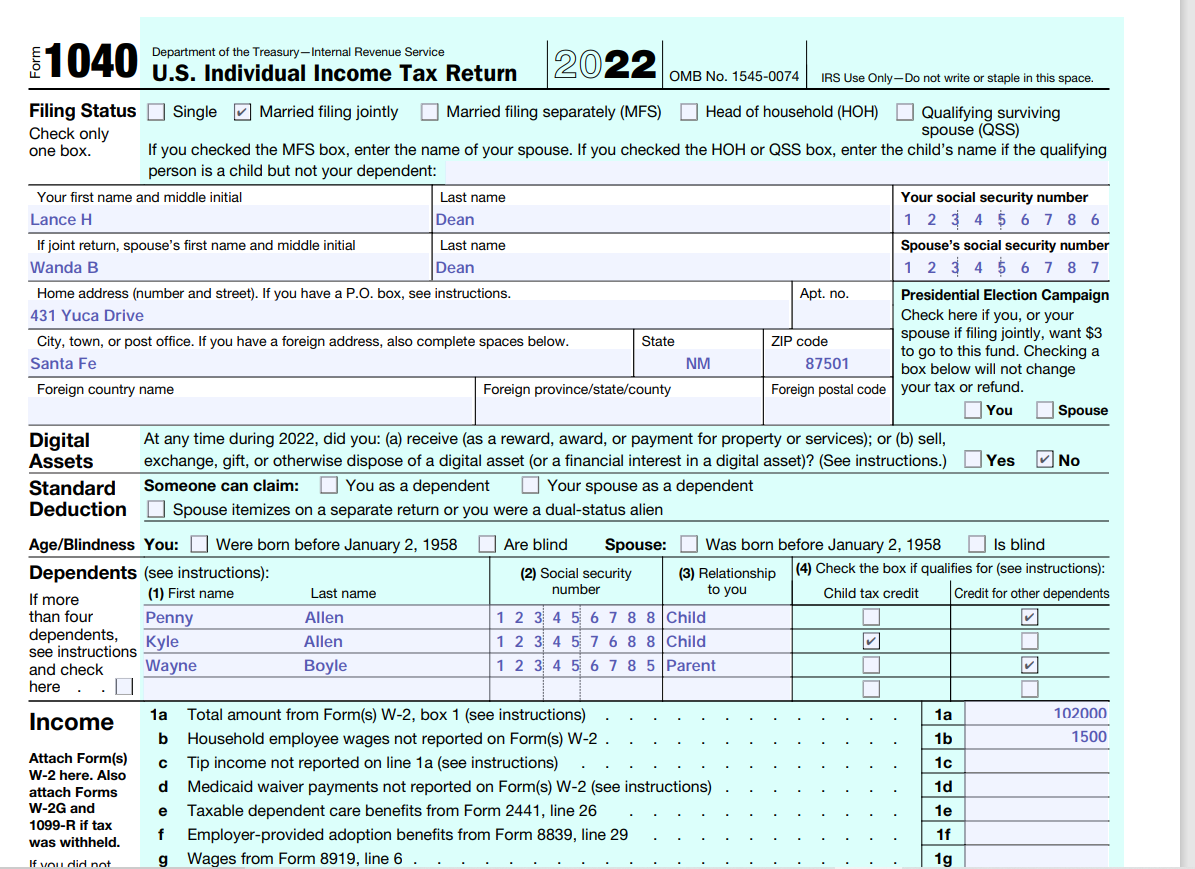

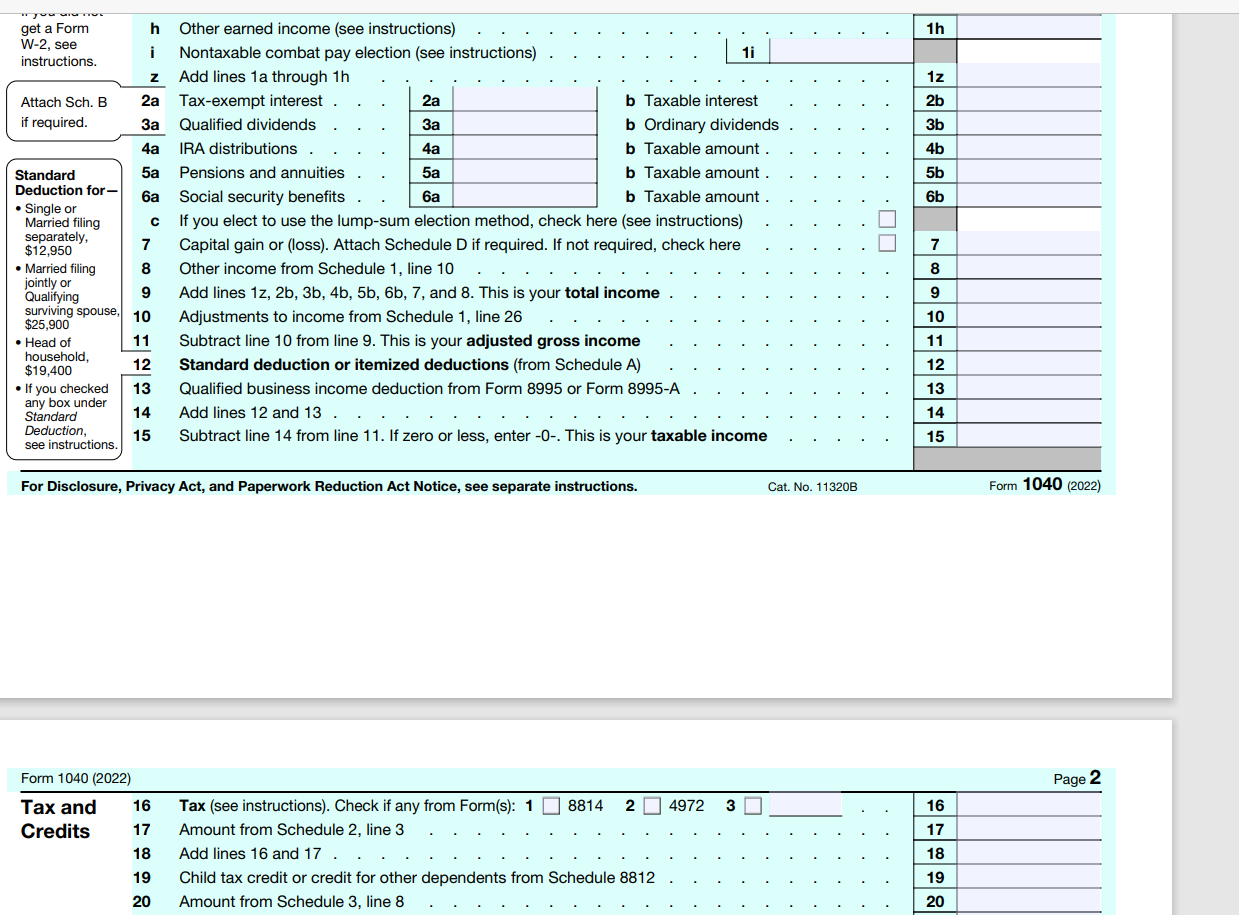

Need help with form 1040 - specifically lines 1 - 26. For the tax year 2022. Thanks!!

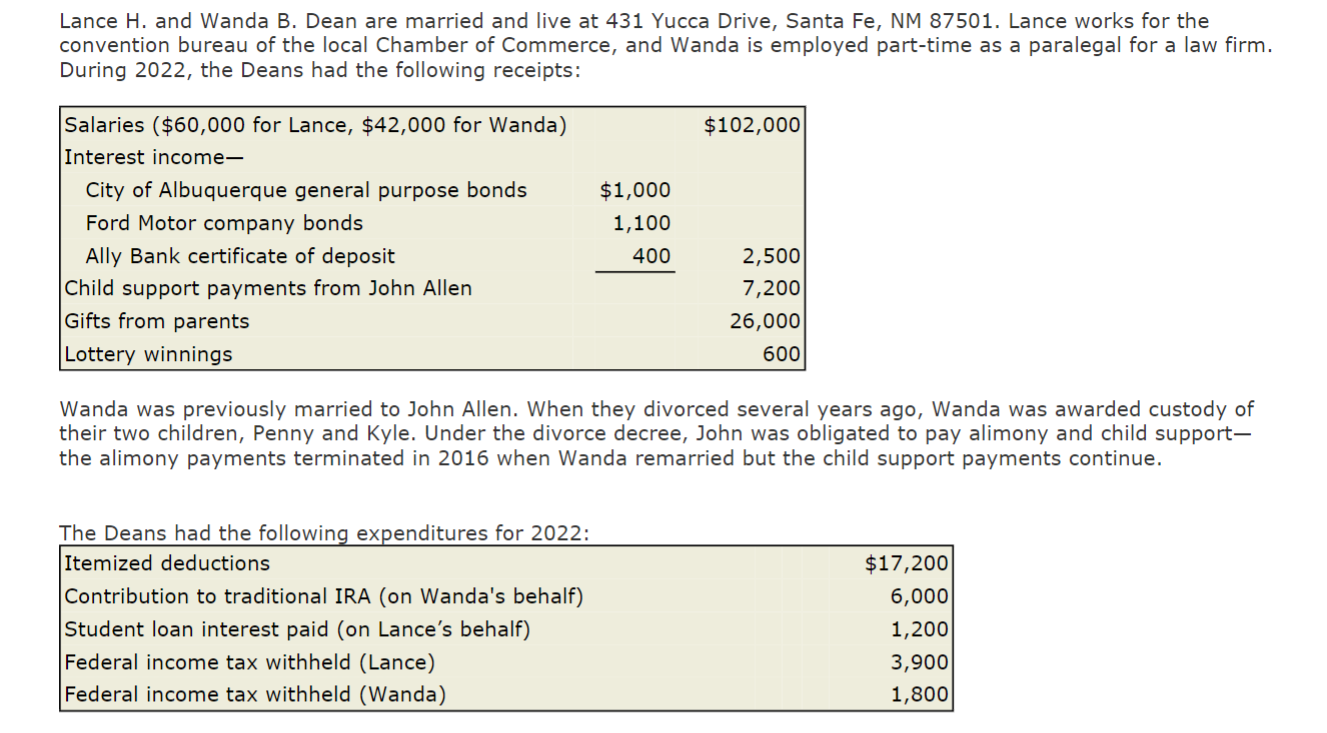

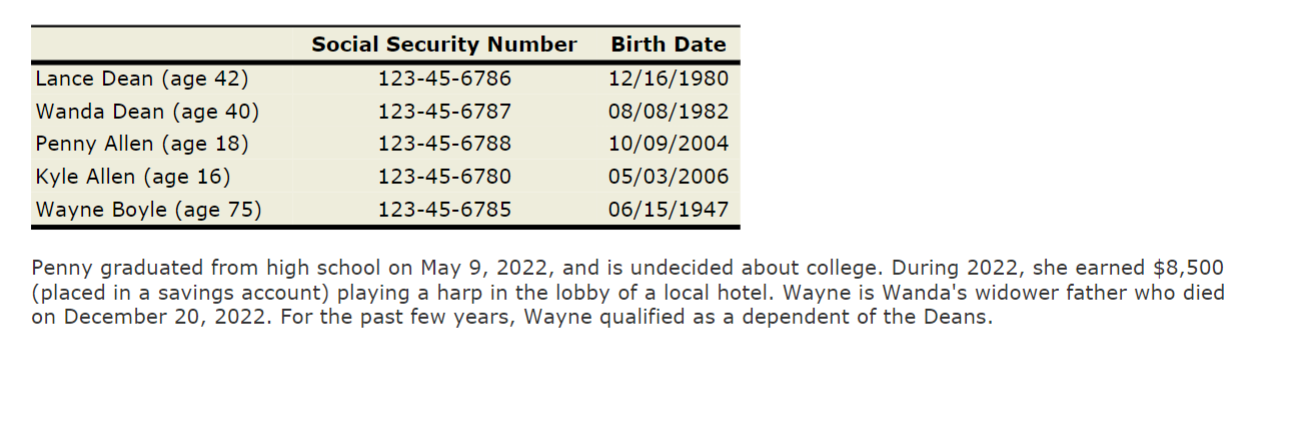

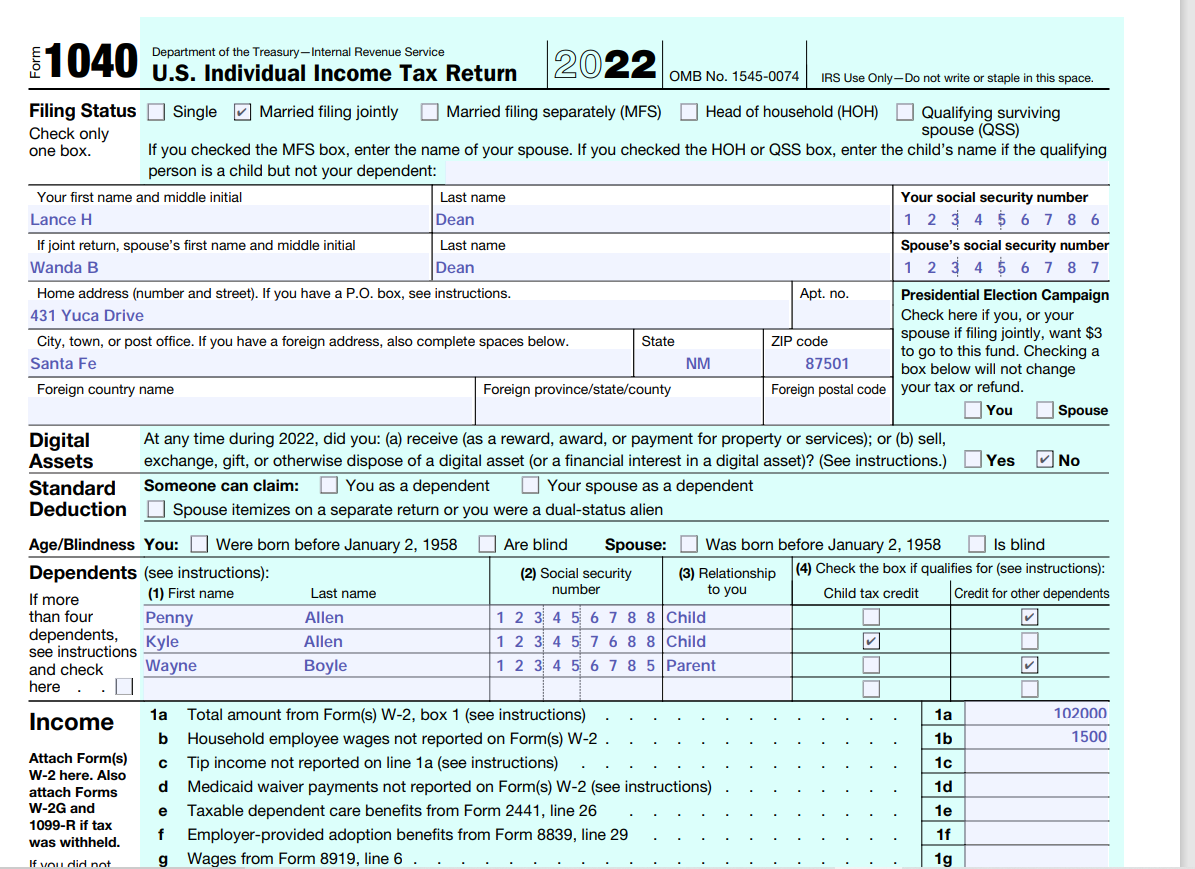

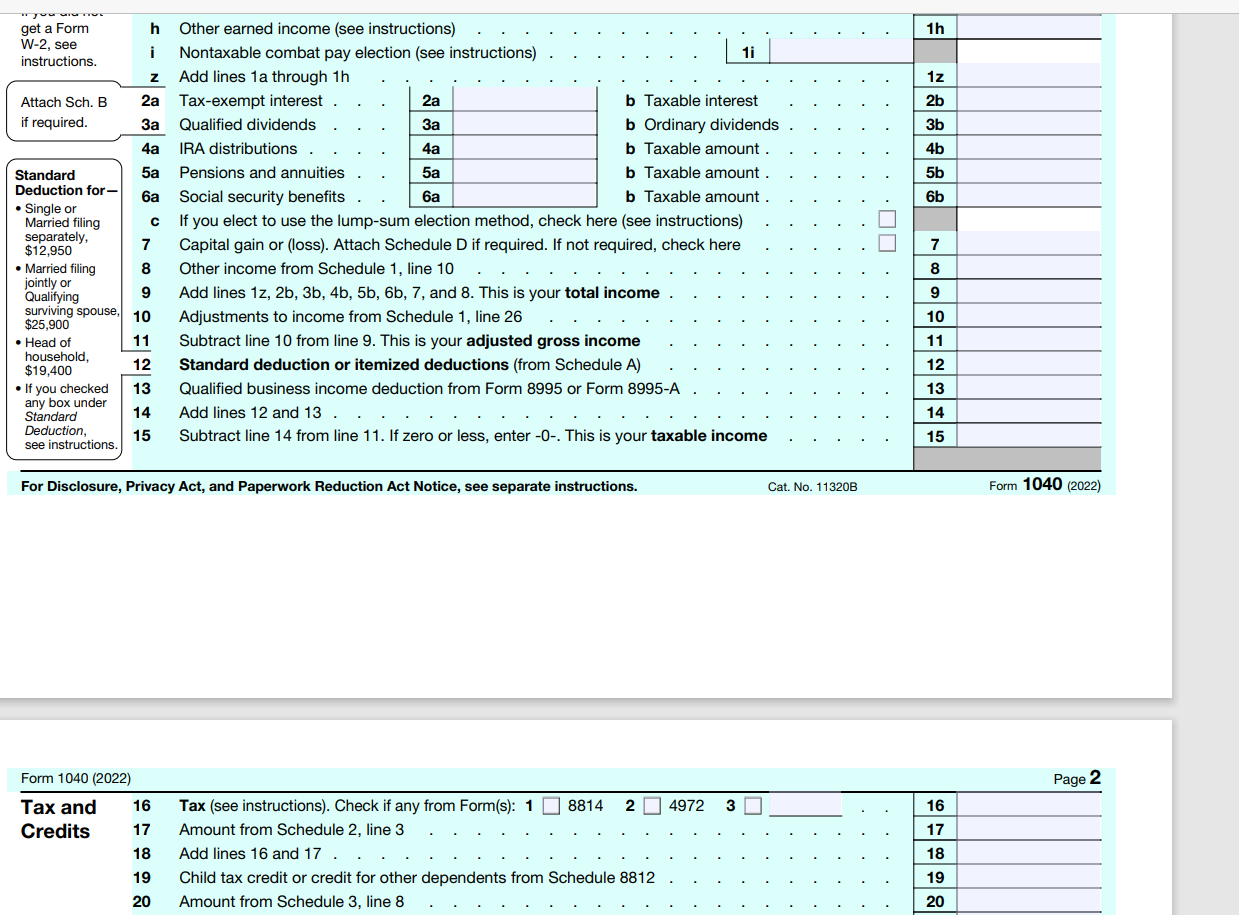

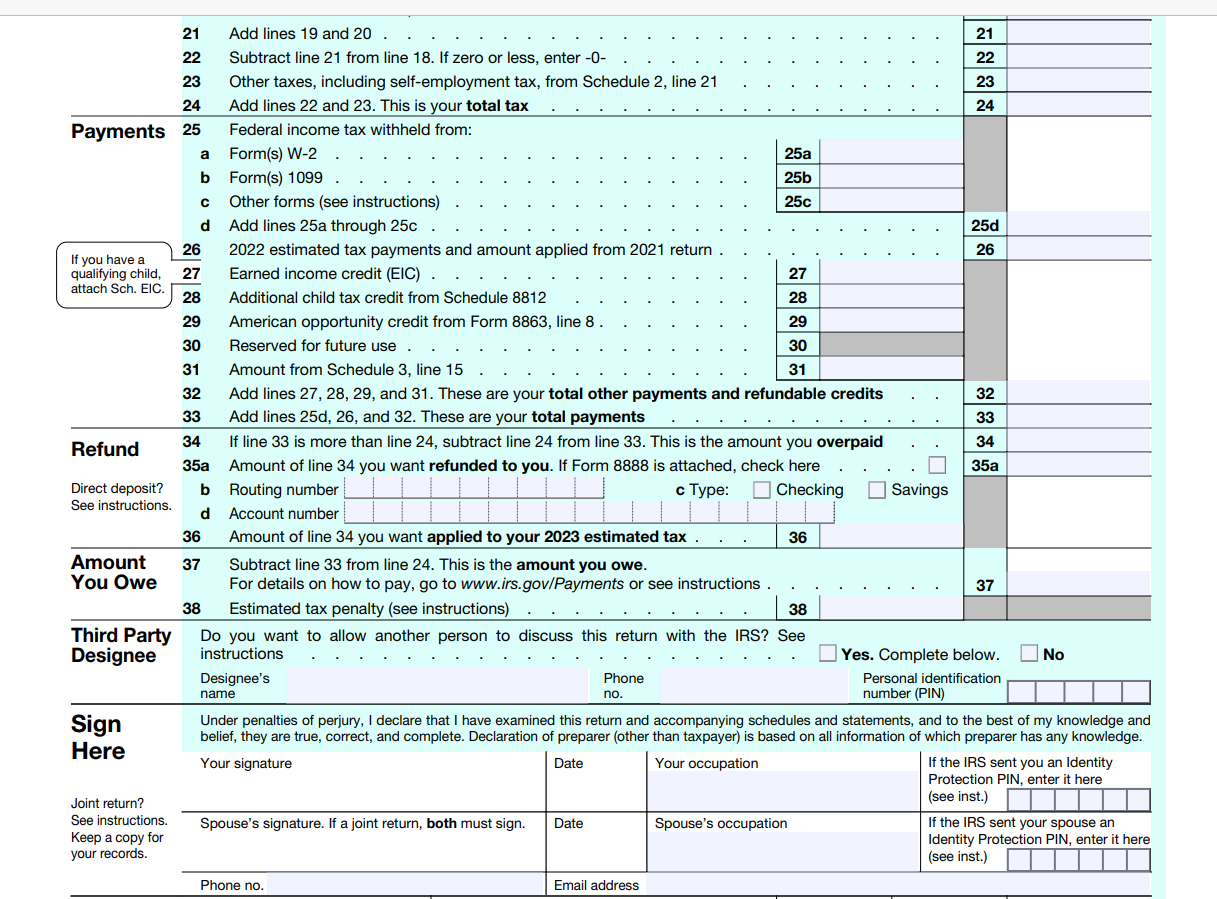

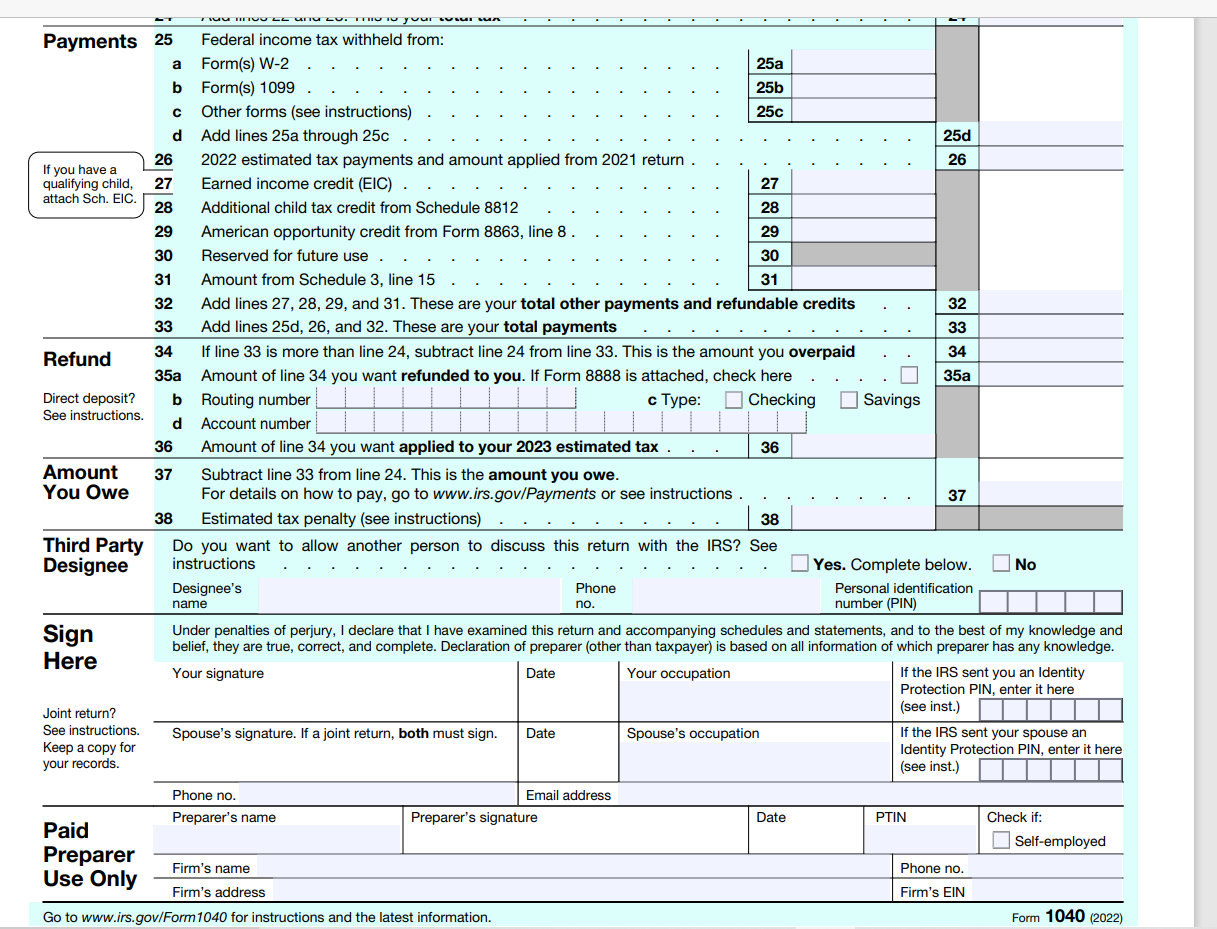

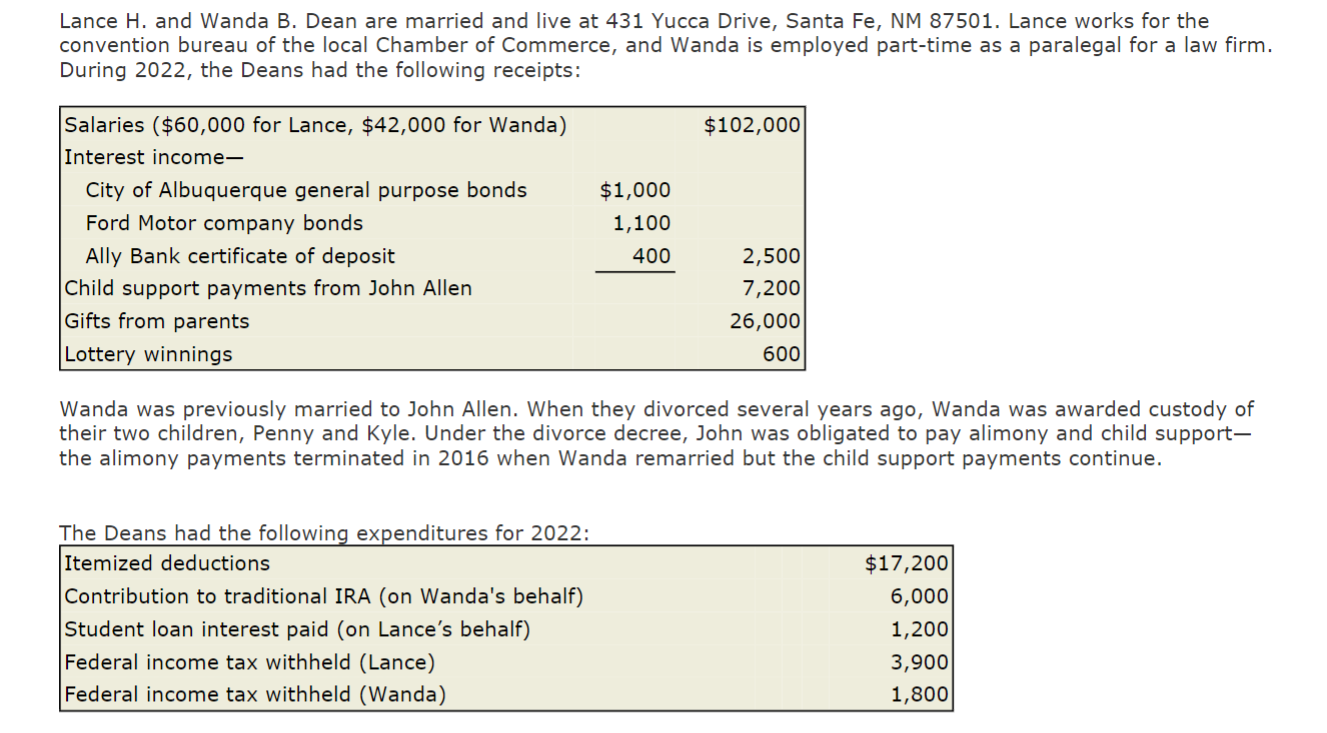

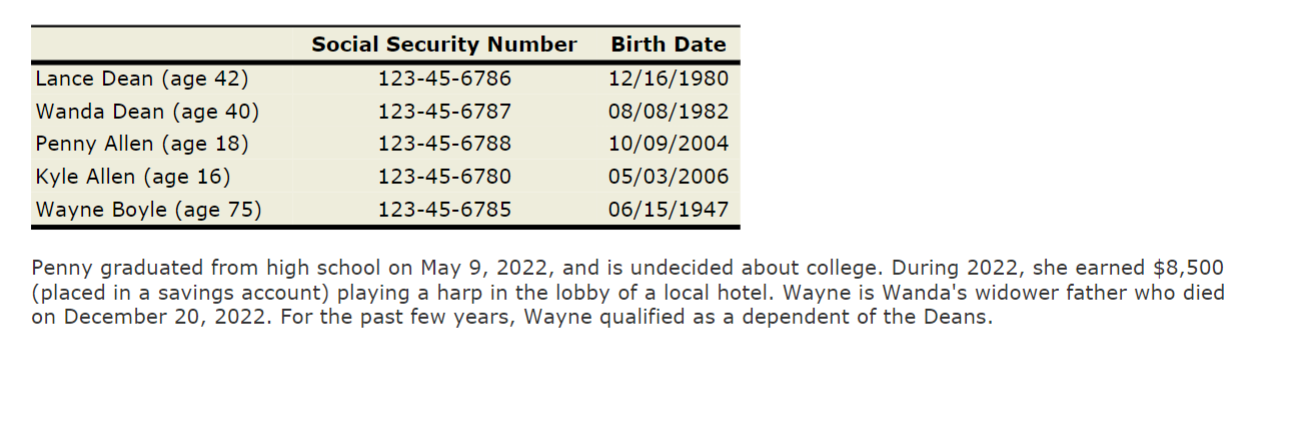

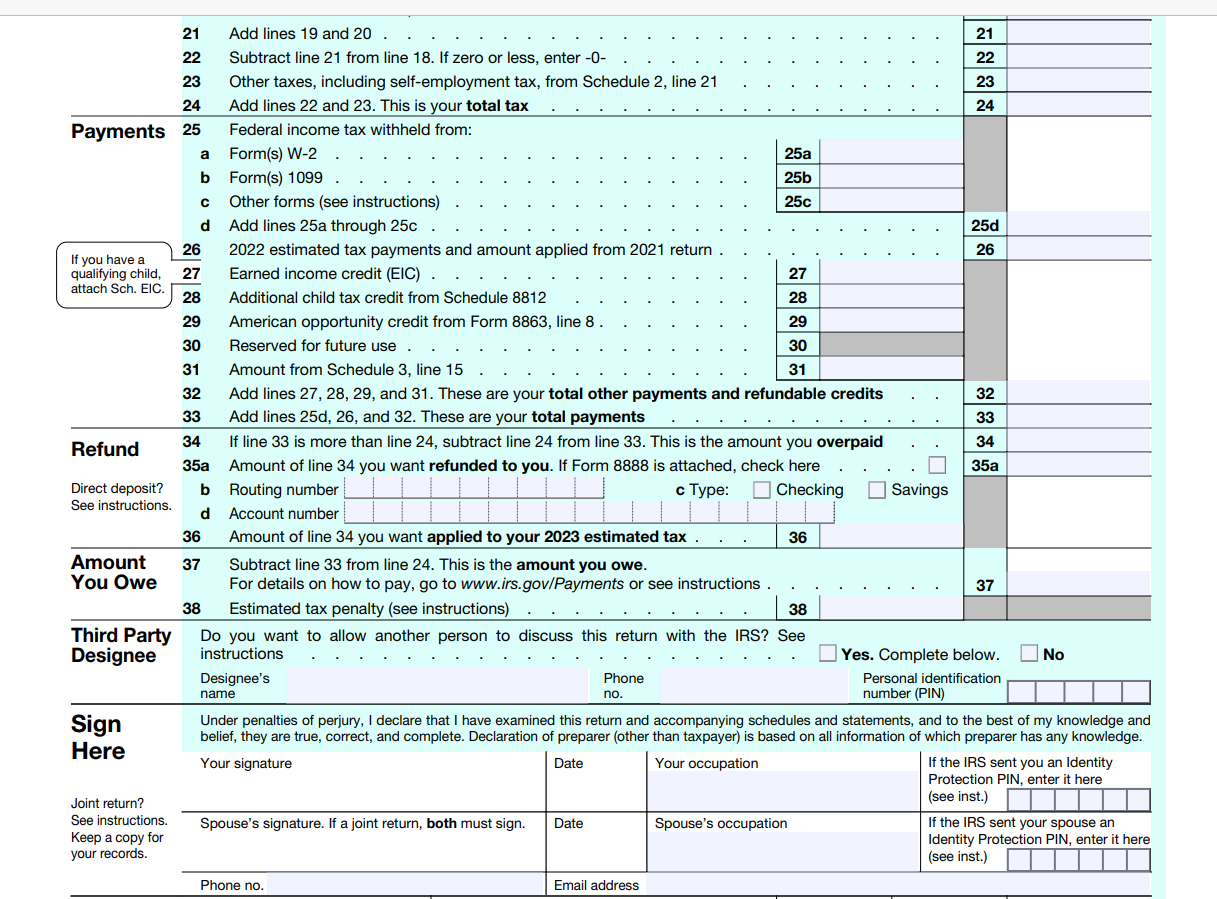

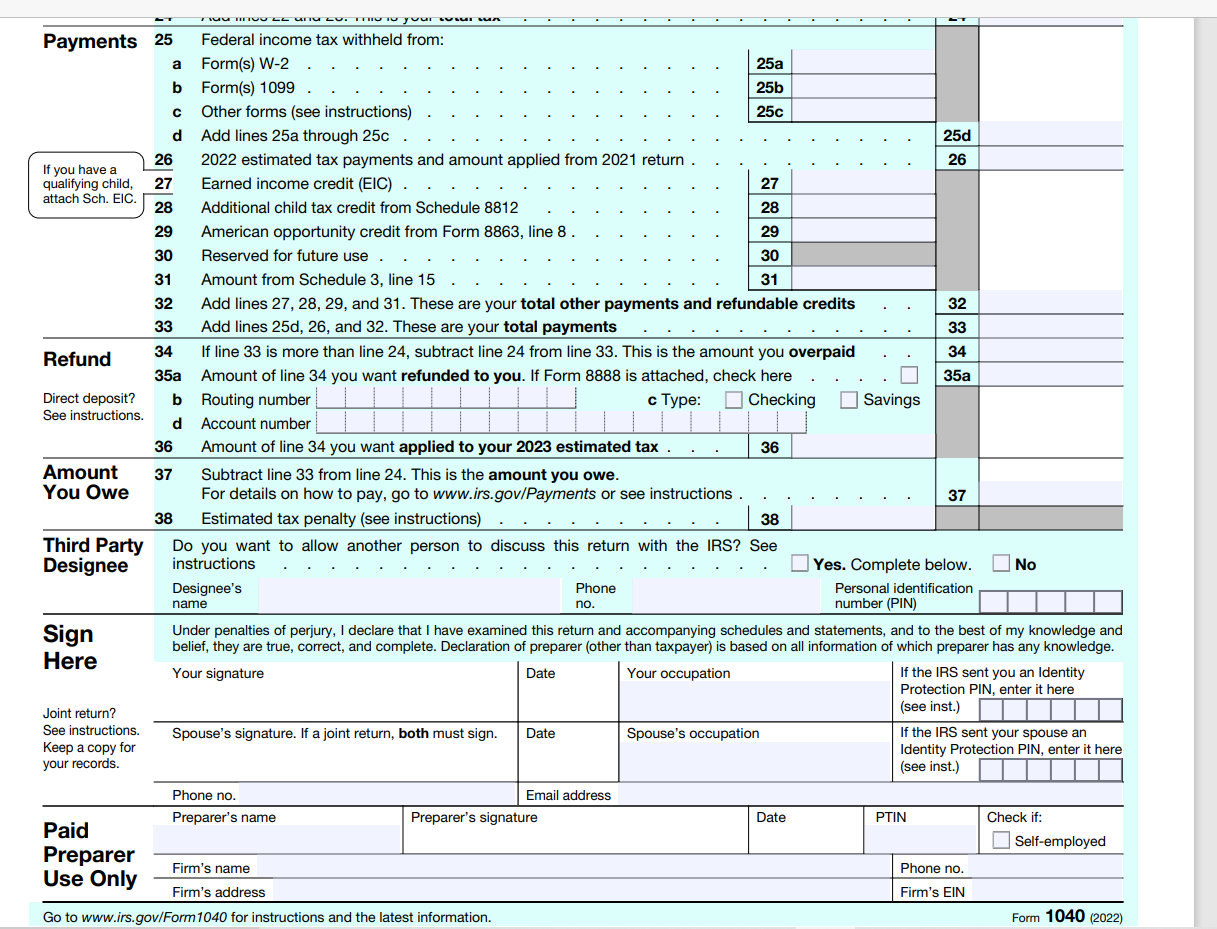

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501 . Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2022, the Deans had the following receipts: Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. Under the divorce