need help with part d

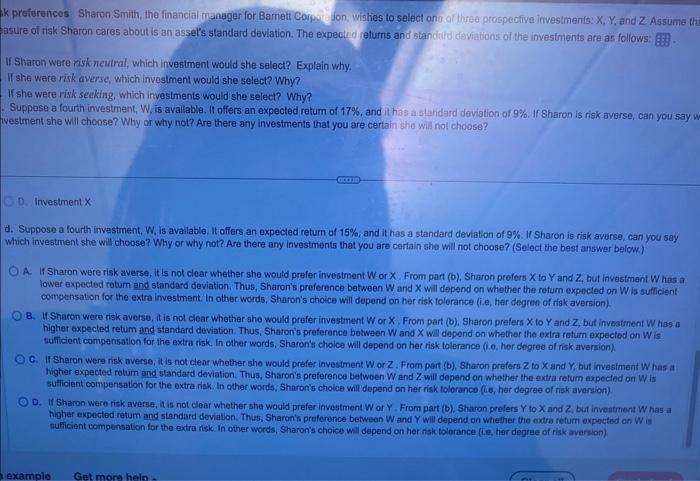

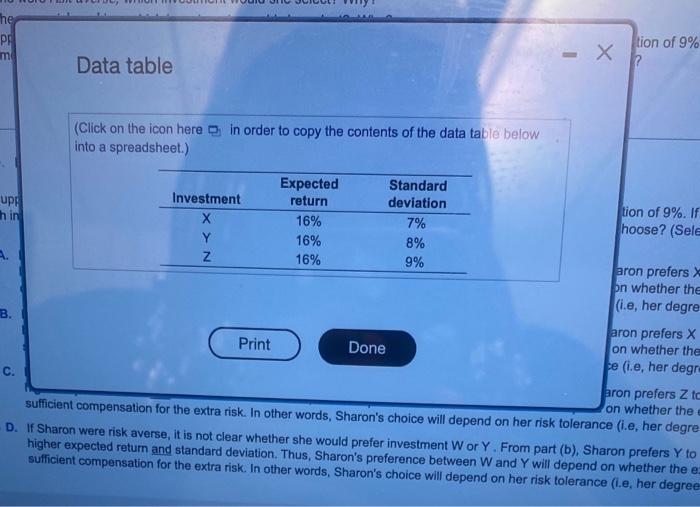

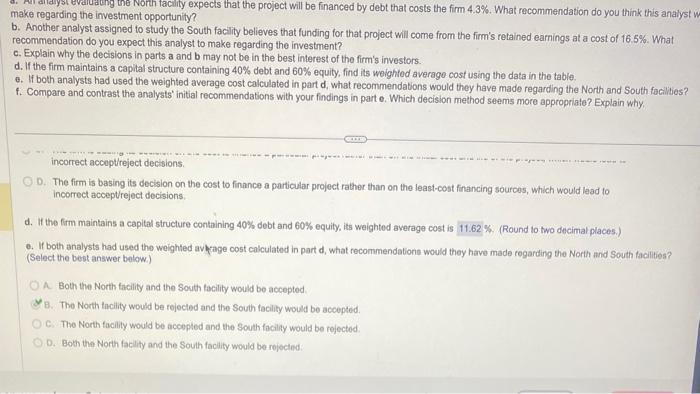

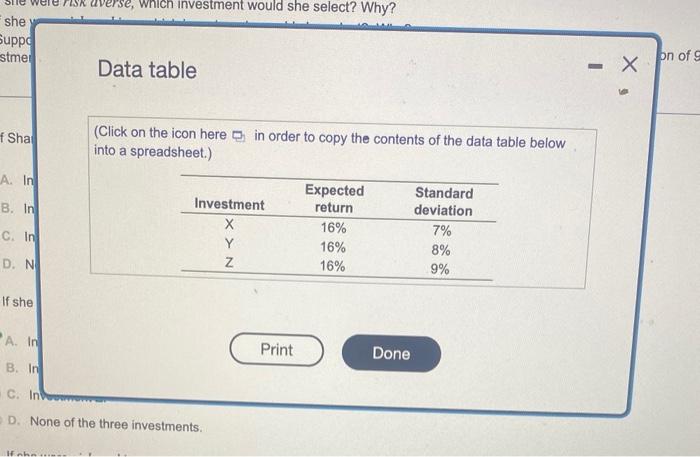

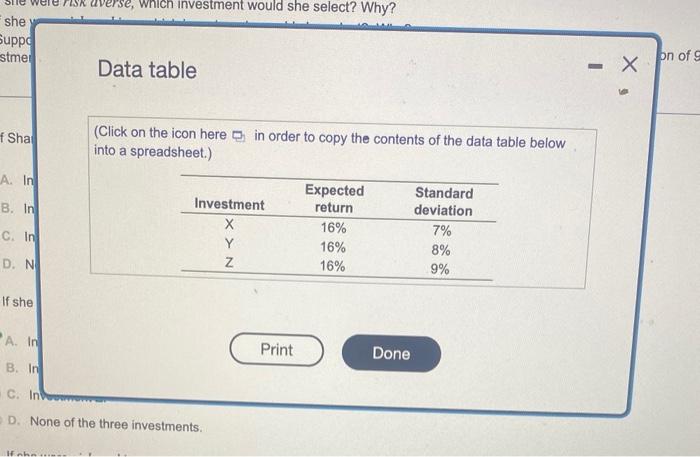

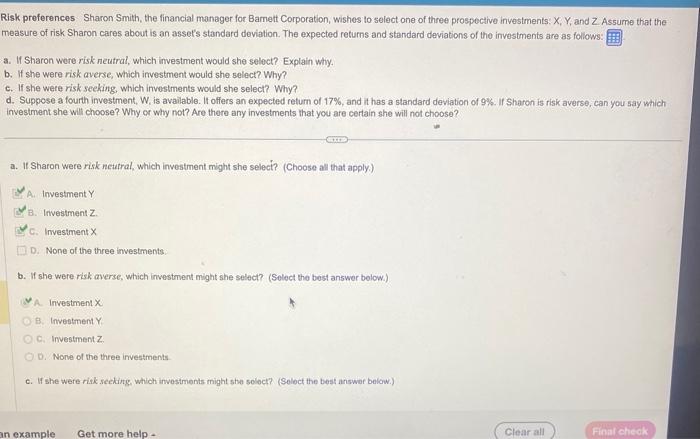

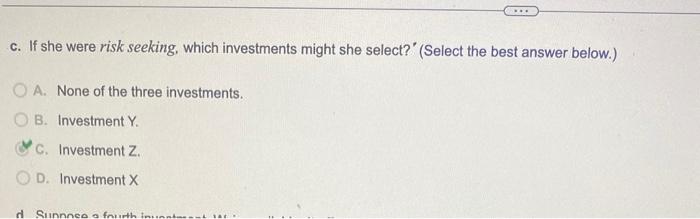

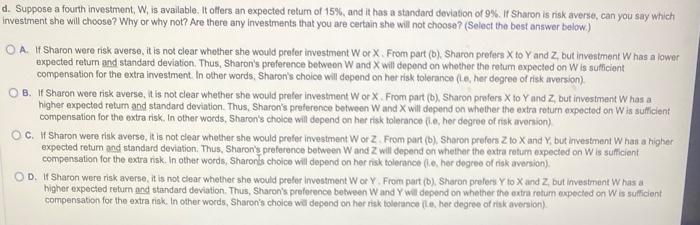

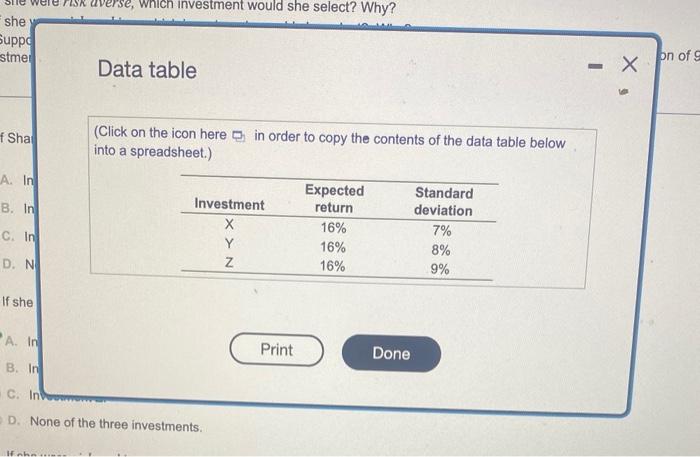

the best answer bolow.) considerebion management decisions on individual project funding sources. B. Opposite decizions are drawn using the two decision criteria. Nether decision-making method provides consistent decisions because each is limited by arsumptions rogatding reinvestment of intermedlate cajh inflows. C. Opgosite decisions are drawn using the two decision criteria. The ovorall cost of capital provides betior decisions bocalse it takea into consideralion the cost of the blend of financing, not the cost of debt of equity alone. D. The same decisions are drewn using the two decision criterin. Either can elfectively be usod to make good decisions because boik take into cansideratice the time value of money, Which is the primary consideration of all providers of funds to the firm. Ik prefurences Sharon. Smith, the financial tranager for Bameti Corpwe jon, wishes to select ono at threo prospective investments: X, Y, and Z Assume th lasure of risk Sharon cares about is an assel's standard deviation. The expecked returns and standuid coviations of the investrients are as follows: If Sharon were risk neutral, which investment would she select? Explain why. II she ware risk averse, which investment would she select? Why? If she were risk seeking, which investments would she select? Why? Suppose a fourth investment, W, is avallable. It offers an expected return of 17%, and it has a alandard deviation of 9%. If Sharon is risk averse, can you say v ivestment she wil choose? Why or why not? Are there any investments that you are certain she will not choose? D. Investment x d. Suppose a fourth investment, W, is available. It offers an expected return of 15%, and it has a standard deviation of 9%. If Sharon is risk avorse, can you say Which investment she will choose? Why or why not? Are there any investments that you are certain she will not choose? (Select the best answer below.) A. If Shaton were risk averse, it is not clear whether she would prefer investment W or X. From part (b), Sharon profors X to Y and Z, but investment Whas a lower expected rotum and standard deviation. Thus, Sharon's preference between W and X will depend on whether the refurn expocted on W is sufficient compensation for the extra invesiment. In other words, Shaton's choice will depend on her risk tolerance (i.e, her degren of risk aversion). B. II Sharen were risk averse, it is nol clear whether she would prefer investment W or X. From part (b), Sharon prefers X to Y and Z, but inveatment W has: a higher expected retum and standard deviation. Thus, Shaton's preference botween W and X will dopend on whether the extra return expected on W is. sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (i.e, her degree of risk aversion). c. If Sharon were risk averse, it is not clear whether sho would prefer investment W or Z. From part (b), Sharon prefers Z to X and Y, but investment W has a higher expected rotum and standard deviation. Thus, Sharon's preference betwoen W and Z. will depend on whether the extra retum axpected on W is sulficiant compensetion for the oxtra riak. In other words, Shaton's cholce will depend on her risk tolorance (le, her degree of risk