Need help with General Ledger & Unadjusted Trial Balance

In the ledger you would use J1, J2, J3 etc. for the post reference number showing which journal and page number you got the information. Then you go back to the journal and fill in the account number from the ledger where you posted it. Finally, prepare an unadjusted trial balance.

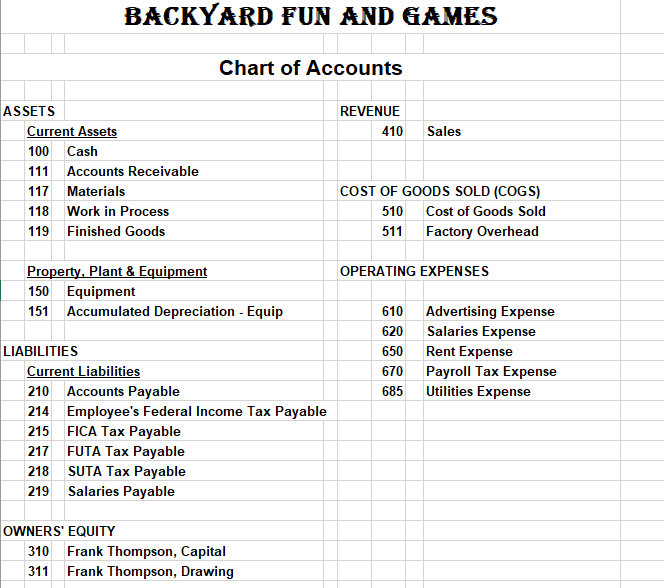

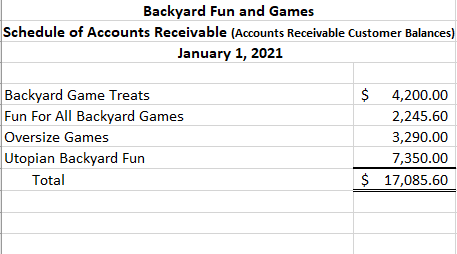

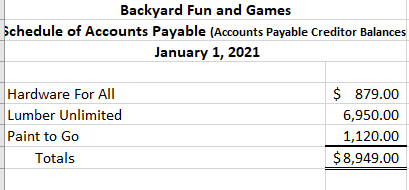

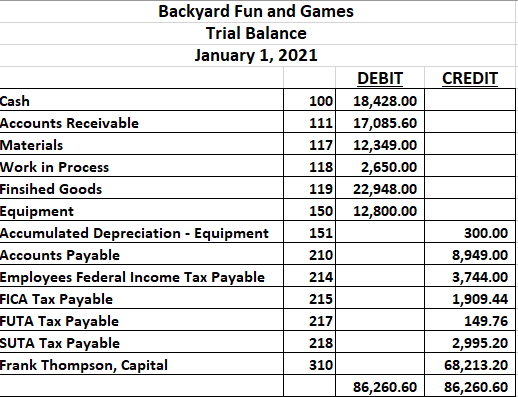

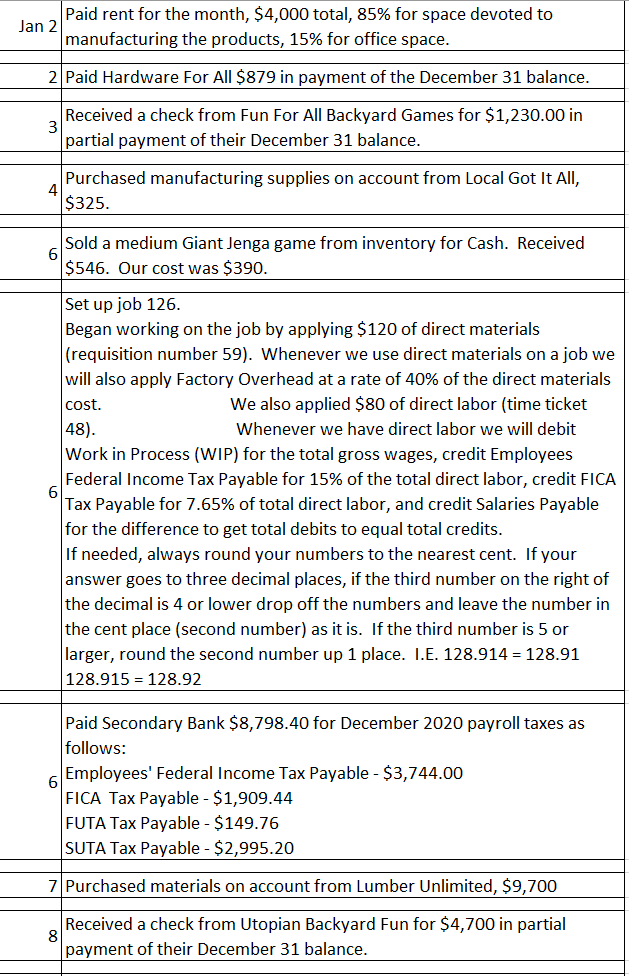

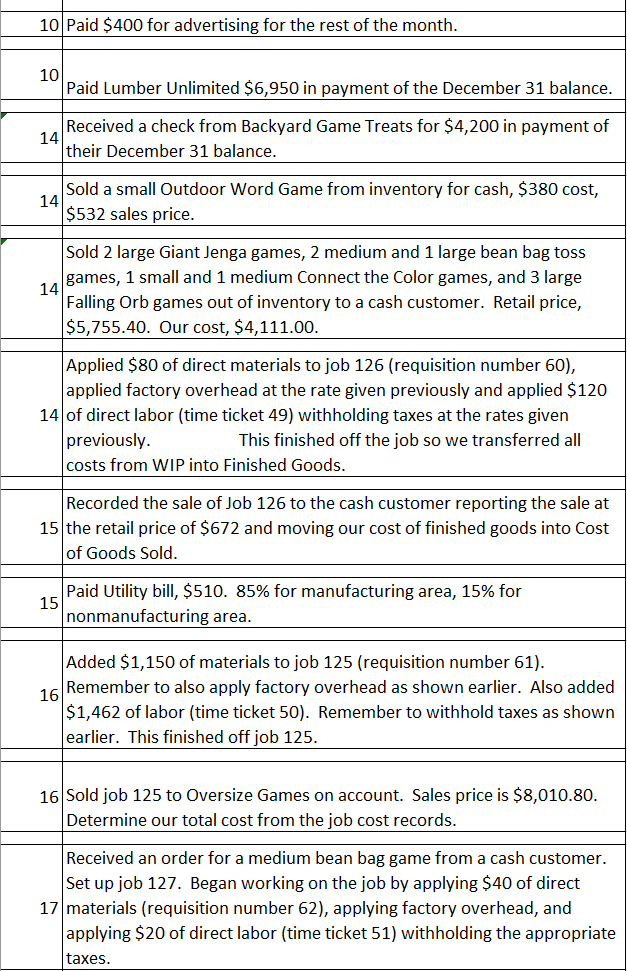

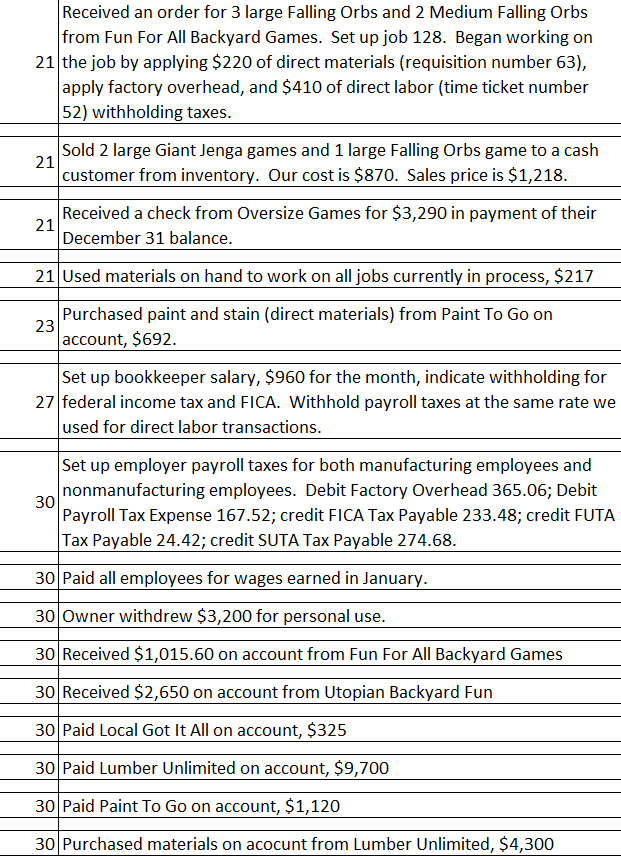

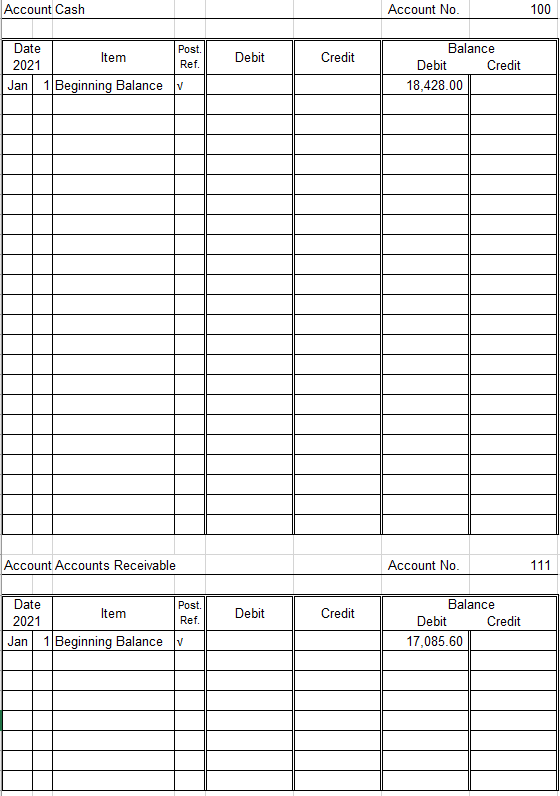

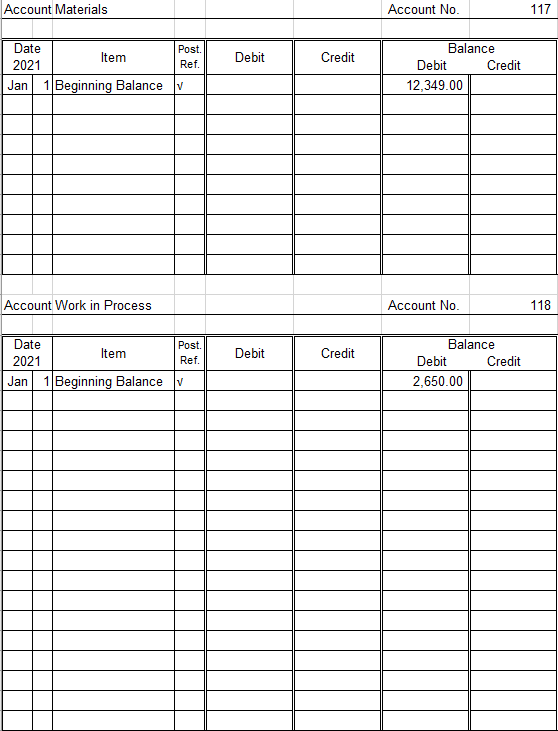

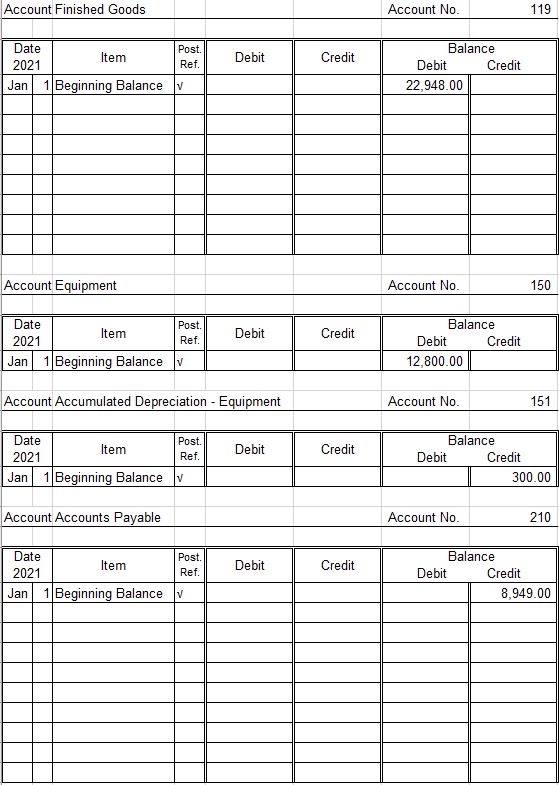

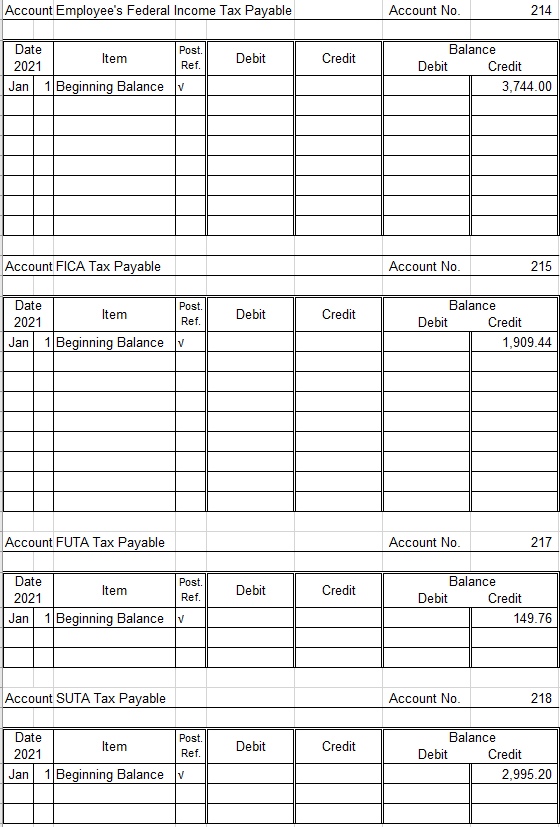

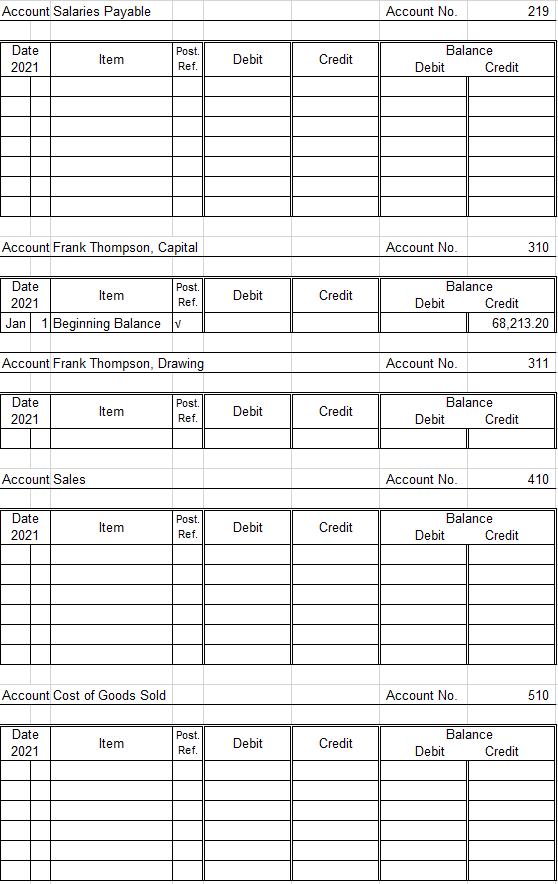

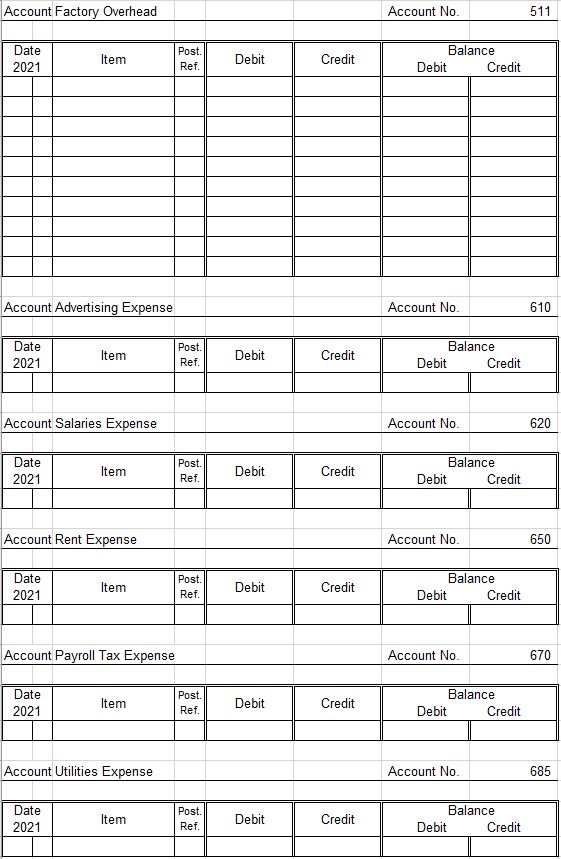

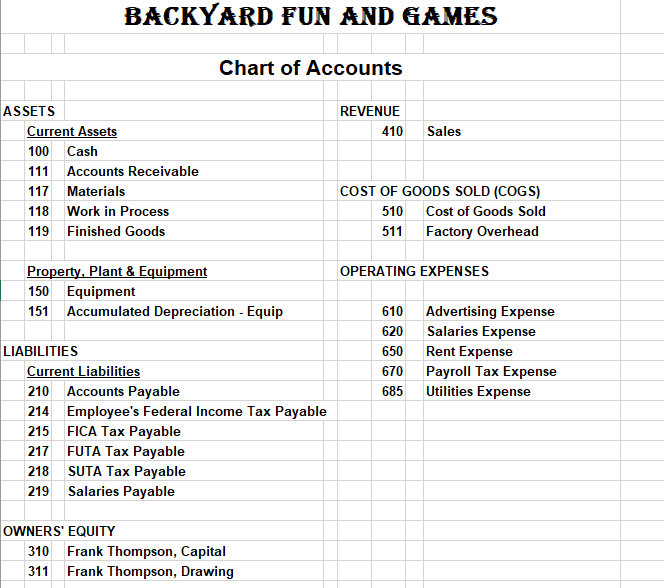

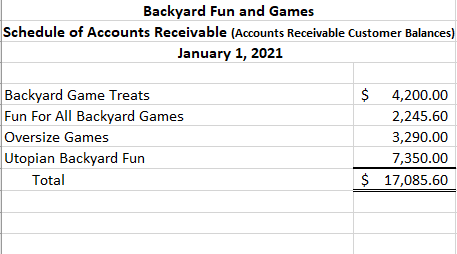

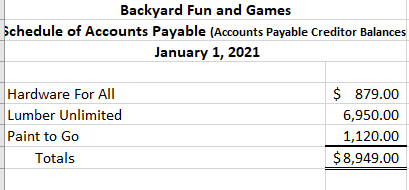

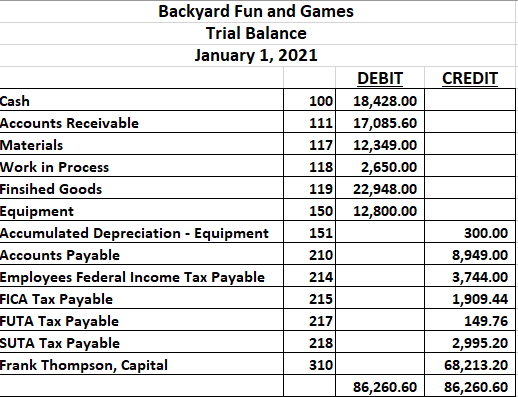

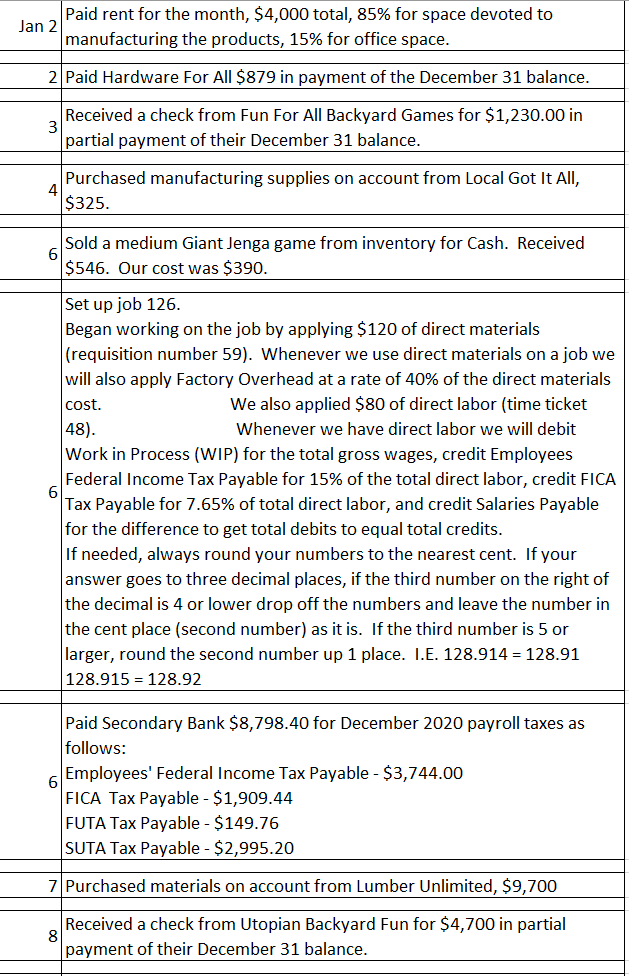

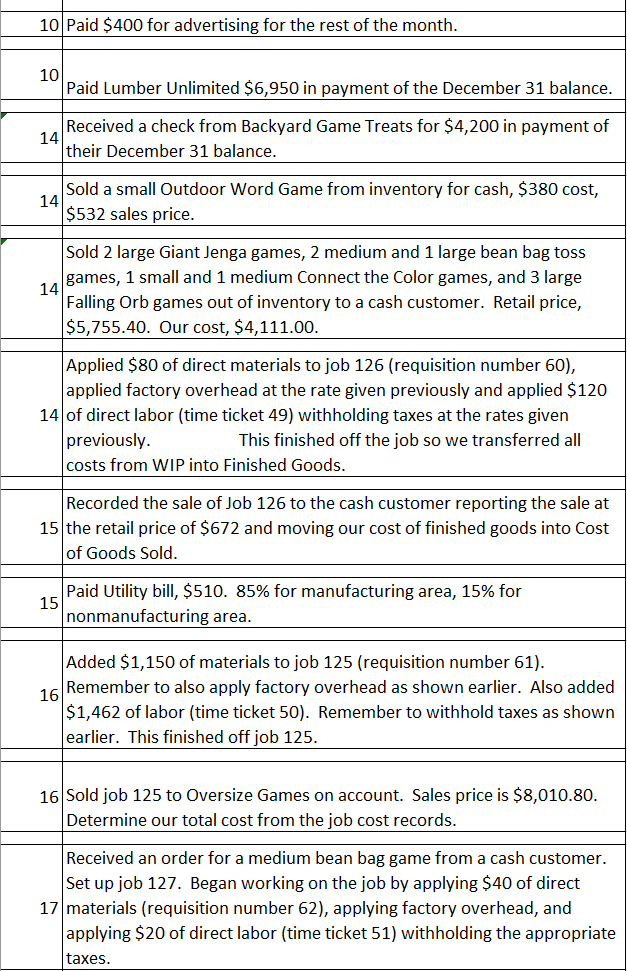

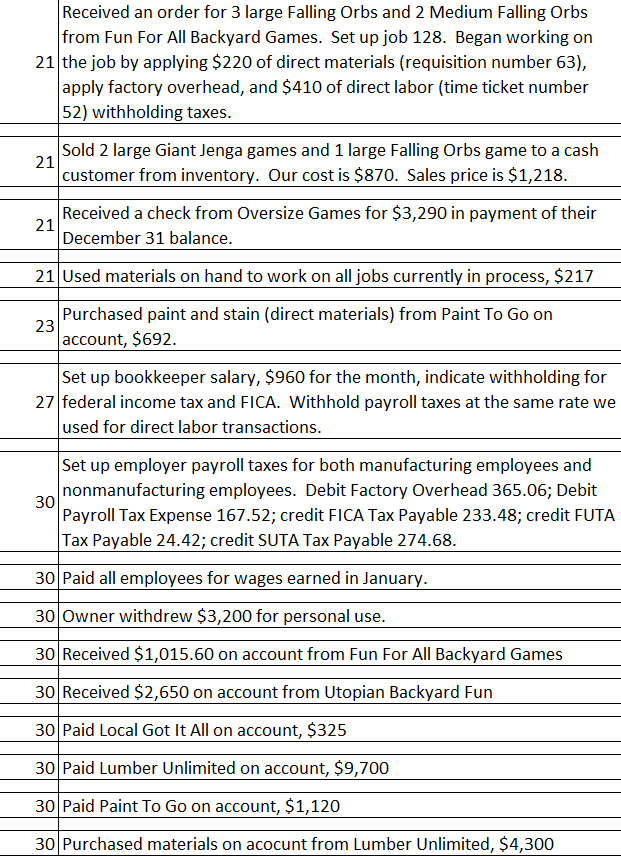

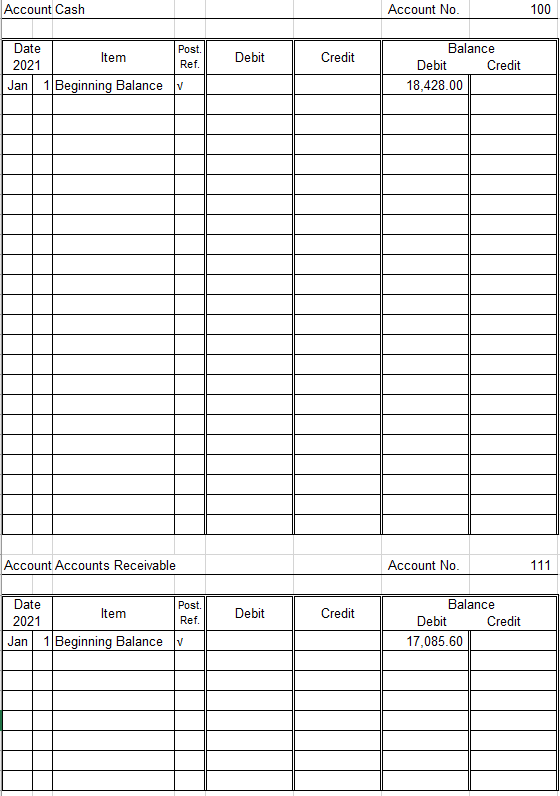

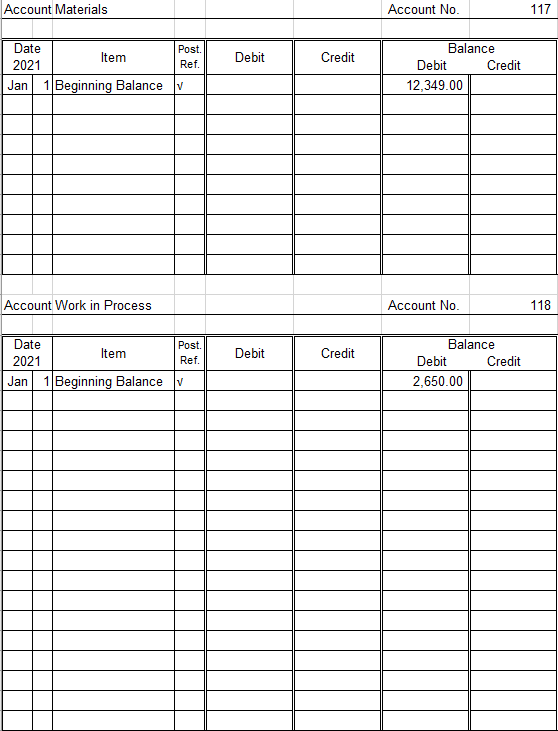

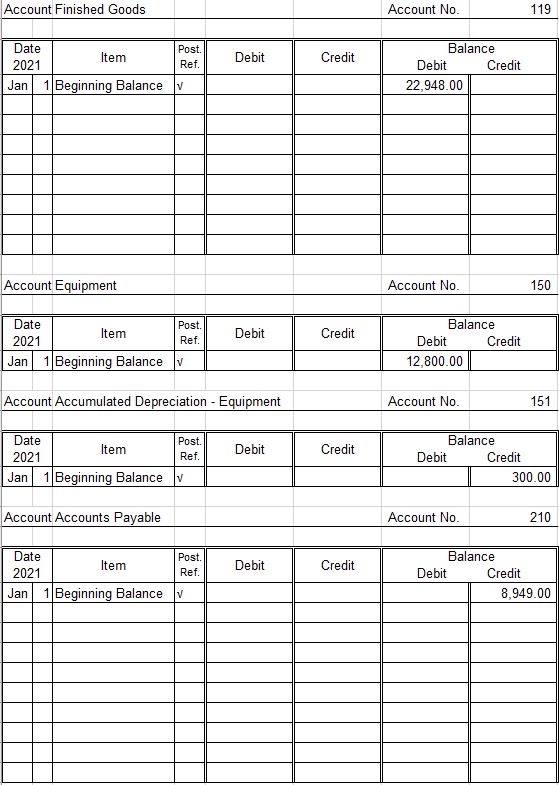

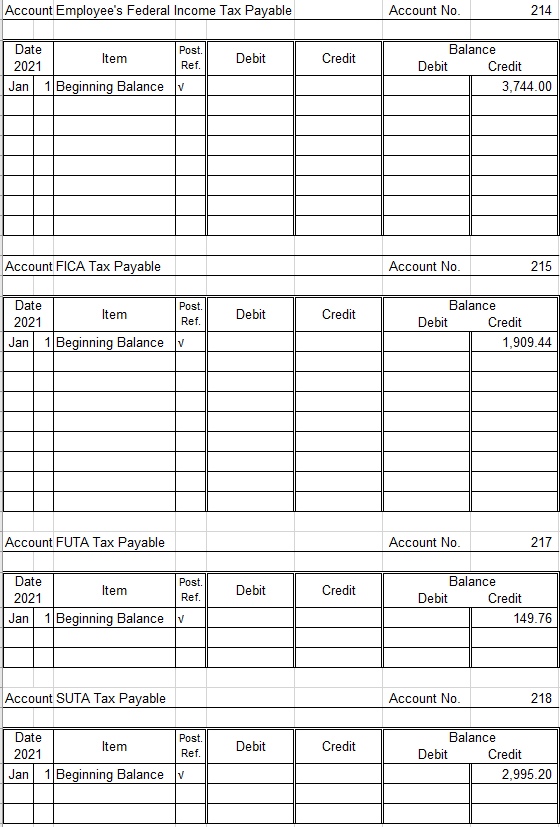

