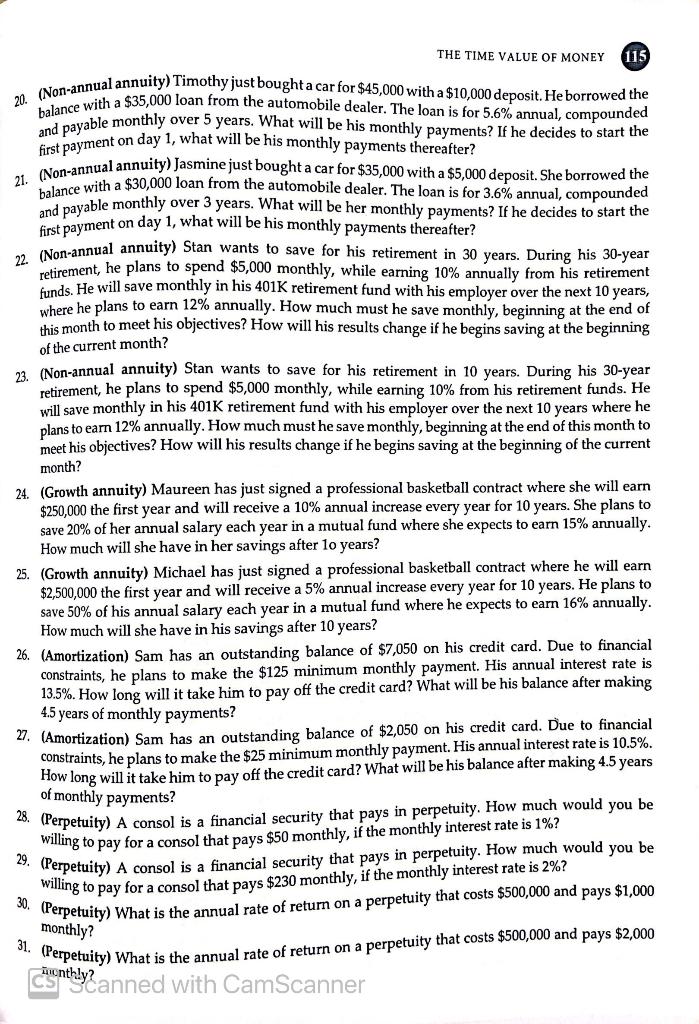

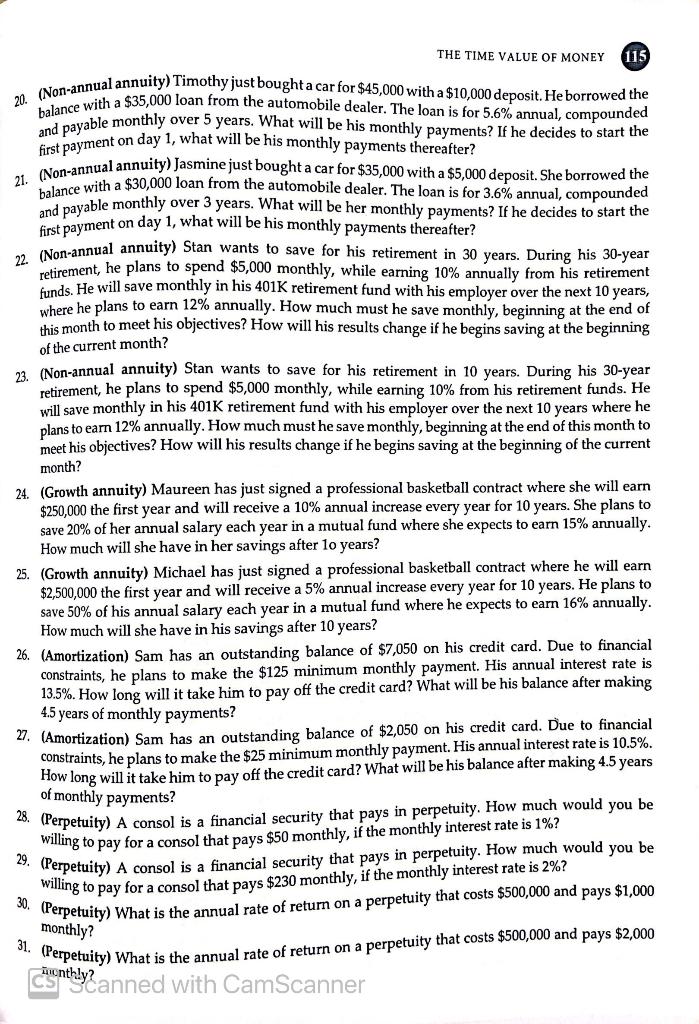

Need Help with EVEN numbers only. 20,22,24,26,28,30

THE TIME VALUE OF MONEY 115 20. (Non-annual annuity) Timothy just bought a car for $45,000 with a $10,000 deposit. He borrowed the balance with a $35,000 loan from the automobile dealer. The loan is for 5.6% annual, compounded and payable monthly over 5 years. What will be his monthly payments? If he decides to start the first payment on day 1 , what will be his monthly payments thereafter? 21. (Non-annual annuity) Jasmine just bought a car for $35,000 with a $5,000 deposit. She borrowed the balance with a $30,000 loan from the automobile dealer. The loan is for 3.6% annual, compounded and payable monthly over 3 years. What will be her monthly payments? If he decides to start the first payment on day 1 , what will be his monthly payments thereafter? 22. (Non-annual annuity) Stan wants to save for his retirement in 30 years. During his 30-year retirement, he plans to spend $5,000 monthly, while earning 10% annually from his retirement funds. He will save monthly in his 401K retirement fund with his employer over the next 10 years, where he plans to earn 12% annually. How much must he save monthly, beginning at the end of this month to meet his objectives? How will his results change if he begins saving at the beginning of the current month? 23. (Non-annual annuity) Stan wants to save for his retirement in 10 years. During his 30-year retirement, he plans to spend $5,000 monthly, while earning 10% from his retirement funds. He will save monthly in his 401K retirement fund with his employer over the next 10 years where he plans to earn 12% annually. How much must he save monthly, beginning at the end of this month to meet his objectives? How will his results change if he begins saving at the beginning of the current month? 