aversion). p. If Sharon were risk averse, it is not clear whather sho would prefer investment W or Y. From part (b), Sharan prefers Y to X and Z, but inveritment W has a Data table (Click on the icon here in order to copy the contents of the data tabie below into a spreadsheet.) sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk toler whether the If Sharon were risk averse, it is not clear whether she would prefeer higher expected return and standard deviation. Thus, Sharon's prof investment W or Y. From part (b), Sharon prefers Y to sufficient compensation for the extra risk. In other words, Sharon's choice will deen W and Y will depend on whether the e make regarding the investment opportunity? b. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 16.5%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors. d. If the firm maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table. 0. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? f. Compare and contrast the analysts' initial recommendations with your findings in part e. Which decision method seems more appropriate? Explain why. incorrect acceptreject decisions. D. The firm is basing its decision on the cost to finance a particular project rather than on the least-cost financing sources, which would lead to incorrect acceptreject decisions. d. It the firm maintains a capital structure containing 40% debt and 60% equity, its weighted average cost is \%. (Round to two decimal places.) 6. If both analysts had used the weighted avkage cost calculated in part d, what recommendatione would thoy have made regarding the North and South facilities? (Select the best answer bolow.) A. Both the North facility and the South tacility would be accepted 8. The North thelitity would be rejocted and the South facility would be accepted. C. The North tacility would be accepted and the South faciliy would be rejected. D. Both the North faclity and the South faclity would be rojocled: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) A. In 8. ln C. In D. N If she A. In B. In C. In D. None of the three investments. Risk preferences Sharon Smith, the financial manager for Bamett Corporation, wishes to select one of three prospective investments: X, Y, and Z. Assume that the measure of risk Sharon cares about is an assel's standard deviation. The expected returns and standard deviations of the investments are as follows: 3. If Sharon were risk neutral, which investment would she seloct? Explain why. b. If she were risk averse, which investment would she select? Why? c. If she were risk seeking, which investments would she select? Why? d. Suppose a fourth investment, W, is available. It offers an expected return of 17%, and it has a standard deviation of 9%. If Sharon is risk averse, can you say which investment she will choose? Why or why not? Are there any investments that you are certain she will not choose? a. If Sharon were risk nettral, which investment might she selech? (Choose all that apply.) 4. Investment Y B. Inverstment Z. C. Investment X D. None of the three investments b. If she were risk averse, which investment might she select? (Select the best answer bolow.) A. Investmen X B. Investment Y. C. Investment Z. 0. None of the three investments c. If she were ritk seeking, which invosimonts might ste soloct? (Soloct the best answor below.) c. If she were risk seeking, which investments might she select?' (Select the best answer below.) A. None of the three investments. B. Investment Y. C. Investment Z. D. Investment X Suppose a fourth imvestment, W, is avBilable. It offers an