Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with balance sheet, income, and impact on income. For each adjustment, indicate the income statement and balance sheet account affected, and the impact

Need help with balance sheet, income, and impact on income.

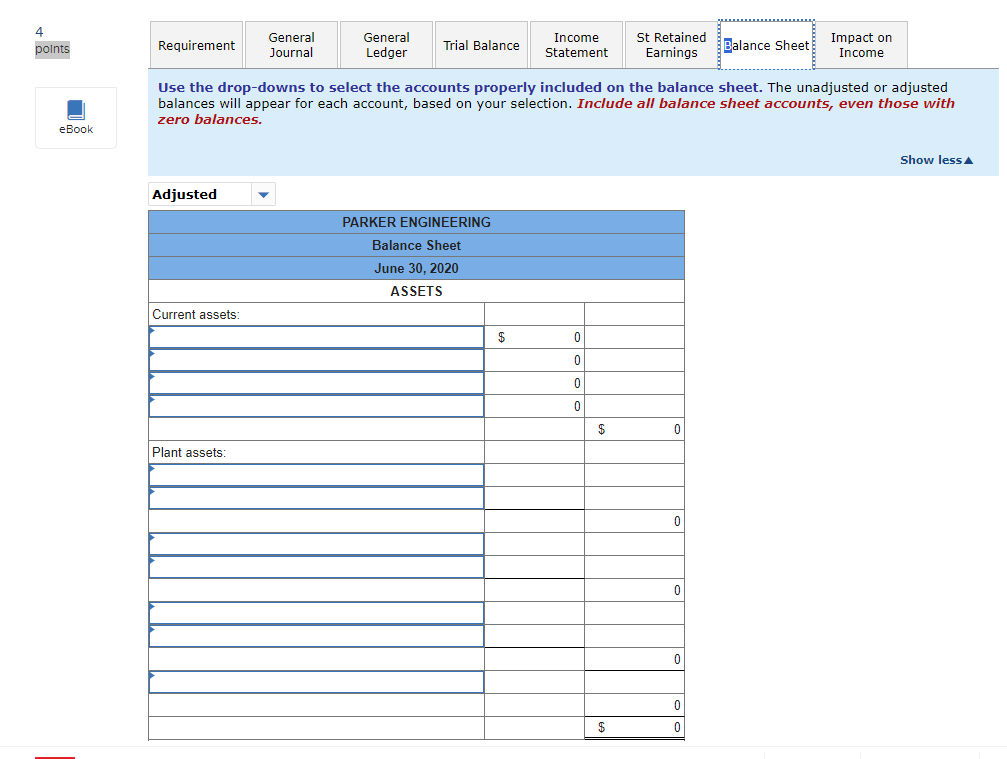

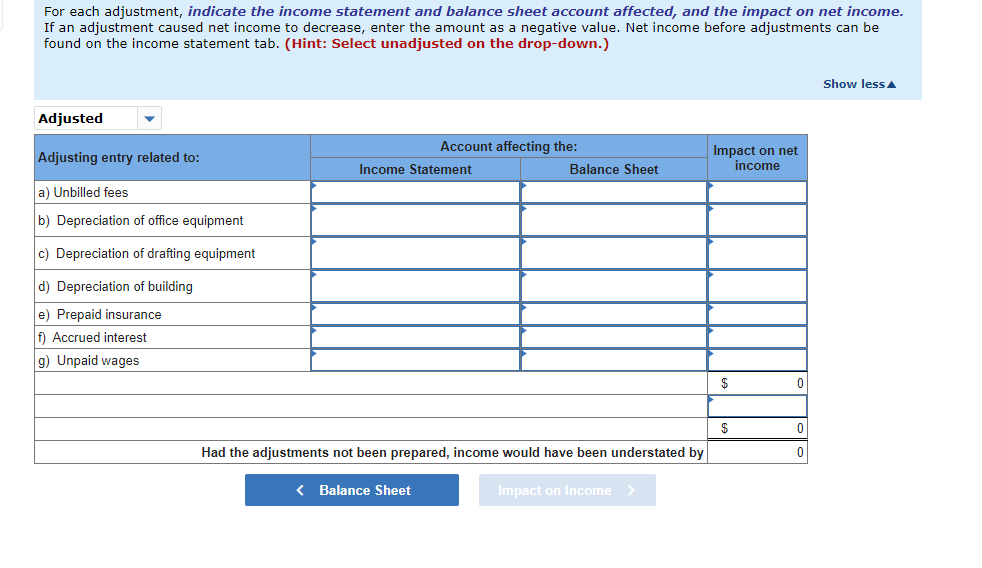

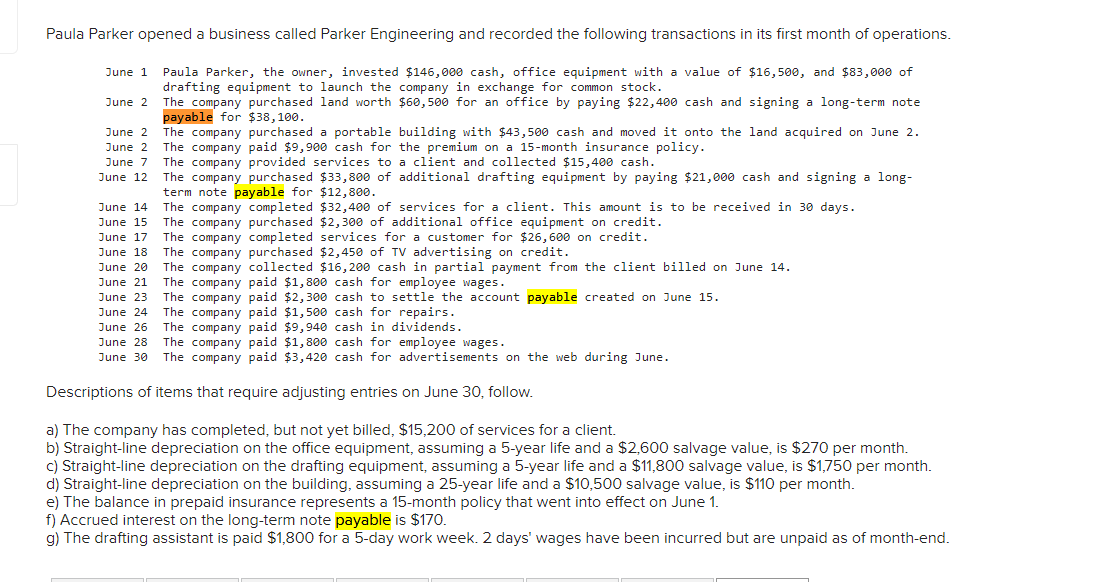

For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection. Include all balance sheet accounts, even those with zero balances. Paula Parker opened a business called Parker Engineering and recorded the following transactions in its first month of operations. June 1 Paula Parker, the owner, invested $146,000 cash, office equipment with a value of $16,500, and $83,000 of drafting equipment to launch the company in exchange for common stock. June 2 The company purchased land worth $60,500 for an office by paying $22,400 cash and signing a long-term note payable for $38,100. June 2 The company purchased a portable building with $43,500cash and moved it onto the land acquired on June 2 . June 2 The company paid $9,900 cash for the premium on a 15 -month insurance policy. June 7 The company provided services to a client and collected $15,400 cash. June 12 The company purchased $33,800 of additional drafting equipment by paying $21,000 cash and signing a longterm note payable for $12,800. June 14 The company completed $32,400 of services for a client. This amount is to be received in 30 days. June 15 The company purchased $2,300 of additional office equipment on credit. June 17 The company completed services for a customer for $26,600 on credit. June 18 The company purchased $2,450 of TV advertising on credit. June 20 The company collected $16,200 cash in partial payment from the client billed on June 14 . June 21 The company paid $1,800 cash for employee wages. June 23 The company paid $2,300 cash to settle the account payable created on June 15 . June 24 The company paid $1,500 cash for repairs. June 26 The company paid $9,940 cash in dividends. June 28 The company paid $1,800 cash for employee wages. June 30 The company paid $3,420 cash for advertisements on the web during June. Descriptions of items that require adjusting entries on June 30 , follow. a) The company has completed, but not yet billed, $15,200 of services for a client. b) Straight-line depreciation on the office equipment, assuming a 5-year life and a $2,600 salvage value, is $270 per month. c) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $11,800 salvage value, is $1,750 per month. d) Straight-line depreciation on the building, assuming a 25 -year life and a $10,500 salvage value, is $110 per month. e) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1. f) Accrued interest on the long-term note payable is $170. g) The drafting assistant is paid $1,800 for a 5-day work week. 2 days' wages have been incurred but are unpaid as of month-end. For each adjustment, indicate the income statement and balance sheet account affected, and the impact on net income. If an adjustment caused net income to decrease, enter the amount as a negative value. Net income before adjustments can be found on the income statement tab. (Hint: Select unadjusted on the drop-down.) Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted or adjusted balances will appear for each account, based on your selection. Include all balance sheet accounts, even those with zero balances. Paula Parker opened a business called Parker Engineering and recorded the following transactions in its first month of operations. June 1 Paula Parker, the owner, invested $146,000 cash, office equipment with a value of $16,500, and $83,000 of drafting equipment to launch the company in exchange for common stock. June 2 The company purchased land worth $60,500 for an office by paying $22,400 cash and signing a long-term note payable for $38,100. June 2 The company purchased a portable building with $43,500cash and moved it onto the land acquired on June 2 . June 2 The company paid $9,900 cash for the premium on a 15 -month insurance policy. June 7 The company provided services to a client and collected $15,400 cash. June 12 The company purchased $33,800 of additional drafting equipment by paying $21,000 cash and signing a longterm note payable for $12,800. June 14 The company completed $32,400 of services for a client. This amount is to be received in 30 days. June 15 The company purchased $2,300 of additional office equipment on credit. June 17 The company completed services for a customer for $26,600 on credit. June 18 The company purchased $2,450 of TV advertising on credit. June 20 The company collected $16,200 cash in partial payment from the client billed on June 14 . June 21 The company paid $1,800 cash for employee wages. June 23 The company paid $2,300 cash to settle the account payable created on June 15 . June 24 The company paid $1,500 cash for repairs. June 26 The company paid $9,940 cash in dividends. June 28 The company paid $1,800 cash for employee wages. June 30 The company paid $3,420 cash for advertisements on the web during June. Descriptions of items that require adjusting entries on June 30 , follow. a) The company has completed, but not yet billed, $15,200 of services for a client. b) Straight-line depreciation on the office equipment, assuming a 5-year life and a $2,600 salvage value, is $270 per month. c) Straight-line depreciation on the drafting equipment, assuming a 5-year life and a $11,800 salvage value, is $1,750 per month. d) Straight-line depreciation on the building, assuming a 25 -year life and a $10,500 salvage value, is $110 per month. e) The balance in prepaid insurance represents a 15-month policy that went into effect on June 1. f) Accrued interest on the long-term note payable is $170. g) The drafting assistant is paid $1,800 for a 5-day work week. 2 days' wages have been incurred but are unpaid as of month-endStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started