need help with problem b please

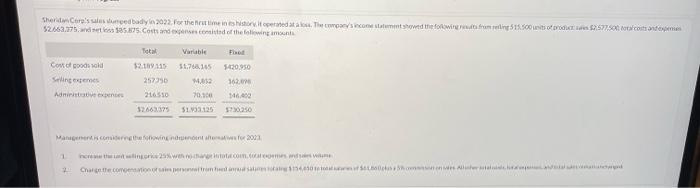

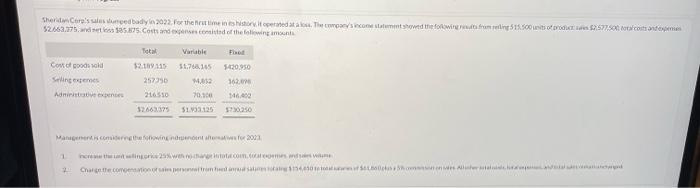

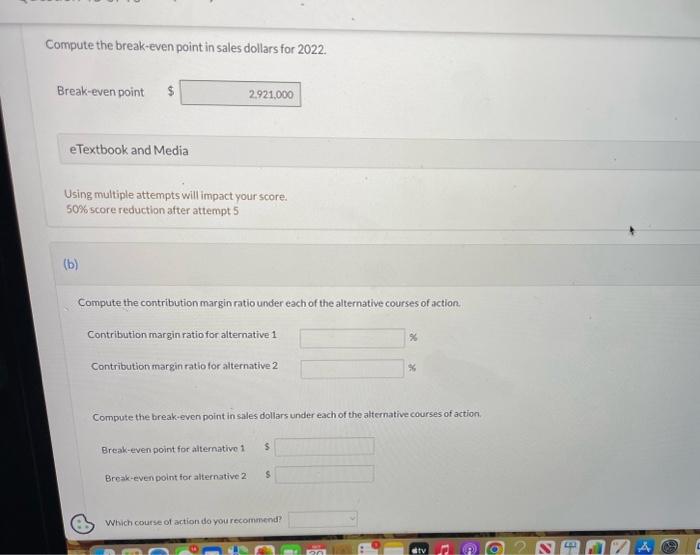

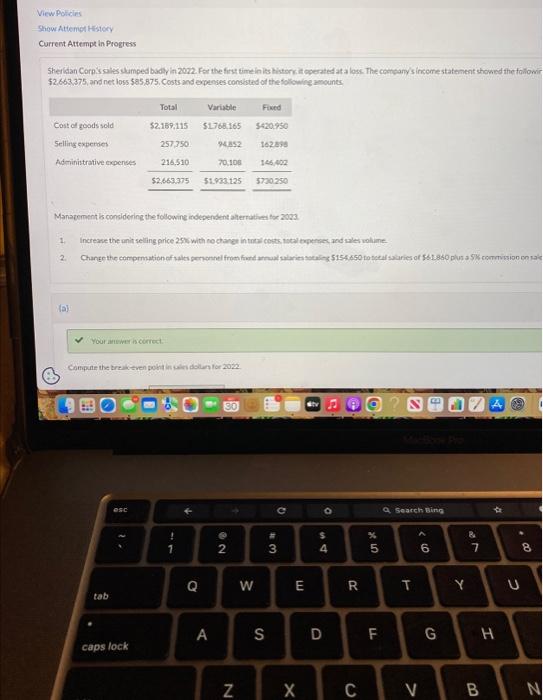

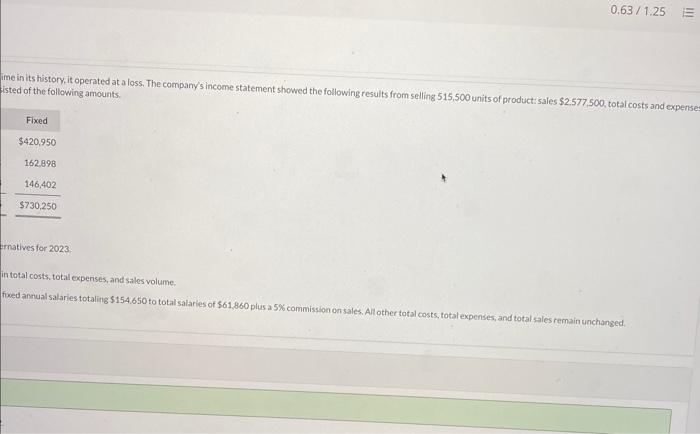

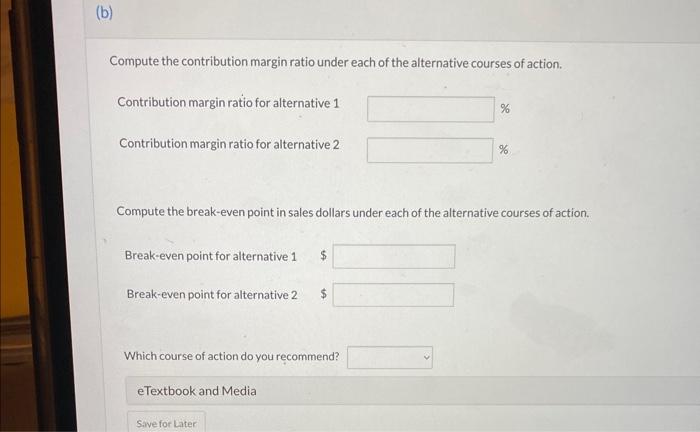

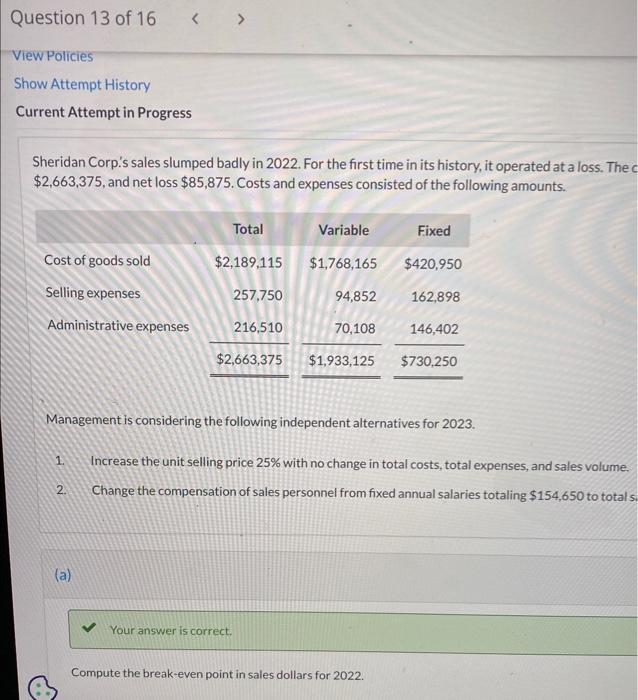

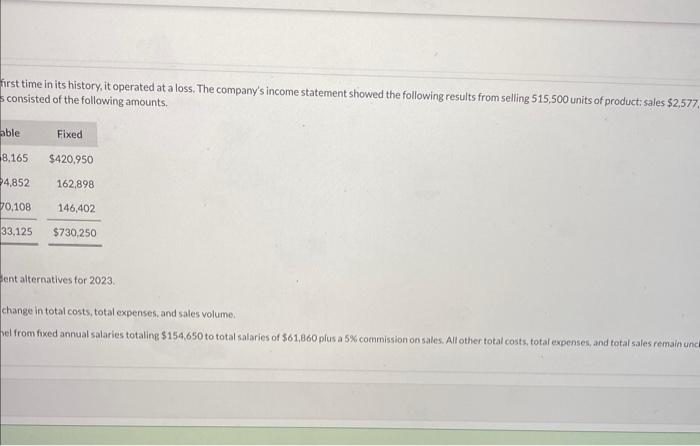

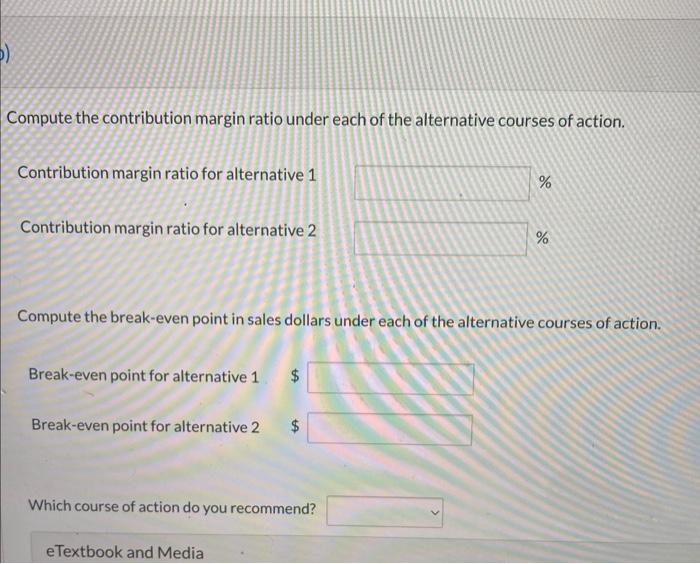

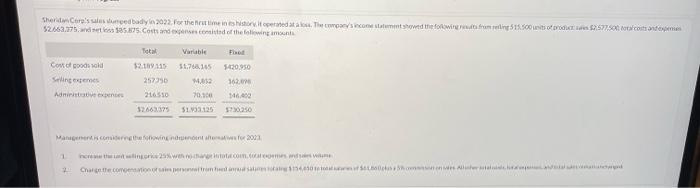

52063.755. Compute the break-even point in sales dollars for 2022. Break-even point \$ eTextbook and Media Using multiple attempts will impact your score. 50% score reduction after attempt 5 (b) Compute the contribution margin ratio under each of the alternative courses of action. Contribution margin ratio for alternative 1 Contribution margin ratio for alternative 2 Compute the break-even point in sales dollars under each of the altemative courses of action. Break-even point for altemative 1 s Break-even point for alternative 2 s Which course of action do you recommend? Viewpolidies Show Attempl History Current Attempt in Progress $2,663375, and net loss 585,875 , Costs and expenses consbted of the following amounts. Manatement is considering the followine iedependent aherratiel tor 2023. (is) Your