, for each alternative. c. Would you recommend that the company automate its operations (Assuming that the company expects to sell 20,200 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. The sales manager is convinced that a 10% reduction in the selling price, combined with an increase of $36,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised net operating income (loss)? (Losses should be entered as a negative value.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LOG-4, LOG-5, LO6-6] Due to ecrabc sales of ats sole product-a hich capacity battery for laptop cempiters-PEM, Incorporated, has been experiencing financiol dificuly for some time. The compeny/s contribution format income statement for the most recent month is given below: Required: 1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales. 2. The president believes that a $6.900 increase in the monthly advertising budget, combined with an intensified etfort by the sales staff, will increase unit sales and the total sales by 585.000 per month. If the president is right what will be the increase (decrease) in the company's monthy net operating income? 3. Refer to the original deta. The sales manager is convinced that a 10% reduction in the selling price, combiried with an increase of 536,000 in the monthy advertsing budget, wit double unit sales. If the sales manager is right, what will be the revised net operating income (loss)? 4. Fefer to the originsl data. The Marketing Deportment thinks that a fancy new pockoge for the laptop computer battery would grow sales. The new packsge would increase packaging costs by $0.80 per unit. Assuming no osher changes, how many units would have to be soid each month to attain a target profit of 54,200 ? 5. Refer to the original data. Ey automating. the compary could reduce variable expenses by $3 per unit. However, fixed expenses would incresse by $56,000 each manth. a. Compute the new CM ratio and the new break-eved point in unit sales and dollar soles. b. Assume that the company expects to sell 20,200 units next menth, Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show data on a per unit and percentage besis, as well as in total, for each atteenative) c. Would you recommend that the company automate its operations (Assuming that the company expects to selt 20,200 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. The Marketing Department thinks that a fancy new package for the laptop computer battery would grow salec. The new package would increase packaging costs by 10.80 per unit. Assuming no other changes, how many units would have to be sold each month to attain a target proft of \$4,200? (Do not round intermediate calculotions, Round final answer up to the nearest whole unit.) Problem 6-22 (Aigo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6] Due to erratic sales of its sole product-a high capacty battery for inptop computers-PEM, Incoiporated, has becn experiencing financial difficulty for some time. The company's contribution format income statement for the most recent month is given below: Aequleed: 1. Compute the company's CM rato and its break-even point in wit sales and dollor sales 2. The president believes that a $6,900 increase in the monthly advertising budget, combined with an intensifed effort by the sales thaff, will increase unit rales and the total sales by $85,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original dath. The sales manager is convinced that a tow reduction in the selling price, combined with an increase of $36,000 in the monthly ndvertising budgot, will double unit sales, If the sales manager is fight, what will be the revised net operating income (loss)? 4. Refer to the original data. The Marketing Department thinks that a fancy new packope for the laptop computer bsttery would grow sales. The new pockage would increase packaping costs by $0.80 per unit. Assuming no other changes, how many units would have to be sald each month to attain a target proft of \$4,2007 5. Reter to the original data. By automating. the company could reduce variable expences by $3 per unit. However, faxed expenses would increase by $56,000 each month a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales, b. Assume that the company expects to sell 20,200 units next month. Prepare two contribution format income Hatements, one assuming thet operations are not automated and one assuming that they are. (Show data on a per unit and percentage basis, as well as in totak, for each altemative) c. Would you recommend that the compony automate its operations (Assuming that the company expects to sell 20.200 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $56,000 each month. Compute the new CM ratio and the new break-even point in unit sales and dollar sales. (Do not round intermediate calculations. Round "CM ratio" to the nearest whole percentage (l.e. 0.234 should be entered as "23"), round "Break-even point in unit sales" up to the nearest whole unit and round "Ereak-even point in dollar sales" to the nearest whole dollar.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6] Due to erratic siles of ts wole product-a highicapicity battery tor laptop computers- PEM, Incorporated, has been expenencing financial difficulty for some time. The company cortrbuson fomat income statement for the most recent manth is given below: Requiredt 1. Compute the company's CM rabio and its break teven poirt in unit sales and collar sales. 2. The president beleves that a 56.900 increase in the monthly adverticing budget, combined with an intensified effort, by the sales staft will increace unit sales and the total zales by 505,000 per month. If the president is right, what will be. the increase (decrease) in the company's monthy net operating income? 3. Refer to the originel deta. The sales managet is convenced that a tos teduction in the selling price, combined with an Increase of $36.000 in the monthily adwertising budget wet double unit salst. If the sales mandger is right, what will be the revised net operating income foss? 4. Refer to the original data. The Marketing Department thiries that a fancy new package for the laptop computer battery would grow sales. The new package would increase packaging costs by $0.80 per unit. Assuming no other changes, how msny units would have to be sold eech month to attain a target proft of 54,200 ? 5. Refer to the original dsta. By autometing, the compaty could reduce valable espenses by $3 per unit. However, fwed expenses would increase by 556,000 each month- a. Compute the new CM rasio and the new breok even point in unit waies and dollor sales. b. Assume that the compony expects to sell 20,200 unts nest month. Prepare two contribution format incoene statements, one assuming that operations are not automated and one astuming that they are. IShow data on a per unit and percentage basic, as wel as in total, for each allechative] c. Would you recommend that the compony outomste its operations (Assuming that the compony expects to sell 20,200 units)? Complete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $56,000 each month. Assume that the company expects to sell 20,200 units next month. Frepare two contribution format income statements, one assuming that operations are not automated and one assuming that they are. (Show dato on a per unit and percentege basis, as well as in total, for each alternative.) (Do) not round your intermediate calculations. Round your percentage answers to the nearest. whole number.) Problem 6-22 (Algo) CVP Applications; Contribution Margin Ratio; Break-Even Analysis; Cost Structure [LO6-1, LO6-3, LO6-4, LO6-5, LOG-6] Due to erratic sales of its sole produc-a high-capacity battery for laptop computers - PEM, lincorporated, has been experiencing financial ditficulty for some time. The company's contribution format income statement for the most recent manth is glven below: Required: 1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales. 2. The president belleves that a $6,900 increase in the monthly advertising budget, combined with an intensified effort by the sales staff, will increase unit sales and the total sales by $85,000 per month. If the president is right, what will be the increase (decrease) in the company's monthly net operating income? 3. Refer to the original data. The sales manager is convinced thot a 10%, recuction in the 5elling price, combined with an increase of $36,000 in the monthly advertising budget, will double unit sales. If the sales manager is right, what will be the revised not operating income (loss)? 4. Refer to the original data. The Marketing Department thinks that a foncy new pockage for the laptop computer bottery would grow sales. The new package would increase pockaging costs by 50.80 per unit. Assuming no other changes. how many units would have to be sold each month to attain a target profit of $4,200 ? 5. Refer to the original data. By automating, the company could reduce varlable oxpenses by $3 per unit. Howover, fixed expenses would increase by $56,000 each month. a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales. b. Assume that the company expects to sell 20,200 units next month. Prepare two contribution format income statements, one assuming that operations are not automated and one assuming that they ate. (Show data on a per unit and percentage basis, as well as in total, for each alternative. c. Would you recommend that the company automate its operations (Assuming that the company expects to sell 20,200 units?? Complete this question by entering your answers in the tabs below. Refer to the original data. By automating, the company could reduce variable expenses by $3 per unit. However, fixed expenses would increase by $56,000 each month. Would you recommend that the company automate its operations (Assuming that the company expects to sell 20,200 units)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started