Answered step by step

Verified Expert Solution

Question

1 Approved Answer

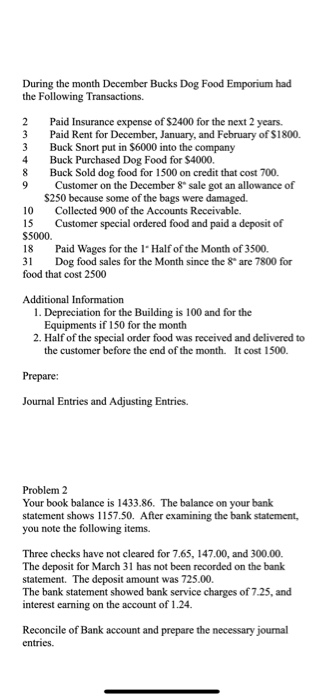

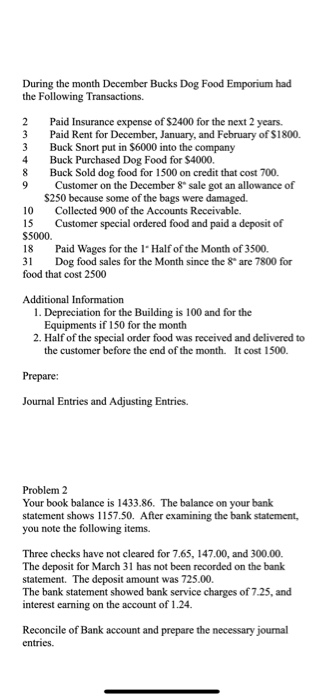

Need help with both problems During the month December Bucks Dog Food Emporium had the Following Transactions. Paid Insurance expense of $2400 for the next

Need help with both problems

During the month December Bucks Dog Food Emporium had the Following Transactions. Paid Insurance expense of $2400 for the next 2 years. Paid Rent for December, January, and February of $1800. Buck Snort put in $6000 into the company 4 Buck Purchased Dog Food for $4000. 8 Buck Sold dog food for 1500 on credit that cost 700. Customer on the December 8 sale got an allowance of $250 because some of the bags were damaged. 10 Collected 900 of the Accounts Receivable. 15 Customer special ordered food and paid a deposit of S5000. 18 Paid Wages for the 1. Half of the Month of 3500. 31 Dog food sales for the Month since the 8 are 7800 for food that cost 2500 Additional Information 1. Depreciation for the Building is 100 and for the Equipments if 150 for the month 2. Half of the special order food was received and delivered to the customer before the end of the month. It cost 1500. Prepare: Journal Entries and Adjusting Entries. Problem 2 Your book balance is 1433.86. The balance on your bank statement shows 1157.50. After examining the bank statement, you note the following items. Three checks have not cleared for 7.65, 147.00, and 300.00 The deposit for March 31 has not been recorded on the bank statement. The deposit amount was 725.00. The bank statement showed bank service charges of 7.25, and interest earning on the account of 1.24. Reconcile of Bank account and prepare the necessary journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started