Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with last 3 problems, for #4 I also tried 41154 and it was incorrect ): Braxton Technologies, Inc., constructed a conveyor for A&G

Need help with last 3 problems, for #4 I also tried 41154 and it was incorrect ):

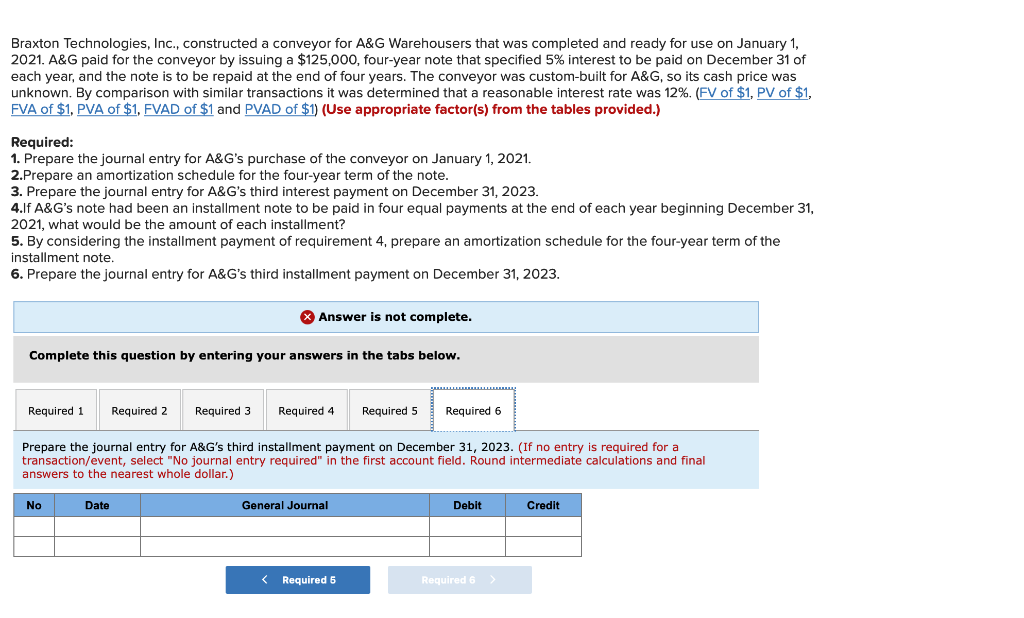

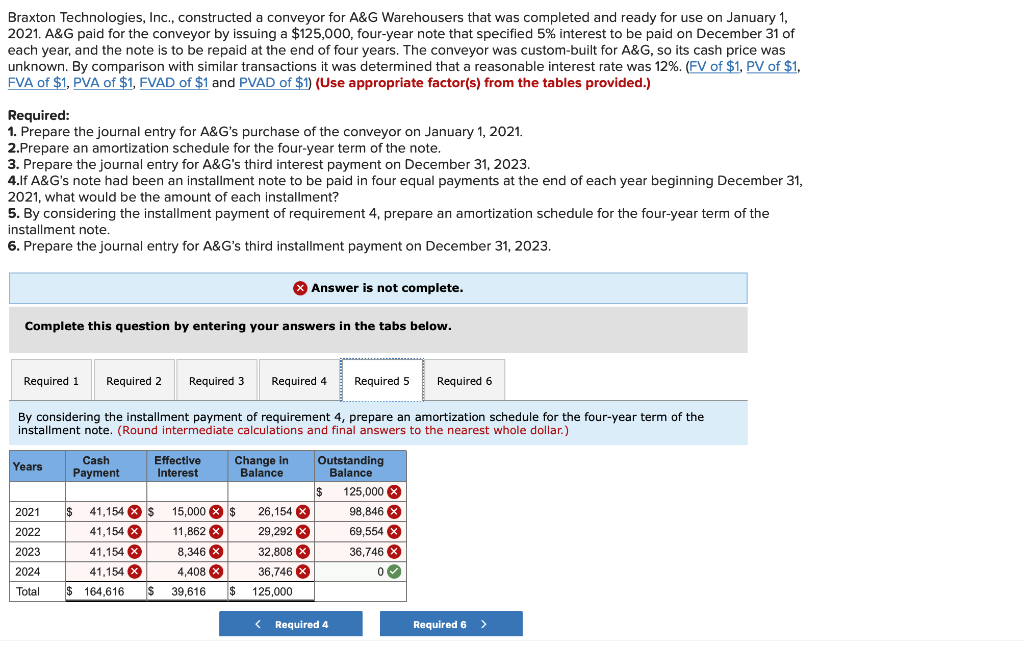

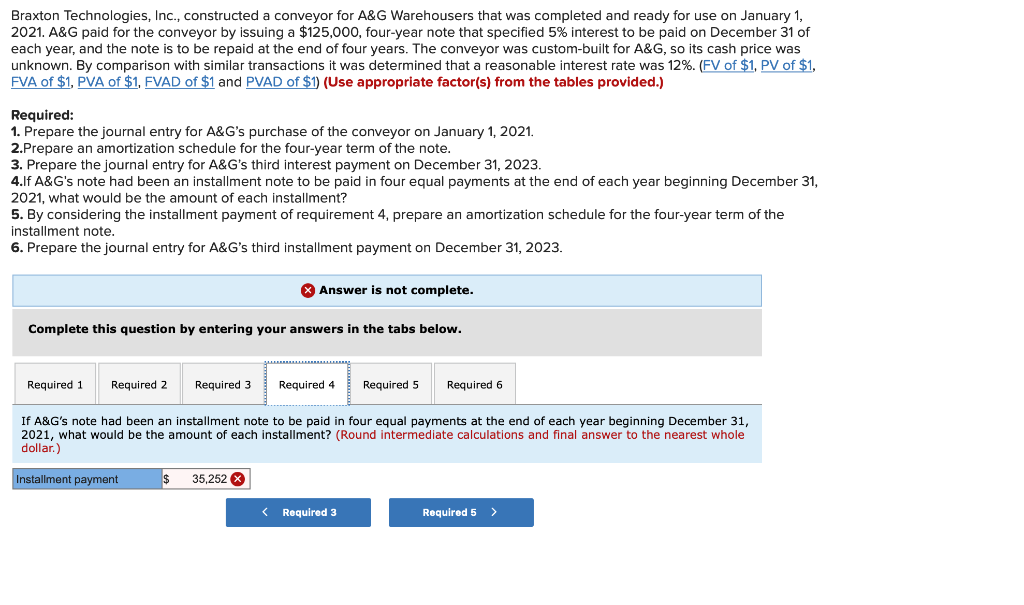

Braxton Technologies, Inc., constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1, 2021. A&G paid for the conveyor by issuing a $125,000, four-year note that specified 5% interest to be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor was custom-built for A&G, so its cash price was unknown. By comparison with similar transactions it was determined that a reasonable interest rate was 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2021. 2.Prepare an amortization schedule for the four-year term of the note. 3. Prepare the journal entry for A&G's third interest payment on December 31, 2023. 4.If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2021, what would be the amount of each installment? 5. By considering the installment payment of requirement 4. prepare an amortization schedule for the four-year term of the installment note. 6. Prepare the journal entry for A&G's third installment payment on December 31, 2023. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Prepare the journal entry for A&G's third installment payment on December 31, 2023. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.) No Date General Journal Debit Credit Braxton Technologies, Inc., constructed a conveyor for A&G Warehousers that was completed and ready for use on January 1, 2021. A&G paid for the conveyor by issuing a $125,000, four-year note that specified 5% interest to be paid on December 31 of each year, and the note is to be repaid at the end of four years. The conveyor was custom-built for A&G, so its cash price was unknown. By comparison with similar transactions it was determined that a reasonable interest rate was 12%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entry for A&G's purchase of the conveyor on January 1, 2021. 2.Prepare an amortization schedule for the four-year term of the note. 3. Prepare the journal entry for A&G's third interest payment on December 31, 2023. 4.If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2021, what would be the amount of each installment? 5. By considering the installment payment of requirement 4, prepare an amortization schedule for the four-year term of the installment note. 6. Prepare the journal entry for A&G's third installment payment on December 31, 2023. % Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 If A&G's note had been an installment note to be paid in four equal payments at the end of each year beginning December 31, 2021, what would be the amount of each installment? (Round intermediate calculations and final answer to the nearest whole dollar.) Installment payment $ 35,252 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started