Need help with part C please

Need help with part C please

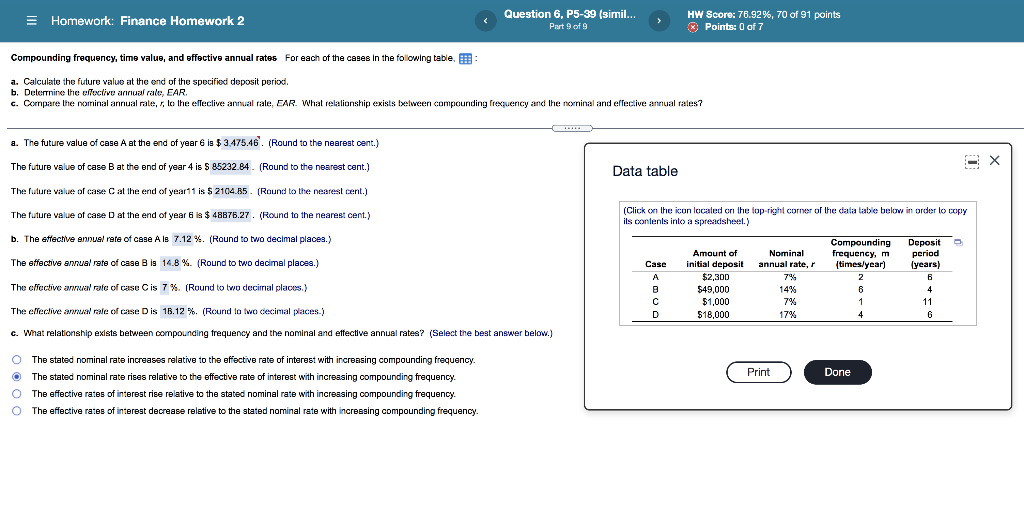

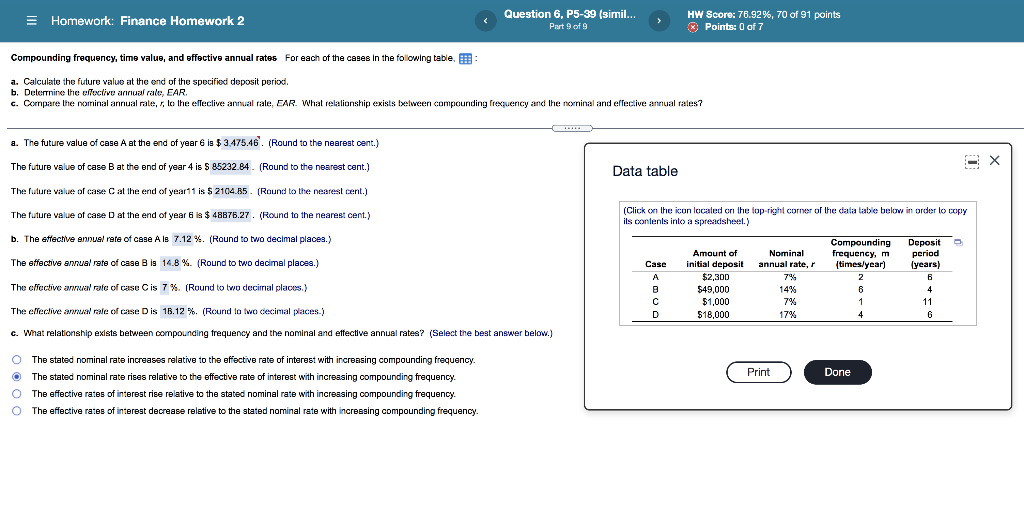

Homework: Finance Homework 2 Question 6, P5-39 (simil... Part 9 of 9 HW Score: 78.92%, 70 of 91 points , x Points: 0 of 7 Compounding frequency, time value, and effective annual rates for each of the cases in the following table, a. Calculate the future value at the end of the specified deposit period. b. Determine the effective annual rale, EAR. c. Compare the nominal annual rale,, to the effective annual rale, EAR. What relalionship exists between compounding frequency and the nominal and effective annual rales? a. The future value of case A at the end of year 6 is $3.475.46. (Round to the nearest cent.) -X The future value of case B at the end of year 4 is S 85232.84. (Round to the nearest cent.) Data table The future value of case C at the end of year 11 is $ 2104.15. (Round to the nearest cent.) The future value of case at the end of year 6 is $ 48875.27. (Round to the nearest cent. (Click on the icon localed on the top-right corner of the dala table below in order to copy ils contents into a spreadsheel.) b. The effective ennus/ rete of case Als 7.12%. (Round to two decimal places.) The effective annual rate of case Bis 14.8 %. (Round to two decimal places.) Case A Amount of initial deposit $2,300 $ $49,000 $1,000 $18.000 Compounding frequency, m [times/year) 2 8 1 4 Nominal annual rate, 7% 14% 7% 17% The cffective arwal rate of case Cis 7%. (Round to two decimal places.) Deposit period (years) 6 4 11 G B D The effective awal rale of case Dis 16.12 %. (Round to two decimal places.) c. What relationship exists between compounding frequency and the nominal and effective annual rates? (Select the best answer below.) ( Print Done The stated nominal rate increases relative to the effective rate of interest with increasing compounding frequency The stated nominal rate rises relative to the effective rate of interest with increasing compounding frequency. O The effective rates of interest rise relative to the stated nominal rate with increasing compounding frequency. The effective rates of interest decrease relative to the stated nominal rate with increasing compounding frequency

Need help with part C please

Need help with part C please