Answered step by step

Verified Expert Solution

Question

1 Approved Answer

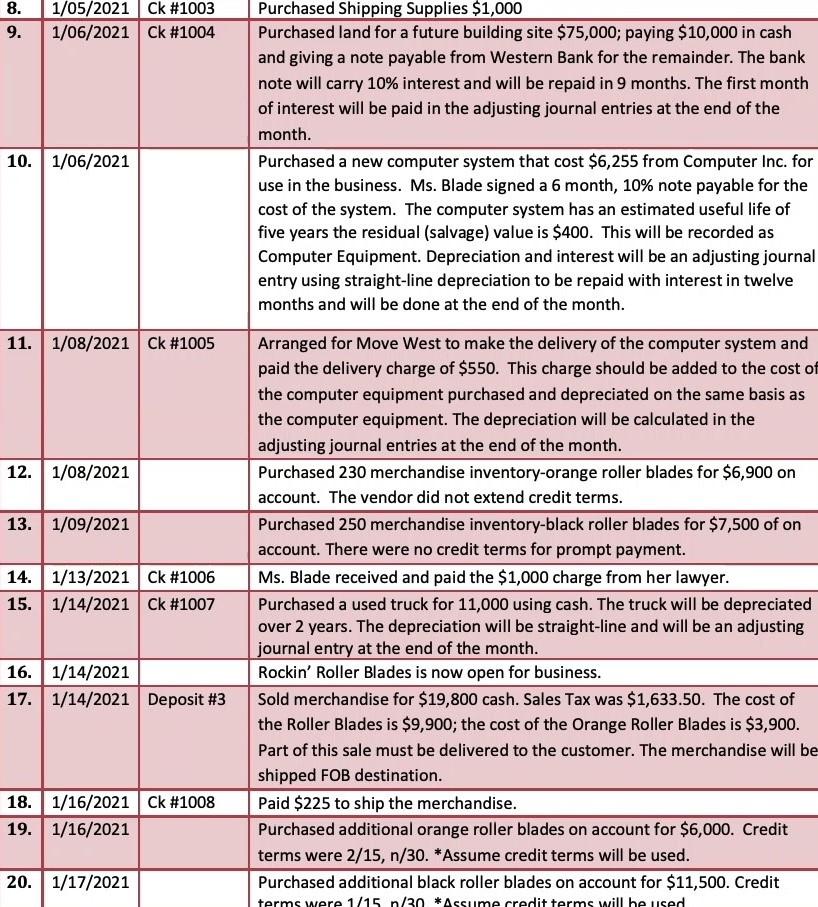

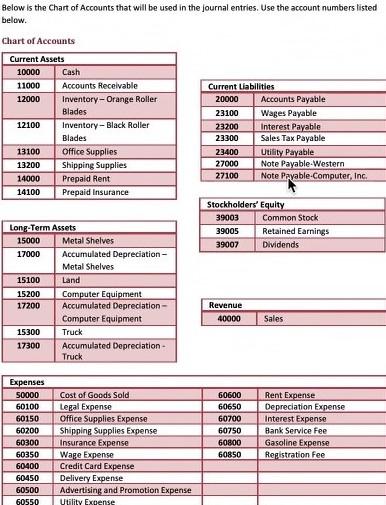

Need help with identifying debits and credit accounts. 8. 1/05/2021 Ck #1003 1/06/2021 Ck #1004 9. 10. 1/06/2021 11. 1/08/2021 Ck #1005 Purchased Shipping Supplies

Need help with identifying debits and credit accounts.

