Answered step by step

Verified Expert Solution

Question

1 Approved Answer

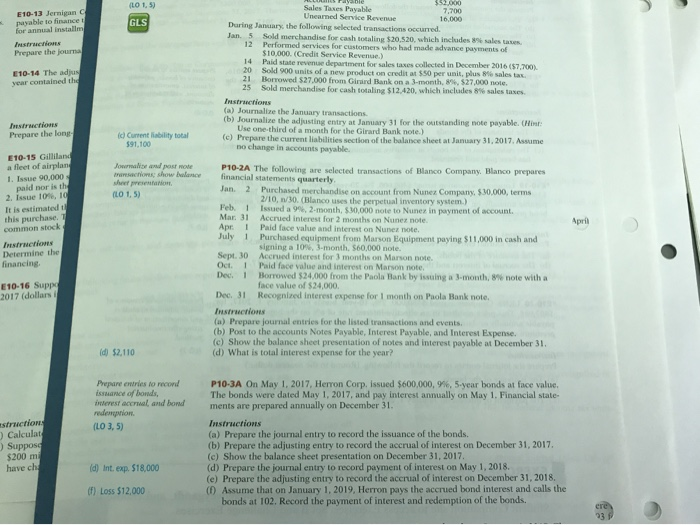

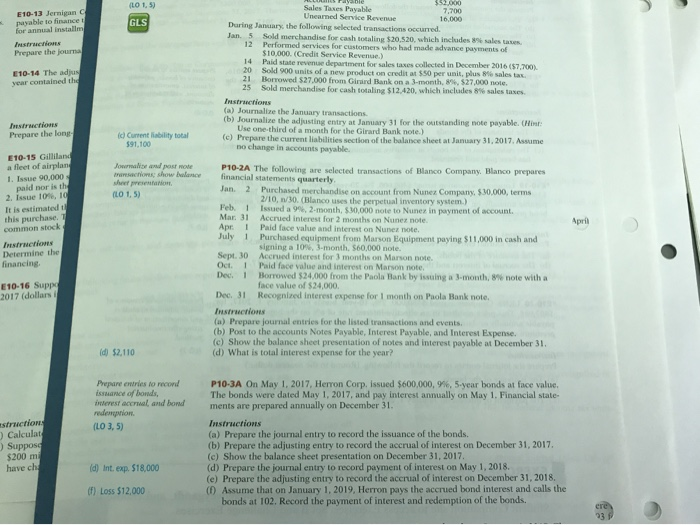

Need help with problem 10-3A Sales Taxes Payable Unearned Service Revenue 7,700 E10-13 Jernigan payable to finance t for annual installn GLS During January, the

Need help with problem 10-3A

Sales Taxes Payable Unearned Service Revenue 7,700 E10-13 Jernigan payable to finance t for annual installn GLS During January, the following selected transactions occurred Jan. 5 Sold merchandise for cash ttaling $20,520, which includes 8% sales taxes. 12 Performed services for customers who had made advance payments of $10,000. (Credit Service Revenue.) Prepare the journa $10,000. 14 Paid state revenue department for sales tases collected in December 2016 (57,700 20 Sold 900 units of a new product on credit at S50 per uni, ilus 8% sales tac 21 Borrowed $27,000 from Girard Bank on a 3-month, s%. S 27,000 note. 25 Sold merchandise for cash totaling $12,420, which includes 8% sales taxes. E10-14 The adju year contained th (a) Journalize the January transactions (b) Journalize the adjusting entry at January 31 for the outstanding note payable. (Hint Use one-third of a month for the Girard Bank note.) (c) Prepare the current liabilities section of the balance sheet at January 31,2017. Assume c) Current lability total Prepare the long 91,100 no change in accounts payable. P10-2A The following are selected transactions of Blanco Company. Blanco prepares Jan. E10-15 Gillilan a fleet of airplan 1. Issue 90,000 Jowmalice and post mote mamsactiones show balaacefinancial statements quarterly sheet presentation paid nor is th 2. Issue 10%. I It is estimated t this purchase common stock 2 Purchased merchandise on account from Nunez Company, $30,000, terms 2/10, n/30. (Blanco uses the perpetual inventory system.) Issued a 9%, 2-month, $30,000 note to Nunez in payment of account. Accrued interest for 2 months on Nunez note. Paid face value and interest on Nunez note. Purchased equipment from Marson Equipment paying $11,000 in cash and signing a 10%, (LO 1, 5) Feb. 1 Mar. 31 Apr I July 1 April Instructions Determine the 3-month. S60.000 note. Sep30d interest for months on Marson note Oct. Dec. Dec. 31 Instructions (a) Prepare journal entries for the listed transactions and events 1 1 Paid face value and interest on Marson note Borrowed $24 000 from the Paola Bank by issuing a 3-month, g% nole with a face value of $24,000, Recognized interest expense for 1 month on Paola Bank note. E10-16 Supp 2017 (dollars i (b) Post to the accounts Notes Payable, Interest Payable, and Interest Expense. (c) Show the balance sheet presentation of notes and interest payable at December 31. (d) What is total interest expense for the year? d) $2,110 />-pure cntrics io rind issuanice of bonds P10-3A On May 1, 2017, Herron Corp. issued $600,000, 9%. 5-year bonds at face value. The bonds were dated May 1, 2017, and pay interest annually on May 1. Financial state- interest accrual, and bondments are prepared annually on December 31 redemsprion Instructions (a) Prepare the journal entry to record the issuance of the bonds. (b) Prepare the adjusting entry to record the accrual of interest on December 31, 2017 (c) Show the balance sheet presentation on December 31, 2017 (d) Prepare the journal entry to record payment of interest on May 1, 2018. (e) Prepare the adjusting entry to record the accrual of interest on December 31, 2018 LO 3,5) structionn )Calcula ) Suppos $200 m have ch (d) Int. exp. $18,000 (D) Assume that on January 1, 2019, Herron pays the accrued bond interest and calls the (f) Loss $12,000 bonds at 102. Record the payment of interest and redemption of the bonds. 23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started