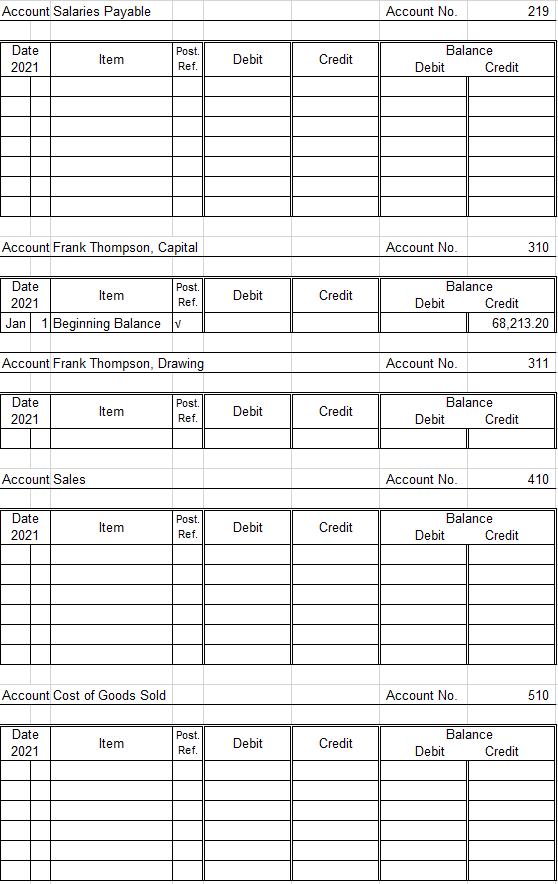

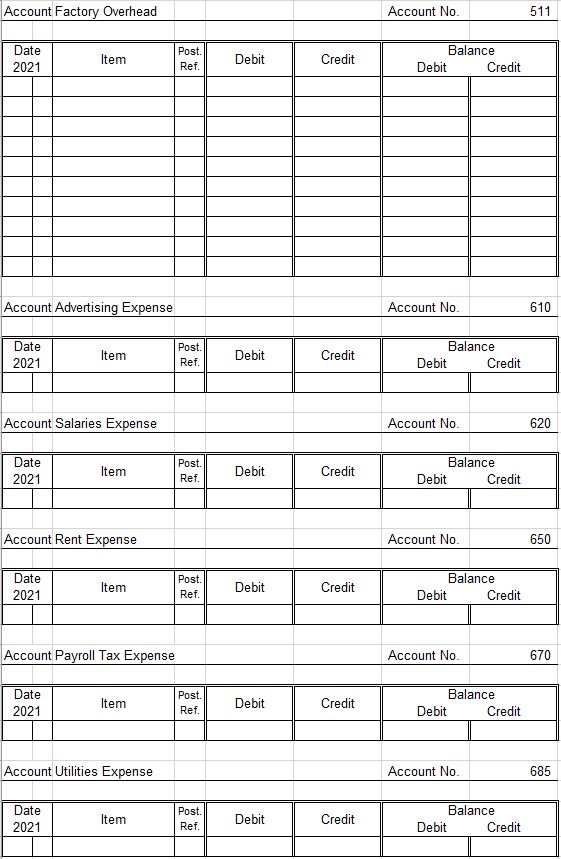

ASSETS Current Assets 100 Cash 111 Accounts Receivable 117 Materials BACKYARD FUN AND GAMES 118 Work in Process 119 Finished Goods LIABILITIES Property, Plant & Equipment 150 Equipment 151 Accumulated Depreciation - Equip Chart of Accounts Current Liabilities 210 Accounts Payable 214 Employee's Federal Income Tax Payable 215 FICA Tax Payable 217 FUTA Tax Payable 218 SUTA Tax Payable 219 Salaries Payable OWNERS' EQUITY 310 Frank Thompson, Capital 311 Frank Thompson, Drawing REVENUE 410 Sales COST OF GOODS SOLD (COGS) 510 Cost of Goods Sold 511 Factory Overhead OPERATING EXPENSES 610 620 650 670 685 Advertising Expense Salaries Expense Rent Expense Payroll Tax Expense Utilities Expense Backyard Fun and Games Schedule of Accounts Receivable (Accounts Receivable Customer Balances) January 1, 2021 Backyard Game Treats Fun For All Backyard Games Oversize Games Utopian Backyard Fun Total $ 4,200.00 2,245.60 3,290.00 7,350.00 $ 17,085.60 Backyard Fun and Games Schedule of Accounts Payable (Accounts Payable Creditor Balances January 1, 2021 Hardware For All Lumber Unlimited Paint to Go Totals $ 879.00 6,950.00 1,120.00 $8,949.00 Cash Accounts Receivable Materials Work in Process Finsihed Goods Backyard Fun and Games Trial Balance January 1, 2021 Equipment Accumulated Depreciation - Equipment