Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help with Part D of this question, finding the expected utility. Thanks A new product has the following profit projections and associated probabilities. (a)

Need Help with Part D of this question, finding the expected utility. Thanks

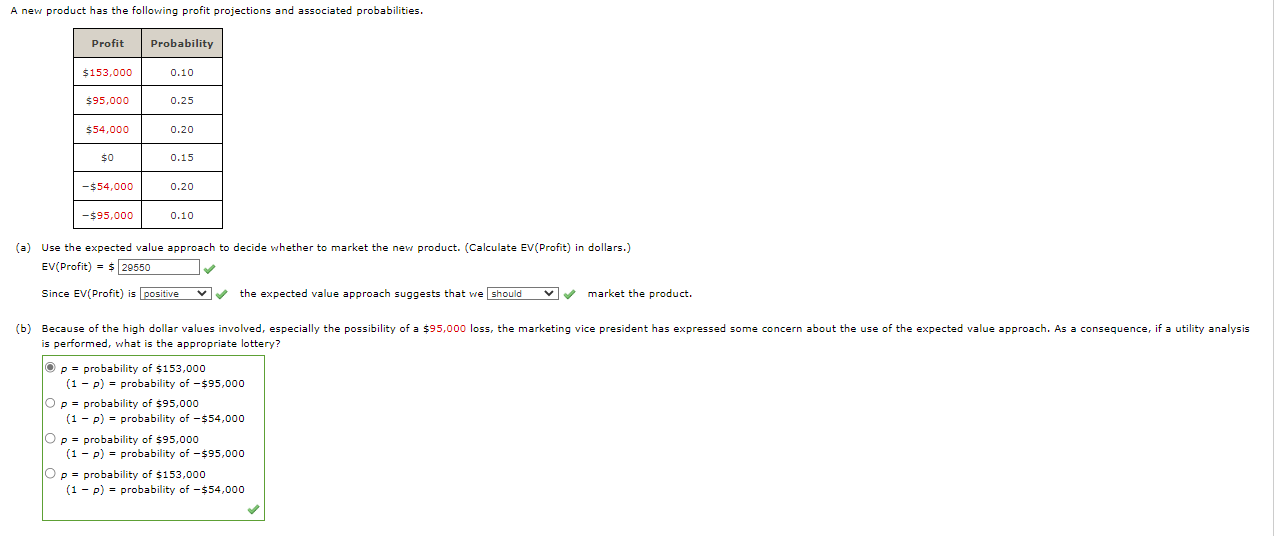

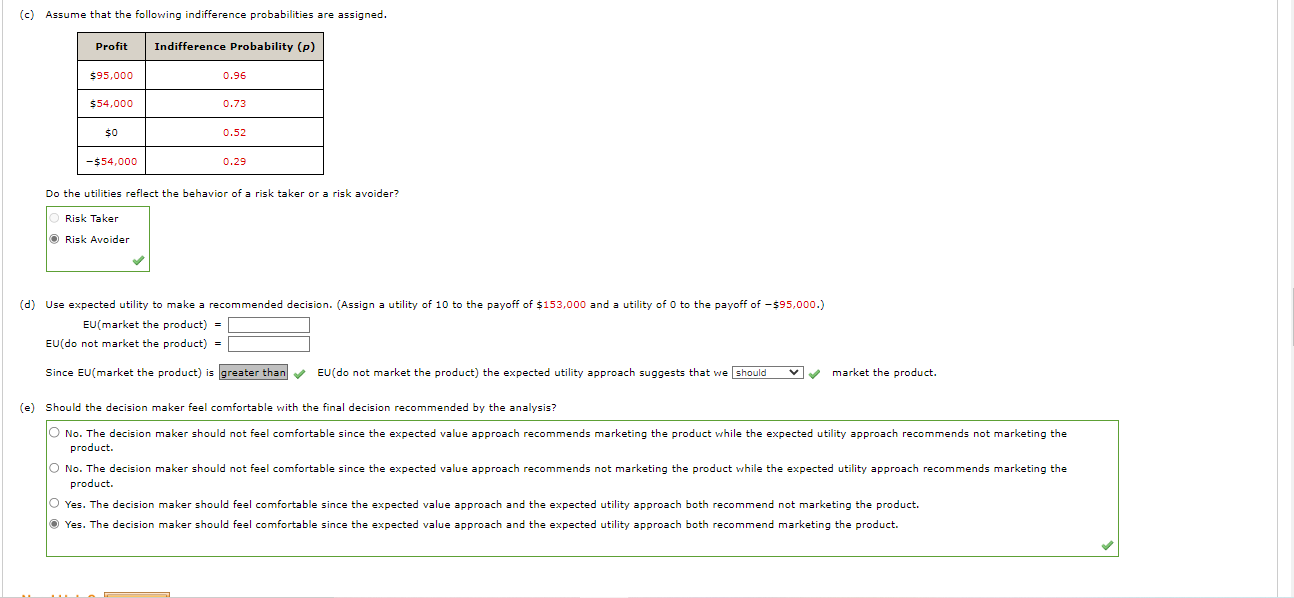

A new product has the following profit projections and associated probabilities. (a) Use the expected value approach to decide whether to market the nev product. (Calculate EV(Profit) in dollars.) EV( Profit )=$ Since EV(Profit) is the expected value approach suggests that we market the product. is performed, what is the appropriate lottery? p= probability of $153,000 (1p)= probability of $95,000 p= probability of $95,000 (1p)= probability of $54,000 p= probability of $95,000 (1p)= probability of $95,000 p= probability of $153,000 (1p)= probability of $54,000 (c) Assume that the following indifference probabilities are assigned. Do the utilities reflect the behavior of a risk taker or a risk avoider? (d) Use expected utility to make a recommended decision. (Assign a utility of 10 to the payoff of $153,000 and a utility of 0 to the payoff of - $95,000.) EU( market the product )= EU( do not market the product )= Since EU( market the product) is EU(do not market the product) the expected utility approach suggests that we market the product. (e) Should the decision maker feel comfortable with the final decision recommended by the analysis? product. | product. Yes. The decision maker should feel comfortable since the expected value approach and the expected utility approach both recommend not marketing the product. Yes. The decision maker should feel comfortable since the expected value approach and the expected utility approach both recommend marketing the product. A new product has the following profit projections and associated probabilities. (a) Use the expected value approach to decide whether to market the nev product. (Calculate EV(Profit) in dollars.) EV( Profit )=$ Since EV(Profit) is the expected value approach suggests that we market the product. is performed, what is the appropriate lottery? p= probability of $153,000 (1p)= probability of $95,000 p= probability of $95,000 (1p)= probability of $54,000 p= probability of $95,000 (1p)= probability of $95,000 p= probability of $153,000 (1p)= probability of $54,000 (c) Assume that the following indifference probabilities are assigned. Do the utilities reflect the behavior of a risk taker or a risk avoider? (d) Use expected utility to make a recommended decision. (Assign a utility of 10 to the payoff of $153,000 and a utility of 0 to the payoff of - $95,000.) EU( market the product )= EU( do not market the product )= Since EU( market the product) is EU(do not market the product) the expected utility approach suggests that we market the product. (e) Should the decision maker feel comfortable with the final decision recommended by the analysis? product. | product. Yes. The decision maker should feel comfortable since the expected value approach and the expected utility approach both recommend not marketing the product. Yes. The decision maker should feel comfortable since the expected value approach and the expected utility approach both recommend marketing the productStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started