24. (Growth annuity) Maureen has just signed a professional basketball contract where she will earn $250,000 the first year and will receive a 10% annual increase every year for 10 years. She plans to save 20% of her annual salary each year in a mutual fund where she expects to earn 15% annually. How much will she have in her savings after lo years? 25. (Growth annuity) Michael has just signed a professional basketball contract where he will earn $2,500,000 the first year and will receive a 5% annual increase every year for 10 years. He plans to save 50% of his annual salary each year in a mutual fund where he expects to earn 16% annually. How much will she have in his savings after 10 years? 26. (Amortization) Sam has an outstanding balance of $7,050 on his credit card. Due to financial constraints, he plans to make the $125 minimum monthly payment. His annual interest rate is 13.5%. How long will it take him to pay off the credit card? What will be his balance after making 4.5 years of monthly payments? 27. (Amortization) Sam has an outstanding balance of $2,050 on his credit card. Due to financial constraints, he plans to make the $25 minimum monthly payment. His annual interest rate is 10.5%. How long will it take him to pay off the credit card? What will be his balance after making 4.5 years of monthly payments? 28. (Perpetuity) A consol is a financial security that pays in perpetuity. How much would you be willing to pay for a consol that pays $50 monthly, if the monthly interest rate is 1% ? 29. (Perpetuity) A consol is a financial security that pays in perpetuity. How much would you be willing to pay for a consol that pays $230 monthly, if the monthly interest rate is 2% ? 30. (Perpetuity) What is the annual rate of return on a perpetuity that costs $500,000 and pays $1,000 monthly? 31. (Perpetuity) What is the annual rate of return on a perpetuity that costs $500,000 and pays $2,000 Cimontly