expected retum of 15%, and it has a standard deviation of 9%. If Sharon is risk averse, can you say which vestment she will choose? Why or why not? Are there any investments that you are certain she will not choose? (Select tho best answer below.) A. If Sharon were risk averse, it is not clear whether she would preter investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a lowe expected return and standard deviabion. Thus, Sharon's preference between W and X will depend on whether the roturn expected on W is sufficient compensation for the extra investment. In other words, Sharen's choice will depend on her risk tolerance (Le, her degree of risk aversion) B. It Sharon were risk averse, it is not clear whether she would preter investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a higher expected retum and standard deviation. Thus, Sharon's preference between W and X will depend on whether the extra return expected on W is sulticient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (l.e, her degree of risk avonion) C. If Sharon were risk averse, it is not clear whether she would prefer investment W or Z. From part (b), Sharen prefers Z to X and Y, but investment W has a higher expected retum and standard deviation. Thus, Sharon's preterence between W and 2 will depend on whether the extra retum expected on W is sufficient compensation for the extra nisk. In other words, Sharorts choice will depend on her risk tolerance (i.e, her degree of risk aversion). D. If Sharon were risk averse, it is not clear whether she would preler imvostment W or Y. From part (b), Sharon prefers Y to X and Z, but livestinent Whas a higher expected return and standard deviation. Thus, Sharon's preforence between W and Y will depend on whether the extra roturn expected on W is sutticient compensation for the extra risk. In other words, Sharon's choice wil depend on her risk tolerance (t.e, her degree of risk aversion). the best answer bolow.) considerebion management decisions on individual project funding sources. B. Opposite decizions are drawn using the two decision criteria. Nether decision-making method provides consistent decisions because each is limited by arsumptions rogatding reinvestment of intermedlate cajh inflows. C. Opgosite decisions are drawn using the two decision criteria. The ovorall cost of capital provides betior decisions bocalse it takea into consideralion the cost of the blend of financing, not the cost of debt of equity alone. D. The same decisions are drewn using the two decision criterin. Either can elfectively be usod to make good decisions because boik take into cansideratice the time value of money, Which is the primary consideration of all providers of funds to the firm. Ik prefurences Sharon. Smith, the financial tranager for Bameti Corpwe jon, wishes to select ono at threo prospective investments: X, Y, and Z Assume th lasure of risk Sharon cares about is an assel's standard deviation. The expecked returns and standuid coviations of the investrients are as follows: If Sharon were risk neutral, which investment would she select? Explain why. II she ware risk averse, which investment would she select? Why? If she were risk seeking, which investments would she select? Why? Suppose a fourth investment, W, is avallable. It offers an expected return of 17%, and it has a alandard deviation of 9%. If Sharon is risk averse, can you say v ivestment she wil choose? Why or why not? Are there any investments that you are certain she will not choose? D. Investment x d. Suppose a fourth investment, W, is available. It offers