Accounts Payable Employees Federal Income Tax Payable FICA Tax Payable FUTA Tax Payable SUTA Tax Payable Frank Thompson, Capital DEBIT 100 18,428.00 111 17,085.60 117 12,349.00 118 2,650.00 119 22,948.00 150 12,800.00 151 210 214 215 217 218 310 86,260.60 CREDIT 300.00 8,949.00 3,744.00 1,909.44 149.76 2,995.20 68,213.20 86,260.60 Jan 2 Paid rent for the month, $4,000 total, 85% for space devoted to manufacturing the products, 15% for office space. 2 Paid Hardware For All $879 in payment of the December 31 balance. 3 Received a check from Fun For All Backyard Games for $1,230.00 in partial payment of their December 31 balance. 4 Purchased manufacturing supplies on account from Local Got It All, $325. 6 Sold a medium Giant Jenga game from inventory for Cash. Received $546. Our cost was $390. Set up job 126. Began working on the job by applying $120 of direct materials (requisition number 59). Whenever we use direct materials on a job we will also apply Factory Overhead at a rate of 40% of the direct materials cost. 48). We also applied $80 of direct labor (time ticket Whenever we have direct labor we will debit Work in Process (WIP) for the total gross wages, credit Employees Federal Income Tax Payable for 15% of the total direct labor, credit FICA Tax Payable for 7.65% of total direct labor, and credit Salaries Payable for the difference to get total