Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with calculating the following practice problems . keep getting incorrect answers, thank you very much!!! Exercise 5-1 The Effect of Changes in Activity

need help with calculating the following practice problems . keep getting incorrect answers, thank you very much!!!

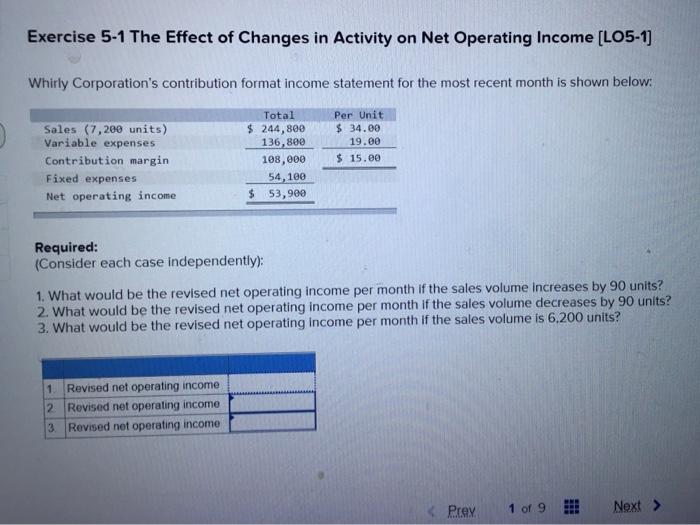

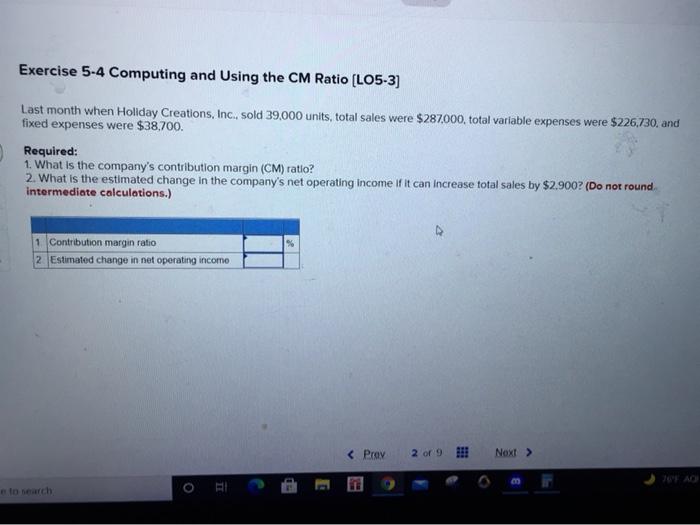

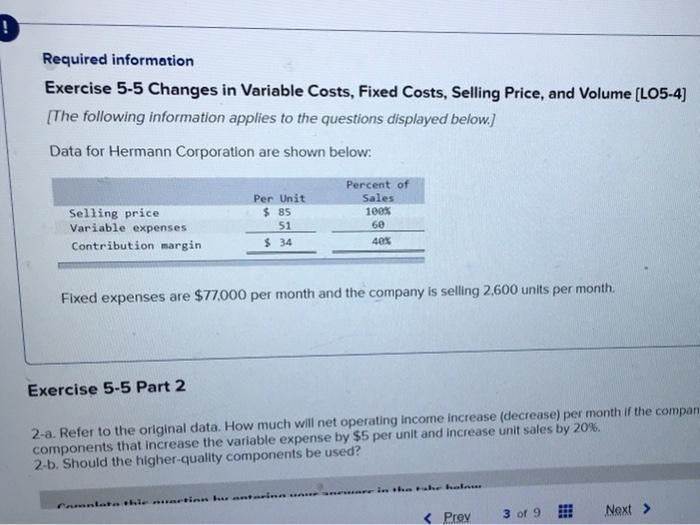

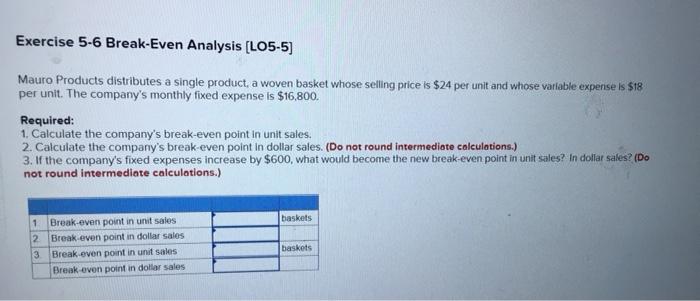

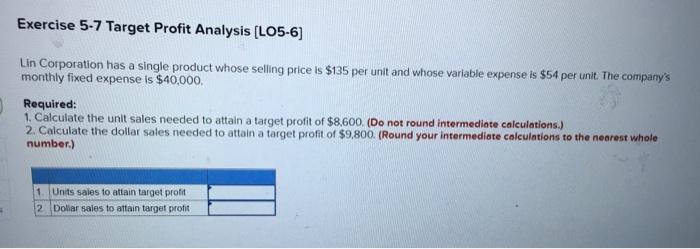

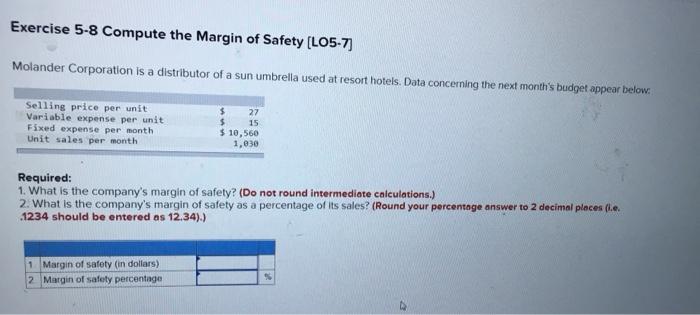

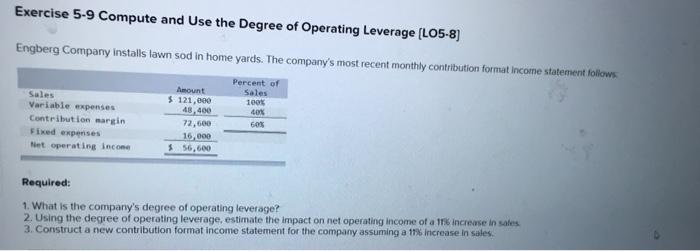

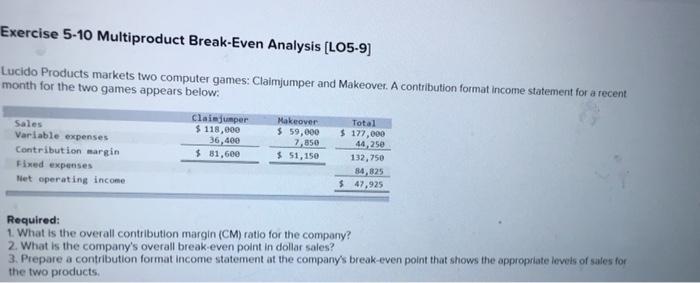

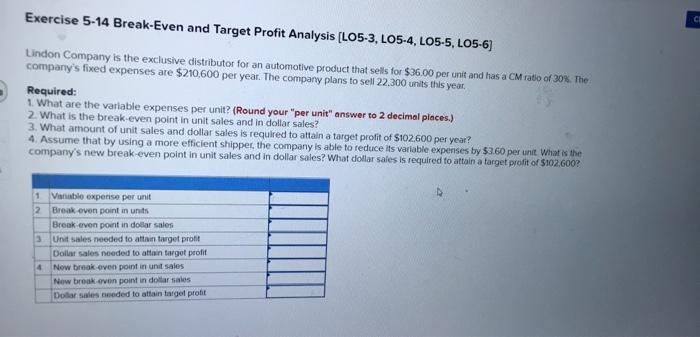

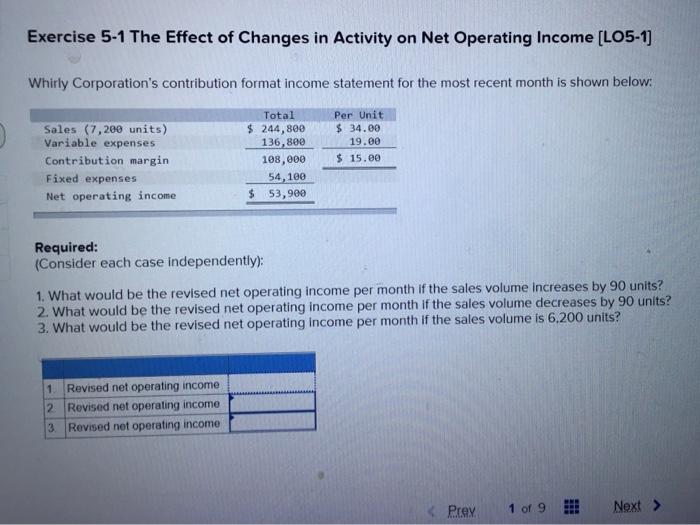

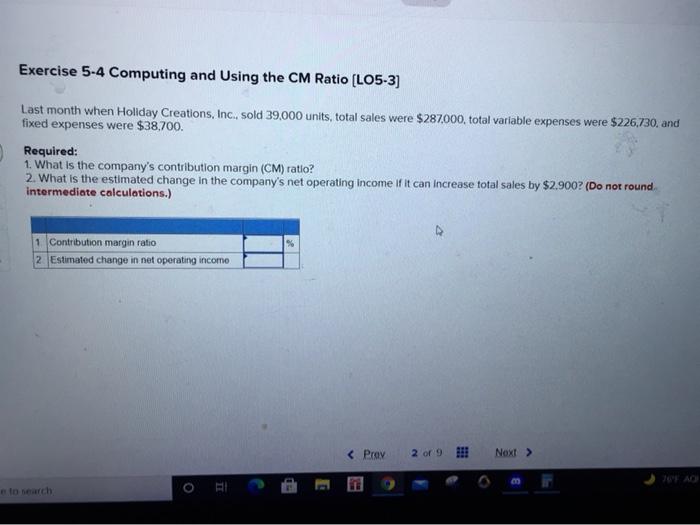

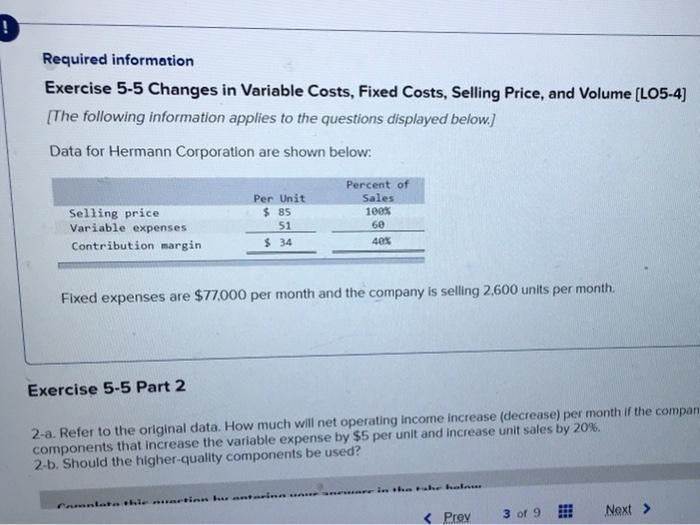

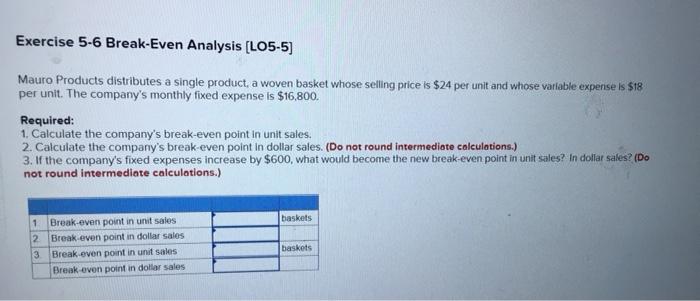

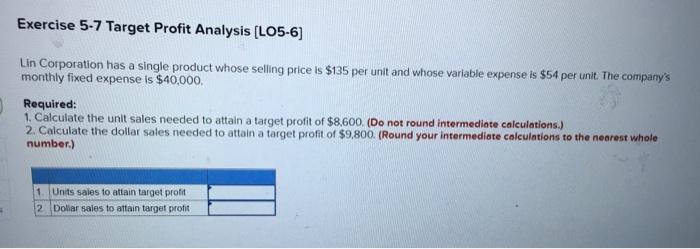

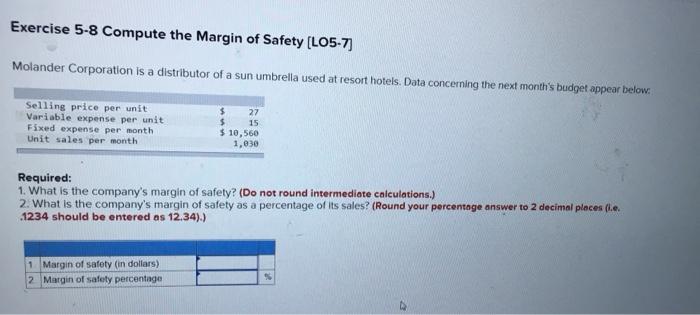

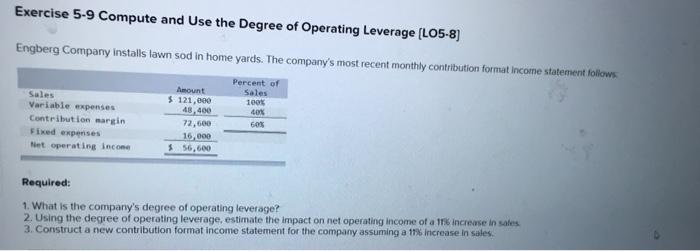

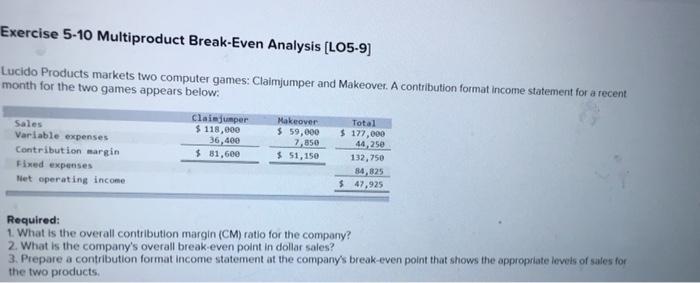

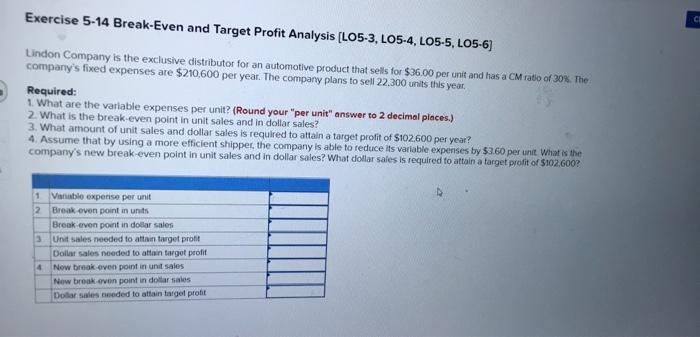

Exercise 5-1 The Effect of Changes in Activity on Net Operating Income (LO5-1] Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 34.00 19.00 Total $ 244,800 136,800 108,000 54,100 $ 53,900 Sales (7,200 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 15.00 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month If the sales volume is 6,200 units? 