Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with homework! Required info is provided & I will give thumbs up! Tom and Suri decide to take a worldwide cruise. To do

Need help with homework! Required info is provided & I will give thumbs up!

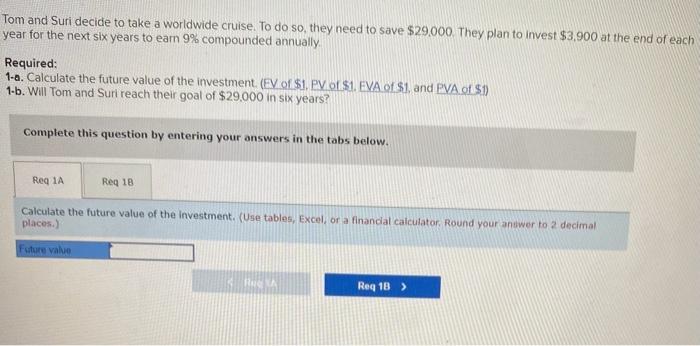

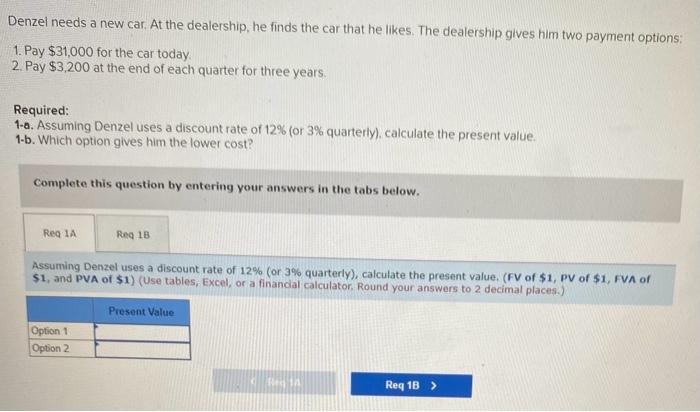

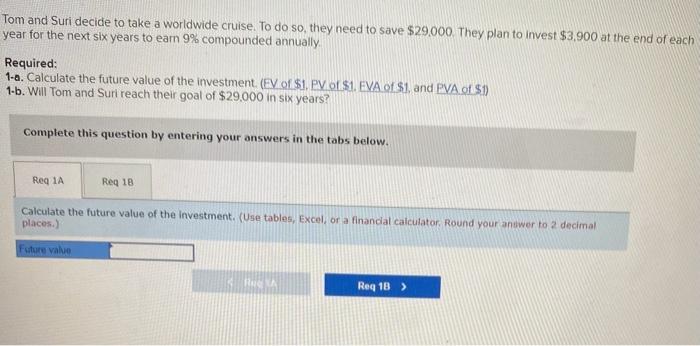

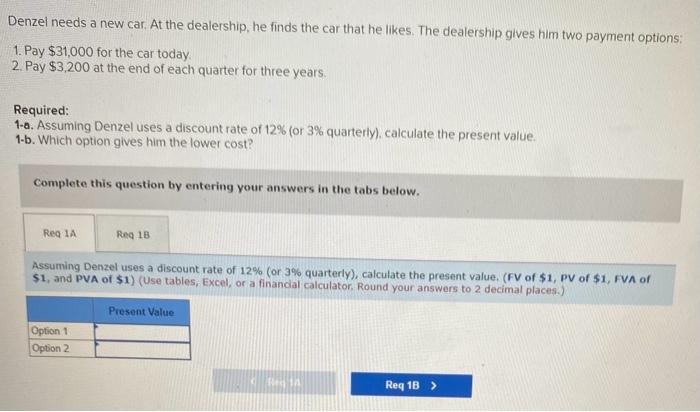

Tom and Suri decide to take a worldwide cruise. To do so, they need to save $29,000. They plan to invest $3,900 at the end of each year for the next six years to earn 9% compounded annually. Required: 1-a. Calculate the future value of the investment. (FV of \$1. PV of \$1. EVA of \$1, and PVA of S1) 1-b. Will Tom and Suri reach their goal of $29.000 in six years? Complete this question by entering your answers in the tabs below. Calculate the future value of the investment. (Use tables, Excel, or a finandal calculator, Round your antwer to 2 decima! places.) Denzel needs a new car. At the dealership, he finds the car that he likes. The dealership gives him two payment options: 1. Pay $31,000 for the car today. 2. Pay $3,200 at the end of each quarter for three years. Required: 1-a. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. 1-b. Which option gives him the lower cost? Complete this question by entering your answers in the tabs below. Assuming Denzel uses a discount rate of 12% (or 3% quarterly), calculate the present value. (FV of $1, PV of \$1, FVA of \$1, and PVA of \$1) (Use tables, Excel, or a finandal calculator. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started