debits to equal total credits. If needed, always round your numbers to the nearest cent. If your answer goes to three decimal places, if the third number on the right of the decimal is 4 or lower drop off the numbers and leave the number in the cent place (second number) as it is. If the third number is 5 or larger, round the second number up 1 place. I.E. 128.914 = 128.91 |128.915 128.92 8 Paid Secondary Bank $8,798.40 for December 2020 payroll taxes as follows: Employees' Federal Income Tax Payable - $3,744.00 6 FICA Tax Payable - $1,909.44 FUTA Tax Payable - $149.76 SUTA Tax Payable - $2,995.20 7 Purchased materials on account from Lumber Unlimited, $9,700 Received a check from Utopian Backyard Fun for $4,700 in partial payment of their December 31 balance. 10 Paid $400 for advertising for the rest of the month. 10 Paid Lumber Unlimited $6,950 in payment of the December 31 balance. Received a check from Backyard Game Treats for $4,200 in payment of their December 31 balance. 14 14 Sold a small Outdoor Word Game from inventory for cash, $380 cost, $532 sales price. 14 Sold 2 large Giant Jenga games, 2 medium and 1 large bean bag toss games, 1 small and 1 medium Connect the Color games, and 3 large Falling Orb games out of inventory to a cash customer. Retail price, $5,755.40. Our cost, $4,111.00. Applied $80 of direct materials to job 126 (requisition number 60), applied factory overhead at the rate given previously and applied $120 14 of direct labor (time ticket 49) withholding taxes at the rates given previously. This finished off the job so we transferred all costs from WIP into Finished Goods. Recorded the sale of Job 126 to the cash customer reporting the sale at 15 the retail price of $672 and moving our cost of finished goods into Cost of Goods Sold. 15 Paid Utility bill, $510. 85% for manufacturing area, 15% for nonmanufacturing area. 16 Added $1,150 of materials to job 125 (requisition number 61). Remember to also apply factory overhead as shown earlier. Also added $1,462 of labor (time ticket 50). Remember to withhold taxes as shown earlier. This finished off job 125. 16 Sold job 125 to Oversize Games on account. Sales price is $8,010.80. Determine our total cost from the job cost records. Received an order for a medium bean bag game from a cash customer. Set up job 127. Began working on the job by applying $40 of direct 17 materials (requisition number 62), applying factory overhead, and applying $20 of direct labor (time ticket 51) withholding the appropriate taxes. Received an order for 3 large Falling Orbs and 2 Medium Falling Orbs from Fun For All Backyard Games. Set up job 128. Began working on 21 the job by applying $220 of direct materials (requisition number 63), apply factory overhead, and $410 of direct labor (time ticket number 52) withholding taxes. 