1. Revised net operating income 2 Revised net operating income 3 Revised net operating income Prey 1 of 9 Next > Exercise 5-4 Computing and using the CM Ratio (LO5-3) Last month when Holiday Creations, Inc., sold 39,000 units, total sales were $287,000, total variable expenses were $226,730, and fixed expenses were $38,700. Required: 1. What is the company's contribution margin (CM) ratlo? 2. What is the estimated change in the company's net operating Income If it can increase total sales by $2,900? (Do not round intermediate calculations.) 1 Contribution margin ratio 2 Estimated change in net operating incomo search O TE Required information Exercise 5-5 Changes in Variable Costs, Fixed Costs, Selling Price, and Volume (L05-4) [The following information applies to the questions displayed below.) Data for Hermann Corporation are shown below: Selling price Variable expenses Contribution margin Per Unit $ 85 51 $ 34 Percent of Sales 100% 60 40% Fixed expenses are $77,000 per month and the company is selling 2600 units per month Exercise 5-5 Part 2 2-a. Refer to the original data. How much will net operating income increase (decrease) per month if the compan components that increase the variable expense by $5 per unit and increase unit sales by 20%. 2-b. Should the higher quality components be used? Camata hitinn hanterinnunnare in the he he... Exercise 5-6 Break-Even Analysis (LO5-5) Mauro Products distributes a single product, a woven basket whose selling price is $24 per unit and whose valable expense is $18 per unit. The company's monthly fixed expense is $16,800. Required: 1. Calculate the company's break-even point in unit sales. 2. Calculate the company's break-even point in dollar sales. (Do not round intermediate calculations.) 3. If the company's fixed expenses increase by $600, what would become the new break-even point in unit sales? In dollar sales? (Do not round intermediate calculations.) baskets 1 2 Break-even point in unit sales Break even point in dollar sales Break even point in unit sales Break-oven point in dollar sales baskets 3 Exercise 5-7 Target Profit Analysis (LO5-6) Lin Corporation has a single product whose selling price is $135 per unit and whose variable expense is $54 per unit. The company's monthly fixed expense is $40.000 Required: 1. Calculate the unit sales needed to attain a target profit of $8,600. (Do not round intermediate calculations.) 2. Calculate the dollar sales needed to attain a target profit of $9,800. (Round your intermediate calculations to the nearest whole number.) 