Answered step by step

Verified Expert Solution

Question

1 Approved Answer

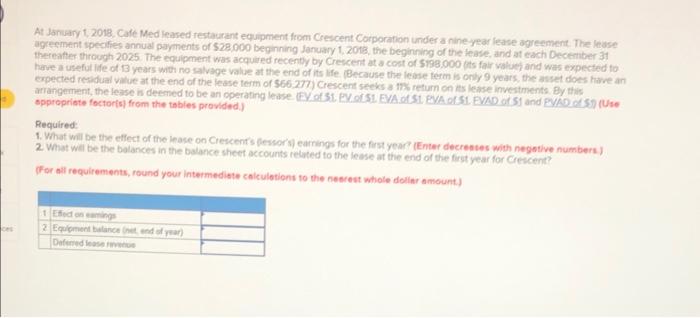

need help with question 10 At January 1, 2018. Cale Med leased restaurant equipment from Crescent Corporation under a nineyear lease agreement. The lease? agreement

need help with question 10

At January 1, 2018. Cale Med leased restaurant equipment from Crescent Corporation under a nineyear lease agreement. The lease? agreement specifies annual payments of $28,000 beginning January 1, 2018, the beginning of the lease, and at each Deceriber 31 thereafter through 2025 . The equipment was acquired recently by Crescent at a cost of 5198.000 (its fair valuel and was expected to have a useful ife of 13 years with no salvage value at the end of its life pecause the lease term is only 9 years, the asset does have an. expected rendual vilue at the end of the lease term of 566.277 ) Crescent seeks a 17 return on in lease investments. By this arrangement, the lease is deemed to be an operating lewse (FV of 31. EV. of S1. EVA. of S1. PVA of S1. EVAD of SI and PVAD orSD (Use sppropriate fector(s) from the tabies provided.) Required: 1. What will be the effect of the lease on Crescent's (fessor's) earnings for the first year? (Enter decrenses with negstive numbers) 2. What wil be the bolances in the balance sheet accounts related to the lease at the end of the first year for Crescent? (FFr all requirements, round your intermediate caiculotions to the nesrest whole dolinr amount.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started