Answered step by step

Verified Expert Solution

Question

1 Approved Answer

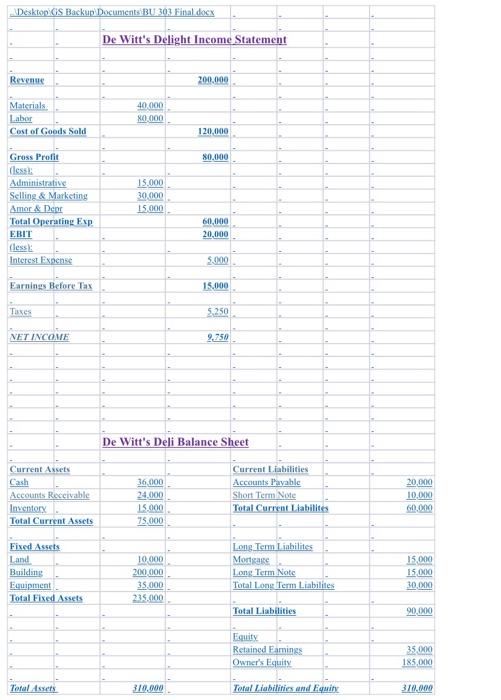

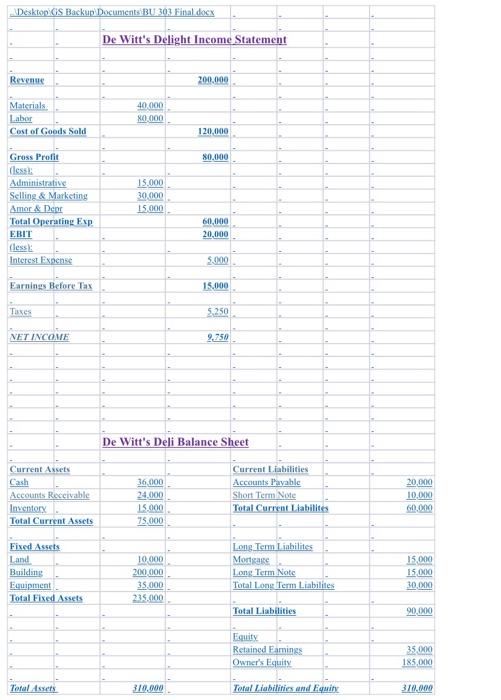

need help with question A and Question B Desktop GS Backup Documents BU 303 Final.docx De Witt's Delight Income Statement Revenue 200.000 Materials Laber Cost

