Need help with placing these items on balance sheet. What categories do they go under? Are they debits or credits?

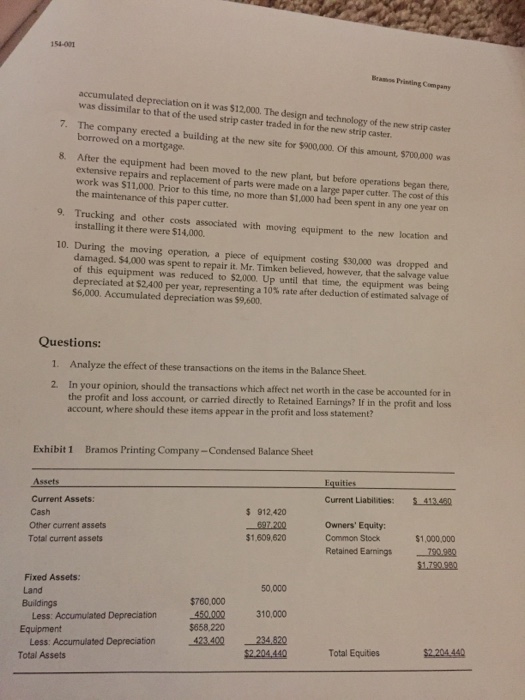

H A R VAR D BU SI N E S S S C H O O L 9-154-001 REV: DECEMBER PERT N ANTHONY Bramos Printing Company in The Bramos Company was founded in 2000 by Mr. Timken as a one-man-job printing firm a small southwestern town. Shortly after its founding, the owner decided to concentrate on one line rapid of printing Because of a high degree of technical proficiency, the company experienced a growth. However, the company suffered from competitive disadvantage in the major market for this specialized output was in a metropolitan area over 300 away from the plant For reason, the owner, in 2012, decided to move nearer his primary market. He also decided to expand and modernize his facilities at the time of the move. investigation, an attractive site was found suburb of ket, and the move was made. A balance sheet prepared prior to the move in Exhibit 1. The transactions that arose from this move are described in the following paragraphs: 1. The land at the old site together with the building thereon was sold for $350,000. The land had originally cost $50,000. The building appeared on the company's books at a cost of s760,000 and a depreciation allowance of S450,000 had been accumulated on it. of $167000, less accumulated depreciation of $97,000. 3. New bindery equipment was purchased. The invoice cost of this equipment was s200,000. A 2% discount was taken by the Bramos Company, so that only $196.000 was actually paid to the seller. The Bramos Company also paid $800 to a trucker to have this equipment delivered Installation of this equipment was made by Bramos workmen who worked a total of 40 hours. These men received $15.00 per hour in wages, but their time was ordinarily charged to printing jobs at $40.00 per hour, the difference representing an allowance for overhead 4. The company purchased land for S200,000 in cash. 5. The Bramos Company paid $40,000 to have an old building on the plot of land torm down. In addition, the company paid S20,000 to have permanent drainage facilities installed on the new land. 6. A new strip caster with an invoice cost of S45,000 was purchased. The company paid $30,000 cash and received a trade-in allowance of $15,000 on a used strip caster. The used strip caster could have been sold outright for not more than $12,000. It had cost S30,000 new, and