an expected return of 15%, and it has a standard deviation of 9%. If Sharon is risk avorse, can you say Which investment she will choose? Why or why not? Are there any investments that you are certain she will not choose? (Select the best answer below.) A. If Shaton were risk averse, it is not clear whether she would prefer investment W or X. From part (b), Sharon profors X to Y and Z, but investment Whas a lower expected rotum and standard deviation. Thus, Sharon's preference between W and X will depend on whether the refurn expocted on W is sufficient compensation for the extra invesiment. In other words, Shaton's choice will depend on her risk tolerance (i.e, her degren of risk aversion). B. II Sharen were risk averse, it is nol clear whether she would prefer investment W or X. From part (b), Sharon prefers X to Y and Z, but inveatment W has: a higher expected retum and standard deviation. Thus, Shaton's preference botween W and X will dopend on whether the extra return expected on W is. sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (i.e, her degree of risk aversion). c. If Sharon were risk averse, it is not clear whether sho would prefer investment W or Z. From part (b), Sharon prefers Z to X and Y, but investment W has a higher expected rotum and standard deviation. Thus, Sharon's preference betwoen W and Z. will depend on whether the extra retum axpected on W is sulficiant compensetion for the oxtra riak. In other words, Shaton's cholce will depend on her risk tolorance (le, her degree of risk aversion). p. If Sharon were risk averse, it is not clear whather sho would prefer investment W or Y. From part (b), Sharan prefers Y to X and Z, but inveritment W has a Data table (Click on the icon here in order to copy the contents of the data tabie below into a spreadsheet.) sufficient compensation for the extra risk. In other words, Sharon's choice will depend on her risk toler whether the If Sharon were risk averse, it is not clear whether she would prefeer higher expected return and standard deviation. Thus, Sharon's prof investment W or Y. From part (b), Sharon prefers Y to sufficient compensation for the extra risk. In other words, Sharon's choice will deen W and Y will depend on whether the e make regarding the investment opportunity? b. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 16.5%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors. d. If the firm maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table. 0. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? f. Compare and contrast the analysts' initial recommendations with your findings in part e. Which decision method seems more appropriate? Explain why. incorrect acceptreject decisions. D. The firm is basing its decision on the cost to finance a particular project rather than on the least-cost financing sources, which would lead to incorrect acceptreject decisions. d. It the firm maintains a capital structure containing 40% debt and 60% equity, its weighted average cost is \%. (Round to two decimal places.) 6. If both analysts had used the weighted avkage cost calculated in part d, what recommendatione would thoy have made regarding the North and South facilities? (Select the best answer bolow.) A. Both the North facility and the South tacility would be accepted 8. The North thelitity would be rejocted and the South facility would be accepted. C. The North tacility would be accepted and the South faciliy would be rejected. D. Both the North faclity and the South faclity would be rojocled: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) A. In 