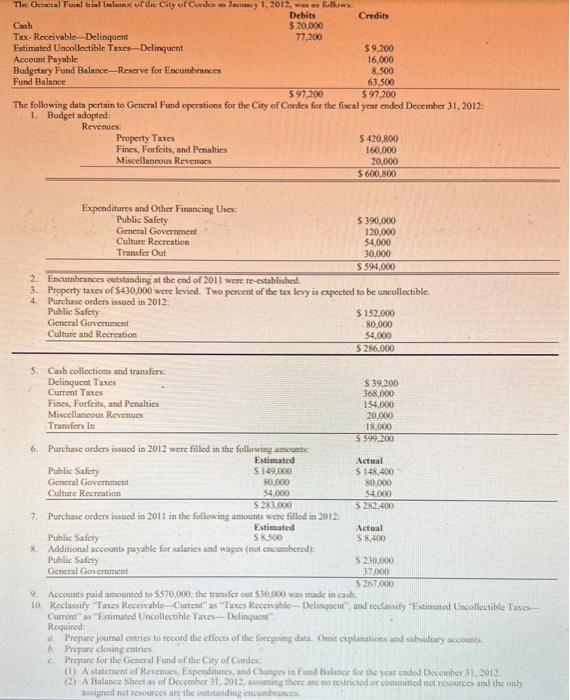

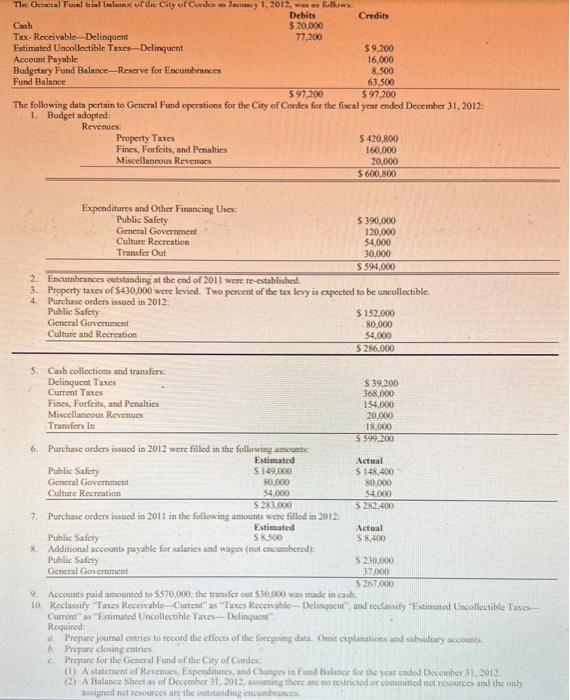

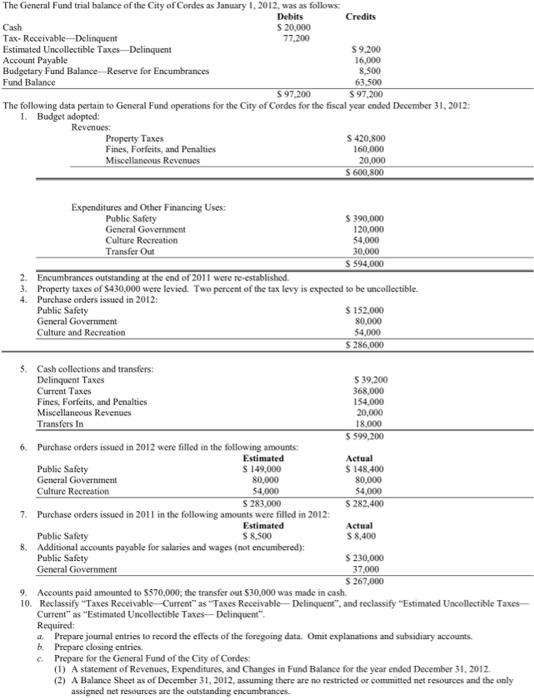

need help with all parts (at the bottom. a, b, c, and d)

