Answered step by step

Verified Expert Solution

Question

1 Approved Answer

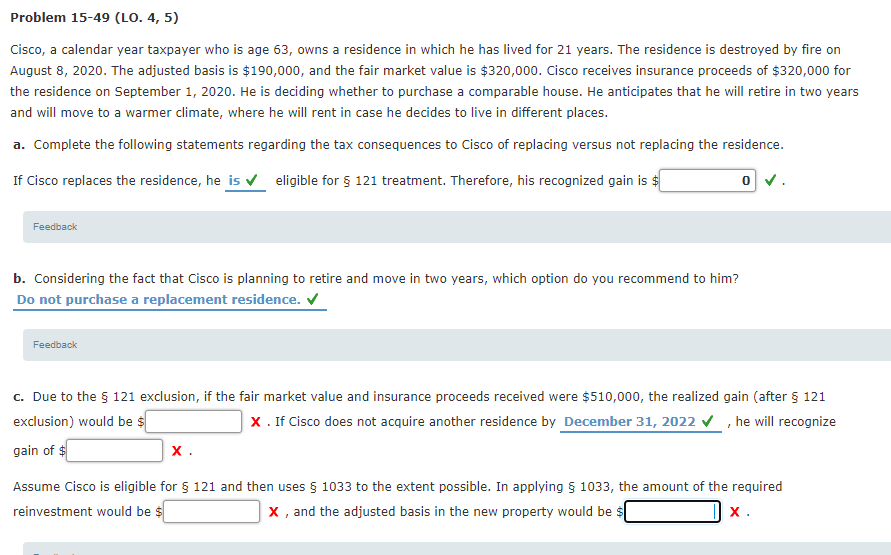

Need help with C. Problem 15-49 (LO. 4, 5) Cisco, a calendar year taxpayer who is age 63, owns a residence in which he has

Need help with C.

Problem 15-49 (LO. 4, 5) Cisco, a calendar year taxpayer who is age 63, owns a residence in which he has lived for 21 years. The residence is destroyed by fire on August 8, 2020. The adjusted basis is $190,000, and the fair market value is $320,000. Cisco receives insurance proceeds of $320,000 for the residence on September 1, 2020. He is deciding whether to purchase a comparable house. He anticipates that he will retire in two years and will move to a warmer climate, where he will rent in case he decides to live in different places. a. Complete the following statements regarding the tax consequences to Cisco of replacing versus not replacing the residence. If Cisco replaces the residence, he is eligible for $ 121 treatment. Therefore, his recognized gain is $ 0. Feedback b. Considering the fact that Cisco is planning to retire and move in two years, which option do you recommend to him? Do not purchase a replacement residence. Feedback c. Due to the $ 121 exclusion, if the fair market value and insurance proceeds received were $510,000, the realized gain (after $ 121 exclusion) would be $ X. If Cisco does not acquire another residence by December 31, 2022 , he will recognize gain of $ X. Assume Cisco is eligible for $ 121 and then uses 1033 to the extent possible. In applying 1033, the amount of the required reinvestment would be s X, and the adjusted basis in the new property would be X Problem 15-49 (LO. 4, 5) Cisco, a calendar year taxpayer who is age 63, owns a residence in which he has lived for 21 years. The residence is destroyed by fire on August 8, 2020. The adjusted basis is $190,000, and the fair market value is $320,000. Cisco receives insurance proceeds of $320,000 for the residence on September 1, 2020. He is deciding whether to purchase a comparable house. He anticipates that he will retire in two years and will move to a warmer climate, where he will rent in case he decides to live in different places. a. Complete the following statements regarding the tax consequences to Cisco of replacing versus not replacing the residence. If Cisco replaces the residence, he is eligible for $ 121 treatment. Therefore, his recognized gain is $ 0. Feedback b. Considering the fact that Cisco is planning to retire and move in two years, which option do you recommend to him? Do not purchase a replacement residence. Feedback c. Due to the $ 121 exclusion, if the fair market value and insurance proceeds received were $510,000, the realized gain (after $ 121 exclusion) would be $ X. If Cisco does not acquire another residence by December 31, 2022 , he will recognize gain of $ X. Assume Cisco is eligible for $ 121 and then uses 1033 to the extent possible. In applying 1033, the amount of the required reinvestment would be s X, and the adjusted basis in the new property would be XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started