Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with question 29 and 30 Scott Enterprises is considering a project that has the following cash flow and cost of capital ( r

need help with question 29 and 30

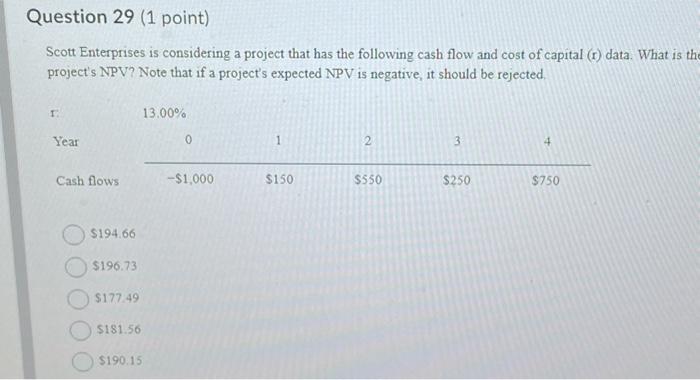

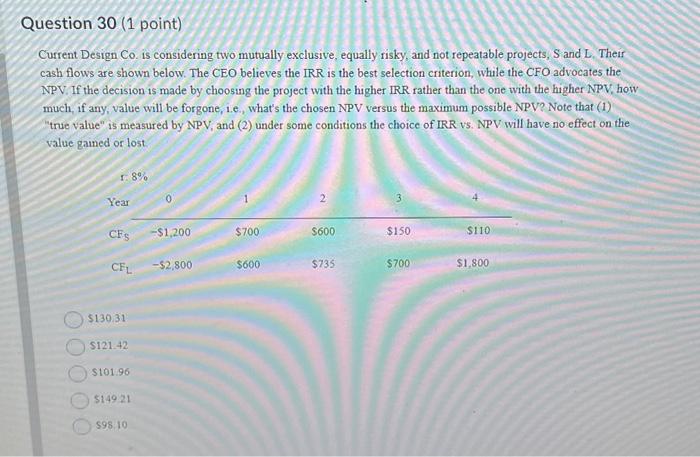

Scott Enterprises is considering a project that has the following cash flow and cost of capital ( r ) data. What is th project's NPV? Note that if a project's expected NPV is negative, it should be rejected. \begin{tabular}{|r|} \hline$194.66 \\ \hline$196.73 \\ \hline$177.49 \\ \hline$181.56 \\ \hline$190.15 \\ \hline \end{tabular} Current Design Co. is considering two mutually exclusive, equally risky, and not repeatable projects, S and L. Their cash flows are shown below. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, value will be forgone, i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR v5. NPV will have no effect on the value gained or lost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started