Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with question f. Ch8 Case Study Assignment - Part 1 Important: Please watch this video >>>>> New Ch8 Bad Debt Expense Journal Entry

Need help with question f.

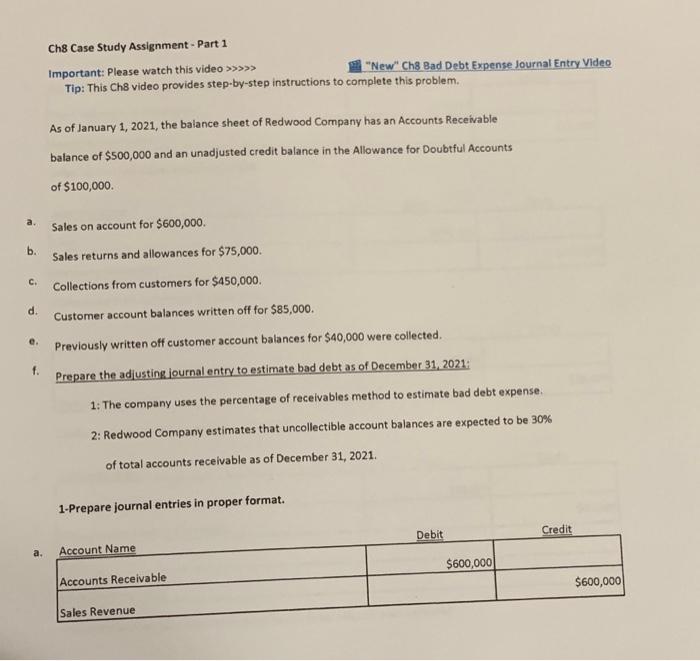

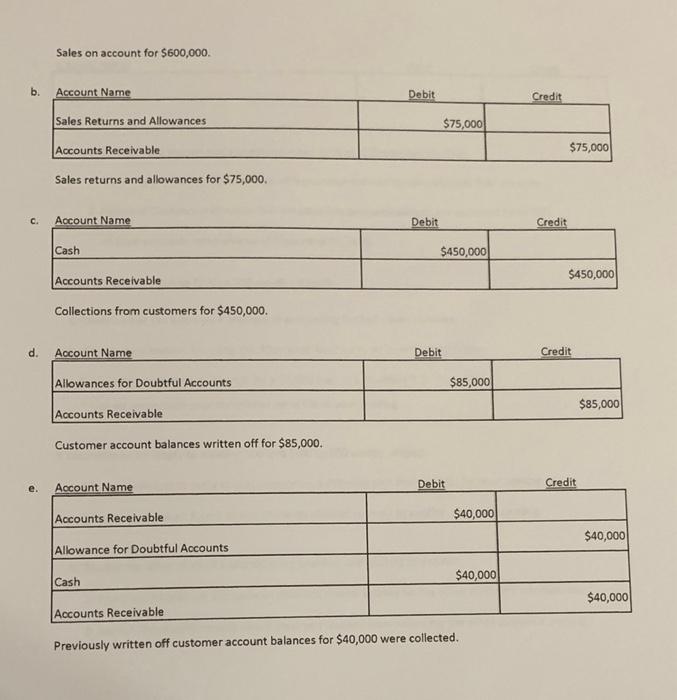

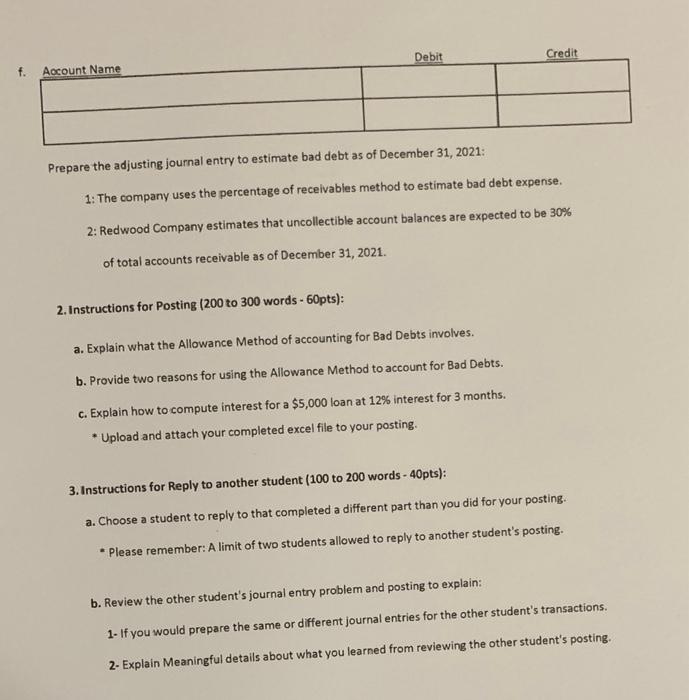

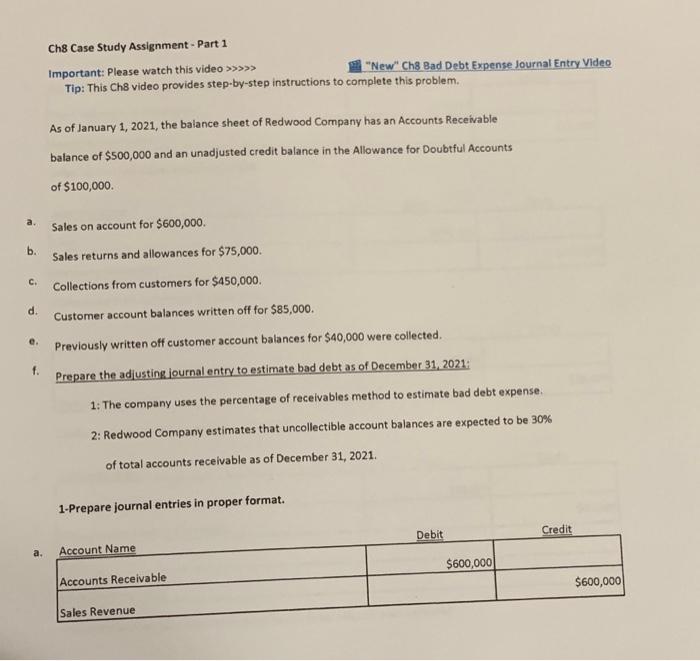

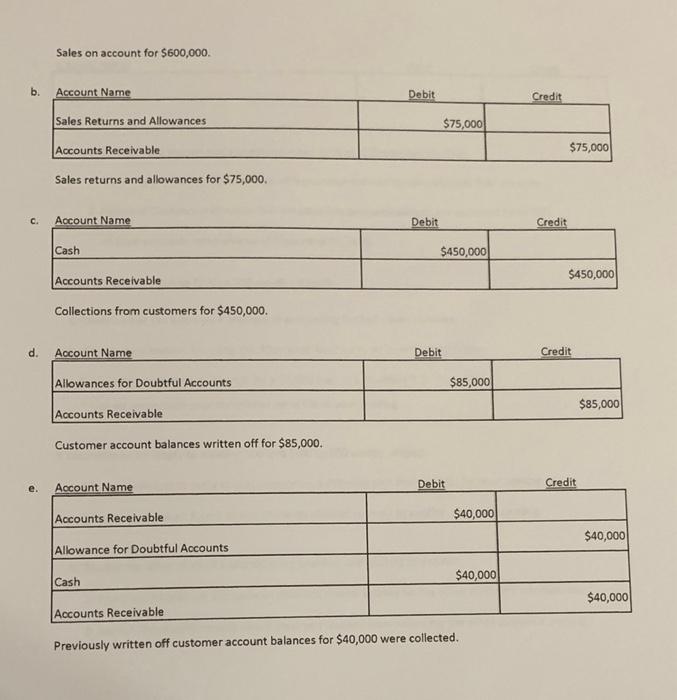

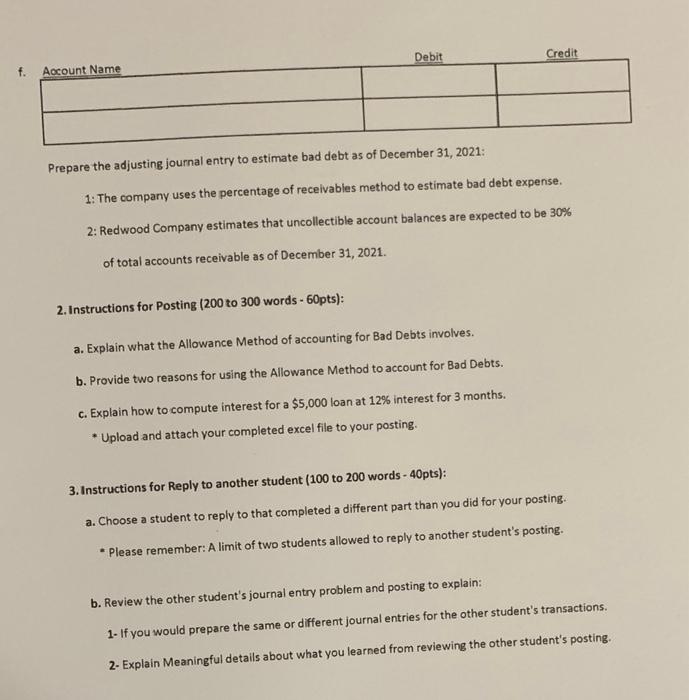

Ch8 Case Study Assignment - Part 1 Important: Please watch this video >>>>> "New" Ch8 Bad Debt Expense Journal Entry Video Tip: This Ch8 video provides step-by-step instructions to complete this problem As of January 1, 2021, the balance sheet of Redwood Company has an Accounts Receivable balance of $500,000 and an unadjusted credit balance in the Allowance for Doubtful Accounts of $100,000. a. Sales on account for $600,000 b. Sales returns and allowances for $75,000. Collections from customers for $450,000 C. d. Customer account balances written off for $85,000. e. f. Previously written off customer account balances for $40,000 were collected Prepare the adjusting journal entry to