decree, John was obligated to pay alimony and child supportthe alimony payments terminated in 2016 when Wanda remarried but the child support payments continue. Penny graduated from high school on May 9,2022 , and is undecided about college. During 2022 , she earned $8,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on December 20, 2022. For the past few years, Wayne qualified as a dependent of the Deans. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 21 Add lines 19 and 20 . 22 Subtract line 21 from line 18 . If zero or less, enter 0 - 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax \begin{tabular}{|l|l} \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline & \\ \hline \end{tabular} a Form(s) W-2 b Form(s) 1099 . c Other forms (see instructions) d Add lines 25 a through 25c. Ifyouhaveaqualifyingchild,attachSch.EIC.262728 2022 estimated tax payments and amount applied from 2021 return . Earned income credit (EIC) . Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863, line 8 . Reserved for future use . \begin{tabular}{|l|} 25a \\ \hline 25b \\ \hline 25c \\ \hline \end{tabular} 33 Add lines 25d, 26, and 32. These are your total payments Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings d Account number See instructions. 36 Amount of line 34 you want applied to your 2023 estimated tax . . . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions. \begin{tabular}{|c|} 25d \\ \hline 26 \\ \hline \end{tabular} Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Payments 25 Federal income tax withheld from: a Form(s) W-2 b Form(s) 1099 c Other forms (see instructions) d Add lines 25 a through 