21 Sold 2 large Giant Jenga games and 1 large Falling Orbs game to a cash customer from inventory. Our cost is $870. Sales price is $1,218. Received a check from Oversize Games for $3,290 in payment of their December 31 balance. 21 Used materials on hand to work on all jobs currently in process, $217 Purchased paint and stain (direct materials) from Paint To Go on account, $692. 21 23 Set up bookkeeper salary, $960 for the month, indicate withholding for 27 federal income tax and FICA. Withhold payroll taxes at the same rate we used for direct labor transactions. 30 Set up employer payroll taxes for both manufacturing employees and nonmanufacturing employees. Debit Factory Overhead 365.06; Debit Payroll Tax Expense 167.52; credit FICA Tax Payable 233.48; credit FUTA Tax Payable 24.42; credit SUTA Tax Payable 274.68. 30 Paid all employees for wages earned in January. 30 Owner withdrew $3,200 for personal use. 30 Received $1,015.60 on account from Fun For All Backyard Games 30 Received $2,650 on account from Utopian Backyard Fun 30 Paid Local Got It All on account, $325 30 Paid Lumber Unlimited on account, $9,700 30 Paid Paint To Go on account, $1,120 30 Purchased materials on acocunt from Lumber Unlimited, $4,300 Account Cash Date 2021 Jan 1 Beginning Balance v