Answered step by step

Verified Expert Solution

Question

1 Approved Answer

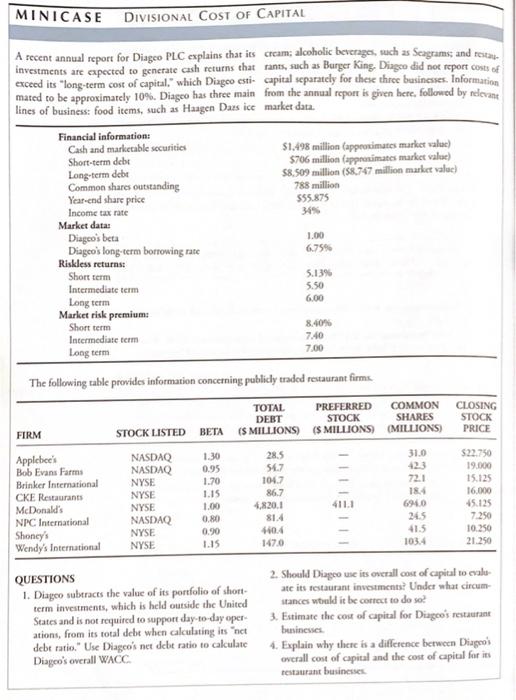

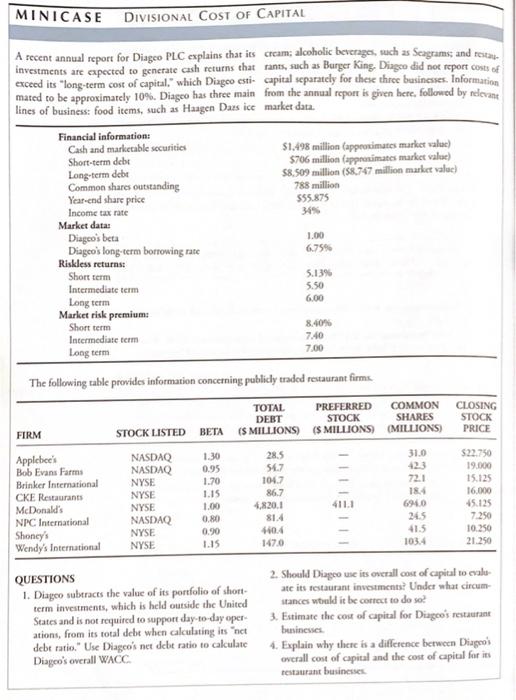

need help with question 1 and 2. please include formulas so I can understand better. MINICASE DIVISIONAL COST OF CAPITAL A recent annual report for

need help with question 1 and 2. please include formulas so I can understand better.

MINICASE DIVISIONAL COST OF CAPITAL A recent annual report for Diageo PLC explains that its crcam; alcoholic beverages , such as Seagrams, and total investments are expected to generate cash returns that rants, such as Burger King, Diageo did not report costs exceed its long-term cost of capital, which Diageo esti- capital separately for these three businesses. Information mated to be approximately 10%. Diageo has three main from the annual report is given here, followed by relevane lines of business: food items, such as Haagen Dars ice marker data. Financial information: Cash and marketable securities $1,498 million (approximates market value) Short-term deht $706 million (approximates market value) Long-term debt $8.509 million (58.747 million market value) Common shares outstanding 788 million Year-end share price 555.875 Income tax rate 365 Market data: Diageo's beta Diagco's long-term borrowing rate Riskless returns: Short term 5.139 Intermediate term 5.50 Long term 6.00 Market risk premium Short term 8.40% Intermediate term Long term 7.00 The following table provides information concerning publicly traded restaurant firma 1.00 6.75% 7.40 TOTAL PREFERRED COMMON DEBT STOCK SHARES (S MILLIONS) (S MILLIONS (MILLIONS) CLOSING STOCK PRICE FIRM STOCK LISTED BETA 31.0 423 72.1 184 Applebee's Bob Evans Farms Brinker International CKE Restaurants McDonald's NPC International Shoney's Wendy's International NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE 1.30 0.95 1.70 1.15 1.00 0.80 0.90 1.15 28.5 54.7 1047 86.7 4,820.1 814 404 147.0 6940 $22.750 19.000 15.125 16.000 15.125 7250 10.250 21.250 245 41.5 103.4 QUESTIONS 1. Diagco subtracts the value of its portfolio of short term investments, which is held outside the United States and is not required to support day-to-day oper ations, from its total debt when calculating its net debt ratio." Use Diagco's net debt ratio to calculate Diageo's overall WACC 2. Should Diageo use its overall cost of capital to evalu ate its restaurant investments? Under what circum stances wtuld it be correct to do se! 3. Estimate the cost of capital for Diageo's restaurant businesses 4. Explain why there is a difference between Diageo's overall cost of capital and the cost of capital for its restaurant businesses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started