8. 1/05/2021 Ck #1003 1/06/2021 Ck #1004 9. 10. 1/06/2021 11. 1/08/2021 Ck #1005 Purchased Shipping Supplies $1,000 Purchased land for a future building site $75,000; paying $10,000 in cash and giving a note payable from Western Bank for the remainder. The bank note will carry 10% interest and will be repaid in 9 months. The first month of interest will be paid in the adjusting journal entries at the end of the month. Purchased a new computer system that cost $6,255 from Computer Inc. for use in the business. Ms. Blade signed a 6 month, 10% note payable for the cost of the system. The computer system has an estimated useful life of five years the residual (salvage) value is $400. This will be recorded as Computer Equipment. Depreciation and interest will be an adjusting journal entry using straight-line depreciation to be repaid with interest in twelve months and will be done at the end of the month. Arranged for Move West to make the delivery of the computer system and paid the delivery charge of $550. This charge should be added to the cost of the computer equipment purchased and depreciated on the same basis as the computer equipment. The depreciation will be calculated in the adjusting journal entries at the end of the month. Purchased 230 merchandise inventory-orange roller blades for $6,900 on account. The vendor did not extend credit terms. Purchased 250 merchandise inventory-black roller blades for $7,500 of on account. There were no credit terms for prompt payment. Ms. Blade received and paid the $1,000 charge from her lawyer. Purchased a used truck for 11,000 using cash. The truck will be depreciated over 2 years. The depreciation will be straight-line and will be an adjusting journal entry at the end of the month. Rockin' Roller Blades is now open for business. Sold merchandise for $19,800 cash. Sales Tax was $1,633.50. The cost of the Roller Blades is $9,900; the cost of the Orange Roller Blades is $3,900. Part of this sale must be delivered to the customer. The merchandise will be shipped FOB destination. Paid $225 to ship the merchandise. Purchased additional orange roller blades on account for $6,000. Credit terms were 2/15, n/30. *Assume credit terms will be used. Purchased additional black roller blades on account for $11,500. Credit 12.1/08/2021 13. 1/09/2021 14.1/13/2021 Ck #1006 15. 1/14/2021 Ck #1007 16. 1/14/2021 17. 1/14/2021 Deposit #3 18.1/16/2021 Ck #1008 19. 1/16/2021 20. 1/17/2021 terms were 1/15 n/30 *Assume credit terms will be used Below is the Chart of Accounts that will be used in the journal entries. Use the account numbers listed below. Chart of Accounts 23100 Current Assets 10000 Cash 11000 Accounts Receivable 12000 Inventory - Orange Roller Blades 12100 Inventory - Black Roller Blades 13100 Office Supplies 13200 Shipping Supplies 14000 Prepaid Rent 14100 Prepaid Insurance Current Liabilities 20000 Accounts Payable Wages Payable 23200 Interest Payable 23300 Sales Tax Payable 23400 Utility Payable 27000 Note Payable Western 27100 Note Payable Computer, Inc Stockholders' Equity 39003 Common Stock 39005 Retained Earnings 39007 Dividends Long-Term Assets 15000 Metal Shelves 17000 Accumulated Depreciation- Metal Shelves 15100 Land 15200 Computer Equipment 17200 Accumulated Depreciation- Computer Equipment 15300 Truck 17300 Accumulated Depreciation - Truck Revenue 40000 Sales Expenses 50000 60100 60150 60200 60300 60350 60400 60450 60500 60550 Cost of Goods Sold Legal Expense Office Supplies Expense Shipping Supplies Expense Insurance Expense Wage Expense Credit Card Expense Delivery Expense Advertising and Promotion Expense Utility Expense 60600 60650 60700 60750 60800 60850 Rent Expense Depreciation Expense Interest Expense Hank Service Fee Gasoline Expense Registration Fee 8. 1/05/2021 Ck #1003 1/06/2021 Ck #1004 9. 10. 1/06/2021 11. 1/08/2021 Ck #1005 Purchased Shipping Supplies $1,000 Purchased land for a future building site $75,000; paying $10,000 in cash and giving a note payable from Western Bank for the remainder. The bank note will carry 10% interest and will be repaid in 9 months. The first month of interest will be paid in the adjusting journal entries at the end of the month. Purchased a new computer system that cost $6,255 from Computer Inc. for use in the business. Ms. Blade signed a 6 month, 10% note payable for the cost of the system. The computer system has an estimated useful life of five years the residual (salvage) value is $400. This will be recorded as Computer Equipment. Depreciation and interest will be an adjusting journal entry using straight-line depreciation to be repaid with interest in twelve months and will be done at the end of the month. Arranged for Move West to make the delivery of the computer system and paid the delivery charge of $550. This charge should be added to the cost of the computer equipment purchased and depreciated on the same basis as the computer equipment. The depreciation will be calculated in the adjusting journal entries at the end of the month. Purchased 230 merchandise inventory-orange roller blades for $6,900 on account. The vendor did not extend credit terms. Purchased 250 merchandise inventory-black roller blades for $7,500 of on account. There were no credit terms for prompt payment. Ms. Blade received and paid the $1,000 charge from her lawyer. Purchased a used truck for 11,000 using cash. The truck will be depreciated over 2 years. The depreciation will be straight-line and will be an adjusting journal entry at the end of the month. Rockin' Roller Blades is now open for business. Sold merchandise for $19,800 cash. Sales Tax was $1,633.50. The cost of the Roller Blades is $9,900; the cost of the Orange Roller Blades is $3,900. Part of this sale must be delivered to the customer. The merchandise will be shipped FOB destination. Paid $225 to ship the merchandise. Purchased additional orange roller blades on account for $6,000. Credit terms were 2/15, n/30. *Assume credit terms will be used. Purchased additional black roller blades on account for $11,500. Credit 12.1/08/2021 13. 1/09/2021 14.1/13/2021 Ck #1006 15. 1/14/2021 Ck #1007 16. 1/14/2021 17. 1/14/2021 Deposit #3 18.1/16/2021 Ck #1008 19. 1/16/2021 20. 1/17/2021 terms were 1/15 n/30 *Assume credit terms will be used Below is the Chart of Accounts that will be used in the journal entries. Use the account numbers listed below. Chart of Accounts 23100 Current Assets 10000 Cash 11000 Accounts Receivable 12000 Inventory - Orange Roller Blades 12100 Inventory - Black Roller Blades 13100 Office Supplies 13200 Shipping Supplies 14000 Prepaid Rent 14100 Prepaid Insurance Current Liabilities 20000 Accounts Payable Wages Payable 23200 Interest Payable 23300 Sales Tax Payable 23400 Utility Payable 27000 Note Payable Western 27100 Note Payable Computer, Inc Stockholders' Equity 39003 Common Stock 39005 Retained Earnings 39007 Dividends Long-Term Assets 15000 Metal Shelves 17000 Accumulated Depreciation- Metal Shelves 15100 Land 15200 Computer Equipment 17200 Accumulated Depreciation- Computer Equipment 15300 Truck 17300 Accumulated Depreciation - Truck Revenue 40000 Sales Expenses 50000 60100 60150 60200 60300 60350 60400 60450 60500 60550 Cost of Goods Sold Legal Expense Office Supplies Expense Shipping Supplies Expense Insurance Expense Wage Expense Credit Card Expense Delivery Expense Advertising and Promotion Expense Utility Expense 60600 60650 60700 60750 60800 60850 Rent Expense Depreciation Expense Interest Expense Hank Service Fee Gasoline Expense Registration FeeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started