arester is correct. me in its history, it operated at a loss, The company's income statement showed the following results from selling 515,500 units of product: sales $2,577,500, total costs and expense isted of the following amounts. rnatives for 2023 in total costs, total expenses, and salles volume. fived annual salaries totaling $154,650 to total salaries of $61,860 plus a 5% commission on sales. All other total costs, total expenses, and total sales remain unchanged, Compute the contribution margin ratio under each of the alternative courses of action. Contribution margin ratio for alternative 1 Contribution margin ratio for alternative 2 Compute the break-even point in sales dollars under each of the alternative courses of action. Break-even point for alternative 1$ Break-even point for alternative 2$ Which course of action do you recommend? Sheridan Corp.'s sales slumped badly in 2022. For the first time in its history, it operated at a loss. The $2,663,375, and net loss $85,875. Costs and expenses consisted of the following amounts. Management is considering the following independent alternatives for 2023. 1. Increase the unit selling price 25% with no change in total costs, total expenses, and sales volume. 2. Change the compensation of sales personnel from fixed annual salaries totaling $154,650 to totals (a) Your answer is correct. Compute the break-even point in sales dollars for 2022. irst time in its history, it operated at a loss. The company's income statement showed the following results from selling 515,500 units of product: sales $2,577 consisted of the following amounts, ent alternatives for 2023. change in total costs, total expenses, and sales volume, tel from fixed annual salaries totaling $154,650 to total salaries of $61,860 plus a 5% commission on sales. All other total costs, total expenses, and total sales remain unce ny's income statement showed the following results from selling 515,500 units of product: sales $2,577,500, total costs and expenses I salaries of $61,860 plus a 5% commission on sales. All other total costs, total expenses, and total sales remain unchanged. Compute the contribution margin ratio under each of the alternative courses of action. Contribution margin ratio for alternative 1 Contribution margin ratio for alternative 2 Compute the break-even point in sales dollars under each of the alternative courses of action. Break-even point for alternative 1$ Break-even point for alternative 2 Which course of action do you recommend