estimate bad debt as of December 31, 2021: 1: The company uses the percentage of receivables method to estimate bad debt expense 2: Redwood Company estimates that uncollectible account balances are expected to be 30% of total accounts receivable as of December 31, 2021 1-Prepare journal entries in proper format. Debit Credit a. Account Name $600,000 Accounts Receivable $600,000 Sales Revenue Sales on account for $600,000 b. Account Name Debit Credit Sales Returns and Allowances $75,000 Accounts Receivable $75,000 Sales returns and allowances for $75,000 C. Account Name Debit Credit Cash $450,000 Accounts Receivable $450,000 Collections from customers for $450,000. d. Account Name Debit Credit Allowances for Doubtful Accounts $85,000 $85,000 Accounts Receivable Customer account balances written off for $85,000. e. Account Name Debit Credit Accounts Receivable $40,000 $40,000 Allowance for Doubtful Accounts Cash $40,000 $40,000 Accounts Receivable Previously written off customer account balances for $40,000 were collected. Debit Credit f. Aocount Name Prepare the adjusting journal entry to estimate bad debt as of December 31, 2021: 1: The company uses the percentage of receivables method to estimate bad debt expense. 2: Redwood Company estimates that uncollectible account balances are expected to be 30% of total accounts receivable as of December 31, 2021. 2. Instructions for Posting (200 to 300 words - 60pts): a. Explain what the Allowance Method of accounting for Bad Debts involves. b. Provide two reasons for using the Allowance Method to account for Bad Debts. c. Explain how to compute interest for a $5,000 loan at 12% interest for 3 months. Upload and attach your completed excel file to your posting. 3. Instructions for Reply to another student (100 to 200 words - 40pts): a. Choose a student to reply to that completed a different part than you did for your posting. . Please remember: A limit of two students allowed to reply to another student's posting. b. Review the other student's journal entry problem and posting to explain: 1- If you would prepare the same or different journal entries for the other student's transactions. 2- Explain Meaningful details about what you learned from reviewing the other student's posting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started