Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with questions 27 and 28 Question 27 (1 point) A company is considering a capital budgeting project of a proposed expansion to its

need help with questions 27 and 28

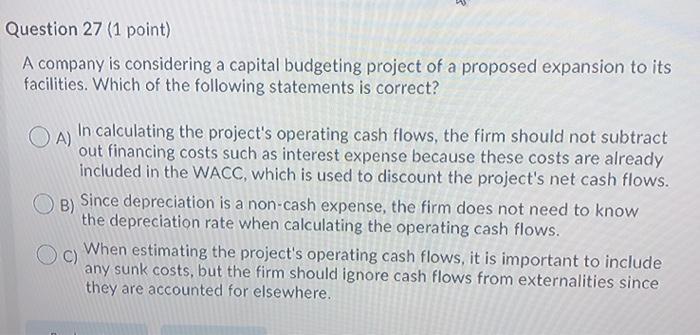

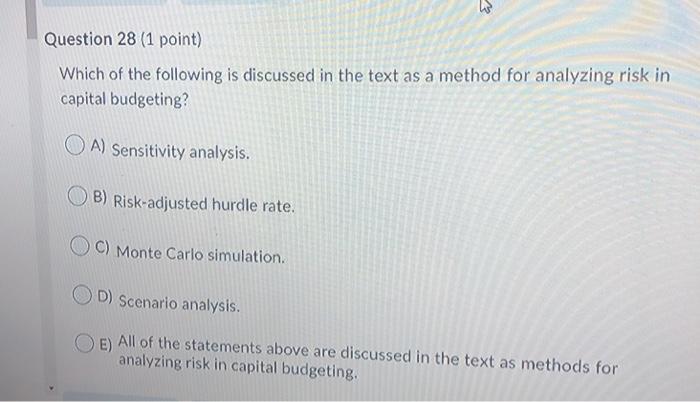

Question 27 (1 point) A company is considering a capital budgeting project of a proposed expansion to its facilities. Which of the following statements is correct? OA In calculating the project's operating cash flows, the firm should not subtract out financing costs such as interest expense because these costs are already included in the WACC, which is used to discount the project's net cash flows. B) Since depreciation is a non-cash expense, the firm does not need to know the depreciation rate when calculating the operating cash flows. C) When estimating the project's operating cash flows, it is important to include any sunk costs, but the firm should ignore cash flows from externalities since they are accounted for elsewhere. Question 28 (1 point) Which of the following is discussed in the text as a method for analyzing risk in capital budgeting? A) Sensitivity analysis. B) Risk-adjusted hurdle rate. C) Monte Carlo simulation. D) Scenario analysis. E) All of the statements above are discussed in the text as methods for analyzing risk in capital budgeting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started