The following data pertnin to Genernal Fund opentions for the City of Cordes for the fiscal year ended December 31, 2012: 1. Budget adopted: 2. Encumbrances outstanding at the cnd of 2011 were re-stablinhed. 3. Property taxes of $430,000 were levied. Two pereent of the tax levy is expected to be uncollectible. 4. Purchase onders issuad in 2012: Public Safety: Gencral Government $152,000 Culture and Recreation 80.000 34,000 5286000 7. Purchase orders isued in 2011 in the following amounts were filled in 2012: Estimated Public Safety Estimuted5500$8,400 8. Additional accocints payable for salaries and wago (not encumberod) Public Safety General Government $24000 $267.06037,000 9. Accounts paid amounted to 5570,000 , the tranufer out 530,000 was mode in cash. Cumnt" as "Estimated Uncollectible Taves-Delinquent". Required: a. Prepare journal entrio to record the effects of the forcgoing duts. Omit explanatises and sehadtiary accouats. b. Prepars closing cntrics. c. Preparc for the Gencril Fund of the City or Cordes (1) A statument of Rerenues, Fspenditures, and Chacess is Find Baluce for the year ended December 31, 2012 asiuned net rcsources are the cutitanding encumbrisces. The General Fund trial balance of the City of Cordes as January 1, 2012, was as follows: \begin{tabular}{lcr} Cash & Debits & Credits \\ Tax-Receivable-Delinquent & $20,000 & \\ Estimated Uncollectible Taxes-Delinquent & 77,200 & \\ Account Payable & & $9,200 \\ Budgetary Fund Balance-Reserve for Encumbrances & & 16,000 \\ Fund Balance & & 8,500 \\ \hline \end{tabular} The following data pertain to General Fund operations for the City of Cordes for the fiscal year ended December 31, 2012: 1. Budget adopted: Revenues: Property Taxes Fines, Forfeits, and Penalties Miscellancous Revenues $420,800 160,000 $600.800 Expenditures and Other Financing Uses: Public Safety General Government Culture Recreation Transfer Out $390,000 120,000 54,000 $594,000 2. Encumbrances outstanding at the end of 2011 were re-establishod 3. Property taxes of $430,000 were levied. Two percent of the tax levy is expected to be uncollectible. 4. Purchase orders issued in 2012: Public Safety General Government $152.000 Culture and Recreation 80,000 54,000 5286,000 5. Cash collections and transfers: Delinquent Taxes S 39,200 Current Taxes 368,000 Fines, Forfeits, and Penalties 154,000 Miscellaneous Revenues 20,000 Transfers In 18,000 $599.200 6. Purchase orders issued in 2012 were filled in the following amounts: Public Safety Estimated Actual General Government S 149,000 $148,400 Culture Recreation 80,000 54,000 $283,000 5282,400 7. Purchase orders issued in 2011 in the following amounts were filled in 2012 : Estimated Public Safety Actual 58,400 8. Additional accounts payable for salaries and wages (not encumbered): Public Safety $230,000 General Govermment 37,000 $267,000 9. Accounts paid amounted to 5570,000 ; the transfer out 530,000 was made in cash. 10. Reclassify "Taxes Receivable-Curreot" as "Taxes Receivable- Delinquent", and reclassify "Estimated Uncollectible TaxesCurrent" as "Estimated Uncollectible Taxes-Delinquent". Required: a. Prepare journal entries to record the effects of the foregoing data. Omit explanations and subsidiary accounts. b. Prepare closing entries. c. Prepare for the General Fund of the Cify of Condes: (1) A starement of Revenues, Expenditures, and Changes in Fund Balance for the year ended December 31, 2012. (2) A Balance Sheet as of December 31, 2012, assuming there are no restricted or comumitied net resources and the only assigned net resources are the outstanding encumbrances