25c. If you have a 262022 estimated tax payments and amount applied from 2021 return . qualifying child, 27 Earned income credit (EIC). attach Sch. EIC. 28 Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863, line 8 . 30 Reserved for future use . 31 Amount from Schedule 3, line 15 \begin{tabular}{|l|} \hline 25a \\ \hline 25b \\ \hline 25c \\ \hline \end{tabular} 32 Add lines 27,28,29, and 31 . These are your total other payments and refundable credits 33 Add lines 25d,26, and 32 . These are your total payments Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: d Account number \begin{tabular}{|c|} \hline 25d \\ \hline 26 \\ \hline \end{tabular} See instructions. 36 Amount of line 34 you want applied to your 2023 estimated tax . . . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions. 38 Estimated tax penalty (see instructions) . . . . . . . . . . . . . 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2022) Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501 . Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2022, the Deans had the following receipts: Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. Under the divorce decree, John was obligated to pay alimony and child supportthe alimony payments terminated in 2016 when Wanda remarried but the child support payments continue. Penny graduated from high school on May 9,2022 , and is undecided about college. During 2022 , she earned $8,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on December 20, 2022. For the past few years, Wayne qualified as a dependent of the Deans. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 21 Add lines 19 and 20 . 22 Subtract line 21 from line 18 . If zero or less, enter 0 - 23 Other taxes, including self-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23 . This is your total tax \begin{tabular}{|l|l} \hline 21 & \\ \hline 22 & \\ \hline 23 & \\ \hline 24 & \\ \hline & \\ \hline \end{tabular} a Form(s) W-2 b Form(s) 1099 . c Other forms (see instructions) d Add lines 25 a through 25c. Ifyouhaveaqualifyingchild,attachSch.EIC.262728 2022 estimated tax payments and amount applied from 2021 return . Earned income credit (EIC) . Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863, line 8 . Reserved for future use . \begin{tabular}{|l|} 25a \\ \hline 25b \\ \hline 25c \\ \hline \end{tabular} 33 Add lines 25d, 26, and 32. These are your total payments Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings d Account number See instructions. 