Need help with all of them!

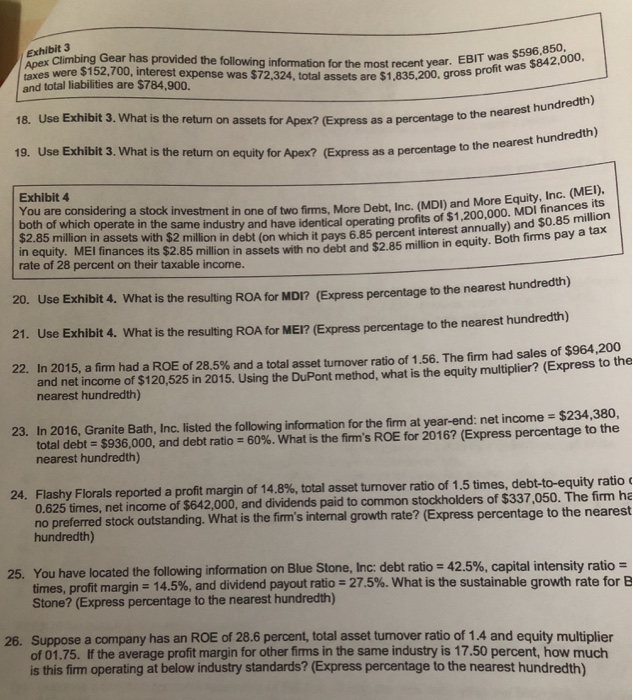

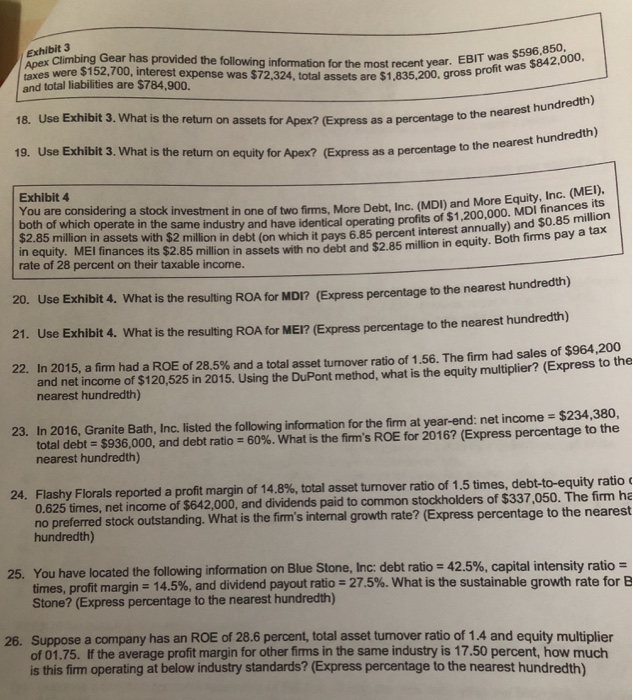

Apex Climbing Gear has provided the following information for the most recent year.842.000 Exhibit 3 850, taxes were $152.700, interest expense was $72,324, total assets are $1,835.200. gross profit wa and total liabilities are $784,900. 18. Use Exhibit 3. What is the retum on assets for Apex? (Express as a percentage to the neares 19. Use Exhibit 3. What is the retun on equity for Apex? (Express as a percentage to the nearest hundredth) Exhibit 4 You are considering a stock investment in one of two firms, More Debt, Inc. (MDI) and More Equ both of which operate in the same industry and have identical operating profits of $1 $2.85 million in assets with $2 million in debt (on which it pays 6.85 percent in equity. MEI finances its $2.85 million in assets with no debt and $2.85 million in rate of 28 percent on their taxable income. EI), ,200,000. MDI finances its interest annually) and $0.85 million (M equity. Both firms pay a t 20. Use Exhibit 4. What is the resulting ROA for MDI? (Expre ss percentage to the nearest hundredth) Use Exhibit 4. What is the resulting ROA for MEI? (Express percentage to the nearest hundredth) 22. In 2015, a firm had a ROE of 28.5% and a total asset turnover ratio of 1.56. The firm had sales of $964,200 and net income of $120,525 in 2015. Using the DuPont method, what is the equity multiplier? (Express to the nearest hundredth) 23. In 2016, Granite Bath, Inc. listed the following information for the firm at year-end: net income $234,380, 60%, what is the firm's ROE for 2016? (Express percentage to the total debt-$936,000, and debt ratio nearest hundredth) 24. Flashy Florals reported a profit margin of 14.8%, total asset turnover ratio of 1.5 times, debt-to-equity ratio 2,000, and dividends paid to common stockholders of $337,050. The firm ha ferred stock outstanding. What is the firm's internal growth rate? (Express percentage to the nearest 5 tirmes You have located the following information on Blue Stone, Inc: debt ratio times, profit margins 14.5%, and dividend payout ratio-27.5%. What is the sustainable growth rate for e Stone? (Express percentage to the nearest hundredth) 25. 42.5%, capital intensity ratio 26. Suppose a company has an ROE of 28.6 percent, total asset turnover ratio of 1.4 and equity multiplier of 01.75. If the average profit margin for other firms in the same industry is 17.50 percent, how much is this firm operating at below industry standards? (Express percentage to the nearest hundredth

Need help with all of them!

Need help with all of them!