Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with project.The information given is below I already completed the general journal so the next step is below here is the templete given

need help with project.The information given is below

I already completed the general journal so the next step is below

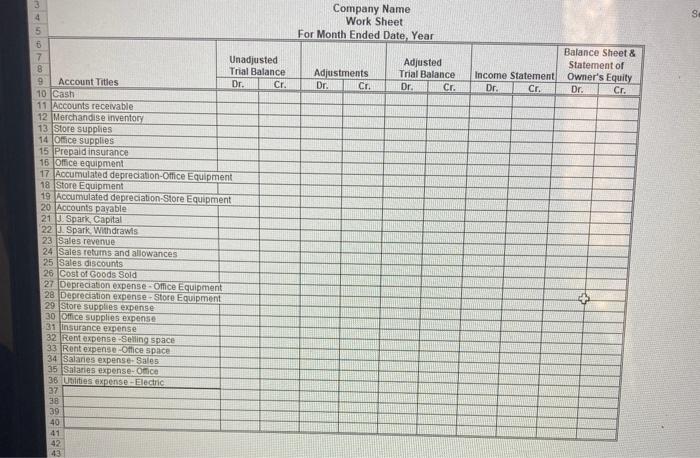

here is the templete given below

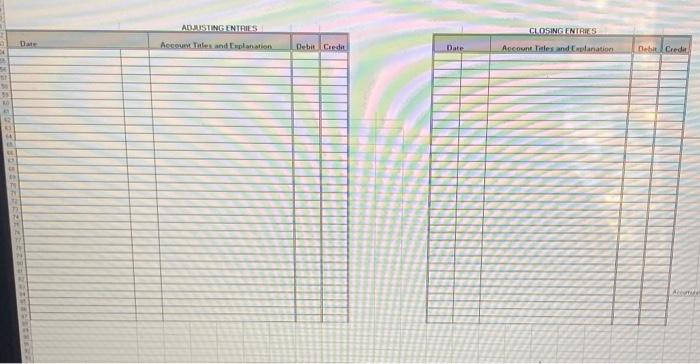

there is also some t charts I need to complete which is also below

help is very much appreciated thank you

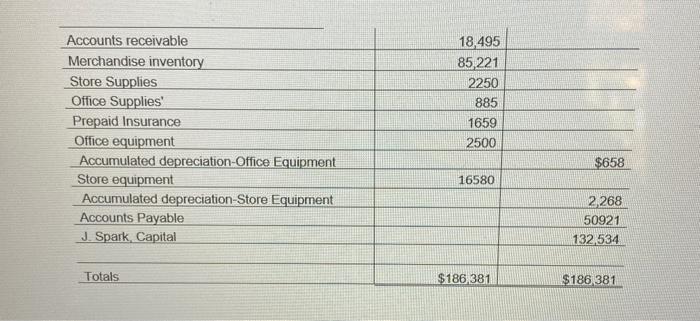

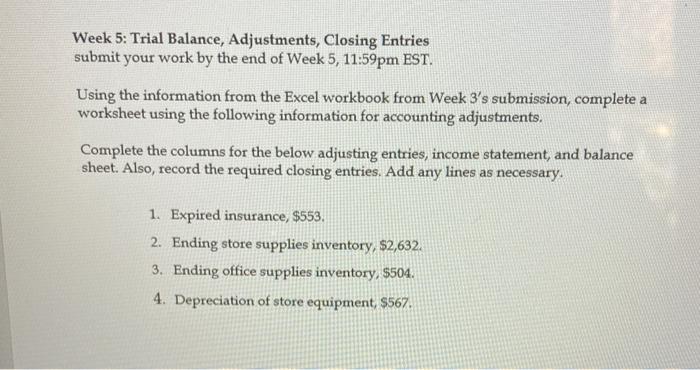

Accounts receivable Merchandise inventory Store Supplies Office Supplies Prepaid Insurance Office equipment Accumulated depreciation Office Equipment Store equipment Accumulated depreciation Store Equipment Accounts Payable J. Spark, Capital 18,495 85,221 2250 885 1659 2500 $658 16580 2,268 50921 132,534 Totals $186 381 $186 381 Week 5: Trial Balance, Adjustments, Closing Entries submit your work by the end of Week 5, 11:59pm EST. Using the information from the Excel workbook from Week 3's submission, complete a worksheet using the following information for accounting adjustments. Complete the columns for the below adjusting entries, income statement, and balance sheet. Also, record the required closing entries. Add any lines as necessary. 1. Expired insurance, $553. 2. Ending store supplies inventory, $2,632. 3. Ending office supplies inventory, $504. 4. Depreciation of store equipment, $567. 3 4 Company Name Work Sheet For Month Ended Date Year Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr. Balance Sheet & Statement of Owner's Equity Dr. Cr. Income Statement Dr. Cr. 5 6 7 Unadjusted 8 Trial Balance 9 Account Titles Dr. Cr. 10 Cash 11 Accounts receivable 12 Merchandise inventory 13 Store supplies 14 Omice supplies 15 Prepaid insurance 16 Omice equipment 17 Accumulated depreciation Office Equipment 18 Store Equipment 19 Accumulated depreciation Store Equipment 20 Accounts payable 21 Spark Capital 22 J. Spark, Withdrawis 23 Sales revenue 24 Sales returns and allowances 25 Sales discounts 26 Cost of Goods Sold 27 Depreciation expense - Office Equipment 28 Depreciation expense. Store Equipment 29 Store supplies expense 30 Office Supplies expense 31 Insurance expense 32 Rent expense Selling space 33 Rent expense Office Space 34 Salaries expense Sales 35 Salaries expense. Once 36 Uities expenso - Electric 37 38 39 40 41 42 43 ANASTINGENTRIES