36 Amount of line 34 you want applied to your 2023 estimated tax . . . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions. \begin{tabular}{|c|} 25d \\ \hline 26 \\ \hline \end{tabular} Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Payments 25 Federal income tax withheld from: a Form(s) W-2 b Form(s) 1099 c Other forms (see instructions) d Add lines 25 a through 25c. If you have a 262022 estimated tax payments and amount applied from 2021 return . qualifying child, 27 Earned income credit (EIC). attach Sch. EIC. 28 Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863, line 8 . 30 Reserved for future use . 31 Amount from Schedule 3, line 15 \begin{tabular}{|l|} \hline 25a \\ \hline 25b \\ \hline 25c \\ \hline \end{tabular} 32 Add lines 27,28,29, and 31 . These are your total other payments and refundable credits 33 Add lines 25d,26, and 32 . These are your total payments Refund 34 If line 33 is more than line 24 , subtract line 24 from line 33 . This is the amount you overpaid 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: d Account number \begin{tabular}{|c|} \hline 25d \\ \hline 26 \\ \hline \end{tabular} See instructions. 36 Amount of line 34 you want applied to your 2023 estimated tax . . . 36 Amount 37 Subtract line 33 from line 24. This is the amount you owe. You Owe For details on how to pay, go to www.irs.gov/Payments or see instructions. 38 Estimated tax penalty (see instructions) . . . . . . . . . . . . . 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Go to www.irs.gov/Form 1040 for instructions and the latest information. Form 1040 (2022)