1 Units sales to attain target profit 2 Dollar sales to attain target profit Exercise 5-8 Compute the Margin of Safety (LO5-7) Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next month's budget appear below: Selling price per unit Variable expense per unit Fixed expense per month Unit sales per month $ 27 $ 15 $ 10,560 1.030 Required: 1. What is the company's margin of safety? (Do not round intermediate calculations.) 2. What is the company's margin of safety as a percentage of its sales? (Round your percentage answer to 2 decimal places the 1234 should be entered as 12.34).) 1 Margin of safety (in dollars) 2 Margin of safety percentage Exercise 5-9 Compute and Use the Degree of Operating Leverage (LO5-8) Engberg Company Installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows Sales Variable expenses Contribution margin Fixed expenses Met operating Income Amount $ 121,000 48,400 72,600 16,000 $ 56,600 Percent of Sales 100% 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 13 increase in sales 3. Construct a new contribution format income statement for the company assuming a 17 increase in sales Exercise 5-10 Multiproduct Break-Even Analysis (LO5-9) Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below. Claimjumper Makeover Total Sales $ 118,000 $ 59,000 $ 177,000 Variable expenses 36,400 7,850 44,250 Contribution margin $ 81,600 $ 51,150 132,750 Fixed expenses 84,825 Net operating income $ 47,925 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products Exercise 5-14 Break-Even and Target Profit Analysis (L05-3, L05-4, LO5-5, LO5-6) CI Lindon Company is the exclusive distributor for an automotive product that sells for $36.00 per unit and has a CM ratio of 30%. The company's fixed expenses are $210,600 per year. The company plans to sell 22.300 units this year, Required: 1. What are the variable expenses per unit? (Round your "per unit" answer to 2 decimal places.) 2. What is the break even point in unit sales and in dollar sales? 3. What amount of unit sales and dollar sales is required to attain a target profit of $102.600 per year? 4. Assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $3.60 per unit What is the company's new break even point in unit sales and in dollar sales? What dollar sales is required to attain a target profit of $102.600? 1 Variable expense per unit 2 Break even point in units Break even point in dollar sales 3 Unit sales needed to attain target profit Dollar sales needed to attain tagot profit 4 Now break even point in unit sales Now broak even point in dollar sales Dotare needed to attain target profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started