need help with question A and Question B

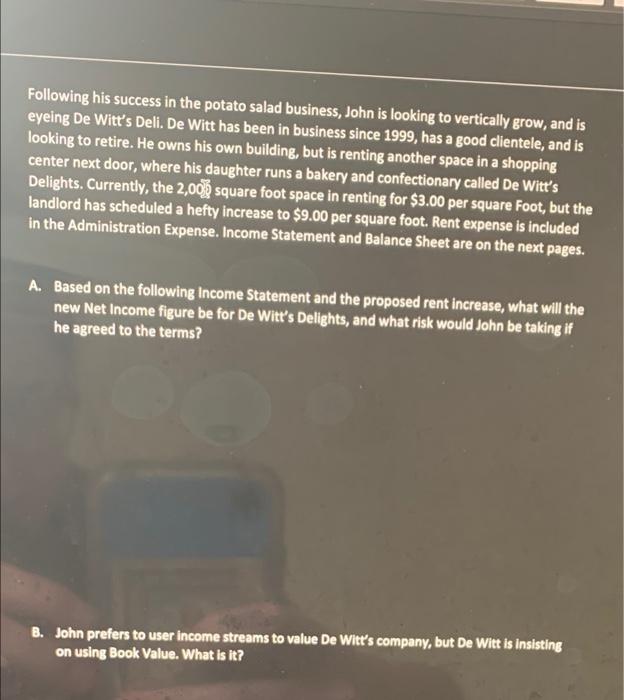

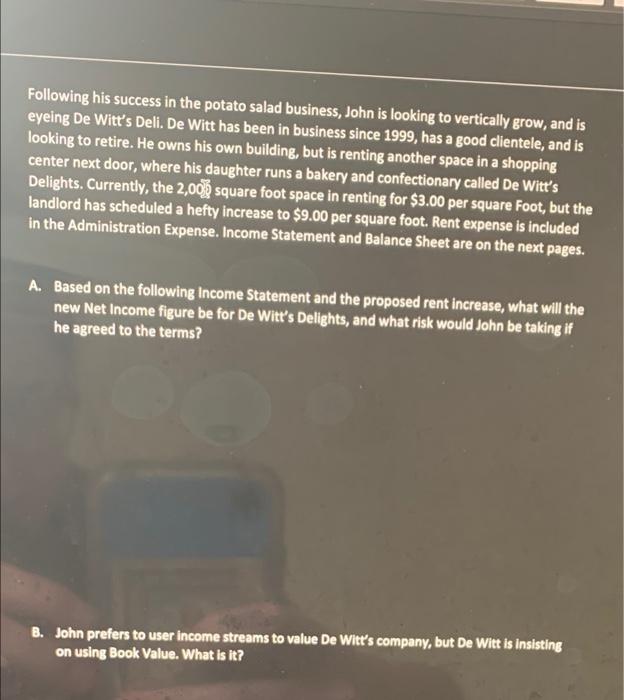

Desktop GS Backup Documents BU 303 Final.docx De Witt's Delight Income Statement Revenue 200.000 Materials Laber Cost of Goods Sold 40.000 0.000 120.000 80.000 Gross Profit (less Administrative Selling & Marketing Amar & Dear Total Operating Exp EBIT (less: Interest Expense 15.000 30.000 15.000 60.000 20.000 5.000 Earnings Before Tax 15.000 Taxes 5.250 NET INCOME 9.750 De Witt's Deli Balance Sheet Current Assets Cash Accounts Receivable Inventory Total Current Assets 36.000 24.000 15.000 75.000 Current Liabilities Accounts Payable Short Term Note Total Current Liabilites 20,000 10,000 60.000 Fixed Assets Land Building Equipment Total Fixed Assets 15.000 Long Term Liabilites Mortgage Long Term Note Total Long Term Liabilites 10.000 200.000 15000 30,000 35.000 235.000 Total Liabilities 90.000 Equity Retained Famings Owner's Equity 35.000 185.000 Total Assets 370.000 Total Liabilities and Equity 370.000 Following his success in the potato salad business, John is looking to vertically grow, and is eyeing De Witt's Deli. De Witt has been in business since 1999, has a good clientele, and is looking to retire. He owns his own building, but is renting another space in a shopping center next door, where his daughter runs a bakery and confectionary called De Witt's Delights. Currently, the 2,00 square foot space in renting for $3.00 per square Foot, but the landlord has scheduled a hefty increase to $9.00 per square foot. Rent expense is included in the Administration Expense. Income Statement and Balance Sheet are on the next pages. A. Based on the following Income Statement and the proposed rent increase, what will the new Net Income figure be for De Witt's Delights, and what risk would John be taking if he agreed to the terms? B. John prefers to user income streams to value De Witt's company, but De Witt is insisting on using Book Value. What is it? Desktop GS Backup Documents BU 303 Final.docx De Witt's Delight Income Statement Revenue 200.000 Materials Laber Cost of Goods Sold 40.000 0.000 120.000 80.000 Gross Profit (less Administrative Selling & Marketing Amar & Dear Total Operating Exp EBIT (less: Interest Expense 15.000 30.000 15.000 60.000 20.000 5.000 Earnings Before Tax 15.000 Taxes 5.250 NET INCOME 9.750 De Witt's Deli Balance Sheet Current Assets Cash Accounts Receivable Inventory Total Current Assets 36.000 24.000 15.000 75.000 Current Liabilities Accounts Payable Short Term Note Total Current Liabilites 20,000 10,000 60.000 Fixed Assets Land Building Equipment Total Fixed Assets 15.000 Long Term Liabilites Mortgage Long Term Note Total Long Term Liabilites 10.000 200.000 15000 30,000 35.000 235.000 Total Liabilities 90.000 Equity Retained Famings Owner's Equity 35.000 185.000 Total Assets 370.000 Total Liabilities and Equity 370.000 Following his success in the potato salad business, John is looking to vertically grow, and is eyeing De Witt's Deli. De Witt has been in business since 1999, has a good clientele, and is looking to retire. He owns his own building, but is renting another space in a shopping center next door, where his daughter runs a bakery and confectionary called De Witt's Delights. Currently, the 2,00 square foot space in renting for $3.00 per square Foot, but the landlord has scheduled a hefty increase to $9.00 per square foot. Rent expense is included in the Administration Expense. Income Statement and Balance Sheet are on the next pages. A. Based on the following Income Statement and the proposed rent increase, what will the new Net Income figure be for De Witt's Delights, and what risk would John be taking if he agreed to the terms? B. John prefers to user income streams to value De Witt's company, but De Witt is insisting on using Book Value. What is it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started