Answered step by step

Verified Expert Solution

Question

1 Approved Answer

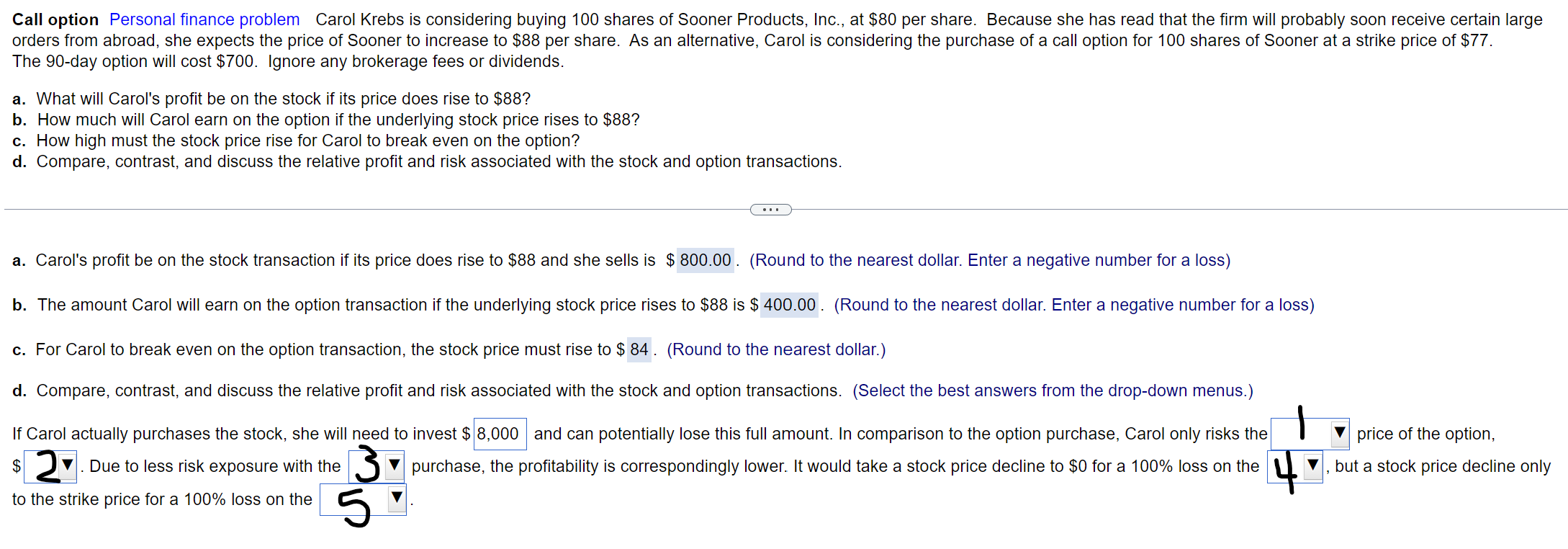

Need help with part D. I have labeled them so I can explain the options. #1: purchase or strike #2: 700, 8000, 77 #3: option

Need help with part D. I have labeled them so I can explain the options.

#1: purchase or strike

#2: 700, 8000, 77

#3: option or stock

#4: option or stock

#5: stock or call option

Will give a thumbs up!

This is the question in its entirety. I have labeled the blanks and provided the options.

Call option Personal finance problem Carol Krebs is considering buying 100 shares of Sooner Products, Inc., at $80 per share. Because she has read that the firm will probably soon receive certain large orders from abroad, she expects the price of Sooner to increase to $88 per share. As an alternative, Carol is considering the purchase of a call option for 100 shares of Sooner at a strike price of $77. The 90 -day option will cost $700. Ignore any brokerage fees or dividends. a. What will Carol's profit be on the stock if its price does rise to $88 ? b. How much will Carol earn on the option if the underlying stock price rises to $88 ? c. How high must the stock price rise for Carol to break even on the option? d. Compare, contrast, and discuss the relative profit and risk associated with the stock and option transactions. a. Carol's profit be on the stock transaction if its price does rise to $88 and she sells is $800.00. (Round to the nearest dollar. Enter a negative number for a loss) b. The amount Carol will earn on the option transaction if the underlying stock price rises to $88 is (Round to the nearest dollar. Enter a negative number for a loss) c. For Carol to break even on the option transaction, the stock price must rise to $84. (Round to the nearest dollar.) d. Compare, contrast, and discuss the relative profit and risk associated with the stock and option transactions. (Select the best answers from the drop-down menus.) If Carol actually purchases the stock, she will need to invest $ and can potentially lose this full amount. In comparison to the option purchase, Carol only risks the $2. Due to less risk exposure with the $ purchase, the profitability is correspondingly lower. It would take a stock price decline to $0 for a 100% loss on the to the strike price for a 100% loss on the Call option Personal finance problem Carol Krebs is considering buying 100 shares of Sooner Products, Inc., at $80 per share. Because she has read that the firm will probably soon receive certain large orders from abroad, she expects the price of Sooner to increase to $88 per share. As an alternative, Carol is considering the purchase of a call option for 100 shares of Sooner at a strike price of $77. The 90 -day option will cost $700. Ignore any brokerage fees or dividends. a. What will Carol's profit be on the stock if its price does rise to $88 ? b. How much will Carol earn on the option if the underlying stock price rises to $88 ? c. How high must the stock price rise for Carol to break even on the option? d. Compare, contrast, and discuss the relative profit and risk associated with the stock and option transactions. a. Carol's profit be on the stock transaction if its price does rise to $88 and she sells is $800.00. (Round to the nearest dollar. Enter a negative number for a loss) b. The amount Carol will earn on the option transaction if the underlying stock price rises to $88 is (Round to the nearest dollar. Enter a negative number for a loss) c. For Carol to break even on the option transaction, the stock price must rise to $84. (Round to the nearest dollar.) d. Compare, contrast, and discuss the relative profit and risk associated with the stock and option transactions. (Select the best answers from the drop-down menus.) If Carol actually purchases the stock, she will need to invest $ and can potentially lose this full amount. In comparison to the option purchase, Carol only risks the $2. Due to less risk exposure with the $ purchase, the profitability is correspondingly lower. It would take a stock price decline to $0 for a 100% loss on the to the strike price for a 100% loss on theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started