Item Account Accounts Receivable Post. Ref. Date 2021 Jan 1 Beginning Balance v Item Post. Ref. Debit Debit Credit Credit Account No. Balance Debit 18,428.00 Account No. Credit Balance Debit 17,085.60 Credit 100 111 Account Materials Date 2021 Jan 1 Beginning Balance v Item Account Work in Process Post. Ref. Date 2021 Jan 1 Beginning Balance v Item Post. Ref. Debit Debit Credit Credit Account No. Balance Debit 12,349.00 Account No. Credit Balance Debit 2,650.00 Credit 117 118 Account Finished Goods Date 2021 Jan 1 Beginning Balance v Item Account Equipment Date 2021 Jan 1 Beginning Balance v Item Post. Ref. Item Post. Ref. Date 2021 Jan 1 Beginning Balance v Account Accounts Payable Account Accumulated Depreciation - Equipment Item Post. Ref. Date 2021 Jan 1 Beginning Balance v Debit Post. Ref. Debit Debit Debit Credit Credit Credit Credit Account No. Debit 22,948.00 Balance Account No. Debit 12,800.00 Debit Account No. Balance Debit Credit Account No. Credit Balance Credit Balance 119 Credit 150 151 300.00 210 8,949.00 Account Employee's Federal Income Tax Payable Date 2021 Jan 1 Beginning Balance v Account FICA Tax Payable Item Date Post. 2021 Ref. Jan 1 Beginning Balance v Account FUTA Tax Payable Item Date 2021 Date 2021 Jan 1 Beginning Balance v Jan Account SUTA Tax Payable Item Post. Ref. Item Post. Ref. Post. Ref. 1 Beginning Balance v Debit