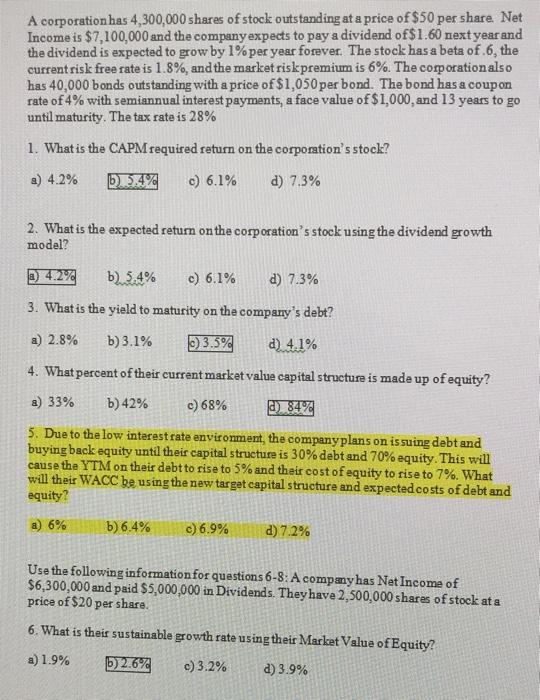

Need help with questions 5, 7 & 8

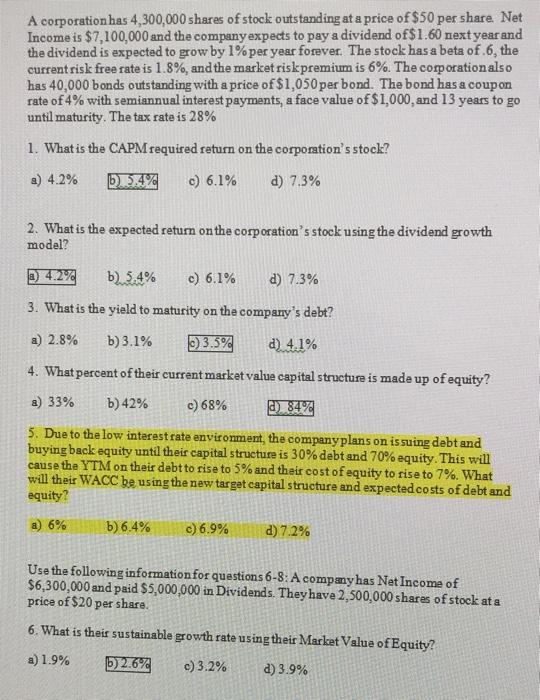

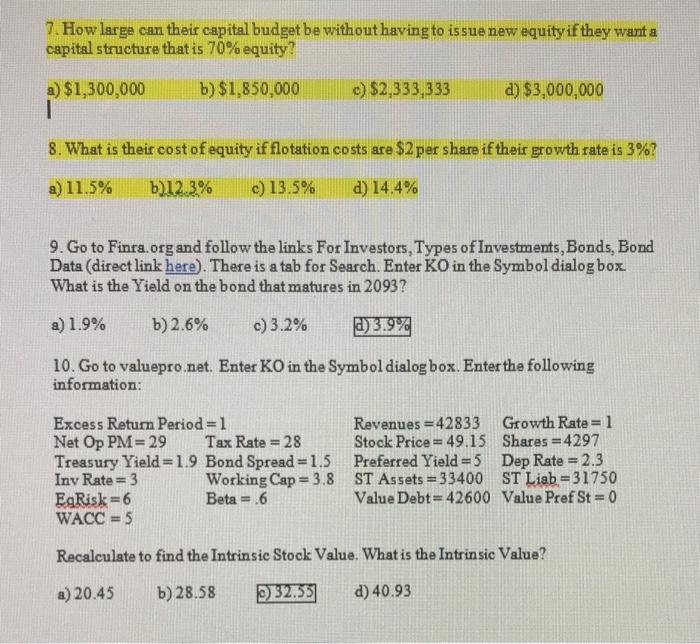

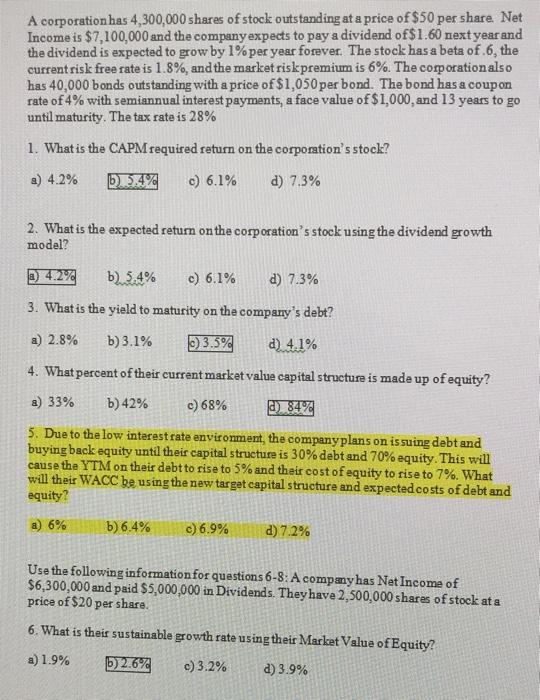

A corporation has 4,300,000 shares of stock outstanding at a price of $50 per share. Net Income is $7,100,000 and the company expects to pay a dividend of$1.60 next year and the dividend is expected to grow by 1% per year forever. The stock has a beta of.6, the current risk free rate is 1.8%, and the market risk premium is 6%. The corporation also has 40,000 bonds outstanding with a price of $1,050 per bond. The bond has a coupon rate of 4% with semiannual interest payments, a face value of $1,000 and 13 years to go until maturity. The tax rate is 28% 1. What is the CAPM required return on the corporation's stock? a) 4.2% b) 5.4% c) 6.1% d) 7.3% 2. What is the expected return on the corporation's stock using the dividend growth model? a) 4.272 b) 5.4% c) 6.1% d) 7.3% 3. What is the yield to maturity on the company's debt? a) 2.8% b) 3.1% b) 3.5% d) 4.1% 4. What percent of their current market value capital structure is made up of equity? a) 33% b) 42% c) 68% d) 84% 5. Due to the low interest rate environment, the company plans on issuing debt and buying back equity until their capital structure is 30% debt and 70% equity. This will cause the YTM on their debt to rise to 5% and their cost of equity to rise to 7%. What will their WACC be using the new