CLOSINGENTRIES Account Titles and Explanation Debit Credit Date Account Titles and explanation Debit Crede Office Supplies Accumulated Depreciation- Store Equip AA AB Sales Returns & Allowances Office Supplies Expense Salaries expense-Office ent Balance Sheet Post Closing TB + Accounts receivable Merchandise inventory Store Supplies Office Supplies Prepaid Insurance Office equipment Accumulated depreciation Office Equipment Store equipment Accumulated depreciation Store Equipment Accounts Payable J. Spark, Capital 18,495 85,221 2250 885 1659 2500 $658 16580 2,268 50921 132,534 Totals $186 381 $186 381 Week 5: Trial Balance, Adjustments, Closing Entries submit your work by the end of Week 5, 11:59pm EST. Using the information from the Excel workbook from Week 3's submission, complete a worksheet using the following information for accounting adjustments. Complete the columns for the below adjusting entries, income statement, and balance sheet. Also, record the required closing entries. Add any lines as necessary. 1. Expired insurance, $553. 2. Ending store supplies inventory, $2,632. 3. Ending office supplies inventory, $504. 4. Depreciation of store equipment, $567. 3 4 Company Name Work Sheet For Month Ended Date Year Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr. Balance Sheet & Statement of Owner's Equity Dr. Cr. Income Statement Dr. Cr. 5 6 7 Unadjusted 8 Trial Balance 9 Account Titles Dr. Cr. 10 Cash 11 Accounts receivable 12 Merchandise inventory 13 Store supplies 14 Omice supplies 15 Prepaid insurance 16 Omice equipment 17 Accumulated depreciation Office Equipment 18 Store Equipment 19 Accumulated depreciation Store Equipment 20 Accounts payable 21 Spark Capital 22 J. Spark, Withdrawis 23 Sales revenue 24 Sales returns and allowances 25 Sales discounts 26 Cost of Goods Sold 27 Depreciation expense - Office Equipment 28 Depreciation expense. Store Equipment 29 Store supplies expense 30 Office Supplies expense 31 Insurance expense 32 Rent expense Selling space 33 Rent expense Office Space 34 Salaries expense Sales 35 Salaries expense. Once 36 Uities expenso - Electric 37 38 39 40 41 42 43 ANASTINGENTRIES CLOSINGENTRIES Account Titles and Explanation Debit Credit Date Account Titles and explanation Debit Crede Office Supplies Accumulated Depreciation- Store Equip AA AB Sales Returns & Allowances Office Supplies Expense Salaries expense-Office ent Balance Sheet Post Closing TB + Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started