Debit Debit Debit Credit Credit Credit Credit Account No. Debit Account No. Debit Balance Debit Account No. Debit Balance Account No. Credit 3,744.00 Balance Credit 1,909.44 Credit 214 Balance 215 Credit 217 149.76 218 2,995.20 Account Salaries Payable Date 2021 Account Frank Thompson, Capital Date 2021 Date 2021 Jan 1 Beginning Balance v Account Frank Thompson, Drawing Account Sales Item Date 2021 Date 2021 Item Item Item Account Cost of Goods Sold Post. Ref. Item Post. Ref. Post. Ref. Post. Ref. Post. Ref. Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Account No. Debit Account No. Debit Balance Debit Account No. Debit Balance Account No. Credit Balance Account No. Credit Debit Balance 68,213.20 Credit Credit Balance 219 Credit 310 311 410 510 Account Factory Overhead Date 2021 Account Advertising Expense Date 2021 Date 2021 Account Salaries Expense Item Date 2021 Item Account Rent Expense Date 2021 Item Date 2021 Account Payroll Tax Expense Item Item Account Utilities Expense Item Post. Ref. Post. Ref. Post. Ref. Post. Ref. Post. Ref. Post. Ref. Debit Debit Debit Debit Debit Debit Credit Credit Credit Credit Credit Credit Account No. Balance Debit Account No. Balance Debit Account No. Debit Balance Account No. Debit Account No. Credit Balance Debit Credit Account No. Credit Balance Debit Credit Credit Balance Credit 511 610 620 650 670 685