target capital structure and expected costs of debt and equity? a) 6% b) 6.4% c) 6.9% d) 7.2% Use the following information for questions 6-8: A company has Net Income of $6,300,000 and paid $5,000,000 in Dividends. They have 2,500,000 shares of stock at a price of $20 per share. 6. What is their sustainable growth rate using their Market Value of Equity? a) 1.9% b) 2.6% c) 3.2% d) 3.9% 7. How large can their capital budget be without having to issue new equity if they want a capital structure that is 70% equity? b) $1,850,000 c) $2,333,333 d) $3,000,000 a) $1,300,000 1 8. What is their cost of equity if flotation costs are $2 per share if their growth rate is 3%? a) 11.5% b)12.3% c) 13.5% d) 14.4% 9. Go to Finra.org and follow the links For Investors, Types of Investments, Bonds, Bond Data (direct link here). There is a tab for Search. Enter KO in the Symbol dialog box. What is the Yield on the bond that matures in 2093? a) 1.9% b) 2.6% c) 3.2% d) 3.9% 10. Go to valuepro.net. Enter KO in the Symbol dialog box. Enter the following information: Excess Return Period=1 Revenues =42833 Growth Rate = 1 Net Op PM= 29 Tax Rate = 28 Stock Price = 49.15 Shares =4297 Treasury Yield=1.9 Bond Spread=1.5 Preferred Yield=5 Dep Rate = 2.3 Inv Rate=3 Working Cap = 3.8 ST Assets = 33400 ST Liab = 31750 Eg Risk=6 Beta = 6 Value Debt=42600 Value Pref St=0 WACC = 5 Recalculate to find the Intrinsic Stock Value. What is the Intrinsic Value? a) 20.45 b) 28.58 2) 32.55 d) 40.93