8. ln C. In D. N If she A. In B. In C. In D. None of the three investments. Risk preferences Sharon Smith, the financial manager for Bamett Corporation, wishes to select one of three prospective investments: X, Y, and Z. Assume that the measure of risk Sharon cares about is an assel's standard deviation. The expected returns and standard deviations of the investments are as follows: 3. If Sharon were risk neutral, which investment would she seloct? Explain why. b. If she were risk averse, which investment would she select? Why? c. If she were risk seeking, which investments would she select? Why? d. Suppose a fourth investment, W, is available. It offers an expected return of 17%, and it has a standard deviation of 9%. If Sharon is risk averse, can you say which investment she will choose? Why or why not? Are there any investments that you are certain she will not choose? a. If Sharon were risk nettral, which investment might she selech? (Choose all that apply.) 4. Investment Y B. Inverstment Z. C. Investment X D. None of the three investments b. If she were risk averse, which investment might she select? (Select the best answer bolow.) A. Investmen X B. Investment Y. C. Investment Z. 0. None of the three investments c. If she were ritk seeking, which invosimonts might ste soloct? (Soloct the best answor below.) c. If she were risk seeking, which investments might she select?' (Select the best answer below.) A. None of the three investments. B. Investment Y. C. Investment Z. D. Investment X Suppose a fourth imvestment, W, is avBilable. It offers an expected retum of 15%, and it has a standard deviation of 9%. If Sharon is risk averse, can you say which vestment she will choose? Why or why not? Are there any investments that you are certain she will not choose? (Select tho best answer below.) A. If Sharon were risk averse, it is not clear whether she would preter investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a lowe expected return and standard deviabion. Thus, Sharon's preference between W and X will depend on whether the roturn expected on W is sufficient compensation for the extra investment. In other words, Sharen's choice will depend on her risk tolerance (Le, her degree of risk aversion) B. It Sharon were risk averse, it is not clear whether she would preter investment W or X. From part (b), Sharon prefers X to Y and Z, but investment W has a higher expected retum and standard deviation. Thus, Sharon's preference between W and X will depend on whether the extra return expected on W is sulticient compensation for the extra risk. In other words, Sharon's choice will depend on her risk tolerance (l.e, her degree of risk avonion) C. If Sharon were risk averse, it is not clear whether she would prefer investment W or Z. From part (b), Sharen prefers Z to X and Y, but investment W has a higher expected retum and standard deviation. Thus, Sharon's preterence between W and 2 will depend on whether the extra retum expected on W is sufficient compensation for the extra nisk. In other words, Sharorts choice will depend on her risk tolerance (i.e, her degree of risk aversion). D. If Sharon were risk averse, it is not clear whether she would preler imvostment W or Y. From part (b), Sharon prefers Y to X and Z, but livestinent Whas a higher expected return and standard deviation. Thus, Sharon's preforence between W and Y will depend on whether the extra roturn expected on W is sutticient compensation for the extra risk. In other words, Sharon's choice wil depend on her risk tolerance (t.e, her degree of risk aversion)